Now to the lectures proper.

What Is the Importance Of the DeFi System?

Importance Of the DeFi System

Before I proceed to Explaining the importance of DeFi system let me give a brief insight about what the DeFi system is. Now the DeFi system was born on the grounds that centralized/traditional financial system had a lot of set backs seeking for addressing, therefore making the financial system more conduesive for end users being that it is built to be a pear to pear technological operation without any central authority. This has been a great breakthrough in the Cryptocurency set world. DeFi known as Decentralized Finance is built in the Ethereum blockchain. Below are list of the Importance of DeFi.

Transparency

The Decentralized Finance is a very transparent platform that exist on the Ethereum blockchain. It is transparent because every transaction on the blockchain is verified by all and registered on the block making it uneditable. The fact that this all Important data is not verified by one person makes transparency very noticeable in this type of financial system.

No Restrictions

Unlike the traditional financial system were members are not in total control of their finances, the DeFi system gives members the leverage of total control over thier financial holdings. In that way members or holders in the DeFi system can have assess to their finances at any time and at any day and can send it to whom ever.

No third Party needed

In the DeFi system, there is no need for a third party, in that the third party will have to vert the transaction before it goes through. The DeFi system operates on a pear to pear basis removing the need for a third party during transactions.

Owners-Custody

In the DeFi system, the participants in this market keep custody of thier keys and access codes to thier assets, unlike the centralized financial system were the participants keys and codes are saved in a central system were it could be assessed easily or even hacked. So one very important commendation of using the DeFi financial system is that there is self custody of participants access key and codes.

No Time Restrictions

In the DeFi system, financial or asset transactions can be made at any time without restrictions of days or night hours. So it the true definition of 24/7 Operations.

Flaws in Centralized Finance.

Flaws in centralized finance

Below are the limitations associated with the centralized financial system.

Presence of Restrictions and limitations

In the centralized financial system participants are restricted in that there is no total control over financial tokens by participants. Looking at it, centralized system almost detect the activities of the users giving authorization before transactions are made.

Time bound.

The centralized financial system does not operate 24/7 only from Monday to Friday and that is a serious restrictions to users who might want to carry out transactions during the weekends, with this restrictions this can't be possible. Though the centralized financial system have tried to bridge the gap to some point, by introducing ATM and online transfers but some transactions requires the presence of the bank's or financial institutions personels.

Easily hacked

Since the information and financial data's of this institution is stored to a central system, with little bridge in the security of the system, it could be hacked and users information or tokens can be transferred.

Verification Requirements.

In the centralized financial system, there is always a need for verification in other to make purchases or sells (trade) on the platforms or institution. Verification such as the request for national identification card, drivers license etc. might be a constraints to users who don't possess this requirement at the time.

DeFi Products. (Explain any 2 Products in detail).

DeFi Products

DeFi which seeks to eliminate intermediaries during transactions have come up with some products but I'll be talking on just two since that's profs Requirement, they are mentioned and Explained below.

Lending

One of the major project of the DeFi system is the lending project. Here the Decentralized system brings up this project in a bid to eliminate the traditional lending process carried out in the centralized financial institutions. The DeFi lending project does not require a third party or a collateral for loans to meted out. Here the system is designed to automatically liquidate the users asset if there a bridge of lending terms through process such as the smart contract were the interest rate is monitored and if the rate gets below the margin of agreement then the users assets is automatically liquidated.

Some lending products of the DeFi system include;

- Aave

- bZx

- BlockFi

- Compound

- Nexo

- CoinList

- Curve etc.

The above mentioned are all lending protocols Which enables borrowers lend assets to participants.

DEXs

Also known as the Decentralized Exchange enables Exchange, swap of asset or buy and sell of asset without a collaborative collateral sent as custody. Difficult Exchanges have thier different platform protocols, which offers users some forms of incentive especially in times of liquidation.

Below are examples of DEXs

- Ox Protocol

- 1inches Exchange

- Bancor

- dydx

- Kyber Network

- Open Sea

- Justswap

- Uniswap etc.

Risk involved in DeFi.

Risk involved in DeFi

Below are the underlying risk involved with the DeFi system.

Liquidity Risk

In this case a participant assets and account gets liquidated due to lack of funding of the DeFi account and this occurs when the borrowed sum has begin or has gotten below the collateral agreed level, the brokers or lenders will come for liquidation. So any lender must be certain of a good return of investment so to be able to pay the loan due based on the agreement.

Credit Risk

This risk stems from the fact that users of the DeFi system can't get enough tokens from lenders and this may lead to losses due to lack of collateral to finance the Liquidity pool.

Market Price Risk

In the DeFi system, ecspecially the Crypto world where the prices of assets are always very volatile they might be a market price down slide and these might lead to losses ecsepecially if the user was a borrowing participants. At this point if the risk level is too high then they might be a liquidation of users asset.

Technological Bridge risk

Any bridge on the blockchain can spell a serious problem for users. Technological bridge such as the smart contract bridge, transaction errors etc. So imagine a chain has an error or is hacked any how, then either the DeFi borrowers or DeFi participants are going to be in loss. This is so because at the point were the DeFi platform experiences error, then liquidation seems almost impossible.

What is Yield Farming?

Yield Farming

Yield farming on the whole is a process that enables holders gain reward while holding their assets, by depositing a token of it into the available lending protocol of choice and then earn interest from trading fees. It is worthy of note to understand that different lending protocols offers differing lending fees, so a user must be able to check up for the best for his/her trading interest.

Yield farming operates like the bank, were they use your traditional finance give it out for business and then you get very little profit in return. But then in the yield farming process, you are the asset(crypto) holder which makes you the bank automatically, you then give out your asset into the lending protocol of choice after the agreed term, when it's time stipulated you make your interest.

How does Yield Farming Work?

Now to understand how the Yield farming works, a trader needs to understand two important terms which are the Liquidity providers and liquidity pool. The liquidity providers are the Investors who put thier money into the pool seeking to get their rewards based on the agreed contract terms while the Liquidity pool is the smart contract were the Liquidity providers supply their asset.

This process carried out through the yield farming is done through the model called Automated market maker(AMM) and this is done through a process of a predestined algorithm. This model helps to eliminate the normal order boss know in trading assets so the liquidity providers supplies the pool with his asset say ETH and then the borrower request for this asset and the AMM stands as the market maker between the smart contract and the liquidity providers.

The liquidity pool is the bedrock on which smart contracts are made, the borrowers agrees on a contract term then funds are sent to the borrower and the account is monitored for interest taking or possible liquidation if any.

What Are the best Yield Farming Platforms and why they are best. (Explain any 2 in detail)

Best Yield Farming Platform

The best Platform for yield farming include the following but not limited to the below mentioned;

- Pancakeswap

- Sushi Swap

- Autofarm

- ApesSushi

- Biswap

- Pancake Bunny

- 1inch Network on Bsc

I'll be explaining the first two I consider as the best yield farming platform.

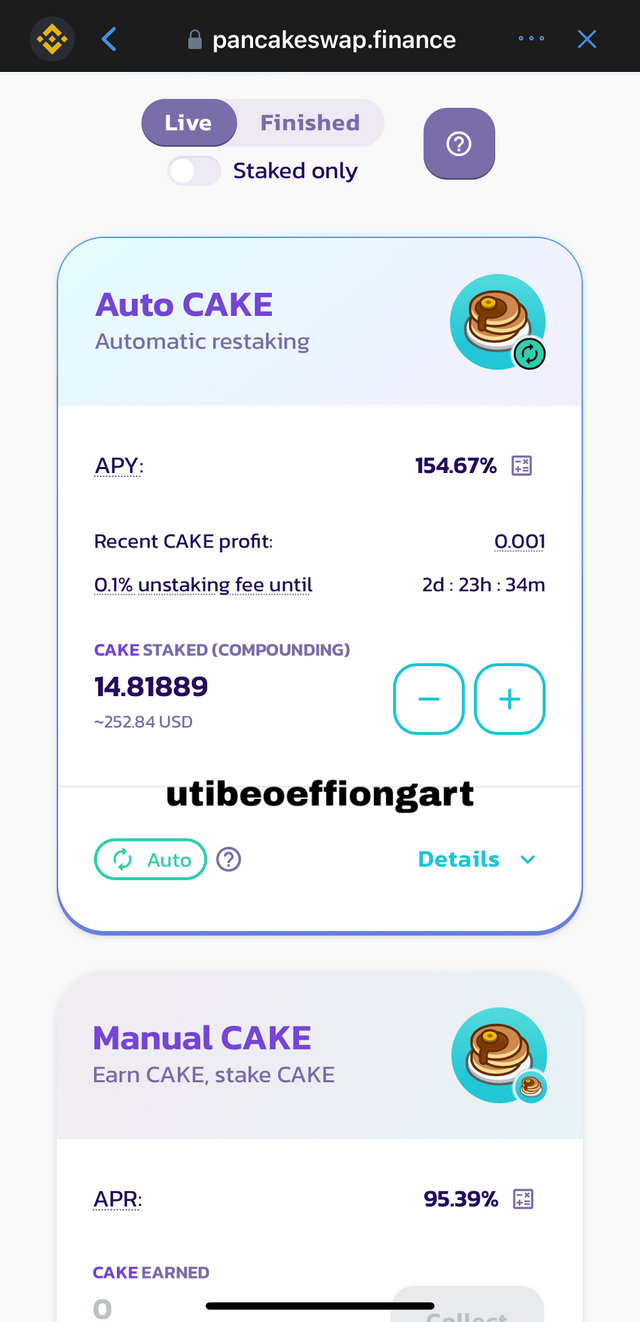

Pancakeswap

Pancakeswap is on of the many Decentralized Exchange existing on the Ethereum blockchain. It operates with the Automated Market marker on the liquidity pool (smart contract) principle exist on the Binance smart chain but the beautiful thing is that it does work with the centralized system as the Binance Exchange is a centralized system.

The Pancakeswap allows users to swap thier token on the liquidity pool and gain reward on s regular bases. Unlike the traditional crypto exchange, were there is availability of order book, the Pancakeswap elimates this possibility giving the liquidity provider leverage of joining in the decision making of the staking.

What is special about Pancakeswap

The Pancakeswap removes the middle man needs associated with the centralized financial system. So liquidity providers make thier rewards continuesly as far as thier tokens remain in the pool.

Sushi Swap

The sushiswap like the Pancakeswap operate with the DeFi system on the Ethereum blockchain. The sushiswap elimates the need for a third party using the smart contract principal stoon with the principle were liquidation providers supply tokens to the pool to be making gains in due course. The sushiswap uses the Automated Market marker model to allocate Liquidity to borrowers on a Decentralized manner.b

The native token of the SushiSwap is know as the SUSHI which is currently on the number 74 by ranking on the coinmarketcap. And tokens traded on the sushi platform automatically caries the S'before the asset in question.

The Calculation method in Yield Farming Returns.

Yield farming calculation

There are two methods used in computing the gains in the yield farming which are the Annual percentage rate and Annual percentage yield

Annual percentage rate

This is the type of interest gotten from a crypto investment were the gains comes on a yearly basis which are compulsory for the borrowers and given to the investors (liquidity providers).

It is worthy of note that the interest gotten from the activities of the liquidity investment are not reinvested into the pool for more interact to be made.

APR calculated..

For instance, I staked CAKE assets worth (600 USD) in the Manual CAKE pool with a 100% APR. In this case, since the APR is 100% then we have;

100% of $600 in APR is equivalent to - 1 X $600 = $600

Therefore, My initial investment + APY - $600 + $600 = $1200

So, after one year my total investment equals $1200.

Annual percentage yield

Here the interest is gotten on a regular basis gotten from the users and subsequently giving to the liquidator's.

Using the formula, (1 + r/n)n -1

Where we have;

r = interest rate

r = 100% ~ 1

n = the compounding period

n = 365 days

Now let's work it out,

(1 + r/n)n - 1

(1 + 1/365)365 - 1,

(1 + 0.002740)365 - 1,

(1.002740)365 - 1,

(2.717) - 1 = 1.717,

Now the APY = 1.717 X 600 = 1030.2

Now my total investment after one year = Initial investment + APY = 600 + 1030.2 = $1630.2

Advantages & Disadvantages Of Yield Farming.

Advantages of Yield Farming

Profitable investment

Yield farming is a very profitable platform or venture into. Comparing the profitability of the yield farming to the traditional financial system, it is incomparable because the profitability rate in engaging with the yield farming is actually very high.

No third party involvement

Unlike the traditional financial system, were you need a third party for verification/approval before proceeding to get your loan or interest(return of investment), the various Yield farming protocols and products seeks to eliminate this restrictions.

Passive income

Instead of just holding your asset or allow it in your wallet, it can be making passive income for while you hold your peace. Just log into any of the

product of the yield farming, get to the smart contract and supply your liquidity while the smart contract runs the runs the contract and settle between you and the borrower.

Disadvantage of yield farming

Market Price volatility

The almost immediately rise and fall in the Cryptocurency ecosystem is a cause to worry about my Investors, because assuming a liquidity provider supplies the pool with some liquidity, when the or of the market price of that asset supplied get a bear, then the total value of that asset supplied automatically deplit too and that is not good for the provider.

Liquidation Risk

Another huge treat to the use of the yield farming investment platform is the liquidation of the asset of any user who cannot keep up with the threshold or collateral bench mark of the agreed smart contract. In any case were the user defaults then he/she experiences liquidation.

Gas fees

This has stood as a constraints to some users from keying into this all Profitable investment. The capital token to even proceed to initiating process stands as constraints to some users.

Conclusion

In conclusion, the Decentralized Financial System remains a vast and great platform because Crypto traders and holders can plunch in and make meaningful gains from the different wide spread of protocols and products so to stay afloat instead of just allow thier asset in the holding watching the market expectantly for a rise(bull) so they can cash out.

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @utibeoeffiongart

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice one bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit