It is good to be back after a long vacation from the crypto Academy. I hope to gather more knowledge from all the lessons from season 6 as the various courses unfolds each week.

Introduce leverage Trading in your words?

The introduction of leverage trading in recent times have helped to make trading more beneficial and open to even those with very little capital.

It is one that is quite demanding for beginners as it can lead to losses on their part, since they are not fully grounded in trading.

Leverage trading method is one that is beneficial to professionals as it allows them maximize profit and reduce the issues associated with fees and commissions. leverage trading is also known as margin trading and can help traders make huge profit if the market tends to move in their prediction, but huge losses can be incurred if their prediction is not favorable.

Leverage trading is one that offers professional traders the opportunity to purchase lots of assets with very little amount of capital. Traders are able to borrow from their brokers or an exchange platform to purchase asset, and there is no limit with the amount that is borrowed.

What are the benefits of leverage trading

• It is very good scalp trading, as traders who practice scalp trading are able to make huge profit in a short period of time.

• It offers feature known as cross margin, which enables traders protect funds in their account from being liquidated in a situation where their prediction is not in same line with the market.

• Leverage trading offers traders the opportunity of not closing trades in full, especially in situation of either profit or loss, and this will enable them manage trades properly.

• Leverage trading offers traders with little capital the opportunity to increase their trading power by offering them the opportunity to borrow funds, and this will help them increase the number of assets with which they trade on.

• With leverage trading, traders are able to practice safe trading by exiting a trade once their desired profit is acquired.

What are the disadvantages of leverage trading?

• Funds of traders can be liquidated if the market does not move in their prediction, and also if the trader does not have much funds to control losses

• it is a type of trading that is not advisable to be practiced by beginners as it is associated with so much risk.

• There is high possibility that a trader can lose all funds if the market goes against their positions and also it is associated with high fees when holding assets.

Basic Indicators Useful for Leverage Trading.

Though highly profitable, leverage trading remains a very technical and risky type of trade to used in trading cryptocurrencies. Apart from the knowledge that needs to be gained about this type of trade, a trader has to use the right indicator or combination of indicators to make the desired profit. Also to avoid total lost of initial capital or liquidation of one's asset, it is best to use the best indicators to spot the best entry/exist point of each trade.

There are three basic indicators that are useful in trading leverage. This are the Parabolic Sar, Exponential Moving Average (EMA) and Relative Strength Index (RSI). In brief, I shall shed light on each of them.

PARABOLIC SAR

This is a trend following indicator that was developed by J. Welles Wilder Jr. It points to the direction in which the asset moves at every point. The "stop and reverse" technique which is called SAR is used in the identification of points to enter the market or exit a trade.

On a chart, parabolic sar is identifiable by a series of dots placed around the price. This dots can either be below the price or above the price. When the dots are below the price, it means the asset in in an uptrend (bullish) while when the dots are above the price action, the asset is in a downtrend (bearish).

With the placement of the dots, it is very easy to identify the direction an asset is moving and a decision can be taken either to buy or sell but a better result is realizable by using the SAR with EMA and RSI when they have meant their conditions that would be discussed below.

EXPONENTIAL MOVING AVERAGE.

Exponential Moving Average, EMA was developed as a modification of Simple Moving Average, SMA. EMA is an indicator built on the chart that helps to track the direction of the price of an asset over a specified period of time. It uses the most recent price Information of an asset rather than the old info used by SMA. This helps it to react very fast to the change in price. The time frame used for the EMA can be 50, 100 or 200 days period.

EMA helps in the identification of trends earlier than SMA. This indicator can be used to determine price direction for trade. Once the direction of the price is determined, trades should be made in the identified direction. When price action rises above the EMA, it is a good time to sell as the asset may go down at any point. When the price action is below the EMA , it is time to buy as the asset is most likely to go up.

Exponential Moving Average can server as a support and resistance to the price action. While a rising EMA supports the price action, a falling EMA resists the price action. This is to say that when EMA rises above the price, it is supporting it while when it falls below the price action, it is resisting it from moving further up.

The 200 moving average is the suitable one for leverage trading. Confirming its signals with the signals from parabolic sar and relative strength index gives the successful trading outcome.

RELATIVE STRENGTH INDEX

Relative Strength Index also developed by J. Welles Wilder Junior is a momentum indicator that gives signals when an asset is overbought or oversold. It gives entry and exit signals in trades. It is used as tool for confirming signals from other indicators and can also be a tool that signals early reversal of a trend that is confirmed by other indicators.

Furthermore, RSI is an oscillator that reads between 0 and 100, placed below the chart. Between readings of 70 and 100, and 0 and 30 the indicator signals overbought and oversold respectively. With the indicator reaching between this points in trades, a trader can take a decision either to enter or exit the market based on the confirmations he has made from other indicators and his convictions. When the RSI reads between 0 and 30, a buy position can be taken and when it reads between 70 and 100, a sell position can be taken.

RSI should be used in conjunction with EMA and Parabolic Sar if it is to be used for leverage trading to get the best result in trades.

THE SPECIAL TRADING STRATEGIES USED TO PERFORM LEVERAGE TRADING.

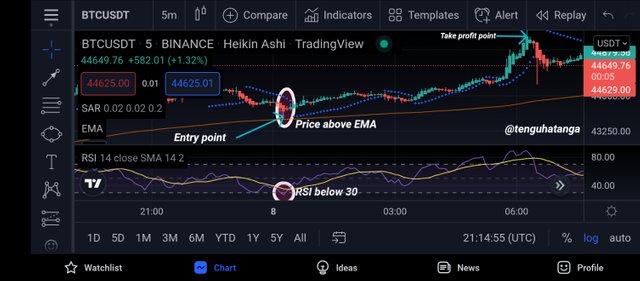

To attain the gains associated with trading leverage, a set of strategies can be followed to determine whether to buy or sell. I shall explain this strategies for buy and sell positions but before then, something important must be done. The chart would first of all be changed from Japanese Candlestick pattern to Heikin Ashi Charts to have a clearer view of the chart and market trend.

Looking closely at the chart, we can see that the chart there is now Heikin-Ashi.

TO TAKE LONG BUY POSITION USING THE SPECIAL STRATEGY.

To use this special strategy in leverage trading to take a long buy position, we first consider what the reading on the EMA indicator is saying. The EMA should be check on the chart to see that the price goes above the EMA. Secondly, the Parabolic Sar should be checked to see that the dots are formed below the price action.

Also to confirm the signals, the relative strength index, RSI should be checked to see that the asset is oversold. That's is the reading on the indicator is between 0 and 30.

In the above screenshot. I have presented an opportunity for a long buy trade. As can be seen, the entry point (buy) was taken when the Parabolic Sar begin to make dots below the price. When it begins to make dots above the price, a take profit point was taken. Looking closely, the EMA is below the price and the RSI has gone below 30 on the reading.

TO TAKE A SHORT SELL POSITION USING THE SPECIAL STRATEGY.

Also, to utilize this special strategy in leverage trading to take a short position, we first consider what the reading on the EMA indicator is saying. The EMA should be checked on the chart to see that the price goes below the EMA. Secondly, the Parabolic Sar should be checked to see that the dots are formed above the price action.

Also to confirm the signals, the relative strength index, RSI should be checked to see that the asset is overbought. When an asset overbought, the indicator reads between 70 and 100.

The above screenshot presents a short sell opportunity. The sell entry point was taken when the Parabolic sar began to make dots above the price. The position was closed in a take profit point when the dots of the indicator began to form below the price. The EMA is seen to be above the price and the RSI had gone past the point 70 of the reading.

Question 6: A REAL LEVERAGE TRADE ON BINANCE.

I performed a technical analysis of COMP/USDT pair on tradingview.com before proceeding to Binance to carry out the trade.

From the analysis I have made below, it is clear that first, the price went above the EMA, the dots of the parabolic sar formed below the price and the RSI was below 30 on the calibration. I took my buy entry when all these conditions were fulfilled on the chart. I carried out a buy long position with a cross margin of 20x on the Binance.

Here is the the detail of the transaction I carried out. Every detail that is summed up on the screenshot above.

After a short while, I closed the trade using the analysis presented below. As can be seen, all the conditions to take a sell trade which includes the dots of the parabolic sar forming above the price, the price going below EMA and the RSI reaching 70 on reading were all met.

This is the detail of the sell trade. I realized some profits according to the amount of usdt I invested on the trade.

Conclusion

Leveraged trading is one that could be seen as a better option when compared with spot trading. To go into leverage trading, one has to have a good knowledge of risk management as well as how to technically predict how the price of an asset will go in future. Despite the lots of advantages involved in leverage trading, one still have to be careful as a wrong prediction might lead to total loss of capital. Special thanks to @reddileep for the wonderful lecture.