This week, the professor has prepared a most detailed course article on RSI, one of the indicators commonly used in cryptocurrency trading. It is considered one of the most used indicators in trading due to its ease of use and successful signals.

What is the Relative Strength Index - RSI and How is it Calculated?

It means relative strength index. It is an indicator that recognizes the overbought or oversold conditions of a stock or cryptocurrency and measures the magnitude of recent price changes.

Developed by Welles Wilder, who is a mechanical engineer by his profession, about 43 years ago, it is among the indicators that are very popular due to their frequent use in technical analysis.

It is regarded as a momentum oscillator. It is used to determine the increasing or decreasing strength of prices, the direction in which prices tend. RSI has a value between 0 and 100. The approach of the indicator line to overbought or oversold areas is considered a signal. Two limits are set as 30 and 70 in RSI indicators. 30 and lower value indicates oversold. 70 and upper value indicates excessive intake. The RSI in purchases is over 50. RSI in sales is below 50.

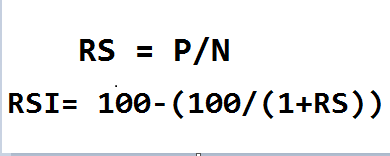

How to Calculate RSI

It is necessary to set a period for RSI calculations. It is generally accepted as 14 days. We can accept this in 14 minutes. In other words, it is possible to use the period by making it smaller or larger. When the periods of the indicators become smaller, the indicators become much more sensitive to price movements and begin to generate more signals.

Let's choose the period as 14 days. For each trading day, the difference of the closing prices in the direction of increase and decrease is taken. Then the RS value is tried to be found.

P = arithmetic mean of the positive closing difference total in the last 14 days

N = arithmetic mean of the negative bite-off sum in the last 14 days

The ratio of P to N reveals the value of RS.

So RS = P / N.

After that, the RSI value is found by placing the RS value in its place in the formula.

The positive closing price average and negative closing price average for any asset are as follows.

P = 9

N = 3

In this case, RS = P / N = 9/3 = 3.

Let's put the RS value we found in the formula.

RSI = 100 - (100 / (1 + 3))

RSI = 100- 25

RSI = 75

We found the RSI value to be 75. This shows us excessive intake. It is indicated by a dashed red line on the graph. If we had found an RSI of 25, that would indicate oversold. On the chart, it would appear as a dashed green line.

Can we trust the RSI on cryptocurrency trading and why?

The RSI indicator is one of the indicators frequently used by traders. Although it usually gives correct signals, it sometimes sends false signals to traders. If the RSI indicator had always given correct signals like other indicators, I think everyone would use the RSI indicator and everyone would have made a profit.

Other people cannot win unless they are a loser. This is the general rule of life. That's why we shouldn't use the RSI indicator alone. We can count on the RSI after looking at support-resistance levels, formations and other technical analysis. Buying or selling by relying only on RSI can cause us losses. The RSI indicator should be one of the indicators that will give us an additional advantage as in other indicators.

How do you configure the RSI indicator on the chart and what does the length parameter mean? Why is it equal to 14 by default? Can we change it? (Screen capture required)

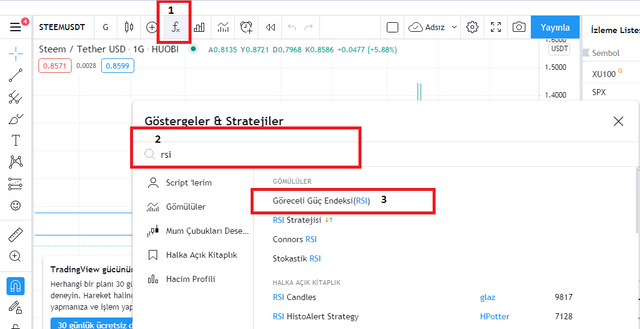

I use the tradingview site to look at the chart of any asset. I open the chart of any asset. For example this is Steem / USDT.

(Tradingview Steem/Usdt chart)

First, I click on the place where it says "fx" in the upper left. Then I type "RSI" in the search box on the page that opens. Then I click on the top result.

(Tradingview Steem/Usdt chart)

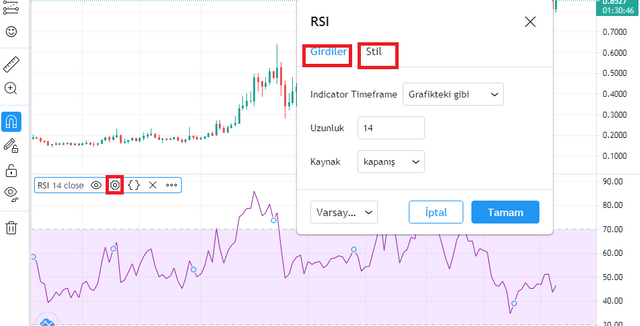

As you can see, the RSI indicator has been processed on the Steem / USDT chart.

We can make the necessary arrangements / adjustments by clicking the places I marked.

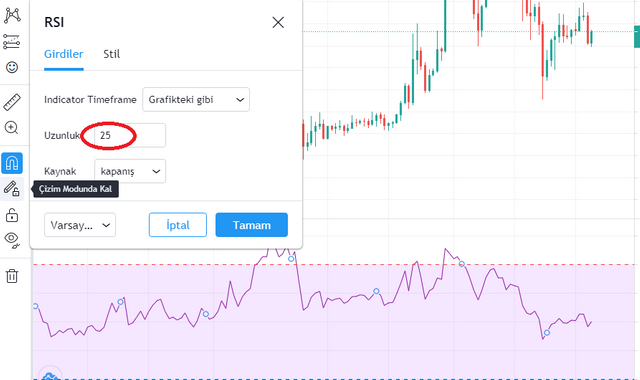

The period commonly used in RSI indicators is 14. This could be 14 days, it could be 14 hours. When Welles Wilder first invented the RSI, he said it would be better to use a 14-day period. However, later on, periods of 9 and 25 days were started to be used.

(Tradingview Steem/Usdt chart)

We can change the length in the "Inputs" section and the colors in the "Style" section. I set the RSI as purple, upper band red, lower band green. I chose the length will be 25.

How do you interpret the overbought and oversold signals when trading cryptocurrencies? (Screen capture required)

(Tradingview Steem / USDT chart)

I marked the overbought and oversold zones. I recommend that you examine the overbought places thoroughly. The RSI value reached 76 at the first overbought. Then there was a correction. In the 2nd overbought, the RSI value reached 77 and correction took place after a while. In the 3rd overbought, the RSI value reached 85. The correction has been greater. On the 4th overbought, the RSI reached 79, after which a correction occurred. An RSI of over 70 indicates overbought, indicating that dips will occur after a while and the price will fall.

In the first oversold, the RSI value is 26. The asset price has fallen sufficiently and after a while the asset price has increased.

In the second RSI value in oversold 27. The asset price started to fall again and after a while the asset price started to increase.

We can think that when the RSI value reaches 30 or below, the asset is sold too much and the asset price will increase after a while.

How do we filter RSI signals to distinguish and recognize true signals from false signals. (Screen capture required)

We try to catch the overbought and oversold signals in the RSI indicators. Then we think a correction will come. Sometimes real signals get mixed up with false signals and a deviation occurs.

We can get false signals on indicators such as MACD.

Bullish divergence:

(Tradingview XRP/USDT chart)

We have come across cryptocurrency prices spiking after dips and the market is recovering. In such cases, we start getting false signals from RSI.

Bearish divergence:

(Tradingview XRP/USDT chart)

We have come across cryptocurrency prices dropping abruptly after rapid increases. In such cases, we start to receive directional signals from the RSI.

If the price of any cryptocurrency is moving steadily, deviations are rare.

Review the chart of any pair (eg TRX / USD) and present the various signals from the RSI. (Screen capture required)

(Tradingview BNB/USDT chart)

Since we are currently in a bullish period, I was able to show more overbought zones.

When the RSI value rises above 70, it indicates that there is overbought. When the RSI value approaches between 80-100, a correction is expected and a sell signal is formed.

It means that when the RSI value approaches 30, there is oversold. When the RSI value approaches between 20-0, the asset price creates a buy signal before it starts to return to normal.

Since we were in a bullish period, BNB was exposed to a lot of overbought and then created sell signals. There are many buy signals on the BNB chart. Buying signals emerged after excessive selling.

Conclusion

I knew about the RSI indicator before and I had not been able to research it in such detail. The RSI indicator gives the correct signals most of the time. In some cases it gives false signals. This is due to bull and bear divergences. Using the RSI indicator alone can mislead us. We should use other indicators along with the RSI indicator. We should also look at the support-resistance levels and examine the chart to the finest details.

Thanks to the professor for the useful course article.

Cc:

@steemitblog

@kouba01

Twitter sharing

https://twitter.com/Steemtht/status/1389994625163747333

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @tht,

Thank you for participating in the 4th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve an 8/10 rating, according to the following scale:

My review :

A well-content article that demonstrates your clear understanding of the questions. The question of signal filtering still lacks more depth in several points and for the last question, you had to analyze more the price change by adding other signals and not just oversold and bought signals.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for checking my homework. I wish you convenience in your work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit