Hello everyone, how are you all doing? I welcome you all to the new season of Crypto Academy, also to the first-week course which is about the Dochian channel, which was taught by professor @lenonmc21, with his awesome explanation I was able to understand more about the course.

Homework Questions

Theory

Explain and define in your own words what the Donchian Channels are?

Does it explain in detail how Donchian Channels are calculated (without copying and pasting from the internet)?

Explain the different types of uses and interpretations of Donchian Channels (With examples of bullish and bearish trades)?

Practical (Remember to use your own images and put your username)

Make 1 inning using the "Donchian Channel Breakout Strategy" and make 1 inning using the "Reversal and Retracement Strategy". You must explain the step by step of how you analyzed to take your entry and make them into a demo account so I can evaluate how the operation was taken.

Explain and define in your own words what the Donchian Channels are?

Donchian channel is an indicator that was developed by Richard Donchian around the mid-20th century, the idea he had when building this indicator was to help him identify the trends of the market.

The Donchian channel indicator is known to have about three lines which are the lower band, middle band, and upper band, all these three lines help to show the price volatility, trend breakouts, reversals, and the market conditions. It also shows that this indicator was built in other to be able to read and measure trends of the market and also to determine the reversal of market trend, because of how unpredictable the market is. The Donchain channel also has about 20 candlesticks which are set as default in the system, this helps in getting the accurate market price of the goods, whether the market is running an uptrend or downtrend.

The image above shows the lines which indicate the upper band, middle band, and lower band.

With this, it makes it easier for traders to know whether the market is running on bullish which shows an uptrend or if the market is running on bearish which also shows that the market is going on a downtrend within a specific period of time. From the above explanations, it is seen that when the volatility of the market rise, there will be some expansion shown in the market band, also when volatility drops, the market band will be narrow.

Explain in detail how Donchian Channels are calculated (without copying and pasting from the internet)?

To calculate the Donchian channel, the first thing you take into consideration is the time period when the transactions will take place, the time can be in a (minutes, hours, days, or months) like I stated earlier the Donchian channel indicator has about three lines which are the lower band, middle band, and upper band, these bands are what we use to get the accurate calculation of the average market price.

To get the accurate calculation I am going to make use of some simple formulas which are;

Time = N

Lowest band channel = LBC

Highest band channel = HBC

Donchian channel = DC

To get the middle band channel we have to calculate and get the overall average of both the lowest band and the highest band.

Let DC = (HBC + LBC)/2

With this, we will be able to get our accurate calculation of the middle price, which also determines the rise and fall of the market price.

Explain the different types of uses and interpretations of Donchian Channels (With examples of bullish and bearish trades)?

As we have stated earlier that Donchian channels are a technical indicator which was developed by Richard Donchian, this indicator comprises of three-line which are the upper band, middle band, and the lower band, these lines are what we use to analyze the market trend, either the market is moving on bullish trend or the market is going on a bearish trend. As the upper band, it helps in indicating how high the current market is within a specific period of time, while the lower band shows how much prices have dropped within a specific period of time while the mid-range band displayed the average market price between the upper band and the lower band channel.

I will be showing my analysis of Donchian channels with the below contents:

- Volatility: The Donchian channels are mostly used to show the volatility of the market which indicates that when the volatility is high the margins will show some expansion, whenever the volatility is low, the margins show that the system is narrow.

- Bullish signal: In the Donchian channel, the bullish signal helps to show when the price in the market is on the upper band which means that the market price at that specific period of time is high, this analysis usually helps traders to determine where they are placing their order in. Traders that use the bullish signals place their order on market stating that when the upper band starts to rise than their will hold on to the goods, which shows that the traders run on extreme greed and when the signal passes the mid-range, going on the downtrend, then the trader tends to sell so as not to make too much loss.

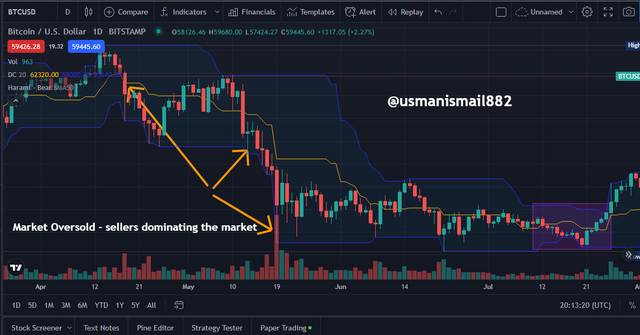

- Bearish signal: In the Donchian channel, the bearish signal shows that the market price of that period of time is on the downtrend and also shows that they are a drop in the market price, which also tells us that the commodity available in the market is much higher compared to when the market is running on the bull, also shows that the sellers are the ones dominating the market at that period of time.

- Overbought: The bullish overbought shows that when the bullish signal of the commodity is on the upper trend when they are a high scarcity of the commodity in the market, which causes the rise in price which means that the commodity or the asset is going to be overbought. Most times traders tend to set their asset to be sold when the market price is on the bullish trend. Also, you can use the Donchian channel indicator to determine when the price of the commodity is high or low.

Image Source

- Oversold: Regarding the bearish oversold, it can be determined when they are a decline in the price of the commodity, also when the price in markets is moving in the downtrend direction, this proves that the bearish trend dominates the market at that specific period of time. It also shows that when it is oversold, the market is controlled by the sellers.

Practice (Remember to use your own images and put your username)

Make 1 inning using the "Donchian Channel Breakout Strategy" and make 1 inning using the "Reversal and Retracement Strategy". You must explain the step by step of how you analyzed to take your entry and make them into a demo account so I can evaluate how the operation was taken

From the overall observation of the Donchian channel, it shows that it is mostly used to show the market breakout, the overbought and oversold, it also shows when the market price is on the upper trend, lower trend, or the mid-range trend.

I will start my evaluation of the Donchian channel with the bullish breakout.

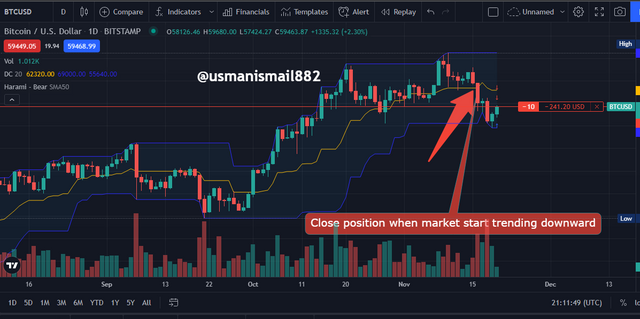

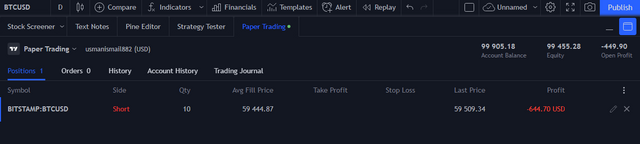

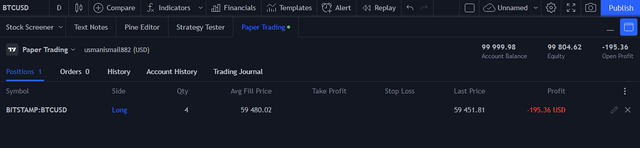

- Bullish breakout: Bullish breakout shows when the market price is going towards the upper trend, this shows that the force or the impulse of the bullish trend is on a breakout. Also when the price moves towards the upper trend then it can also be considered as a bullish breakout which also indicates the perfect time for buying. which can be seen in my trade as I choose to make an entry buy of 4 units of BTC when the market is still in an uptrend.analyses below

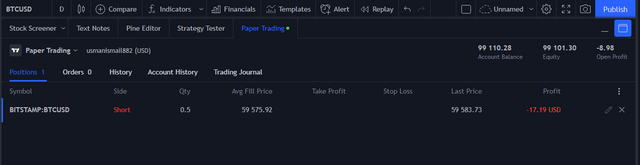

- Bearish breakout: The bearish breakout indicates when the market is going on a downward trend, it shows that momentum that the bearish trend is on a breakout and as well shows that the sellers are dominatingg the market and that is when you close short so as not to risk all your asset.analyses below

Reversal and Retracement Strategy

Reversal retracement strategy is known to be when you temporarily have a price reversal in an upper or lower trend, the reversal of price is not permanent, it is possible to have a new high in price, with this it is possible to have a new higher high and higher low. And when the price moves from lower high to lower low, then we might have a reversal in the market price or in case if the market moves in opposite.

Conclusion

With all this explanation and illustrations, we can say that the Donchian channel is very important in order to show the accurate trends in the market, either the bullish signal which is moving towards the upper trend or going downward trend, when it is going towards the upper trend it means that the sellers are in control of the price in the market when it's on the bearish signal, it means that the sellers are in control of the market.

Special thanks to prof @lenonmc21 for his wonderful explanation on the course, I hope this article is of use to you all thank you.