INTRODUCTION

There are different strategies that can be applied to trade in cryptocurrency but this largely depends on the experience of a trader as no strategy would exist without an experience with trades. Last week, for the first time, I knew of the market structure break strategy and when I looked charts patterns and trends, it is very applicable.

Break Retest Break strategy is yet another good strategy that is very useful for trading a long trend. This is because crypto assets do not just go down without any break in trend in one direction. After an asset has broken a resistance or support levels, it goes back to that level again before continuing in the direction of its movement. This happens when the particular trend is strong.

1 - What do you understand about the Concept of Break Retest Break Strategy? Give Chart Examples from Crypto Assets.

Break Retest Break Strategy is a method is of trading used by people who trades daily for daily profits.

Break Retest Break happens when a crypto asset breaks a resistance in a bull market or support in a bear market and comes back to test the resistance or support it has overcome before it continues in its original direction.

The simple idea behind this strategy is that, a user of it must identify the mode of the crypto asset. The chart of the asset should be studied to know if it is in consolidation mode or it is in a particular direction of movement (trend). This is due to the fact that the consolidation stage must be overcome and it falls back to the same consolidation stage to retest it before the price can continue in the direction of its movement. Once it retests it and passes that stage, breakout happens. Breaking out happens after a successful bull or bear run. Because breakouts can be fake and deceitful, one can wait to see that the price tests the previous resistance before taking decisions on trade.

In price breakout in a bullish market, some persons buys at the point of breakout when the resistance have not been tested. As the uptrend continues, persons who have bought earlier before the breakout would begin to sell leading to a period of downtrend. As the price reaches support level, some buyers who have sold or are new in this market buys then the price goes up back. Just because of this action, the price passes the resistance that had previously broken and it goes higher than even expected.

This same thing happens in price breakout in a bearish market.

BRB at Resistance Level

At resistance, the price goes up above the resistance making a swing higher than the resistance. It will then come down from the higher point to test the resistance before going back above the swing higher point that was marked. It goes up and up until it reaches another resistance.

EPS/USDT PAIR ON 15MINS TIME FRAME.

BRB at Support Level

At support, the price goes down below the support and makes a swing below support. It will then go above the support to retest it then comes down below the lower swing point then goes down and down until it reaches another support.

EPS/USDT PAIR ON 15MINS TIME FRAME

2 - Mark important levels on Crypto Charts to trade BRB strategy. Do it for Both Buy and Sell Scenario.

The break retest break strategy is used to make profit from a continuous uptrend or to reduce loss from a continuous downtrend for persons who have not bought or sold before a price break out.

Buy Scenario

SUPPER/USDT PAIR ON 15MINS TIME FRAME

The screenshot is a chart of SUPPER/Usdt above. The price broke the existing resistance in an uptrend and went up making a swing. It then came down to the resistance level to retest it. It went up after the retest and the uptrend continues. To make a buy entry, it is better to buy when the retest has been made and the price is on its way up again hence, I set a buy ordera little above the resistance level after the retest.

Sell Scenarios

In the chart of SUPPER/USDT below, the asset is in a downtrend. The price broke the support level and went down. It came back up to retest the support level and then went down again to continue in the downtrend. For someone who could not sell at the higher high or during the swing, seeing that the support has been broken, it's safe to sell since a retest of support has been made. Therefore, I made a **sell entry just below the support that has been retested.

SUPPER/USDT PAIR ON 15MINS TIME FRAME

3 - Explain Trade Entry and Exit Criteria for both Buy and Sell Positions on any Crypto Asset using any time frame of your choice (Screenshots Needed)

Every strategy used in cryptocurrency trading has criteria that must be fulfilled in order to be able use the strategy effectively. This can be achieved after an Indepth study of the chart pattern for that particular strategy. There are criteria to be used when trading with the break retest break strategy for bother entry and exit points for buy or sell.

Trade entry Criteria for a buy Position Using Break Retest Break Strategy.

TKO/USDT PAIR ON 15MINS TIME FRAME

The following criteria must be fulfilled before buy entry is made.

a. The crypto asset should be in an uptrend close to resistance and this point should be noted.

b. The resistance must be broken and a swing high should be made. One has to wait for this to happen as it may take some time or it may not even happen.

c. The previous resistance should be retested and the price should be in an uptrend again.

d. Allow the price goes above the swing high that was made earlier.

e. The buy entry should be made from a point a little above the break of swing point.

Trade entry Criteria for a sell Position Using Break Retest Break Strategy.

ASR/USDT PAIR ON 15MINS TIME FRAME.

a. The crypto asset should be in a downtrend close to support and this point should be noted.

b. The price should break the support and make a swing low point. One has to exercise patience in waiting for this especially when the time frame is 1hr and above.

c. The price goes back to the support position and retest it then move down the more.

d. Allow the price go past the recent swing low point to validate the break.

e. A sell entry should be made below the swing point that was broken.

Trade exit criteria for a buy Position Using Break Retest Break Strategy.

REP/USDT PAIR ON 1HR TIME FRAME

Set a stop loss for your crypto asset incase their is a reversal of trend after you have made a buy entry.

The stop loss should be below the the resistance level that has been identified in the chart.

Once the price gets to the stop loss that was set, the trade set up will be invalidated.

For a trade that is in one's favour, one should set take profit. For the first time, it's better to set this take profit at 1:1 Risk Reward Ratio.

Once the price reaches take profit level, one should go ahead and take profit.

Trade exit criteria for a sell Position Using Break Retest Break Strategy.

WIN/USDT PAIR ON 1HR TIME FRAME

Stop loss should be set if the trade go in the reverse direction after one has entered.

A stop loss should be fixed at a price a little above support.

Another trade set up should be fixed incase the price gets to the stop loss level, because it will invalidate the first set up.

A take profit level should be set for a trade in one's favour. If it is the first time, the ratio should be in 1:1 Risk Reward ratio.

As the price reaches the take profit set, one should take profit at once

4 - Place 2 demo trades on crypto assets using BRB Strategy. You can use lower timeframe for these demo trades (Screenshots Needed)

Demo Trade 1

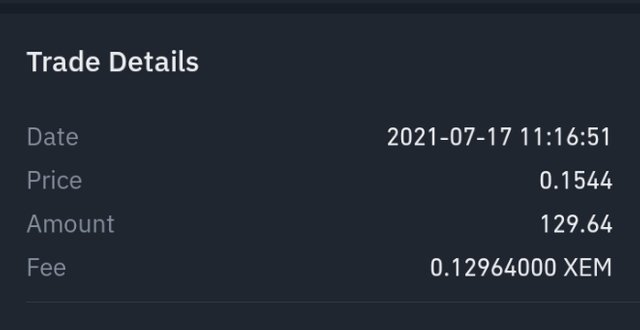

XEM/USDT 1HR TIME FRAME.

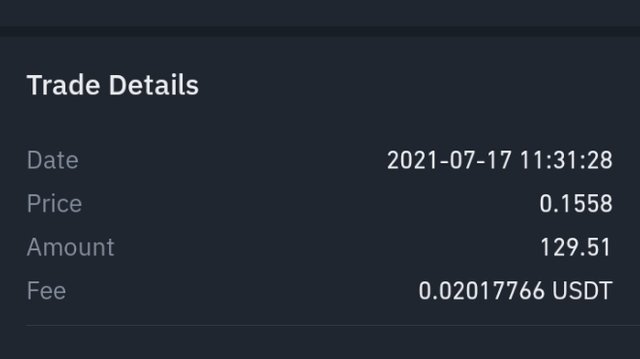

I placed a buy order at 0.1544 just above the second break. I set a stop loss and take profit at 0.1555 and 0.1558 respectively. I didn't waste time to take profit because it's just a demo trade. My profit was $0.161.

The details of my trade are below.

Chart description

Execution of my buy order

Where I took profit

Demo Trade 2

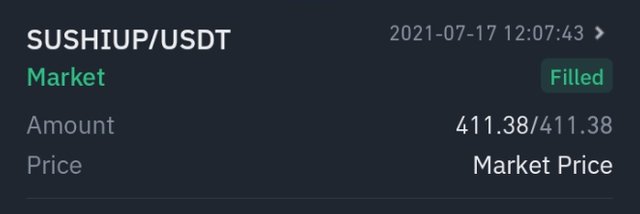

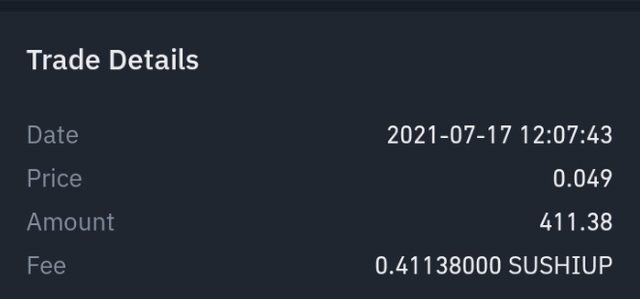

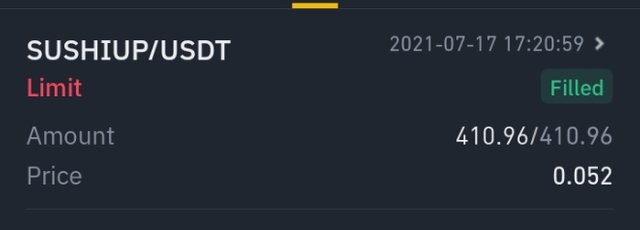

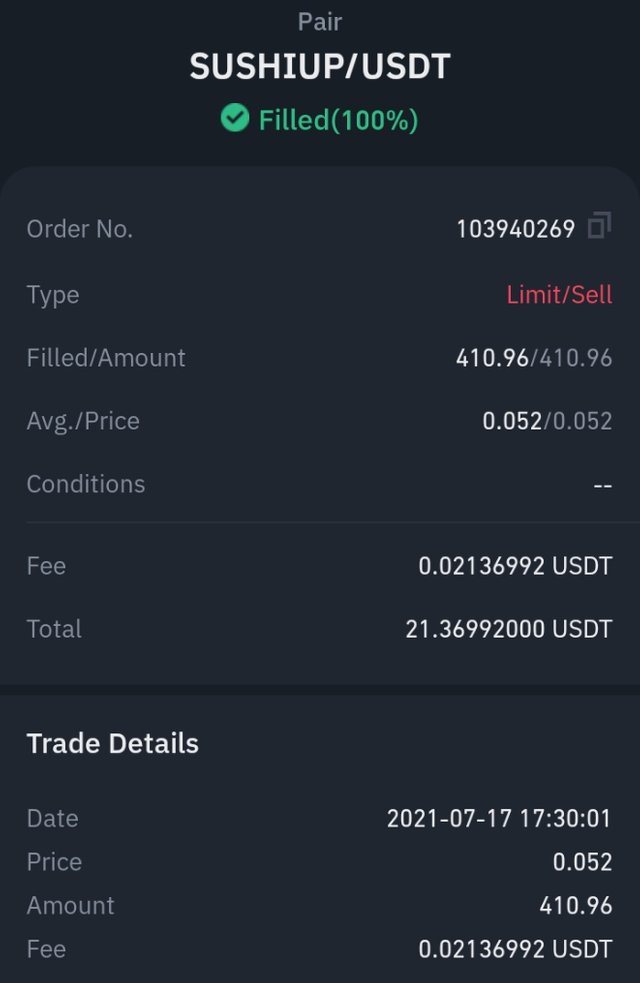

SUSHIUP/USDT ON 1HR TIME FRAME.

I bought sushi up at 0.049 which was the market price just after the second break a little above the swing point and set a stop loss at 0.050 and take profit at 0.052. I waited for about 10 before it hit the take profit level. I made a profit of $1.2089.

Below are details of the trade and Chart.

Chart Description

Buy Order details

Sell details of where I took Profit

Conclusion

Break Retest Break Strategy is a great method of trading used by intraday traders but also used by investors. It is used for trading trend continuation. If used effectively, a lot of profit can be made in a short while and losses can be reduced or averted. To use this strategy and make a positive return, their criteria criteria the chart of the crypto asset must display.