Good day, am glad to be part of this academy, I also acknowledge the impact of our professor for bringing this course to us. Well done sir.

Answers to Question 1

The case study above is an example of trading psychology

Reasons why the case study is an example of a trading psychology

Trading psychology deal with the behavior of an individual when making decisions concerning their crypto asset, the case study above show the behavior of Jane in regards to the signer she got from the Telegram group, her behavior was first characterized with fear which leads to her slowly entry into the market, as the market begin to turn into her favour, her behavior was also characterized by greed which leads to not taking her profit at 20$, as she expects more profit from the coin which also lead to her buying more when the price is going down, the totality of the case study show the behaviour of an individual (Jane) in the market is is an example of a trading psychology.

Answer to question 2

The following are the biases that Influence Jane's behavior

- Emotional Bias

- Anchoring Bias

- Disposition Bias

- Trend chasing Bias

- Confirmation Bias

Explanation with Examples of how they affect Jane's trading behavior

1.Emotional Bias: this is a situation in which a trader make a decision base on his or her feelings,

Jane's Trading was influence by greed type of Emotional bias, she could have sold the asset at $20 but didn't with the hope of getting more profit, she also start averaging a point when the market was going down with the aim of getting much more profit and thus it ends in regret which is another type of Emotional bias.

2.Anchoring Bias: this is a bias where the decision of a trader or an individual is are influence by a particular reference point.

The Stop lost point of 5$ in Jane's Trading serve as a based for Anchoring bias, Jane on her own would not have sold the coin or close the trade if not the price reaching it stop lost point. Putting stop lost serve as an anchoring Bias which affected Jane's Trading behavior.

3.Disposition Bias: It happened when a trader fail to accept mistakes on investment but instead looking for ways to prove his or her decision by holding his positions even when the asset is getting low in value. "He stated that an asset can not be considered lost until you sold it out.

We can see a prove of this bias in Jane's behavior when she refused to sell the asset when the price is getting low but instead, she decided to buy more. And thus it affected her trading behavior.

4.Trend chasing Bias: this bias involved following past even, present event or past success of people.

Jane's only place her buy order when she had see the results of the signal, the coin had moves from the entry point of 9$ to 15, if there had not be previous success, jane would not have placed the buy order. Jane was acting on the present and past success of people who enter the trade earlier.

5.Confirmation Bias: this bias deal with seeking information to support ones believe, Jane who was a crypto trader didn't start her trade until she get a confirmation from a Telegram group, she also get more confirmation by allowing the market to start going up before placing her buy order.

Answer to question 3

How each of the Bias mentioned above can be avoided

1.How to avoid Emotional Bias: to avoid this type of bias, a trader must learn how to only buy asset or sell asset base on facts and signals, doing away with self attribute of greed and fear. Taking self and emotional feelings out of trading and stick with facts and pattern.

2.How to avoid Anchoring Bias: avoiding the use of stop lost or take profit is a great way to avoid Anchoring bias. Entering and stoping a trade should be self decision and not by other people's reference point.

3.How to avoid Disposition Bias: one of the quality of a good trader is the ability to accept market outcome, to avoid this type of bias, a trader must accept lost as part of his or her trading activities, good understanding of buying and selling point and taking self justification out of trading.

4.How to avoid Trend Chasing Bias: A trader must understand that past success doesn't assure present success and present event don't assure future success, there must be genuine reason for entering a trade or buying an asset other than just because people are buying or because it has give profit in the past.

Part B

Answer to question 1

Technical analysis as a tool to monitor Market and Trading psychology

Since market psychology is the overall behavior of every traders of cryptocurrency and Trading psychology is the behavior of individual that affect their trading pattern. Thus the best way to monitor these behaviors that makes up the market psychology is the knowledge of technical Analysis. The question in mind will be what is Technical Analysis? Technical Analysis is simply using real world data such as chart, indicators, market Volume etc. to predict or monitor the future of a currency.

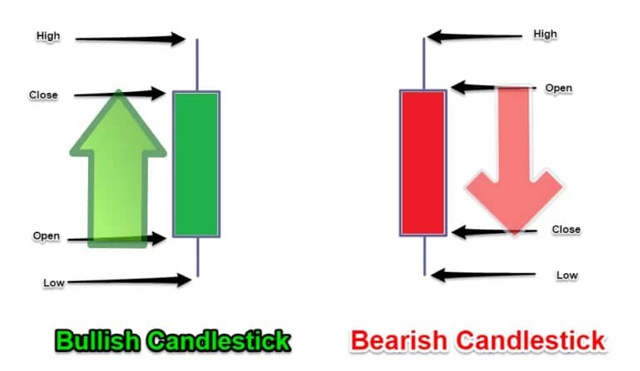

Cryptocurrency chart which includes candle sticks are formed by combining the overall behavior of traders in the market, A red candle sticks formation mean that majority of traders are selling their asset while the blue Candle stick formation mean the dominant of buyers in the market.

The knowledge of this chart marge with other technical Analysis tools such as indicator, market Volume, market cap helps to monitor or predict the market psychology and trading psychology of an individual.

Different between Trading psychology and Market Psychology

Trading psychology

The thinking of a trader while on the market is referred to as trading psychology. It can indicate whether or not they are successful in making a profit, or it can explain why a trader has suffered significant losses.

In trading psychology, innate human qualities like as biases and emotions play a critical role. The major goal of studying trade psychology is to become aware of the different traps linked with a negative psychological attribute and to build more positive traits. Traders that are well-versed in trading psychology will rarely act on emotion or bias. As a result, they have a better probability of making money during their time in the market.

While

Market Psychology

Market psychology refers to the current behaviors and sentiments of market participants at any given time. The term is frequently used by financial journalists and analysts to explain market movement that cannot be explained by other metrics, such as fundamentals.

Market psychology refers to the overall behavior of a market based on emotional and cognitive factors on the internet, and should not be confused with trader psychology, which refers to the same factors but only affects one person.

Answer to Question 2

There are a handful of alternative ways to use cryptocurrency charts to measure market psychology, but my personal favorite is the candlesticks chart.

I'll show you how to use a bitcoin price chart to measure market psychology.

The following are the essential aspects of crypto candlestick charts:

Step 1: Choose a time frame

You can choose which time window you want the candlesticks to cover on the crypto charts. This means that the crypto candlesticks will display all of the transactions that occurred during the time period chosen.

If your preferred cryptocurrency time frame is the 5-minute chart, for example, each candle represents 5 minutes.

The time frame may obviously be altered to make it even more flexible, or you can just choose from the predefined time frames (5-minute, 15-minutes, 1 hour, 4 hour, daily, weekly, monthly).

Step 2: VOLUME

The volume will be displayed on the standard cryptocurrency chart as the second item.

The volume will show you how much trade activity took place during the time window you choose.

The greater the buying or selling pressure, the longer the volume bar is. A green volume bar indicates growing interest and buying demand in the coin. A red volume bar, on the other hand, indicates a drop in interest in the coin as well as selling pressure.

CANDLESTICK

Finally, we must distinguish between two sorts of candlesticks:

*Bearish Candlesticks

*Bullish Candlesticks

Green candles are used to signify bullish candlesticks by default, indicating that the price has increased over the given time frame. A bullish candlestick is one in which the ending price of a 5 minute candle is higher than the opening price.

The initial price is represented by the bottom of the thick part in bullish candlesticks, while the closing price is represented by the top of the body. The wicks of the candlesticks show the highest and lowest prices for the time period chosen.

Candlesticks will be available in a variety of shapes and sizes. These candlestick price formations are an excellent technique to forecast market trends in the future. Chart patterns are a collection of candlestick combinations that can forecast what will happen next.

WHAT IS EFFICIENT MARKET HYPOTHESIS?

The efficient market hypothesis (EMH), otherwise known as the efficient market theory, is a hypothesis that says that share prices represent all information and consistent alpha production is not possible.

According to the EMH, stocks always trade at their fair value on exchanges, making it impossible for investors to purchase discounted equities or sell stocks for inflated prices. As a result, expert stock selection or market timing should be impossible to outperform the overall market, and the only way for an investor to earn higher returns is to buy riskier investments.

Advantages of Efficient Market Hypothesis

1.It saves money of innocent investors.

The efficient market hypothesis's first and most important benefit is that it aids in the saving of money of innocent people who try to enter the stock market believing that they can make a fortune by following the advice of technical or fundamental analysts. In the case of stock markets, small retail investors enter at the end of bull markets and end up buying stocks at a discount.

2.Self-made experts are rendered ineffective.

Another advantage of this theory is that once you understand that the stock market is efficient and reflects the true value of stocks, you will avoid falling into the trap of blindly buying any stock based on the advice of self-made experts who continue to give stock advice on various social media platforms, as the majority of people end up burning their money by investing in stocks.

3.Helps you save time

Once you understand that stock markets are efficient, you won't waste time analyzing the balance sheet, profit and loss accounts, or technical charts of stocks because, according to this theory, these tools are useless and you won't be able to make an abnormal return by using them. Simply put, much as you would place bets on your gut feeling in speculating, you should buy or sell stocks based on a gut feeling that does not require any investigation or analysis, according to this notion.

Disadvantages of Efficient Market Hypothesis

1.Irrational markets exist.

The first and most significant disadvantage of the efficient market hypothesis is that, while this theory claims that markets are efficient, history is littered with examples of stock markets becoming irrational due to panic, stocks becoming available at bargain prices, and people profiting handsomely by buying stocks at bargain prices. As a result of the illogical character of stock markets, the claim that market timing can do nothing falls flat, and an individual can profit by buying inexpensive stocks during a market crash and selling overvalued stocks during a market boom.

2.Work of Fundamental and Technical Analysis

The argument that fundamental analysis and technical analysis are a waste of time is also incorrect because the chances of an accident occurring as a result of a bad driver are higher than for a good driver. Similarly, while there can be a bad fundamental analyst or technical analyst, saying that fundamental and technical analysis are useless is not the right thing to say because there are many people who benefit from them.

Conclusion: the knowledge of market and trading psychology in addition with different bias will help every aspiring traders to become successful. This course have gave me all the basic knowledge I need to know about the above content. Is also my pleasure to be part of the class.