Here come another week in the world of crypto, thanks to dear professor @asaj for his class. I love the class, it really added to my knowledge. Here is my submission sir

The demo account I will be using for this assignment is meta trader 5, I downloaded the .exe (PC) file on their official website and installed it immediately after the download was completed.

Then I proceeded by opening a demo account in wish I was given a login, a password and investor which I was advised to keep in a safe place. Then I logged into my demo account with the provided details.

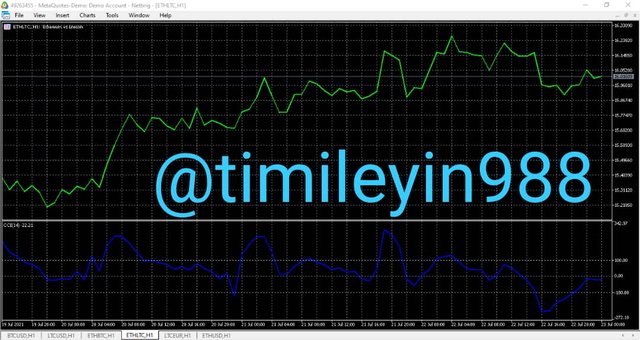

Choosing five cryptocurrency pairs

Looking at the question in the first place before opening the Demo account, I intended to choose STEEM/USD, TRX/BTC, ADA/USD, XLM/USD and DOGE/BTC but here on meta trader account the available cryptocurrency are limited so I have to choose BTC/USD, LTC/USD, ETH/BTC, ETH/LTC, LTC/EUR

To add each pairs of cryptocurrency, I pressed the “click to add” option that is located below the list of trade pairs on the market watch window and I inserted the cryptocurrency of my choice in the available list.

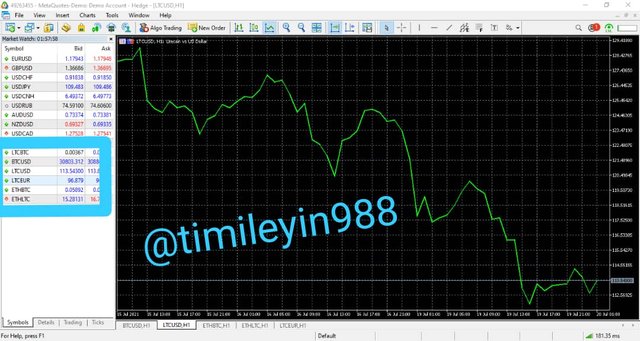

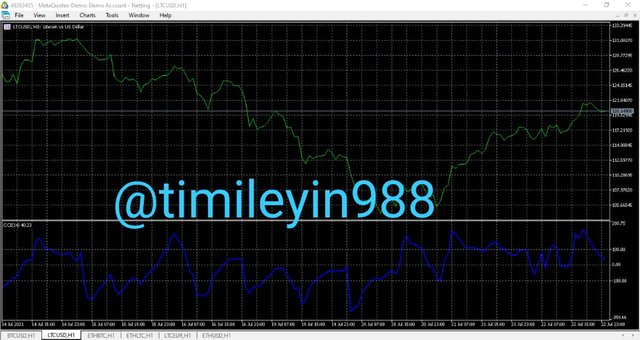

LTC/USD pairs

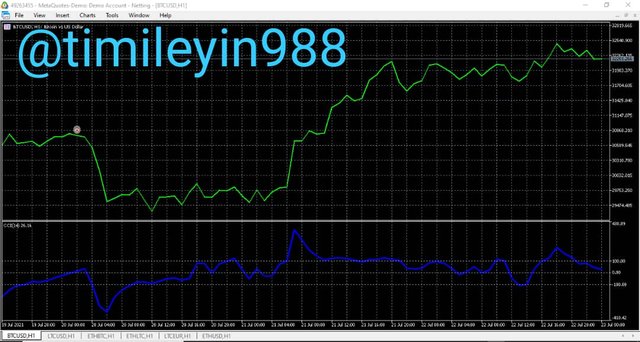

BTC/USD pairs

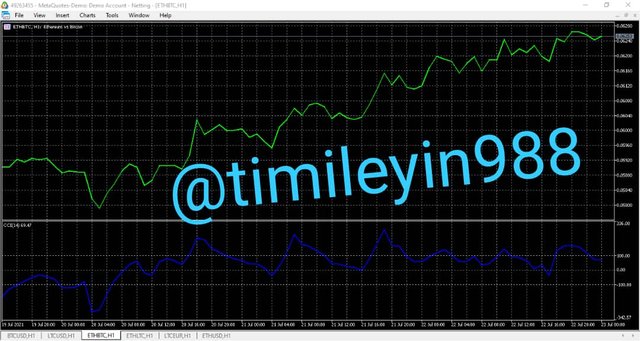

ETH/BTC pairs

ETH/LTC pairs

LTC/EUR pairs

Though I have my own strategy I normally used before entering and exiting a market, I normally use trading view charts to set up my strategy by combining two indicators (Exponential moving average EMA and Half trend). The combination of the two indicators have been given me positive result since I got to know them.

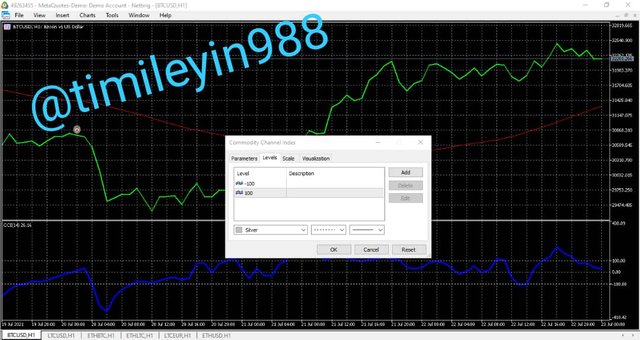

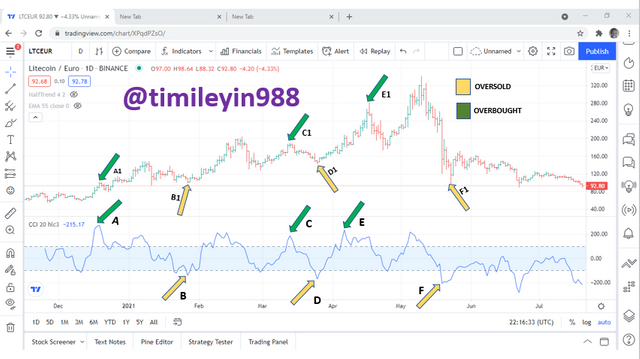

But in the case of this assignment I will be using the CCI strategy plus the “stop-loss and take profit” strategy to determine my market exit and entry point.

On my demo account, I look for indicators and under indicators there is oscillators, so I picked the CCI indicator under the oscillators and I make sure that it is set to be between -100 and 100 level.

Stop loss: This is one of the orders that trader normally set in trades, this type of order are set to take action in specific market price period and they are executed automatically whenever it's time. This type of order controls trade loss

Take profit: this is the opposite of stop loss in the sense that it controls profit of trader. It is also a type of order that is set to take action automatically whenever trade reaches a particular market price.

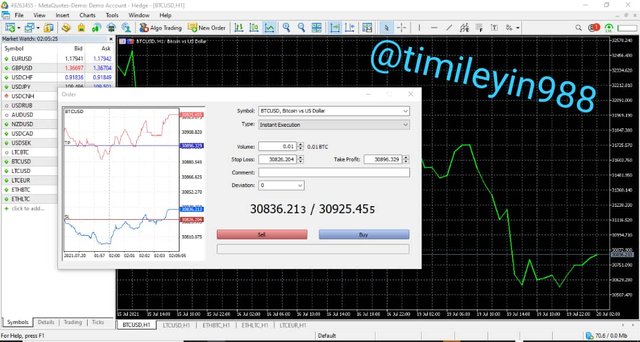

Stop-loss and take profit strategy

In Trading, it's either the trader loss or make profit. This is one of the reasons why it's good to set stop-loss and take-profit strategy.

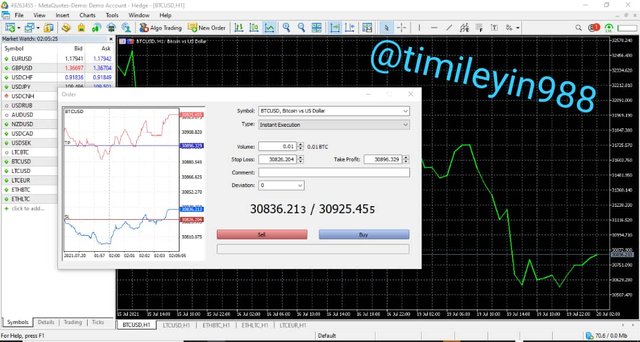

Taking the above trade as an example, it's a trade between Bitcoin and US dollar.

The current price of BTC as at the time I was performing this task is $30,836.213 and I set the stop loss to be at $30,826.204 and take profit to be $30,896.329.

This means that my trade will stop automatically when I am loosing beyond the set stop-loss limit of $30,826.204 and as well it will stop automatically when I'm making profit beyond the set take-profit limit of $30,896.329

LTC/USD

LTC/EUR

Green Arrows: Those points where I added green arrows signifies that a trader can sell their coin because the coin is currently in it's overbought position. Whenever people are rushing coin, it called the overbought period. The price will be high by this time and trader will make a lot of profit.

Yellow Arrows: Those yellow arrowed area signifies the buy signal, it helps a trader to know that it is the best time to buy their coin because the coin is currently in it's oversold position. This time the price of coin will come down, many people will buy coin during this time and hold it pending the time people will be rushing it back (overbought season)

A1, C1, E1: These are the points where market reversal begins to occur (downward movement) as a result of market overbought in A, C, E respectively

B1, D1, F1: These are the points where market reversal begins (upward movement) as a result of market oversold in B, D, F respectively

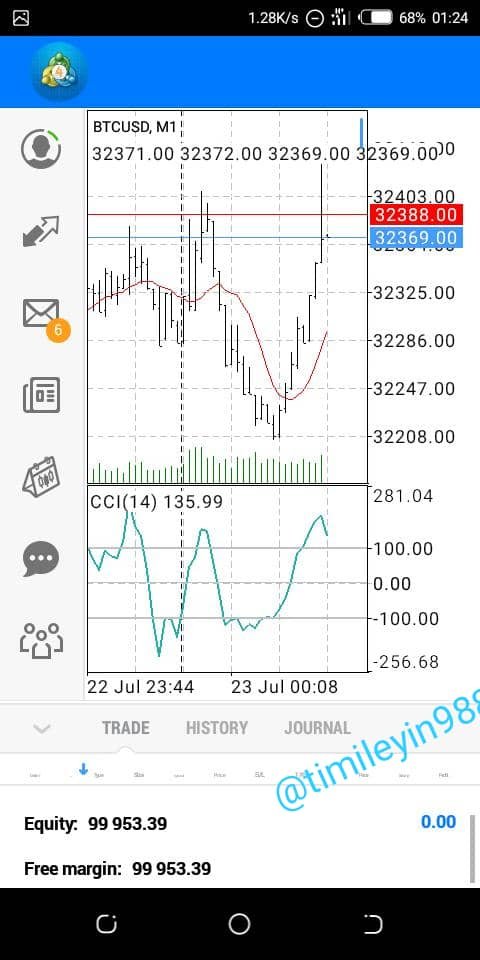

In this section, I will be make my trade both on my phone and PC using demo account. So, the trade declaration will be on two trades. I am doing this because I couldn't viem my trade history with my PC (don't know why)

As you can see in the above image that I made a buy transaction when the price was and I set my trading to stop loss when it reaches $30,826.204 and take profit when it reaches $30,896.329, Due to the light issue in my area I wasn't able to check back on my trade untill it's the 3rd day

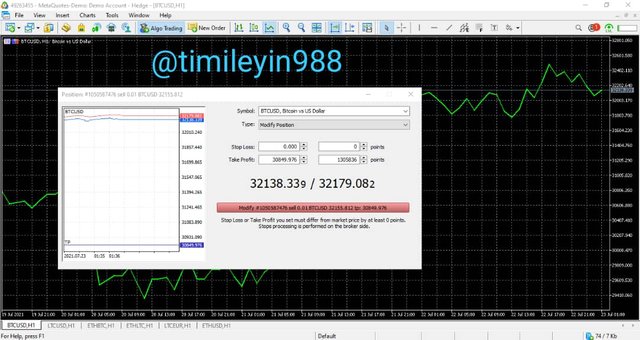

Checking my trade history 3 days later, I made a profit and my trade stopped immediately it reached the take profit point. Though I found the current price to have increased which would have become a greater benefits for me but my order has been completed because it has reach the set take profit limit.

Now, to calculate my profit, I will be subtracting the current market price when I enter the market from the price when I left (take profit - market price at entry)

Which is equal to $60.11

($30,896.329 - $30,836.219 = $60.11)

Therefore, my profit is $60.11

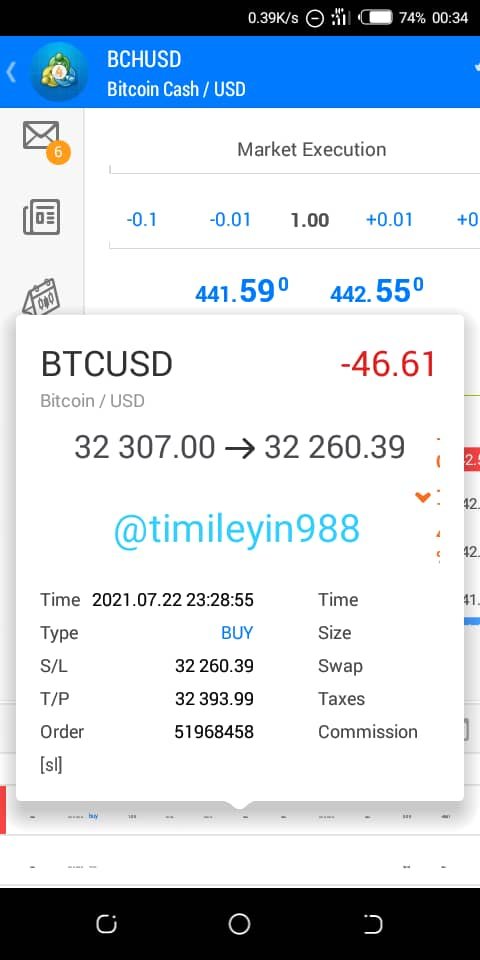

The above image is for the trade I made using my phone.

I made the move but in this case I loss $46.61

I will check different broker to know the current chart of a coin, because at times some charts are not accurate with their prices. So I need to make sure that I check very well to be sure about market trend.

The first thing I do after knowing what the market trend looks like is to calculate what my stop loss level will be. So that when I'm ready to start I will set my stop-loss to the amount that will never affect me when I lose. Then I proceed with other things

I will also set the exponential moving average and my half trend indicators. The two indicators helps whenever I'm buying and selling

Note:

All images used here are directly from my phone and Laptop.

Hi @timileyin988, thanks for performing the above task in the fourth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 6.5 out of 10. Here are the details:

Remarks:

You have shown that you understand the topic Stephen-pious. You completed the first three task in a good fashion. However, the last two task could use some depth.

In the fourth task, you provided only two cryptos in your account summary (BTC and BCH). Overall, this was a good performance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit