Before I proceed to answering the assignment questions, I'll like to first of all thank Prof. @kouba01 for this wonderful lectures, It was such a wonderful eye opener to a different means of trading..

Now to the assignment questions.

QUESTION 1

WHAT IS CRYPTOCURRENCY CFD?

MY ANSWER.

Before I proceed to explaining the meaning of the cryptcurrency CFD. Let me let us know what CFD means.

CFD- CONTRACTS FOR DIFFERENCE.

This simply means a term of agreement entered into on a particular asset (cryptcurrency, stock, commodity etc) that you don't actually own but you want to take advantage of the rise and fall of the asset's market price value.. That is taking advantage of the bullish and bearish market price pattern of an asset.

You might be wondering what the bullish and bearish market price pattern of an asset is.. below is the explanation in very simple term

Bullish market pattern simply means when the market price experiences a significant uprise in value while

Bearish market pattern also simply means when the market price of an asset experiences a significant fall which might cause a loss or a gain depending on the trading pattern of the trader or such asset investor.

So an investor or trader in the CFD market takes advantage of this rise and fall based on the terms of agreement entered into with the broker or asset owner without actually owning the assets.

Now that we have had an understanding of what CFD means.. Now let's relate that to Cryptocurency CFD.

Now Cryptocurency CFD means entering into an agreement with a broker or trader who owns a crypto asset(BTC, TRX, ETH etc) with the aim of investing or trading your flat currenncy usually the US dollars in the market fluctuations of the asset without actually directly purchasing the crypto asset from the broker or asset owner.

So you first of all make an agreement with your self on the particular asset you want to invest or make a contract for difference on, based on the technical and fundamental analysis you have carried out on such asset.

Then proceed to selecting the asset you have made the assession on from the broker. And during this selection and buying process, the investor should enter into some agreement such as if the investment will be long or short term, the amount of leverage or margins and some other important term specific to the broker and investor.

Then you the investor and the broker should enter into an agreement on the opening price of the trade or investment usually the deposition agreement as I would term it.

Now it is worthy of note that at a point were the contract is closed, the broker pays the investor were the profit margin favours the investor and then the broker is paid when the investor is on the lossing end. It is also worthy of note that the contract will remain open till the investor decides to close it maybe based on his prediction of the rise or fall of the market price of that asset or it might be forced to a close if the profit or lossing margin exceeds the contract terms.

I'll like to end this question with the fact that an investor very skilled at market price forecasting will always be at an advantage of breaking even i.e Making profit.

QUESTION 2.

HOW DO I KNOW IF CRYPTOCURRENCY CFDs ARE SUITABLE FOR MY TRADING STRATEGY?

MY ANSWER.

Now I'll try to make this as simple as possible.

If you want to invest in a particular crypto asset say Bitcoin or Etheruem or Steem but then your investment capital will not gurantee you to purchase a tangible amount of the asset as you might want to. That is simply saying the price of the asset is too high at the moment for you to purchase, then Cryptocurency CFD is just what you need. Because you can invest in this crypto-asset without actually purchasing it but by entering into an agreement with a broker based on what you have as your exposure and they you go.

-Exposure means the amount of money you invest in the asset.If you want to benefit from the asset without actually owning it.

If you want to invest in a trading environment were it's safety is provided by the brokers based on the term of contract you have made with them.

To summarize this question I will say that this type of crypto trading is for you if you as the investor have a relatively low exposure, leverage, or margin but you seek to make profit from the price fluctuations of a coin then the Cryptocurency CFD trading is just for you.

Leverage- the money you borrow as your capital to invest in a trade with an expectation that the your profit margin will surpase leverage.

QUESTION 3

ARE CFDs RISKY FINANCIAL PRODUCT

MY ANSWER

I will say yes and no (but at the end of this question I'll state whether the yes or no is stronger and give my recommendations)

YES BECAUSE

After all every investment to me is a risk taken with the hope that the outcome will favor you.. But then let's get more in-depth.

As a Centralized trading system being backed by a Decentralized asset, what if there is a system siezure that means the investor is done for.

The whole system is liquidated immediately the loss margin is high. You just look at that, which was not the investors fault but then you had entered into an agreement already so your brokers come for your asset immediately terms of contract is breached without a renegotiation because it favors them at that point.

The risk is even very high with an investor who is not skilled with market price predicting/forecasting.

NO BECAUSE

With your less amount of capital you call still invest in any asset, commodity etc of your choice no matter how high the asset is in the market without and be making profit from it.

You have a choice of setting an agreement term with the broker which a good investor should be able to manipulate this to his/her favour.

The brokers offers you alot of protection since the environment you coming into an already established environment.

Alot of risk management tools that can guarantee your success.

So at the end of the day I'll recommend the CFDs to investor in the light that every investment you make has some certain degree of risk attached to it. But then you need to manage this risk well which the brokers provide for your safe landing Making the risk level in the CFD very minimal and then your market prediction ability is of greater advantage.

QUESTION 4

DO ALL BROKERS OFFER Cryptocurrency CFDs

MY ANSWER

In my opinion I will say no, not all. Because some brokers will actually want a direct asset trade instead of entering into a contract for difference. And some time the complex nature makes it stressful for some investor.

QUESTION 5.

EXPLAIN HOW YOU CAN TRADE WITH CRYPTOCURRENCY CFDS ON ONE OF THE BROKERS(USING A DEMO ACCOUNT).

MY ANSWER

We are going to be working with an Etoro Demo account.

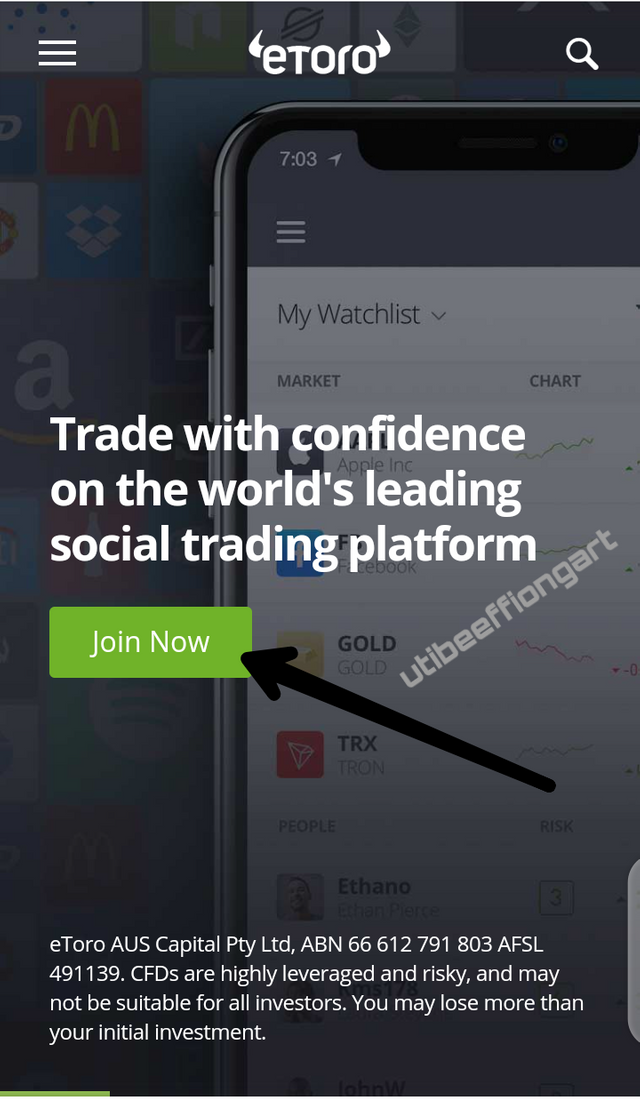

First of all you visit the site https://www.etoro.com/

N/B: all pictures are gotten from my Etoro Demo account.

Immediately that page opens you click on the arrow- Join now.

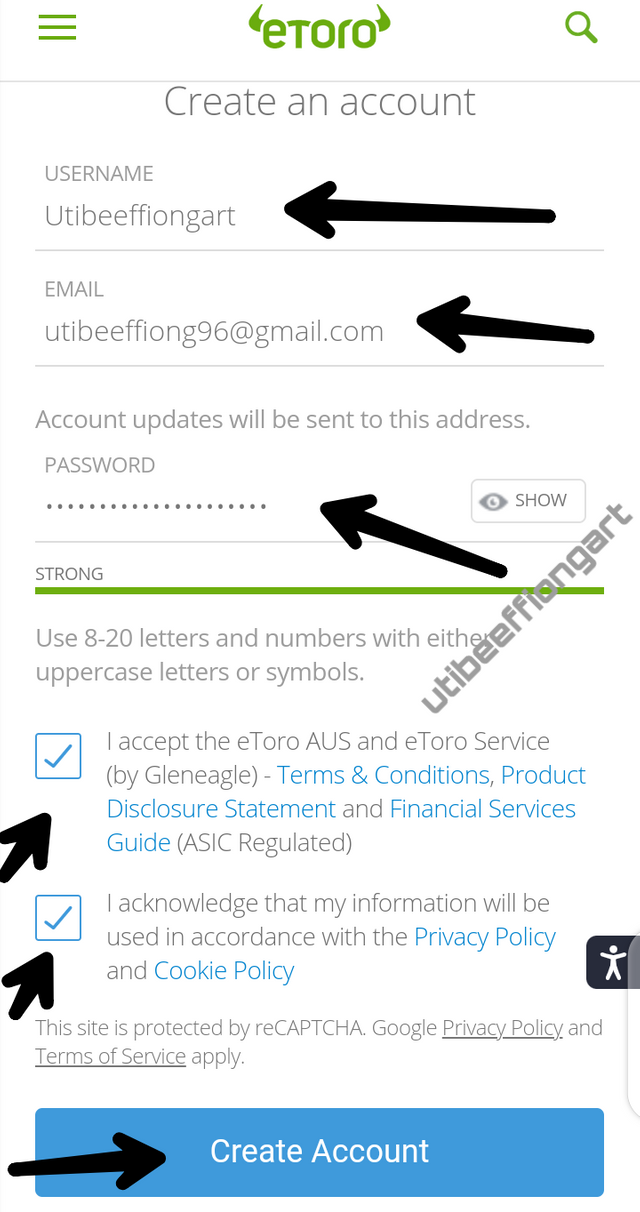

This page will open then you fill in your details and accept the terms and conditions and then proceed to create account.

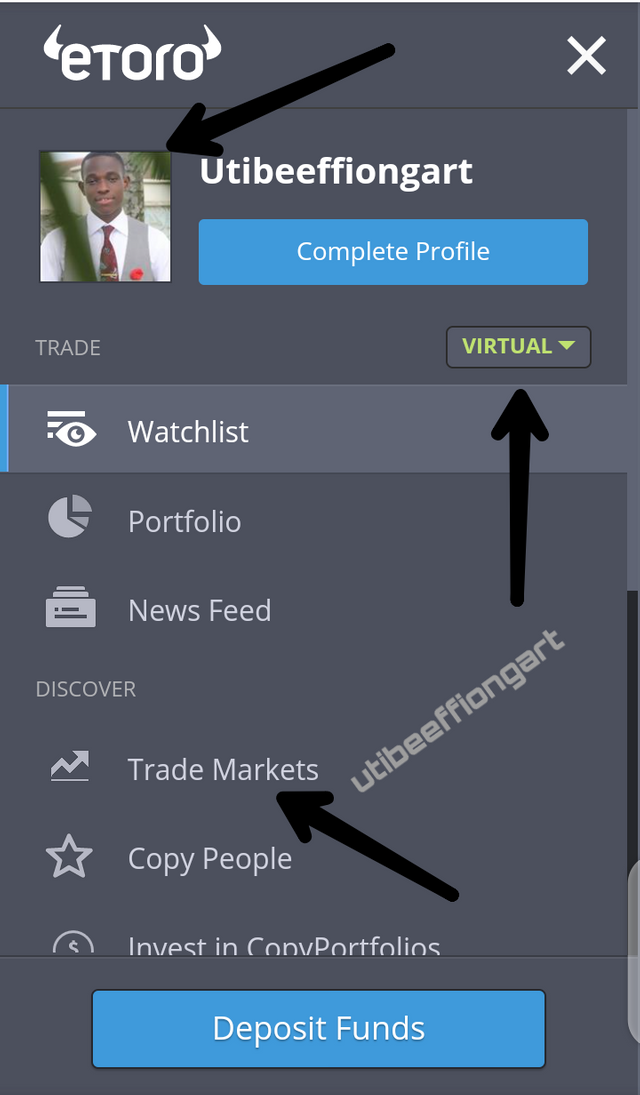

This page opens then you complete your profile by uploading your picture like I have just done.

Since we are working with a demo account, you will click at that point were we have virtual but it was formerly real and have done the change already though.

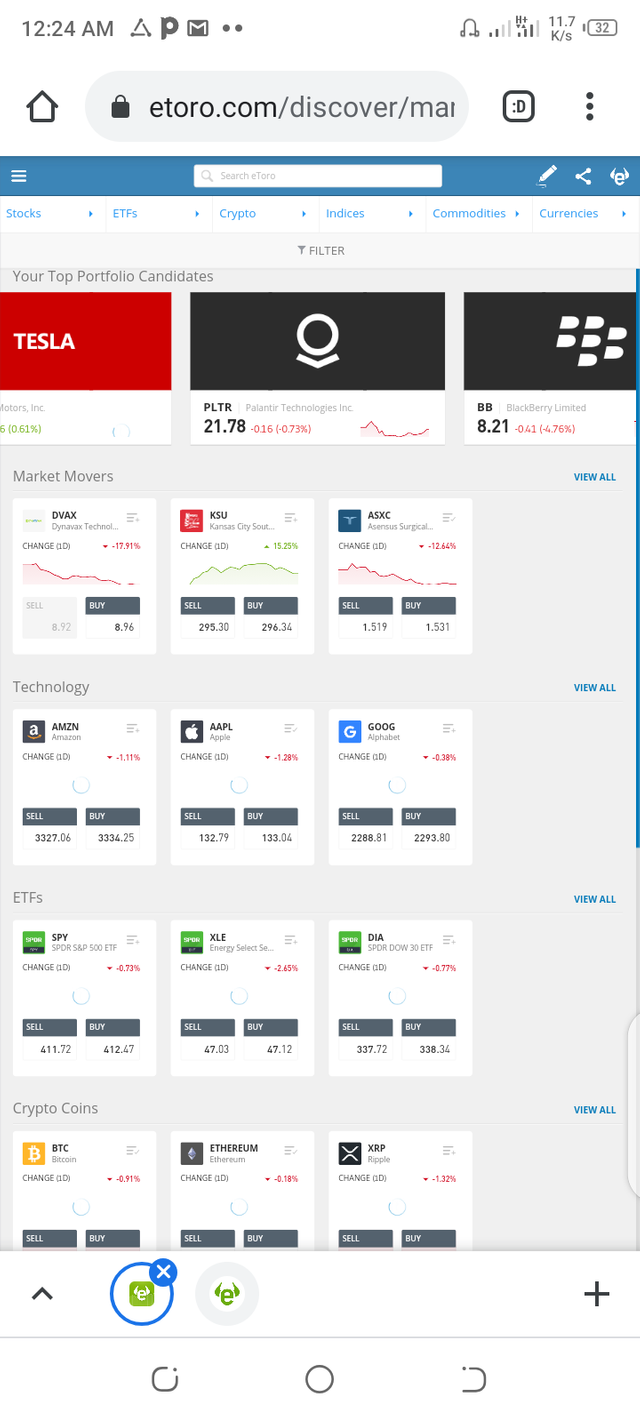

Then you click the trade marker for the actual purchase.

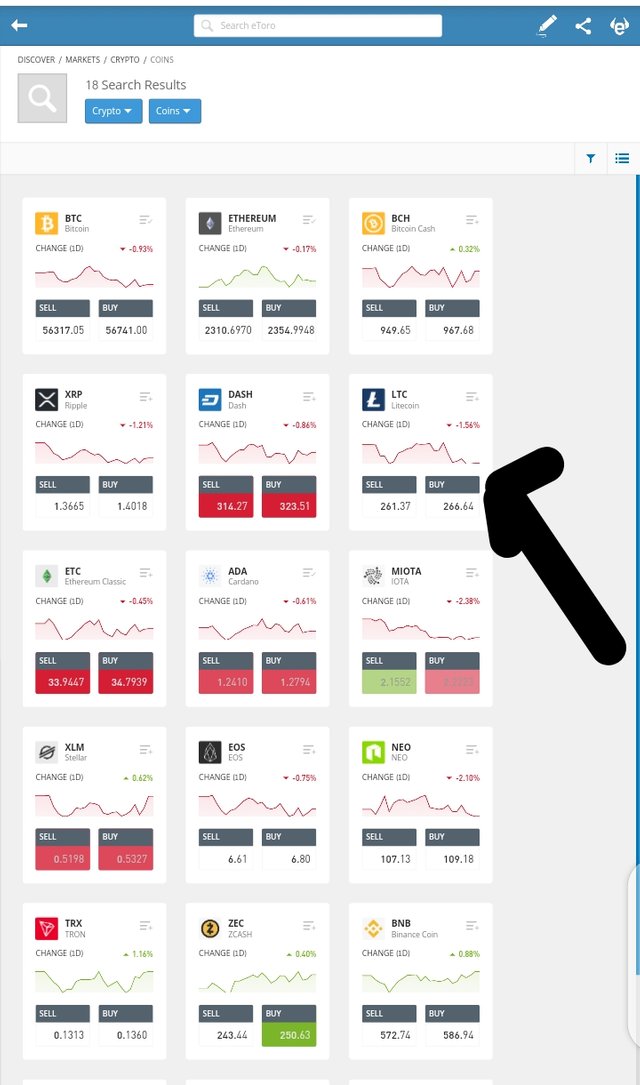

Immediately this opens you click on crypto up there since we are working with that asset.

Then you select the currency of your choice.

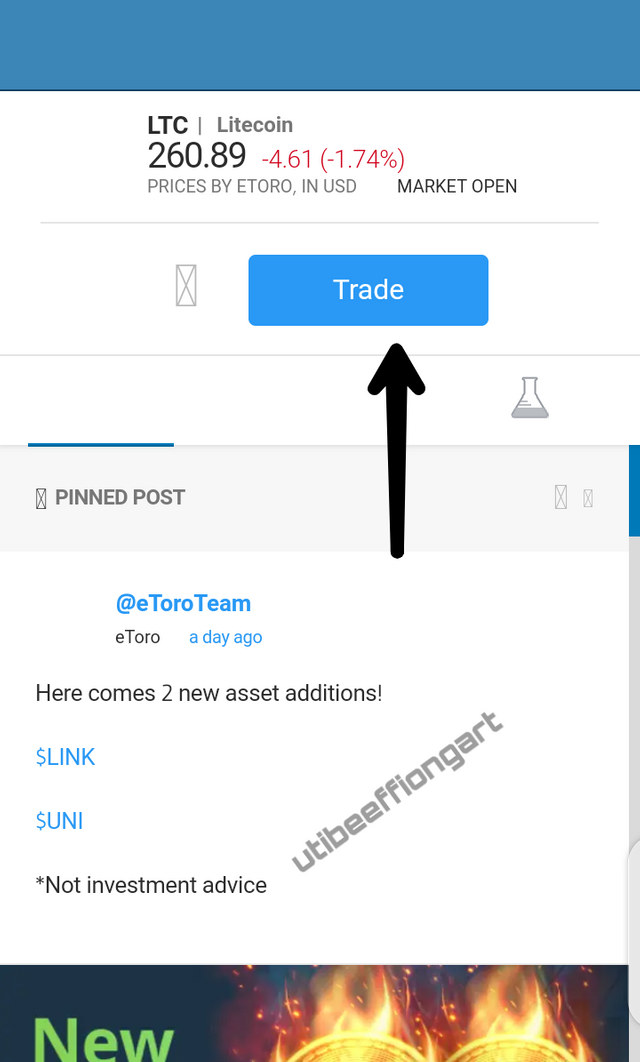

Here I selected the litecoin..

Immediately this opens then you click trade.

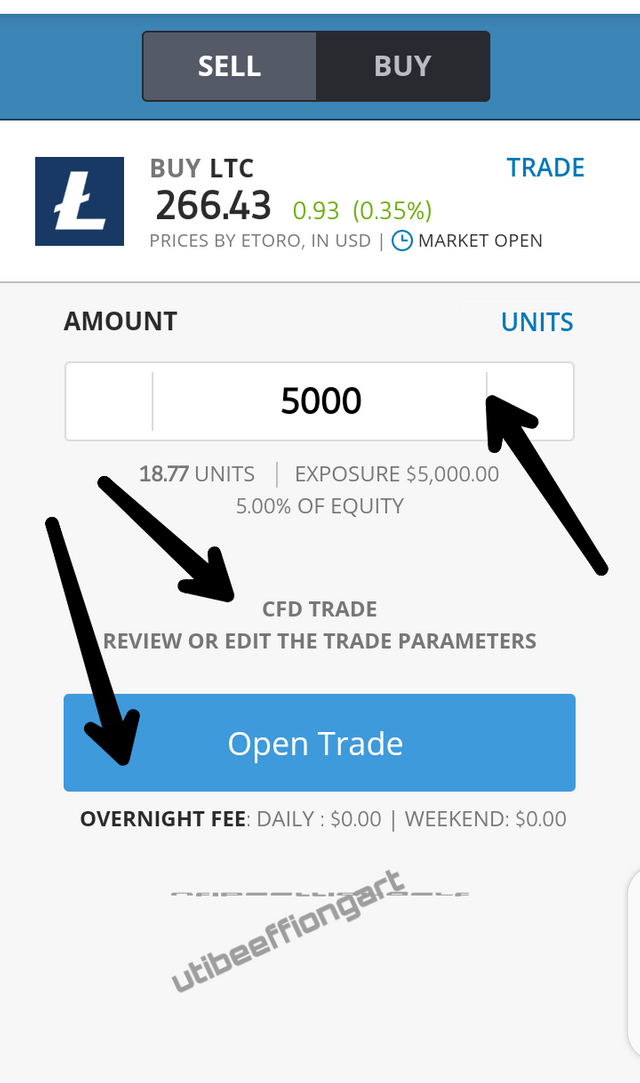

Then this page comes up and you fix your investment amount. And here I choose to use $5000.

Then if you look closely you will see review or Edit trade parameters. That were the terms of agreement is set. And over-there you set whether it will be a long term or short term investment. Then you open trade.

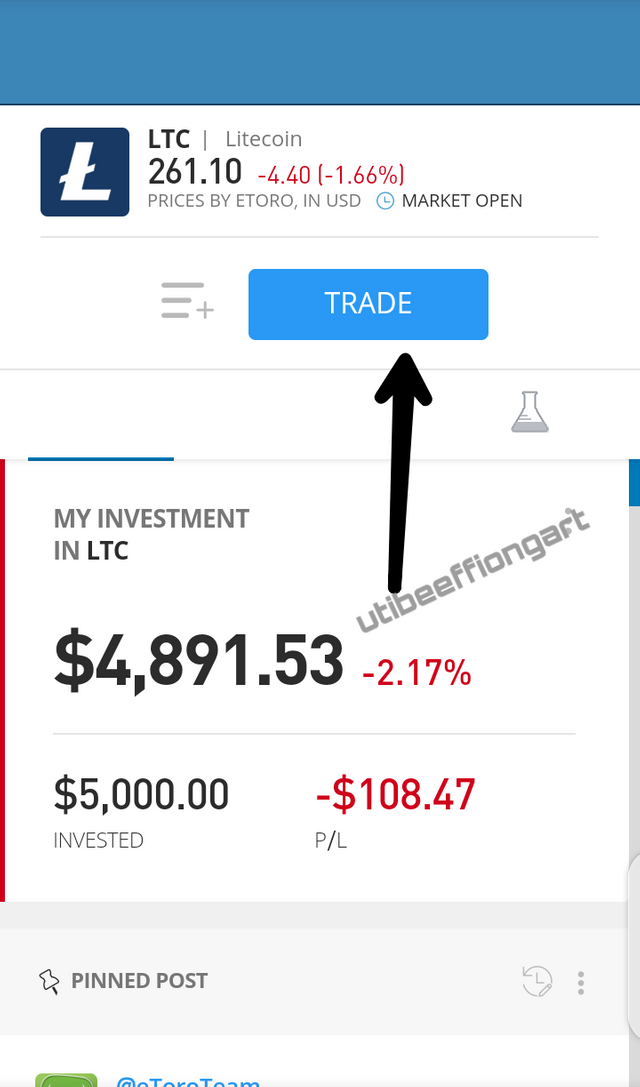

Immediately the trade is opened this comes up. If you can notice am on the lossing end right now but then if my contract terms was in short term bases then am done for because it's getting towards the losing end, but then since I would likely use the long term investment, then I believe the market will be better as it proceed..

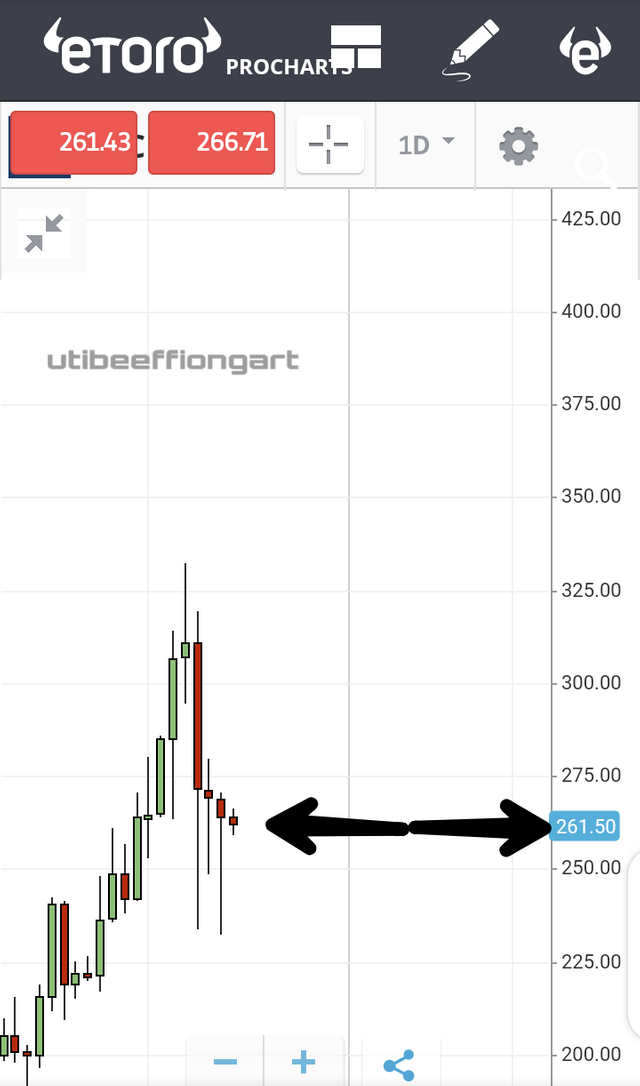

Then you click the top right corner then click on view chat, and the chat for the litecoin we are working on comes up.

This is the coins chat showing a fall in price of the coin to $261...

IN CONCLUSION

CFD Trading is a suitable trading for any investor or trader.. I would recommend it for investment even though I have not carried out a real portfolio investment but from the prospect from this lectures and from my research I would definitely recommend it..

Thank you.

Hello @utibeoeffiongart,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve an 8.5/10 rating, according to the following scale:

My review :

As with any financial product involving over-the-counter markets, CFDs are inherently risky products. Plus, they use leverage which can quickly increase your returns on small investments, but also magnify your losses.

A good method for answering questions. You start with the general idea and try to analyze it, which is necessary. Try using the formatting tools to distinguish between paragraphs, now Steemit offers a toolbar that helps you realize this.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay Prof. Thank you very much. Corrections noted.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit