INTRODUCTION

Hello steemians, I am very delighted to write my homework post for this week and also using this opportunity to say a very big thank you to prof @stream4u for this wonderful lecture this week.

Question 1

What Is the Importance Of the DeFi System

Before I begin with the importance of DeFi systems is, I will like to throw more lies you on what a DeFi system is.

The full meaning of Defi is Decentralized Finance and the following feature can be found in DeFi. And they are; Smart Contracts, Assets, and then dApps which is created and hosted on a blockchain.

What we should know about DeFi is that, the initial stages Ethereum was the main platform hosting DeFi applications even though it is not the only Blockchain platform that can actually serve that same purpose. There are other blockchain platforms, but the Ethereum blockchain was the primary one for DeFi aaps.

The reason behind DaFi is to offer the chance to user’s to have an open financial environment in which financial services or transactions can be made, such services depend on the possibility of the decentralized system.

What I will like to talk about is the chance to discuss in changing or modifying this DeFi application which is made on certain specified blockchains. The evolution of DeFi begins in the early 2018, where a group of expect worked together to build an alternative financial system, hoping they will be able to address fairness, transparency and equity issues that the existing system (Central Finance system) faces.

Moreover, I will like to now talk about the main agenda that’s, the importance of DeFi System.

Firstly, The main thing I will like to talk about is the opportunity the DeFi system offers out to investors. It offers high opportunity to yield high farming which we as a whole know as "yield framing". This permits investors/ traders in the system to credit/ loan or borrow money and loan their crypto assets at a very higher rate which we can discover in the centralized system.

secondly, I will like to talk about; Total Asset Control. Users on decentralized finance systems has access to their assets at any point in time, this means that transaction can be performed without the involvement of intermediaries. Users take charge of their assets as to when, where and who to make transaction to. Unlike the centralized system where intermediaries like banks ans exchanges take charge of users assets and determine when, where, how and who to make transaction to.

Thirdly, I will talk about Privacy. The reason behind this system is to make sure that there is user privacy when it comes using it or making transactions. Unlike the centralized system where user data is handle by an intermediary, here is different. There is privacy involvement since there are no requirements for user information to be presented to anyone.

Fourthly, I will like to talk about User Verification . other verification systems are not needed in a decentralized financial system, transactions can be made without the requirement of users identity. Unlike in the centralized finance system where every detail (address, contact, date of birth, name etc.) of a client is taken before processing any transaction.

Last but not least, the DeFi system is able to offer the opportunity of adequate access to all financial services being made.

Question 2

Flaws in Centralized Finance.

Firstly, in this type of system, I will say there is a form of administrative leadership. In this type of system, the employees are only expected to deliver the results which is stated by the top officials or executives. there is a form of dictatorship which makes it not comfortable working with. The employees are not able to give their opinion when there is a form or time for decision making.

- Limited Control: Customers resources are access by central authorities like the bank in centralized finance. So when transactions are to be made in a period where the central authority isn't working, one needs to wait till it resumes. This gives a practical control to owners of assets or resources. Sometimes there specific approvals that are needed before getting ones accounts.

- Additionally, there is a slow in work. Records are slow due to the fact that, the data / information has to be sent to the head office and to do that, the employees will have to subject to the information which is communicated to them from the top. This can prompt to the slow and which brings low productivity.

- Presence of Intermediaries: The various middle people in Centralized finance make it very costly to utilize. Clients ought to pay a lot of expenses and must need to utilize this mediators to carry out a few imperative transactions. The banks has workers who process client’s transactions and in return clients pay huge amount of fees to settle the workers.

- User Identity Verification: Centralized systems required users identity before performing certain transactions. This identifications sometimes includes users’ house address of which different users can use to track down other clients and confiscate their personal properties.

Question 3:

DeFi Products. (Explain any 2 Products in detail).

DeFi Products

The DeFi system is trying to remove the centralized system. Accordingly, neutralizing working against the flaws of the centralized system to better its. There are products of the DeFi ecosystem that doesn't expect intermediaries( middleman) to accomplish a tax and below are some of the products that are lending and then decentralized exchanges which will be discussed below in detail.

DeFi lending

When looking at Lending, it is one of DeFi decentralized ecosystem that requires two parties to complete a transaction. Thats, there is somebody who willing to lean his or her assets or resources for premium or interest.

Traders utilize this concept of decentralized finance to make more interest and also borrow funds to invest into their assets. Moreover, the other party will will be willing to borrow the asset at an interest rate. One of the best system that can help in this kind of transaction is JustLend.

I will also like to talk about Lending and borrowing. In his type of system, markets are available in a sense that, you can find assets that are offered by the markets, and also their APY is provided for cases of borrowing and lending. Those always interested in borrowing or lending will know the kind of interest they will have to pay back.

The Decentralized Exchanges

These form a major part of Decentralized Finance and provide users with buy/sell, swap/exchange, provide liquidity. With this users can perform transactions without any third party. Examples of decentralized exchanges are; PancakeSwap, JustSwap, Uniswap and many more.

Now, I will like to talk about UNISWAP PROTOCOL.

Non the less, the usage of Automated Market Maker (AMM) in the Decentralized Exchange platforms, which utilize smart contracts to make liquidity pools through which exchanges are consequently completed on the off chance that they take after the set of instructions given.

UNISWAP PROTOCOL

Most trade project organizations or companies support the saving in as market creator but Uniswap likes liquidity pools instead of saving as a market producer. To make an effective market, liquidity suppliers give out liquidity to the trade, they do as such by adding tokens to a smart contract which can bought and sold by various clients. The liquidity suppliers get a percentage of trading fees earn per each trade. expenses acquire per each exchange. A calculated amount is removed from the pool for an amount of the additional tokens per each trade which changes the price.

UNISWAP

Uniswap is a decentralized finance protocol with the basic aim of exchanging cryptocurrencies. Uniswap represent the name of the institution that first formulate the Uniswap project. It seeks to facilitate automated transactions between cryptocurrency tokens on the Ethereum blockchain through the use of smart contracts. By daily trading volume in October 2020 Uniswap was presume to be biggest decentralized exchange a d fourth in the crypto market. The liquidity providers who seeks to enhance in liquid market for cryptocurrencies being exchanged start to generate a fees of approximated value US$ 2.5-3 in March this year.

Question 4:

Risk involved in DeFi.

- Price Volatility:price of an asset is not stable, it fluctuates every seconds, so when a user stake or lock an asset at time of its great price and when he/she decides trade it and the asset is at its worse price, this can bring a very huge loss and risk with DeFi.

Scalability: scalability is one of the major risks/problems as well. Blockchains that have low scalability result in a long period of time for transactions to take place and transactions are expensive as well

Security of funds: If you are in total control of your funds is really a good thing. When once in the custody of your keys, the keys could be misplaced, forgotten, stolen, etc. Once this happens, all the funds or assets are lost and can't be assessed. this could lead to cases of dismissal.

- Liquidity Risk: As seen in decentralized exchanges, liquidity is continuously lower as compared to centralized exchange and as such can lead to intemperate transaction expenses within the DeFi system.

Question 5

What is Yield Farming?

Yield Farming is a method of acquiring rewards. This happens when you hold your crypto assets or clients lock up their assets over a period and earn from it. Traders who take part in this process of locking their assets are called Liquidity Providers. Liquidity provides goals are to acquire from trade fees from a calculation algorithm, APR and APY depending on the type of yield Farming chosen.

The yield project grants trades to credit their assets or resources to others in type of a Liquidity pool. The Experienced clients inside the crypto environment can acquire up to 40% get per annum making use of contributing methodology.

In basic terms, Yield Farming can be clarified as a method of acquiring rewards. This can be possible when you hold your Crypto assets, you get your rewards for it.

Question 6:

How does Yield Farming Work?

This works with the assistance of Liquidity Providers and Liquidity Pools in a DeFi market. Yield farming gives involves investors giving liquidity and earn from it. At the point when investors lock their assets in liquidity pools of lending protocols, they have given the liquidity and they acquire from it.

Yield farming works through this automated market maker (AMM) model. This model includes liquidity pools into which stores of Liquidity Suppliers (LPs) are dashed up. Along these lines, liquidity supplies would store their assets into the pools. Such pools will serves as the point serve as marketplace from exchange of tokens, borrowing or lending capacities can be carried out. Normally, using these platforms, it came with a couple of transactions and exchanging expenses which are at that point then paid out to the suppliers of liquidity. The partial payment are done dependent on the share of the liquidity every LP has.

Lenders get interested from the funds they deposited into the liquidity pools. This interest is in a form of yield tokens. Just like how it was done in the traditional style. you will have to pay interest from a loan you took from a bank.

Question 7:

What Are the best Yield Farming Platforms and why they are best. (Explain any 2 in detail)

In this particular sector, I will be talking two different decentralized exchanges on different blockchains that offers yield farming. PancakeSwap (Binance Smart chain) and compound finance (Ethereum Blochchain).

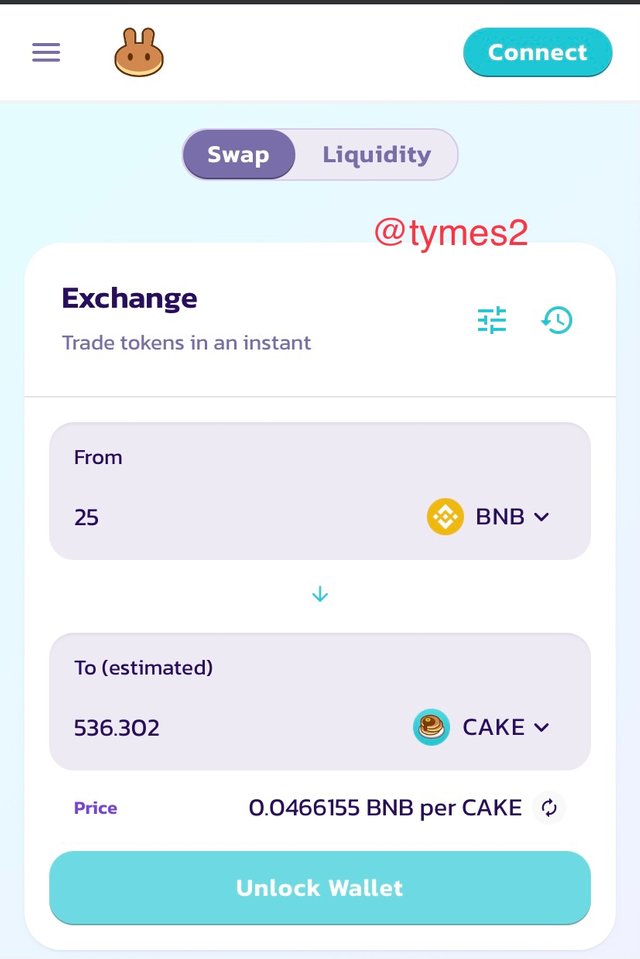

PancakeSwap

PancakeSwap is one of the decentralized exchange platforms that works using the Binance Smart Chain. PancakeSwap works using liquidity pools that work through the AMM. Pancakeswap is mostly known for the exchange of BEP-20 Token, where yield farming is also practiced. You could decide to state the tokens you have for an interest.

PancakeSwap offers the buy/sell, swap/exchange... of BEP-20 (BSC tokens) which makes it simple to trade BEP-20 tokens for another BEP-20 token. In spite of the fact that it runs on the BSC, tokens from other smart chains can still be exchanged to the system through the Binance Bridge and grant you an opportunity to benefit in hard-to-find and indeed uncommon yield farming benefits.

This platform is a nice one with features such as; liquidity to the exchange and earns profits, trading of the BEP-20 tokens. Also, other features such as staking cake to also earn some more cake. You can also Stake your assets and then be given the cake tokens. This platform is also good because it has low charges or low fees. It using the BEP-20 network makes it comes with a very less fee charge. Another thing is the ability to make fast transactions. The transaction time for pancake is about 5 seconds most at time.

Why PancakeSwap is among the best

PancakeSwap is classified among the best because; It has one of the most reduced and cheapest transaction fees which is an included reward to it against some AMMs on the Ethereum arrange. also, Liquidity can be provided and even represented as non-fungible tokens, moreover, acquired LP tokens on PancakeSwap can be used in staking in the farms in order to earn more rewards.

Last but not least, It incorporates a very user-friendly interface that's exceptionally simple to explore even without earlier knowledge of its functionalities. This helps you to maximize benefits through ease of utilize.

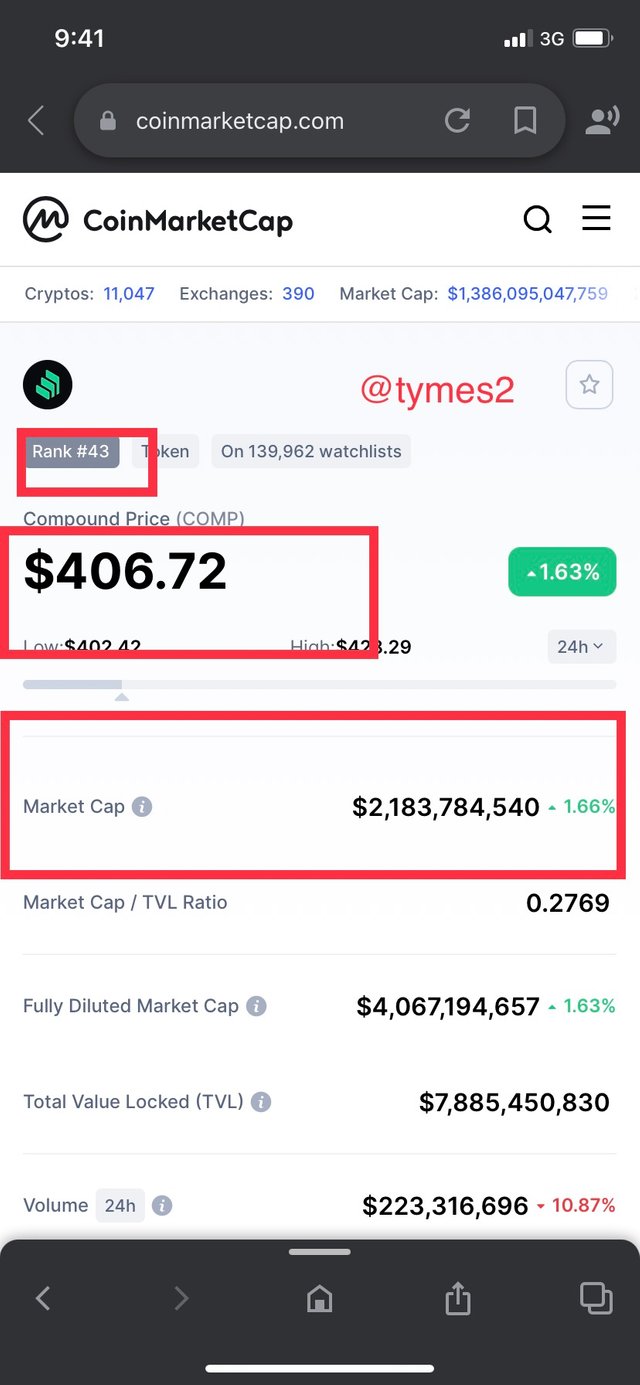

Compound finance

Compound finance is another Yield farming platform that was established and started in 2017. Geoffrey Hayes and Robert Leshner was the people behind this platform and its offices which can be located in San Francisco, California. Compound Finance is based on the Ethereum blockchain based algorithmic money market protocol and runs an open source interest rate protocol assembled as an attractive feature to engineers in bringing other new financial systems. The Compound Finance grants clients to have a consistent ability to borrow and lend assets , especially with those having the Ethereum wallets who can give liquidity.

Compound finance DEX has been important and valuable due to the fact that, it has ousted the bureaucracy quarrel between suppliers of liquidity and their borrowers. The AMM model which turns out to be incharge in dealing citing to of price, rates and different collaterals that are under the smart contracts. As such individuals that are associated with the system directly.

The native token for Compounf Finance is the COMP token which is ranked 43rd by market capitalization and with a price of $ 406.72 as at the time of my homework task. Some of the supported tokens seen in the Compound protocol include; ETH, USDC, USDT, REP, ZRX, BAT DAI & WBTC.

Why compound Finance is among the best

Liquidity can be provided and even represented as non-fungible tokens

The platform is non-custodial and will not require you to transfer your assets into it

compound finance does not require any form of KYC or AML procedures and offers ease of usage

- Compound finance has a form of concentrated liquidity that enables LPs to add more liquidity at selected or fixed prices.

Question 8:

The Calculation method in Yield Farming Returns.

There are two ways/ method of computing for it. Which is the APR and the APY. lets take a look at how this is done.

APR

This means annual rate of returns without the interest earned. This does not come with the interest. It only gives the rate of return exactly after a year.

Example, if we have an APR of 70% and we dealing with a capital of $1000. Our returns at the end of the year will be;

70/ 100* 1000= $700

1000 + 700 = $ 1,700

At the end of the year, these borrowing will have to pay the annual percentage rate.

APY

This is another type of the yearly returns but over here, we manage revenue that are acquired in time intervals in the year.

This is another yearly returns however it includes compound interests earned at specific interval the year. It is calculated with the help of the mathematical formula;

APY = (1 + r/n) ^n -1

But, r = interest rate

n = number of compounding periods

Example, I staked my token worth $100into the Auto Asset pool which offers 100% APY.

With the help of my formula which is; (1 + r/n) ^n -1

Now, my r which is the interest rate = 100%

n which is number of compounding period =

Where we have; r = interest rate, and r = 100% ~ 1

n = the compounding period, and n = 365 days ~ 1 year

Now, let's put the resources together,

(1 + r/n)^n - 1 <---> (1 + 1/365) ^365 - 1,

(1 + 0.002740)^365 - 1,

(1.002740)^365 - 1,

(2.717) - 1 = 1.717,

Now the APY = 1.717 X 100 = $171.7

Now my total investment after one year = Initial investment + APY = 100 + 171.7 = $271.7

Therefore, my total returns after one year = $271.7

Question 9;

Advantages & Disadvantages Of Yield Farming.

Advantages

In Yield Farming there is a chance of gainign a higher rewards than traditional bank loan system. You will be able to make upto 80% profits.

It has been able to attract inventors and some millions of locked in liquidity, that not withstanding, it has been lucrative.

As seen in Annual Percentage Yield, we get high interest profits. It is comprised of the compounding interest

Traders do not have to know everything about yield farming before starting to invest,. Traders only require access to finance and a crypto wallet to get started.

Some yield farming platform gives it holders the ability to participate in governance.

Disadvantages

The return on investments made usually gets decreased over time especially when new pool options emerged.

Changes in the nodes of a smart contract can affect the funds on that smart Contract.

There will always be a problem in the loan price when we have cases of the DeFi exchange liquidity provided by the traders dropping in regard to the collateral.

Yield farming is not an area for beginners. That’s , Those new in trading should not venture.

Because of the high instability within the crypto market, assets utilized as collateral confront the threat of liquidation in case they can't topple your collateral, as a result of diminished value.

CONCLUSION

Decentralized finance has create a conducive environment for traders to have a complete transaction without the involvement of intermediaries which as well reduces transaction fees. With DeFi, traders can send tokens to anyone at when and how they want. In some seconds, we can have a complete transaction through DeFi platforms unlike CeFi which takes hours and sometimes days.

Trader who engage in this process of locking their assets are called Liquidity Providers. As well users can borrow from the liquidity pool and in return pay some amount of interest.

I will like to use this opportunity to thank the professor @stream4u for his wonderful lecture this week. I really learn a lot from his lecture and I hope my homework task will be accepted and review thank you!!!!

Hi @tymes2

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The best post of the day i read. Best of luck for your journey on steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit