Now to the assignment proper.

Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Dark Pools

The dark pool can be liken to what is called the black market in a general market concept were goods are exchanged at a price different from prices generally accepted by the government or institutions involved. So the persons here can manipulate the market to their favour. While that could favor some persons it can be of disfavor to others. But then let's base our discussion on the crypto currency ecosystem.

The dark pool in respect to the cryptocurency ecosystem is were cryptocurency users can easily get to exchange assets without a corresponding effect on the general crypto market. So traders especially the whales traders carry out huge transactions here without getting to place orders in the normal order book as seen in the normal cryptocurency exchange platforms.

So by definition the dark pool is a platform outside of the normal or general crypto market were large or huge exchanges can be carried out without a corresponding effect being felt in the general market since it done in private and other traders can not see it so the general fear that can lead to market decisions causing undue volatilities in asset prices. So the dark pool is a hidden marketing platform.

How the Dark Pool Works

Now the dark pool works in a manner different from the normal exchange platforms in that here all traders don't have access to the orders of others and they is no general order book like the general crypto exchange platforms.

Here there is a minimum limit order that can be placed and this minimum order is not at all small, telling us that the dark pool is more for the whales traders. So a trader seeking to make exchange places his order and then through a predetermined manner that when another trader places such order it clicks automatically.

So the dark pool works with limit order through a kind of hidden order book hid from other traders so not to create panick in the market because of the large orders placed.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Kraken Dark Pool

A visit to the kraken dark pool official site kraken site gives an in-depth knowledge of the kraken dark pool exchange platform. Now am explaining the kraken dark pool exchange as an answer to this question.

The kraken platform offers traders an exchange in the dark pool in that large orders can be placed in this site without an effect on the crypto market. As a way of introduction the kraken platform was created by Jesse Powell in the year 2011 and it is a US-based exchange platform. The idea of the creation of this dark pool exchange platform was birthed when when the then working crypto exchange site Mt. Gox was down and it actually stopped operating in 2014. Kraken first launch it dark pool service in 2016, starting with just Ethereum but then with much advancement and development, Jesse Powell added Bitcoin to the pool.

How it Works

Like I said earlier, that the kraken dark pool offers traders private and anonymous crypto exchange opportunity and in the platform there is a minimum order placement per order and this minimum order to any degree is always large, which is safe to say that the dark pool is best fit for the whales traders. Now trader initiating the order places an order of his or choice either buy or sell order and this order is not exposed to other traders just the placer only. Through a predetermined algorithm called crossing or cross trading, when another trader places a limit order it automatically trades itself.

So one striking thing about this platform is that there is no order book like the general crypto market, so this takes away market panick which might arise from fear of the market dipping any time soon if it was a sell order.

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

Assets Supported in the Kraken Dark Pool

As stated above that the kraken platform basically support two main crypto asset which comes in pairs of other asset first the Ethereum and later the Bitcoin was introduced in. Below are the available assets with thier corresponding pairs.

ETHEREUM BASED

ETH/CAD

ETH/EUR

ETH/GBP

ETH/JPY

ETH/USDBITCOIN BASED

BTC/CAD

BTC/EUR

BTC/GBP

BTC/JPY

BTC/USD

Requirements for Getting Involved in the Kraken Dark Pool

- Only available to clients verified to the Pro level i.e user who have not completed thier verification and registration process up to the pro level are not eligible to trade in the platform.

- The minimum amount for a BTC pair order is approximately $100,000.

- The minimum amount for an ETH pair order is approximately $50,000.

- Only limit orders are accepted.

The above are stated on the official kraken site kraken site

Fee Attraction on Kraken Dark Pool.

On the kraken platform, the fee is paid relative to the rate of engagement of the trader on the platform. And this is on a 30 days trading spread out of the trader. That is to say when a trader is carrying out a trade, a quick analysis will be carried out on his/her 30 days trading volume and the fees will be determined from they.

But then basically the fee on the kraken platform is based on a 0.20% to 0.36% range.

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

Performing Block Trading on the Kraken Dark Pool.

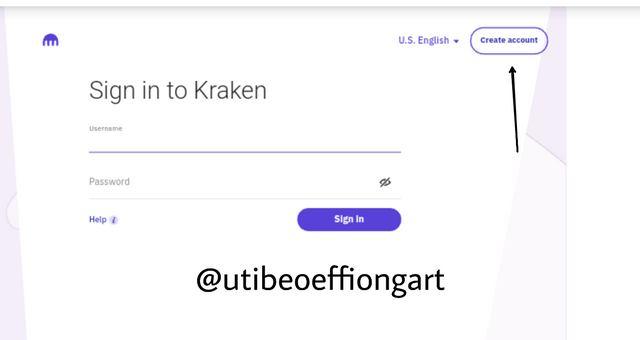

To perform a block trading on this platform, you log into the site through kraken site and sign up on the site.

Screenshot from the kraken platform

- Looking at the above screenshot, click on create account and the page below will come up.

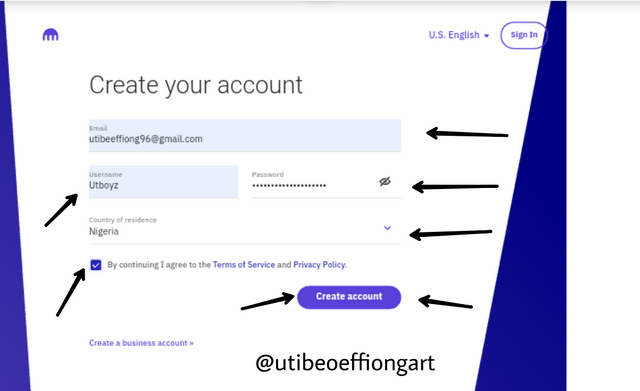

Screenshot from the kraken platform

- Now after inputting your details you proceed to clicking on the create account and the page below will come up.

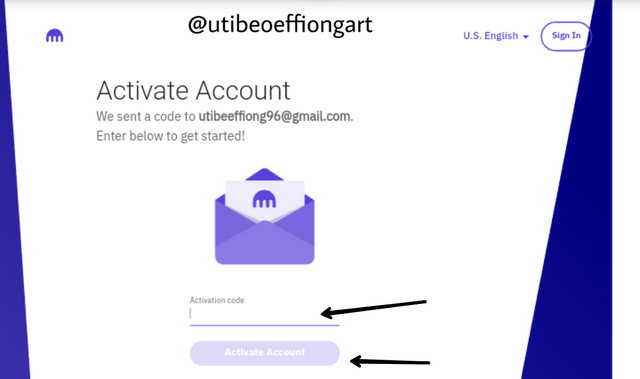

Screenshot from the kraken platform

- After that you input your activation code that is sent to your email, the one you had earlier inputted during the registration process. Mine was 608315, after doing that I proceeded and the page below comes up.

Screenshot from the kraken platform

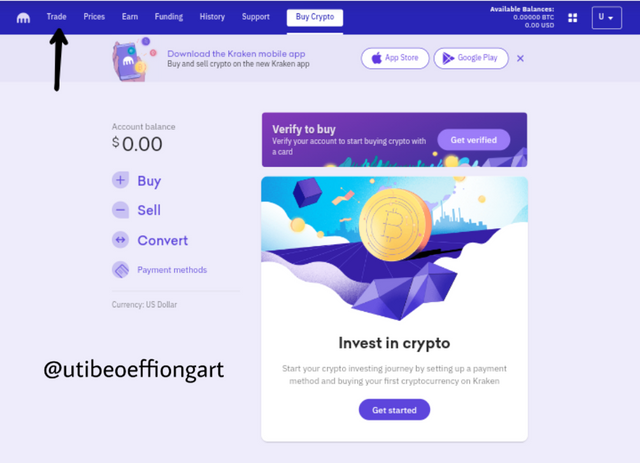

- As seen above I proceed to clicking trade and the page below comes up.

Screenshot from the kraken platform

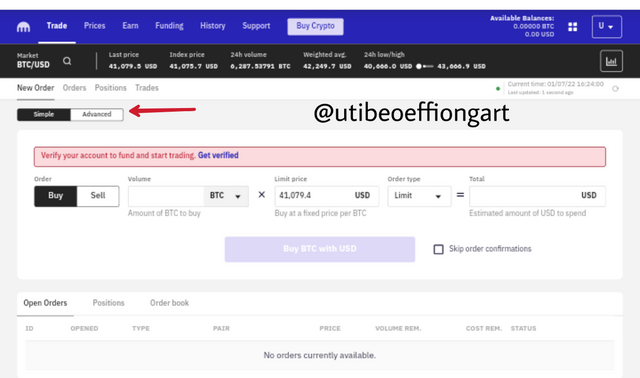

- Now when the page above comes up, I switch from simple to advance since this is the part that will allow for the actual trading in the pool.

Screenshot from the kraken platform

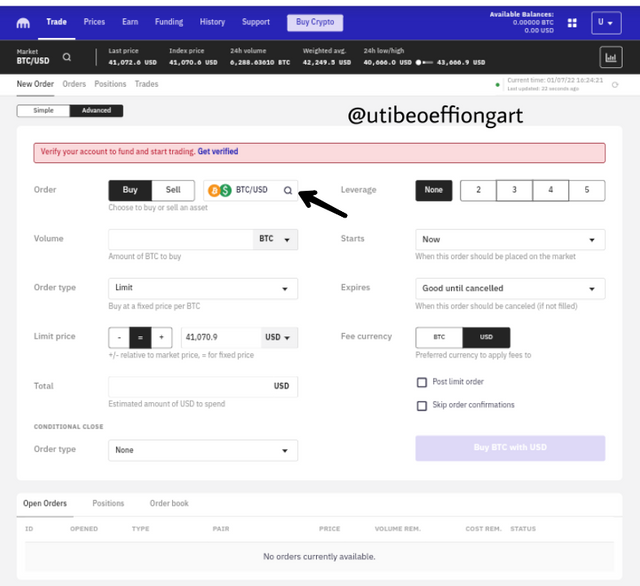

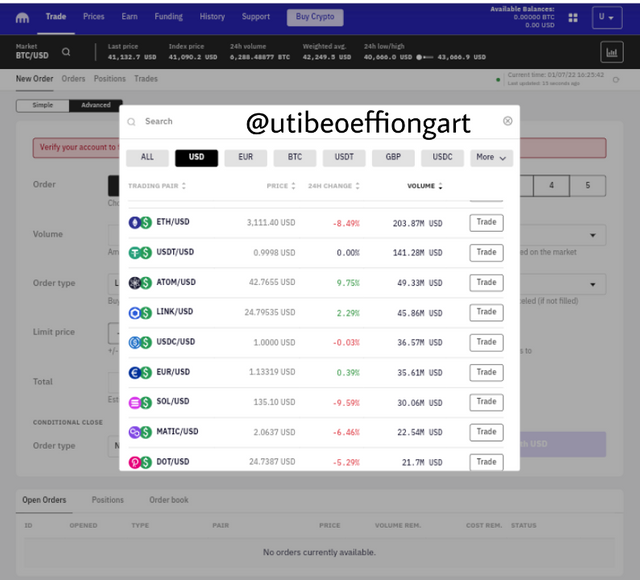

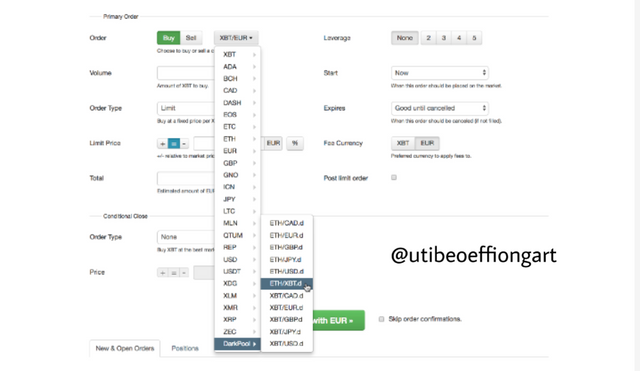

- After switching to the advance section the page above will come up, and then we choose the asset pair to be traded and the page below comes up.

Screenshot from the kraken platform

- After here the proceedings is difficult because the krekan site currently is not active. But if it was active the page below will come up for the actual trading to be carried out.

Screenshot from the kraken platform

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Decentralized Dark Pool

The decentralized dark pool by means of definition can be defined as an anonymous and more private means of transacting large asset without a slippage on the main market that making huge crypto trades without the awareness of the open or larger crypto market. And the good thing about the decentralized dark pool is that most of the times the volume of asset to be traded, the personal details of the trader are not exposed and this what distinguishes the decentralized dark pool from the centralized dark pool in that both do almost the same thing but then the identity and other important documentation of the trader is not revealed.

The decentralized dark pool uses a system called the atomic cross-chain for exchange actualization. In this case there is no third party in-between the transaction, just a direct progression between the maker and the market taker in a peer to peer manner. So there are nodes responsible for this transactions on the platforms and this nodes gets thier rewards from the fees generated during the transaction.

It's worthy of note that the decentralized dark pool has limited transaction it can carry out at a time, so through a method called the zero knowledge proof, the exchange breaks down this transactions to bits or segmented transactions and actualize them in a segmented manner till they are completely actualised.

Zero-Knowledge Proofs

The zero-knowledge proof is a system of verification that helps the actualization or completion of trading orders in a decentralized system. As it is in a normal blockchain were there are distributed ledgers that helps in the verification process of data on the blockchain from sender to receiver so likewise is the process with the zero-knowledge proof.

Now in the decentralized dark there is a limit the nodes available can match at a time for an order to be executed, abd we know that the transactions on the dark pool are always large, even the minimum order is large. Therefore the decentralized platform breaks down this order to simple fragments for execution. Now this is were the zero-knowledge proof comes in because bad nodes can take advantage of this order and cause double spending. So the zero-knowledge proof gives a system if authorization to the nodes to match this orders from sender to receiver and keep on executing this orders to the very last fragmented order is completed or executed.

Therefore the zero-knowledge proofs gives rise to accountability, transparency, scalability, anonymity and privacy during transaction which is one of the major characteristics of any decentralized platform.

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Ren Exchange

The very first decentralized dark pool in crypto currency is the Ren Protocol and this will be our discuss attraction. Republic protocol launched the Ren exchange in the year 2017 and this was created by Taiyang Zhang and Loong Wan.

The Ren exchange is a decentralized dark pool exchange that creates a high level of anonymity to users while still offering a great and incredible service in the crypto dark pool exchange ecosystem. In the Ren protocol a method known as the atomic swap is used to execute orders. Here when an order is placed is divided into fragments smaller bit of the order using a mechanism called the shamir secret Sharing. When this is established, the nodes through the smart contract begin to scramble for the pairing execise with another fitting matching order. This is the duty of the nodes and this done through a verification process to avoid front running.

After the matching orders which is done through the ability of the registrar of the smart contract so no fragmented order is left behind, the next action to be experienced in the Ren protocol is the actual execution which by the process of zero-knowledge proofs is verified for actual execution. This is also done by the smart contract through the judges action.

Over here there is total privacy of the order book. In time past the order book was accessible for members and even the staffs of the republic protocol. But because of undue advantage it was resolved that the order is only known by the sender and only reveal after the trade has been executed.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Differences between the centralized dark pool and the decentralized dark pool.

| Centralized (krekan dark pool) | Decentralized (Ren Protocol) |

|---|---|

| Orders are executed using the crossing method. | Here orders are executed using the atomic cross swap. |

| Here nodes are not involved with order execution proceed. | Nodes are totally involved were they gain thier rewards from the fee generated during the transactions. |

| KYC verification is involved. | No KYC verification process. |

| Here orders are available to the members of the dark pool. | Over here orders and even senders personal details are hidden from every other members of the pool, till after the order is executed. |

| Here orders are not fragmented before execution | here orders are fragmented for matching order pairing before actual execution. |

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

Market Response to trade.

Screenshot from coinmarketcap

From the above chart gotten from the Coinmarketcap showing a BTCUSD trade placed by a trader on 31st of December 2021 making the market price for the pair fall from $48,500 to $45,750.

Now this trader being a smart trader placed a sell order in the market at the as high as $48,500 knowing that such action will cause panic among the traders to be forced into a sells also with the fear that the market will soon fall. And this fear can only be caught on the small traders, and this major stunt is majorly pulled by the whales traders. Now as the whales traders predicted it went his way were the market caught a major dipping to a $45,750. And to his advantage there is a rebuy just some few hours from the sell orders and this pulls the market upwards again.

Now if this was the dark pool expecially if it was the decentralized dark pool were everything about the trade even the volume of the trade is kept secret from any other party except the sender of the order this kind of fear would not have occurred. This is one of the major advantage of the dark pool in that it activities does not have a direct impact on the main market because of it anonymous and hidden nature.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

Impact of the trades on the dark pool on the market price

Now I'll start by saying that the effect of the dark pool trading is not felt on the mainstream market. Now unlike the main market as seen in the previous question were the activities of demand and supply has alot of effect on the market volatility rate. In that when traders see a huge sell order made on the order book because of the fear of loosing out they is a force sell on the market causing an unwarranted fall on the market price and then when there is also a very large buy order placed here as well, order traders fearing to loose out on this too will be forced to make buys pulling the market upwards too.

Conversely, in the dark pool there is a kind of balance in the activities of the trades forcing a balance on the demand and supply. This is possible because of what is called matching order, in that after a trade is placed by a sender, it is kept secret till it executed through a crossing or an atomic cross-swap method depending on the exchange used. So the impact of this kind of large trade placed on the dark pool not felt on the market because third parties don't have access to them for fear to be generated to cause an undue volatilities on the mainstream market.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages of Dark Pool in Cryptocurency

There is a level of privacy and anonymusity experienced here.

The dark pool prevent undue volatility due to fear of orders placed by the whales traders, since the orders are hidden.

Trades are executed without a corresponding liquidation.

Problem of market price slippage is eliminated due to the invisibility of the order book.

Disadvantages of the Dark Pool in Cryptocurency

As the dark pool continues to waxes stronger, whales traders might be forced to perform more trades they and this could be a great disadvantage to the main market in that volatility will reduce and so much of range market price will be experienced.

The dark pools favors majorly the whales traders since they are capable of carrying out the large trades involved.

Conclusion.

The dark pool is another very interesting platform for traders and it can be detrimental and also beneficial to the mainstream market. The dark pool is a platform, were large trades are carried anonymously without a converse effect on the mainstream market. As mentioned most of the times afore, this is possible because it the fact that the order book user here is hidden from the general public, so no fear which might cause order traders to spring into action.

It is important to note that the dark pool we operational using the centralized she the decentralized operational systems and both systems are recommended for use only that while the former is simply to use, the later is a little bit complex in operation.

Thank you.