Risk Management

Trading can be very profitable, yet so risky. Majority of newbies in crypto trading end up with more losses than profits. Even when they make profits, it does not cover up for their previous losses or they would lose the profits to the next trade.

The number of trading strategies a trader has in his arsenal is not enough to guarantee success. Trading strategies are usually effective 50% of the times, so what what about the other 50%? Market situations can change in the blink of an eye irrespective of the prediction and signals given by indicators.

Losing is a general part of trading. Every trader, both newbies and experienced, are bound to encounter losses in their trades from time to time. This is where Risk Management comes in.

Risk management refers to all the tools and strategies that are put in place to minimize losses in a trade setup. Risk management ensures that the losses that are liable to occur in the situation of unpleasant market situation would be bearable for the trader.

Importance of Risk Management in Crypto Trading

Risk management reduces losses to a minimum in crypto trading.

It ensures that the trader has sufficient capital left after suffering a loss.

It improves the overall decision making of traders.

1% Rule

The 1% rule is a risk management strategy that involves risking only 1% of the trade capital to open trades. Risking this little percentage of the capital would ensure that the capital would still be sufficient if a trade results in a loss.

Let's take an example. A trader, Mr A, has $5000 as trading capital. He utilizes the 1% rule which implies that only 1% of his capital should be used to open positions.

If Mr A wants to open two positions, he'll use 2% of his capital (i.e 1% each).

2% of $5000 = $100

If both trades end up in a loss, the trader would still be left with 98% of his trade capital, which is more than enough to recover the losses and make more successful trades.

$5000 - $100 = $4900

Risk-Reward Ratio

The risk-reward ratio is a risk management tool that is used for setting stop loss and take profit points. The risk-reward ratio somewhat advises traders in decision making on whether to take a trade or not.

It is calculated with the entry price, stop loss and take profit as parameters.

Risk-reward ratio = (Entry Price - Stop Loss )/ (Take Profit - Entry Price)

A risk-reward ratio of 0.5 (1:2) and 0.3 is usually required to keep a trade profitable. But for the most minimal risk, a Risk-Reward ratio of 1 is required.

Let's take a buy position of $1600 as an example. Using a risk-reward ratio of 1:2, the stop loss can be set at $1400 and the take profit point at $2000. If the trade doesn't go as planned, the trader would lose just $200. If the trade becomes successful, the trader would make a profit of $400.

In the above scenario, the trade is valid when the risk is compared to the reward. That is, the risk is bearable and can be recovered easily in another trade if the current trade goes sideways, and the reward is sufficient if the trade goes as planned.

Stop Loss and Take Profit

A stop loss is an exit order that triggers a sell order if the market goes in the opposite direction of the predicted movement. In a buy order, a stop loss is set to sell the asset at a lower price if the price of the asset drops to a particular level. This would help in minimizing the risk incase the market keeps falling far below the predicted level.

Take profit is also an exit order that is activated when price moves as predicted. Take profit is triggered in a successful trade and it is a sell order to sell the asset as the price reaches the desired region.

Setting a stop loss and take profit point is important as a risk management technique. It helps the trader define his profit point and loss points. Setting a stop loss and and take profit point would prevent greedy and emotional trading.

Let's take an example of a trader who sets his take profit and stop loss point. He is sure of his profit target and leaves it untouched irrespective of the market situation. The stop loss would be set to minimize the loss he would incur incase the trade goes sideways.

A different trader who doesn't define his stop loss and take profit point would trade impulsively. He may see a good opportunity to take profit in the market and not make the decision because the market seems to exceed his expectations. In the twinkle of an eye, he can lose that trade without a stop loss to save the trade if the market situation reverses .

On this note, it is important to set the stop loss and take profit points for every single trade.

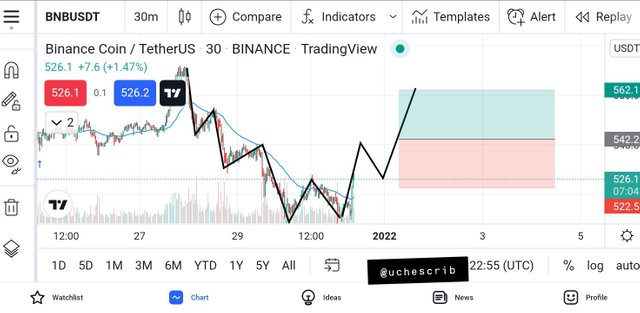

Demo Trade on Trend Continue using Market Structure

Entry Strategy

The market is in a current downtrend which is indicated by lower highs and lower lows. A retracement is formed and I placed the sell entry at the candlestick that was formed after the candlestick that marked the retracement.

Exit Strategy

The stop loss is set above the newly formed resistance at the last high. A risk-reward ratio of 1:1 is used to set the take profit.

1% rule

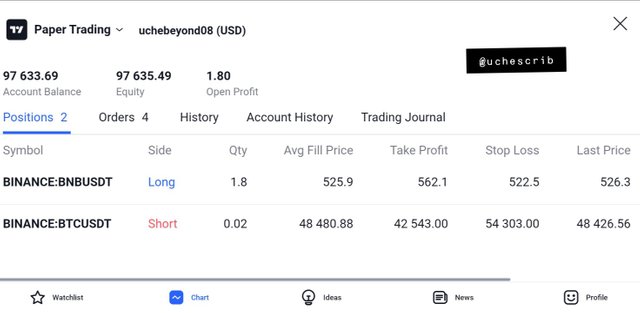

My trade capital is approximately $97,600. I used the 1% rule as a risk management strategy in placing my trades.

1% of $97,600 = $976

This means that about $976 was used to open this trade.

Demo Trade on Trend Reversal using Market Structure

Entry Strategy

This particular market situation is characterized by lower lows and lower highs. Currently, two bullish candles have been formed which causes a new high to be formed. This new high is higher than the previous high. Predicting a break in market structure, I created an entry at the position suspected to be where the engulfing bullish candle would end.

Exit Strategy

I set my stop loss below the last support that would be formed at the point where price would retest the broken structure. I used a risk-reward ratio of 1:1 to set my take profit point. If the trend reversal was defined, I would use a risk-reward ratio of 1:2.

1% Rule

My trade capital is approximately $97,600. I used the 1% rule as a risk management strategy in placing my trades.

1% of $97,600 = $976

This means that about $976 was used to open this trade.

Summary of Demo Trades

Conclusion

Risk management is essential to capitalize on trades by reducing the risk that would be incurred in the situation of an unplanned market situation.

Confluence trading is also a risk management technique and it involves using multiple technical analysis methods to make better decisions in the crypto market.

All in all, it is advisable to always minimize risks and avoid trading with emotions by utilizing good risk management strategy.

Cc: @reminiscence01

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 1/5) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @uchescrib the minimum requirement to join the club5050 is a powerup of at least 150 steem. you didn't meet the requirement.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank your for the notice. I have powered up more SP to reach the threshold of 150 Steem. It was an oversight.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Alright.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit