This week, the professor detailed the Bollinger bands, one of the indicators that generate buy and sell signals in trading. He showed with graphs one by one in which situations the signals would occur.

Define the Bollinger Bands indicator by explaining its calculation method, how does it work? and what is the best Bollinger Band setup?

Bollinger bands are indicators developed 40 years ago and used in technical analysis. It allows us to get ideas about the volatility of prices, overbought and oversold situations.

It is the volatility band that gives various signals to traders that are placed above and below simple moving averages. Volatility varies depending on the standard deviation. Changes in volatility affect the standard deviation.

Bollinger bands widen transversely when volatility rises. On the contrary, Bollinger bands narrow when volatility decreases. Thus, Bollinger bands help us to understand whether the prices are low or high. In exceptional circumstances, price movements go outside the bollinger bands.

When prices are close to the upper band, the prices are considered to be high, and if the prices are close to the lower band, the prices are considered to be low.

It is known that using a simple 20-day average will be more efficient when calculating Bollinger bands. When the number of days changes, the standard deviation also changes. We can also take the moving average as 10 days or 50 days.

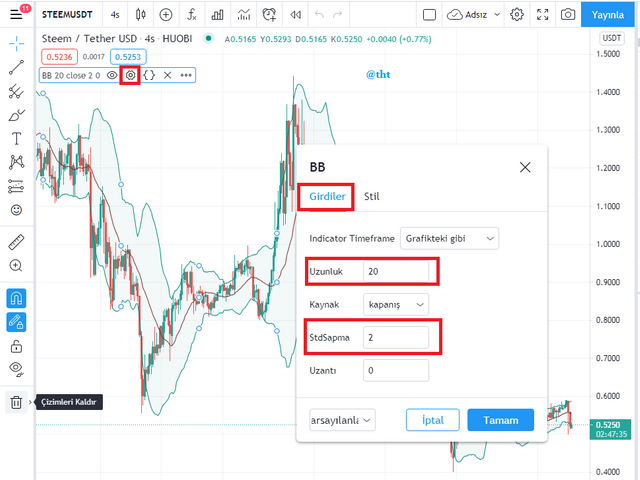

(tradingview Steem /Usdt chart)

Bollinger Band consists of 3 bands.

Middle band: It is usually the 20-day simple moving average.

Lower band: It is shifted down by 2 standard deviations of the 20-day simple moving average.

Upper band: It is shifted up by 2 standard deviations of the 20-day moving average.

As you can see in the screenshot above, there is a picture resembling a channel. There are sharp bands in the middle, right and left of the channel. The middle line is the 20-day simple moving average. The lower line is 2 standard deviations from the 20-day simple moving average. The top line is 2 standard deviations increase of the 20-day simple moving average.

Sometimes the exponential moving average is used in Bollinger bands, but the simple moving average is most commonly used.

How Bollinger Band Works

The reason for using Bollinger bands is to know the low and high levels of cryptocurrencies and to predict which bands they will be in. It is also used to detect overbought and oversold.

Volatility

It is quite easy to detect the volatility of the market through Bollinger bands. The further apart the Bollinger bands are, the more volatile the market. The closer the Bollinger bands are to each other, the more volatile the market is. If the bands widen, volatility increases, if the bands narrow, volatility decreases.

Now I want to show some charts showing the volatility of the market.

(tradingview Steem /Usdt chart)

I have identified 4 parts in the chart regarding the volatility of the market. In the first part, we immediately notice that there is width between the bands. The reason for this is that the rising Steem price suddenly drops sharply. Steem price, which fell too much in the 2nd part, is increasing with a sharp rise. So the bands are widening. Too much volatility. Steem price, which rose up to $1.44 in the 3rd part, is depreciating about 30%. There is a widening between the bands. In part 4, it is difficult to talk about a width between the bands. Steem price is trending sideways. Therefore, there is a narrowing between the bands.

Oversold and Overbought

We know that Bollinger bands also give us clues in overbought and oversold situations.

In overbought situations, buyers dominate over sellers and the asset price starts to rise. In overbought situations, the price touches the upper line. In this case, traders are advised to sell.

In oversold situations, sellers dominate over buyers and the price starts to drop. In oversold situations, the price touches the bottom line. In this case, traders need to make purchases.

Now I want to show overbought and oversold points from any chart.

(tradingview Steem /Usdt chart)

The parts I marked in red in the screenshot are oversold. Price is in contact with the bottom line. In such cases, asset purchases are required. If you examine the chart thoroughly, the asset price starts to increase after a while after the price contacts the lower line. A really good signal is given here. Time to buy.

The areas I marked green in the screenshot are over-received. As a result of overbought, the asset price started to increase. The price is in contact with the upper line. After a while, the asset price begins to decline. In this case, sellers have to sell.

Best Bollinger Band Setup

(tradingview Steem /Usdt)

Generally, the period in Bollinger bands is considered to be 20 standard deviation 2. The most productive period is 20.

You can also set the period to 10 and 50. When you set the period to 10, the standard deviation is 1.5. When you set the period to 50, the standard deviation is 2.5.

Bollinger bands are usually simple moving averages, but sometimes exponential moving averages are used to create bollinger bands.

You can set the periods you want by clicking on the places I marked in the screenshot above.

What is a breakout and how do you determine it? (Screenshot required)

Any asset starts to break resistance or support levels when overbought or oversold. When the asset price rises above the resistance level, the resistance price is broken. When the asset price falls below the support levels, the support price is broken. In such cases, volatility and volume change stand out in serious ways.

A breakout occurs after compressions in the Bollinder bands. When the support price is broken, the price drops. When the resistance price is broken, the price goes up.

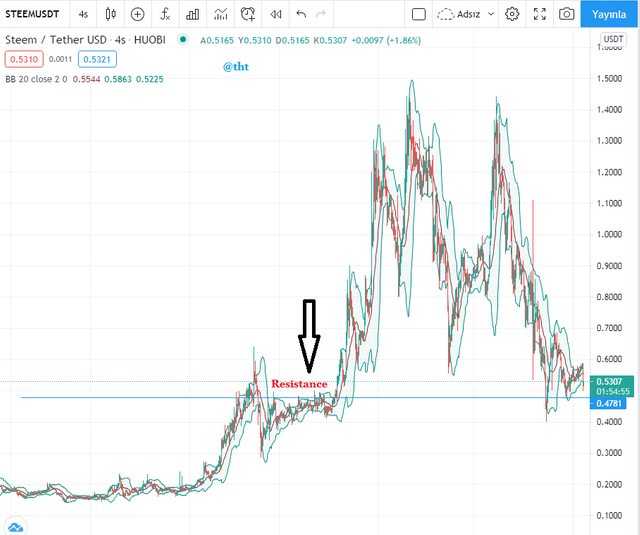

(tradingview Steem /Usdt chart)

As you can see in the screenshot, Steem price is horizontal in the first 2 weeks of March. Overbought and oversold not so much. There is a squeeze in the Bollinger bands. After this situation, the resistance price is broken and the Steem price is rising too much. Steem price, which is around $0.40, is up almost 100% with the breakout of the resistance price at $0.478. Steem price eventually climbs as high as $0.902.

After the price increase, there is an expansion from the Bollinger band. The same breakdowns occur many times during bear periods. In this case, the support prices are broken and the direction of the market is downwards. The width between Bollinger bands increases.

How to use Bollinger bands with a trending market? (screenshot required)

Using Bollinger bands in trending markets gives us advantages. It makes it easier for us to make the next move.

In trending markets, bollinger bands also move in the direction of the trend. If the trend is up, the Bollinger bands also move up. Bollinger bands move down when the trend is down. Because bollinger bands are intertwined with current prices and have to follow the trend.

Volatility is high in trending markets. If the trend is up, it is overbought. The width between the bands is too much. When the trend is down, the width between the bands continues to increase.

(tradingview ADA /Usdt chart)

In the screenshot, the direction of the trend is upwards. A bull trend is very clear. In an uptrend, when the price touches the middle line, it creates a support level in that region and creates a buy signal to buyers. After a while, the price will start to rise. A sell signal occurs when the price touches the upper band.

(tradingview ADA/USDT chart)

The direction of the trend is downward. There is a bear trend. In a downtrend, when the price touches the middle line, a resistance level begins to form in that area, creating a sell signal to traders. When the price touches the lower band, the price starts to increase.

What is the best indicator to use with Bollinger Bands to make your trade more meaningful? (Screenshot required) (Screenshot required)

No indicator gives a 100% positive result. Sometimes they can be wrong, and sometimes they can give correct results. We need to apply indicators together with other indicators to reduce our mistakes or increase our profits even more.

I think we will get more positive results when we combine the Bollinger band with the RSI indicator. They are similar to each other in many respects. The RSI indicator gives traders various signals of overbought or oversold situations. I'm going to apply the Bollinger Band and the RSI to any chart soon and we'll see the results together.

(tradingview ADA /USDT chart)

In the first place I marked, the RSI indicator shows 70 and above. This indicated that overbought had occurred and that the price would decrease after a while. Likewise, in the Bollinger band, the price is in contact with the upper band. In such cases, a sell signal occurs.

In the first place I marked, the RSI indicator shows 70 and above. This indicated that overbought had occurred and that the price would decrease after a while. Likewise, in the Bollinger band, the price is in contact with the upper band. In such cases, a sell signal occurs.

The RSI value at the 2nd marked place is 30 and below. Such situations indicate oversold. A recovery in price is expected after oversold. The sale is in its last period. It starts giving buy signals to traders. Bollinger shows the same signal where I marked 2. The price is in contact with the lower band. In such cases, the direction of the price is expected to be upwards. There has already been a price increase for a while.

What timeframe does the Bollinger Bands work best on?And why? (Screenshots required)

The question of what time frame the Bollinger bands show best varies from person to person. In fact, it differs according to the trading style of the trader.

(tradingview ADA/USDT chart)

Some traders trade very briefly, try to get the signals according to the 15-minute candlestick charts and make their moves accordingly.

(tradingview ADA/USDT chart)

Some traders trade a little longer. like 1 day. That's why it tries to buy signals according to 1-day candlestick charts. Depending on the signal he receives, he makes his moves or gives up on making a move.

Apart from that, you can examine the charts in different time frames to find the direction of the trend and get different signals, and make your moves accordingly.

I would advise short-term traders to review 15-minute timeframes, long-term traders to review 1-day timeframes. They should also seek help from other indicators before trading.

Review the chart of any pair and present the various signals giving by the indicator Bollinger Bands. (Screenshot required)

When the appropriate chart is selected, it is possible to show all signals in the Bollinger band on a single chart. I want to show all the signals in several charts.

(tradingview ADA/USDT chart)

Bollinger bands are very close to each other where I show in blue. There is little volatility. There is a jam. Market makers are making gradual purchases in this region without any price changes. After a while, the resistance level breaks. The uptrend begins. We know that sharp price movements begin after periods of low volatility.

In periods when the trend is up, the price makes contact with the middle band. A support zone is formed here. It creates a buy opportunity for traders.

A sell signal occurs when the price makes contact with the upper band. We can say that it is overbought when it makes contact with or exceeds the upper band.

(tradingview ADA/USDT chart)

Bollinger bands show us trend changes. This usually occurs after periods of high volatility. The formation of more than one candlestick outside the lower or upper bands is an important signal for a trend change.

It heralds the beginning of an up or down trend during a low volatility period. After these situations, either the resistance level is broken and the price increases, or the support level is broken and the price decreases.

After overbought, a price change occurs, the trend starts to reverse. In overboughts, the price contacts the upper band and traders get a sell signal here. In oversold, the trend starts to reverse. Traders get a buy signal here. After a while, the price starts to increase upwards.

As can be seen in the screenshot, where the volatility is high, the bands are quite far from each other.

Conclusion

Bollinger bands give signals to traders in many ways. It indicates the beginning of a new trend, especially in overbought and oversold periods, when volatility is high. Thus, we have the opportunity to sell the asset we have at a high price or we have a chance to buy the asset at a low price.

As with other indicators, we need to use Bollinger bands alone. If we apply the usage to the chart with the indicator we know, our success rate will increase considerably. I would recommend using the Bollinger band and the RSI indicator together.

Thanks to the professor for this useful lesson.

Cc:

@steemitblog

@kouba01

Twitter sharing

https://twitter.com/Steemtht/status/1400823156990951431

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @tht,

Thank you for participating in the 8th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 10/10 rating, according to the following scale:

My review :

As usual, well-organized work with good content, your answer to the questions was clear and your analysis of the elements was deep which is evidence of your good understanding of all aspects of the topic related to the Bollinger Bands indicator.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit