The professor talked about all the details about the Elliott Wave theory this week. It is one of the theories that traders use in technical analysis.

What's the application of this theory? - What are impulse and corrective waves?

The theory created by accountant Ralph Nelson Elliot by examining repetitive wave formations in certain patterns is called wave theory. According to this theory, every formation, every new price change in the market depends on a specific reason. Previous data, previous changes have data important enough to affect the next changes.

Developments in the market create a certain pattern in a certain period of time. The ability to repeat such patterns over time gives the opportunity to anticipate future changes.

Price changes in the market create charts and formations in certain time periods. These patterns have certain stages in the graphics. For example, this theory consists of 8 stages. It shows an upward or downward trend depending on the bearish or bull period.

A good trader who has mastered this theory predicts / suspects that this formation will occur in stage 2. In the third stage, he is very sure that this theory will come true. There are 5 stages left. At these stages, he will earn good profit by trading, margin trading.

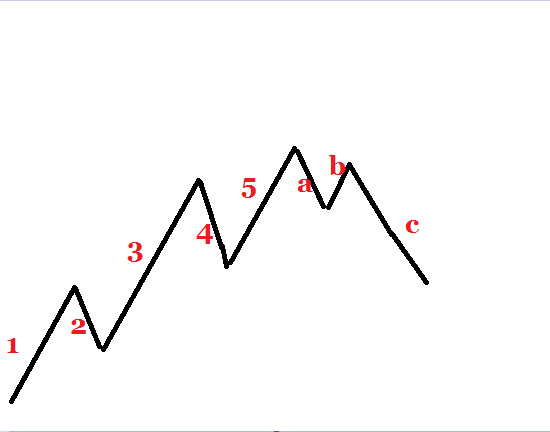

(Bullish trend)

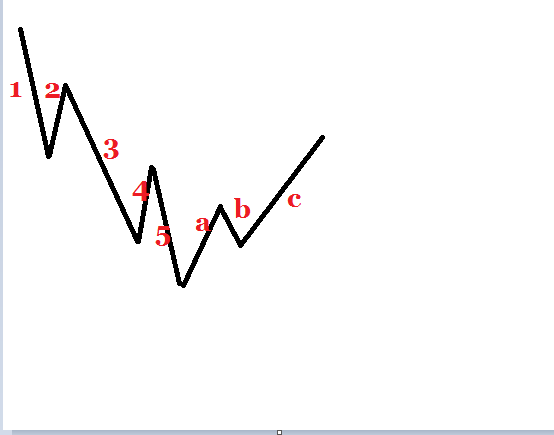

(Bearish trend)

I drew the formations / graphics that could occur during the bear and bull periods myself.

Elliott Wave Theory consists of 8 stages. The first 5 stages consist of motion waves. The next 3 stages consist of a correction wave.

Impulse wave

- In the bull period, the 1st stage is upward. In the bear period, the 1st phase is downward.

- In the bull period, the 2nd stage is downward. In the bear period, the 2nd phase is upward. Stage 2 cannot go below the lowest point in stage 1.

- In the bull period, the 3rd stage is upward. In the bear period, the 3rd phase is downward. Stage 3 is usually the longest wave. It doesn't have to be the longest wave. But one thing is for sure, it shouldn't be the shortest wave. Stage 3 moves further from the last point of stage 1.

- In the bull period, the 4th stage is downward. In the bear period, the 4th stage is upward. The 4th stage cannot go beyond the last point of the 3rd stage before it.

- Tier 5 is usually the last point (highest price in bull period, smallest price in bear period)

Corrective Waves

The phases I show with a, b, c are correction waves. They consist of 3 stages. They tend to be small compared to motion waves. Because the small part of the big trend moves in the opposite direction of the big trend.

- In the bull period, waves a and c are downward. During the bear period, waves a and c are upward.

- b waves are upward in the bull period. b waves are bearish during the bear period.

- Correction waves can be zigzag, flat and triangle.

How can you easily spot the different waves?

It is possible to detect different waves easily. Because every wave has certain rules. By understanding these rules well, it is possible to distinguish different waves from each other. Let's imagine we are in the bull era. Wave 1 will move up. Wave 2 will move down, however, wave 2 should not exceed the end point of wave 1.

Wave 3 should not be the shortest wave. Usually, wave 3 is the longest wave. With this feature, the 3rd wave differs from other waves. The 5th wave is in the farthest place compared to the 1st and the 3rd waves.

Let's imagine we are in the bull era. Suppose we are going to take STEEM.

Impulse waves

In wave 1, the end point of the Steem price is $ 0.8 and the bottom is $ 0.5.

Wave 2 cannot go below $ 0.5.

The endpoint of wave 3 will likely be $ 1.4.

$ 1.2 is ideal for the lowest point of the 4th wave.

The last point of the 5th wave is $ 1.7.

Correction waves

Wave a will be bearish. 1.5 $

Wave b will be bullish. 1.6 $

Wave c will be bearish $ 1.3

What are your thought on this theory? Why?

I think all theories are useful. However, the trader's experience and ability to read the market are more important here. A novice trader will have a hard time distinguishing the different waves. It also requires skill and experience to distinguish waves.

Sometimes experienced traders also have difficulty distinguishing different waves. Because wave properties can have subjectivity.

Some circles argue that the Elliott Wave Theory is not a valid theory. Because they say that it does not have clear / rigid rules and that it has subjective characteristics.

Wave theory is one of the technical analysis methods. More precisely, it is a method that gives an idea to traders. It is not considered correct to use any indicator alone in technical analysis indicators. So using the Wave theory in conjunction with technical indicators will give traders a great advantage. This situation both increases your success rate and allows you to earn more profit. It is recommended to use the Wave Theory with some fibonacci indicators.

Finally I want to say this. If the Elliott Wave Theory has been around for many years, it is a useful theory. Of course, it is necessary to combine it with recommended indicators to make more accurate decisions.

As always, we should not forget to use stop loss in response to negative situations.

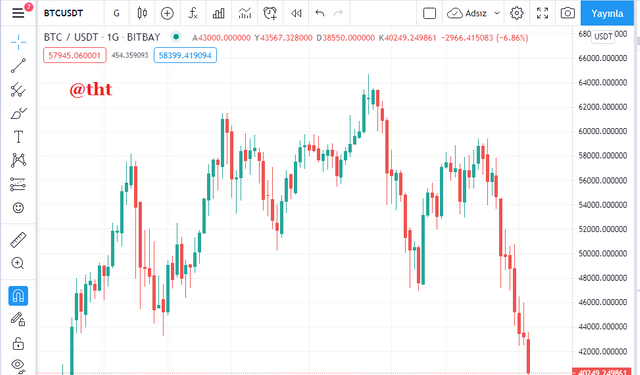

B) Choose a coinchart in which you were able to spot all impulse and correct waves and explain in detail what you see. Screenshots are required and make sure you name which cryptocurrency you're analyzing.

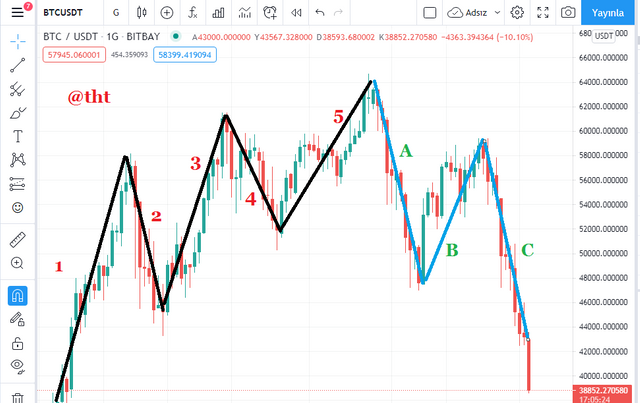

(Tradingview BTC/USDT chart)

Since the most popular crypto currency is Bitcoin, I immediately looked at the Bitcoin chart. Without drawing the lines, a trader with experience in wave theory can tell by just looking at the chart that this chart occurred in the bullish period. Because the impulse waves are upward. There was a price decrease with the correction movements.

(Tradingview BTC/USDT chart)

- I determined the impulse waves as 1,2,3,4,5. A, B, C are correction waves.

- 1,3,5 impulse waves are upward. Impulse waves 2 and 4 are bearish.

*A, C correction waves are downward. B correction waves are bullish.

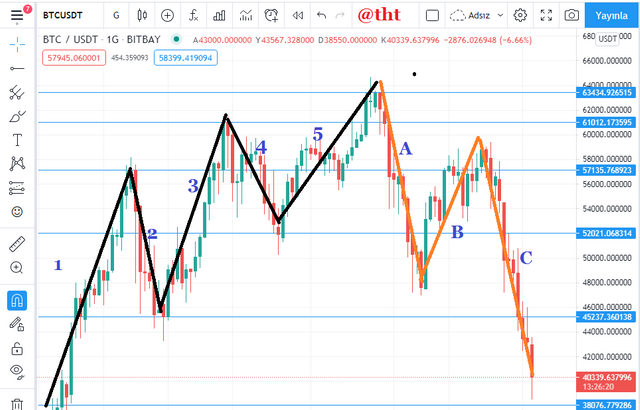

(Tradingview BTC/USDT chart)

Impulse Waves:

- Starting price of wave 1: $ 38,076, final price of wave 1: 57,135. Difference = 19,059

The last price of wave 2 is $ 45,237. - The last price on the 2nd wave ($ 45,237) did not exceed the lowest price on the 1st wave ($ 38,076).

The starting price of the 3rd wave is $ 45,237, the last price of the 3rd wave is $ 61,012. Difference = $ 15,775 - Usually the 3rd wave is the longest wave, but in this graph, the 3rd wave length is not as long as the 1st wave. There may be some exceptions. The important thing is that the 3rd wave does not have the shortest wavelength.

4th wave last price 52,041 - The last price of the 4th wave did not exceed the last price of the 1st and 3rd waves.

The starting price of the 5th wave is 52,041, and the last price of the 5th wave is 63,434. Difference: $ 11,393

Usually, the 3rd wave would have the longest wavelength, but in this graph, the 1st wavelength has the longest wavelength ($ 19,059). There may be some exceptional cases. A graph that contains all the rules of the Wave Theory.

Corrective Waves

I showed the correction waves as A, B, C. A and C waves are bearish. On the other hand, Wave B is bullish. The length of the C wave is longer than the length of the A wave.

Correction waves could have been in 3 ways. There is a zigzag (5-3-5) formation with correction movements on the chart. Because the length of the B wave is shorter than the A and C waves.

Conclusion

The Elliott Wave Theory is not a highly recommended theory due to its subjective nature. However, it is one of the theories that increases the success rate when used with other indicators.

Cc:

@steemitblog

@fendit

Twitter sharing

https://twitter.com/Steemtht/status/1394964562580066304

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for being part of my lecture and completing the task!

My comments:

Your explanations were fine, on a theorical level, but when you recognized the pattern in the chart, you showed that wave 1 was larger than wave 3 and that's not correct.

Aside from that, it was really good, nice job :)

Overall score:

7/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agree,Its no so easy to understand whats presnt trend some times.

In last Two days BTC is in huge volatility,not understanding present wave is bullish or bearish. Some says Bullish ,Some says Bearish.

Based on each experience personsa skills they giving like those analysis. For knowing exact trend,It take another 2 to 3 days.

Your presentation is simply super.

Best of luck my friend.

#affable #india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for stopping by.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit