Wyckoff Method

Brief Overview

The Wyckoff Method was the brain child of Richard Demilie Wyckoff, born 1873 and died 1934 at the age of 61 years. He was a renowned researcher, founder, editor and stock trader. He studied the financial market for many years, and he also studied prominent investors and traders of his time. It was after much of this study that he created and then developed the trading method called Wyckoff Method.

This method has some principles at it foundations and they follow each other, the method also includes strategies that different traders can employ according to their trading style and become a successful trader.

The concept of the Composite Man was an idea Mr. Wyckoff brought about in order to explain in simpler language how the financial market should be viewed and be traded in. He gave different descriptions and components of the financial market using the concept of the composite man.

I would be talking about what this composite man is all about.

Composite Man

The Composite Man is a concept Mr Wyckoff thought about to help explain the influence of big players which comprises of wealthy individuals and institutional investors and how their activities affect the financial markets.

The composite man should be seen as an imaginary identity of the crypto market. When investors and traders alike want to partake in the crypto market, they should make studies of the market with the idea that the big players i.e. the wealthy investors and the institutional investors is controlling it. These group of people act in their own best interest by buying low and selling high.

When you look at how the Composite Man, that is, the biggest players behaves, and then you compare it with the activities of retail traders, you see that the behaviors of each group (biggest players; retail traders) is opposite to each other. This is why retail traders keep losing money.

But with the idea of the Composite Man, retail traders can learn a lot, because he uses a strategy that is predictable, and retail traders and investors can learn from them.

Four Phases

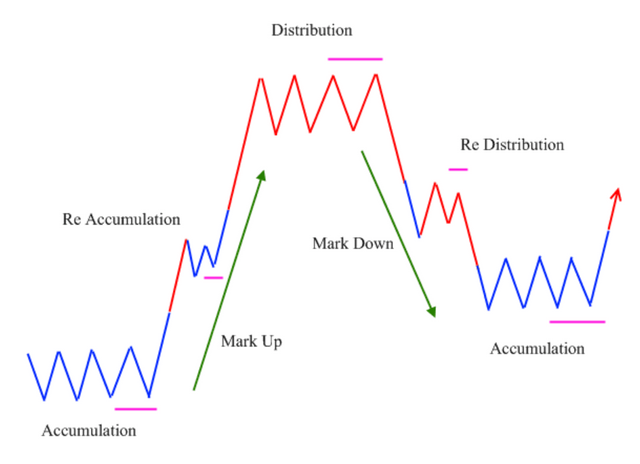

When using the concept of the Composite Man we should note that the market move in phases. These phases are the periods in which different events takes place in the market. We need to explain the crypto market in four different phases of a market cycle.

These market four phases are:

Accumulation

There is the accumulation phase, which is predicated by the accumulation of assets occurs as the Composite Man initiates them before other investors. This accumulation phase doesn't occur in a swift manner, but it is more of a gradual process, which makes prices not to change in a significant way.

During this period of accumulation, the movement of the price on the chart is sideways or more of a range.

Uptrend

After the period of accumulation, a phase of uptrend begins. During this phase period the Composite Man begin to make the prices of a crypto asset attractive, by pushing up the market prices. When this is done, other investors are attracted, this makes demand to increase, thereby leading to an increase in price.

As this trend progresses in an upward direction, there would come a time when there would be periods of another accumulation which can be termed Re-accumulation, where this trend stops to consolidate for a while, after which it continues its upward movement.

With this increase in price, more investors are encouraged to join the trend. This makes the general public (retail trader) to get involved. At this point, the demand becomes very high.

Distribution

We get to another phase where the Composite Man is characterized by distributing his holdings. As the price has reached very high levels and more investors get to partake of the markets recent activities, the Composite Man begins to sell of his profitable positions to them.

This market in the distribution phase also moves in a sideways movement, this period demand is being absorbed till it is exhausted.

Downtrend

This is the last phase in a full market cycle. After the distribution phase, the market starts moving in a downward direction. This means that as the Composite Man has begun pushing the price downwards. Because of the activities of the Composite Man more investors start selling their assets which drives the prices downwards more.

Also as the market moves in a downtrend, there are periods of Re-distribution, where the price consolidates and moves in a sideways manner, after which the price continues to drop.

When this downtrend has expired, a new accumulation phase begins all over again and the market cycle continues again.

The Fundamental Laws

There are three laws in which Wyckoff used to elaborate on his method of analysing the charts.

They are:

Law of Demand & Supply

This law simply states that as the demand for a crypto asset increases, the price also increases. Conversely, as the supply of an asset increases, the price reduces.

This means that when demand for a crypto asset is high, the supply at that moment would be low and thus the price for the asset will increase. In the same vein, if the supply of an asset is high, thus the demand is low, therefore, the price would reduce.

There are also periods when demand would equal supply, at the point there wouldn't be any significant changes in price. Price would range at a certain level.

Mr Wyckoff used this law as an illustration to explain what happens when the price of an asset increases or decreases.

Investors seeking to use this method, should take note of the price action and the bars on the volume indicator on the charting view to get a better view of the relationship between supply and demand.

The Law of Effort & Result

This law states that for every effort put in a thing, there is always a result.

The way this law is reflected on Wyckoff's method is that if a lot of traders put in effort on a particular asset, this can be viewed on the volume bars, the price of that asset changes. And in an event where the price of an asset moves in conjunction with the volume, as displayed by the bars, the trend would continue to go in the same direction. But, whenever there is a disparity between price and volume significantly, the market trend is likely to stop or change direction.

The Law of Cause & Effect

This law states that for every effect of a thing, there is a cause behind it.

Wyckoff explained that those things that causes periods of demand and supply are not random. They arise after periods of preparation, which are because of specific events.

According to Wyckoff, there is a period of accumulation, the cause, which then lead to an uptrend, the effect,. Conversely, there is also another period of distribution, the cause, that then leads to a downtrend, the effect.

Analysing the Crypto Markets with Wyckoff Method

_LI.jpg)

This is a 4 Hour chart of INCH?BUSD crypto currency trading pair. I would be discussing about the principles of Wyckoff's method as seen on this chart.

Accumulation: The first yellow circle on the chart indicates the accumulation stage. The volume bar below it shows the amount of traders were not so much. The accumulation period didn't last for so long, before prices went up again.

Uptrend: After the short accumulation phase, there was an uptrend. When you check the volume bars below, you would see that most of the bars were green, which meant traders were buying at that time.

Re-accumulation: During the uptrend it reached a period of re-accumulation, where the price moved in a sideways manner. The volume bar at this point was low. That is the region labeled A on the chart.

Then the uptrend continued. Though there was a period the price retraced.Distribution: After the uptrend the price got to a stage where it reached it's peak, many traders were selling, while many other traders were buying. At this point the market moved in a sideways manner and it took a longer time for the distribution process to take place. Also the volume bars increased.

Downtrend: After the distribution phase, the price began to go down, you can also witness it in the volume bars below.

Re-distribution: At some point, the prices began to re-distribute in the region labeled B. The volume bars was also high. After this period of re-distribution, the price of the asset began to go down continually.

Thank you @fendit for this wonderful exercise

Thank you for being part of my lecture and completing the task!

My comments:

Nice work!

Explanations were ok and in the chart the pattern was properly identified. Still, I wish I had seen a bit more in-depth analysis when it comes to the chart!!

Overall score:

7/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @fendit for the feedback. I would try to improve on giving in-depth analysis of my charting experience.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @theoppourtunist

I'm new to Steemit. Achievement is completed up to 5.1. I am interested to work in your group of cryto Academy . What kind of post and homework do I have to do. Is it helpful to give details ???

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @amirhamja79999, I don't have a group that I work with to post exercises on Steemit crypto academy.

My advice is that you quickly complete your achievement post in the Newcomer's community. Then you can join us here in Steemit crypto academy to partake in the exercises.

Season 2 just ended and Season 3 is about to begin in 2 weeks time.

And this time newbies like you would be able to participate, albeit in the beginner's level. Enjoy yourself my man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit