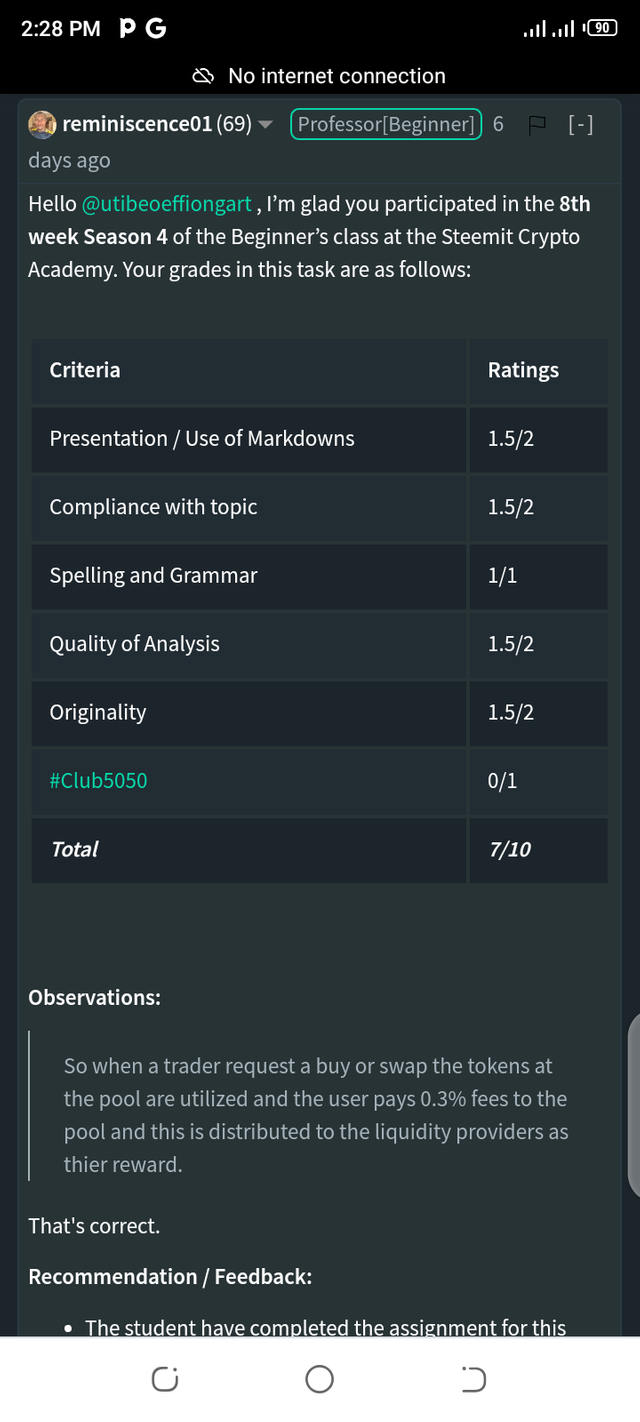

Below is the score sheath.

Here's a link to the post.

https://steemit.com/hive-108451/@utibeoeffiongart/defi-product-crypto-academy-s4w8-homework-post-for-reminiscence01

Below is the assignment post.

Now to the lectures proper..

In your own words, explain DeFi products and how it is shaping the present-day finance.

DeFi Product

The word DeFi is short form for the word Decentralized Finance, which is a very good alternative for the traditional financial system which we all know and can be crowned with the word centralized finance.

Over the years when we never heard any thing about Cryptocurency, the world was overly ruled by the the traditional financial system which we all know as the banking system at the seem to be the best till we started experiencing some challenges with this system such as;

Slow transaction due to intercontinental or international banking criteria.

Ease of hacking an account

Transaction charges.

Centralized nature of the system

Third party involvement in transaction.etc

All this aforementioned short comings lead individuals like Satoshi Nakamoto in the year 2009 to come up with the first mother coin the Bitcoin which through that particular project has birthed alot of other altcoins. And today we can boost of coins Ethereum, Dogecoin, Tron Etc. So a much more development of this birthed the DeFi product which aids as a bridge to the short comings of the centralized financial system.

So the DeFi product are those Decentralized Financial product that are built on a blockchain using the smart contract so through a peer to peer methodology Digital currency can be traded with so much ease either for other digital currency or to fiat currency.

The word Smart Contract is that phenomenon that removes the third party criteria needed in the traditional financial system. The smart contract is an automated protocol created to automatically execute orders or task in the DeFi system which bridges the gap between the sender and the receiver. This is what makes the DeFi product unique because unlike the centralized financial system that needs a third party which are humans working at the helm of such affairs, the DeFi needs non of those but just an automated protocol doing the work of Market Match making..

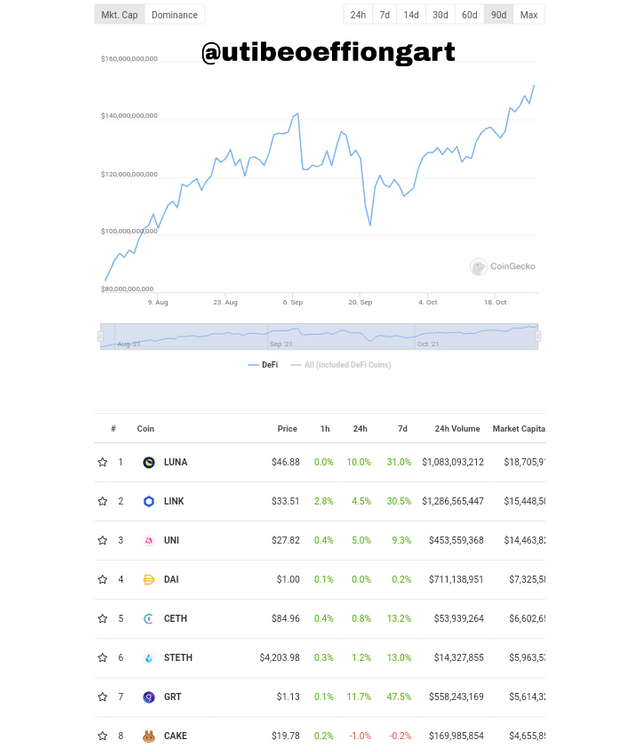

Below is a screenshot showing some of the available DeFi product but for a self and better access to them, you can visit DeFi Listing.

How it is shaping the present-day finance.

The DeFi available products is shaping the present day finance through its enormous benefits to finance with it peer to peer method of transaction making transactions very easy and affordable.

Further more the smart contract protocol incorporation is another very interesting part that has really shaped the present day finance because of the self reliance nature of this financial system, leaving the system in a free flow of communication or transaction between the sender and the reciever.

Explain the benefits of DeFi products to crypto users.

Below are the benefits of DeFi product to Crypto users.

Transaction speed

The Decentralized Financial has really cured the short coming of the centralized finance in terms of speed of sending finances from one location or account to another. When making transactions especially intercontinental, then you should be sure to wait for 2 to 3 days before your transaction gets through. But then looking at the DeFi products in less than seconds a very huge transaction with large rating can be obtained.

No time/day bound

The digital currency or digital financial platforms work all day and all times, unlike the traditional financial system there is time and day limitation were we hear things like working days and working hours. The digital financial system has non of those in play in that all the digital platforms dealing with DeFi product work at all time and all days..

No Third Party Requirement

In the traditional financial system we have what we call account managers who verify transactions and activities of an account before it goes through. But then in the Decentralized Finance non of this is required, the peer to peer is functional here in consonant with the smart contract which makes the transaction automatic without the help of a third party.

Account Security

The DeFi products existing on blockchains provides a very strong security for account and existing finance product. This is possible because of the consensus mechanism available on the platform were all or up to 50% of the nodes on the block have to give verification before an action can be allowed to go through. Because of this hacking of the blockchain becomes almost impossible plus the fact that all information or datas of the block are not stored in a single place therefore hacking one more time is very difficult.

This provides the ought most security.

Transaction Fees

There's something going on in the traditional financial system currently that's very alarming is what is called the bank charges and this is very very voluminous. Apart from that when carrying out intercontinental or inter-country transactions, the transaction fee is always very outrageous. But then viewing the DeFi gas fees are very friendly even while carrying out very huge transactions.

Discuss any DEX project built on the following network.

Binance Smart Chain

Tron Blockchain

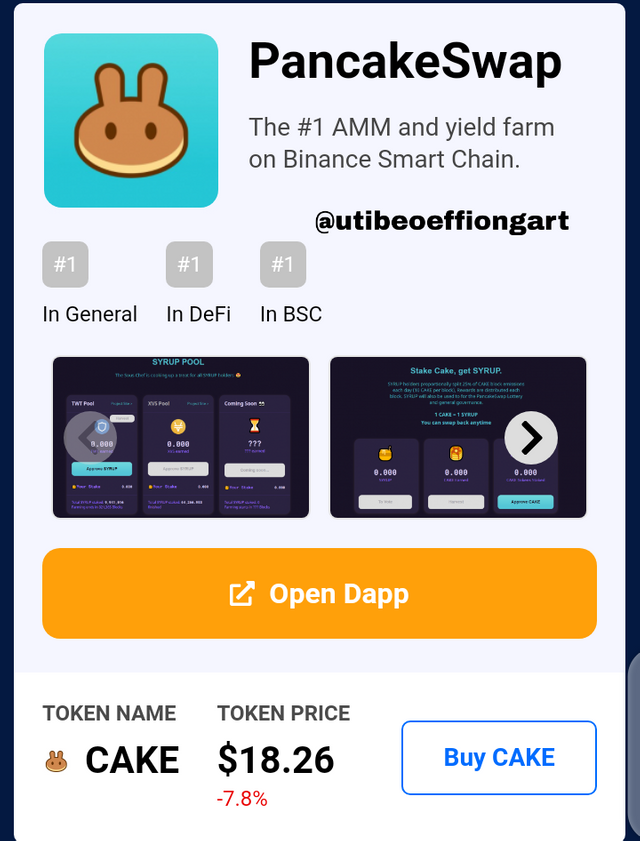

Pancakeswap on Binance Smart Chain

The pancake swap one of the Dex project on the Binance Smart Chain that has gain enormous popularity over the months with over 100 million dollars trading volume in 24 hours basis. The pancake swap was lunch on September 2020 with a number of teams members and engineers which are called chefs. Hops and Thumper stands as the two co leaders of the platform.

Pancake swap allows users to trade Binance Coins and a host of other BEP-20 tokens and this is done in a very secured and anonymous process. It's an AMM (Automated Market Maker) protocol platform user and that is possible through the help of Smart Contract. With this AMM concept the idea of order book is completely eliminated.

The pancake swap has a native token called cake and this helps member to participate in the voting of governance, staking, farm yield etc.

How Pancake Swap works

Now the pancake swap operates with a protocol called the AMM Automated Market Maker concept which with the help of Smart Contract helps transactions to be carried out automatically.

Now this AMM would not be possible if there is no place were the protocol will pick the funds from for the buyers. So the liquidity pool survices here, were some members of the platform donate asset to the pools and are called the liquidity providers.

The liquidity pool provider's gain their reward from the transaction fees generated during the transaction on the platform and this reward is calculated based on the staking of such provider. Generally 0.25% flat rate us usually shared among the liquidity providers.

The pancake swap exchange can be accessed and operated on through wallet such trust wallet, wallet connect, Metamask, Binance. Etc.

Pancake swap members enjoy lots of benefits on the platform such as low transaction fee rate, very secured transaction etc. Other benefits include;

Initial Farm Offering (IFOs);

This allows users or members who have the native token, cake to purchase tokens before the are lunched for the public to take part of the purchase.Yield Farm;

This allows users to stake their cake token in the Liquidity pool and also earn an additional reward apart from the transaction fee reward.Syrup Pool;

Like the Yield Farm the pancake swap offers a Syrup pool which allows users to stake cakes and other BEP-20 tokens to the pool to earn a considerable amount of reward.LOTTERY v2

With this offer users stand a chance of winning more cakes from an initially purchased lottery ticket which falls as low as $5, though a discount of 4.95% can be given to users who purchase up to 100 tickets. By matching up to 6 numbers on their lottery ticket 40% of the price pool is allocated to such user.Prediction Market

This is more like a predict and win offer. Were users are allowed to predict the price of BNB Binance coin on a 5 minute time-frame chart whether it will rise or it will fall. On correct prediction the user who got the prediction correctly earn the prediction staking of the users who lost out on the prediction.

Justswap on Tron Blockchain

Justswap is said to be the first Decentralized exchange on the Tron Network. And it uses AMM protocol method just like the pancake swap. Justswap enables users to exchange Tokens such as the TRX and the TRC20 tokens with other tokens.

By the Justswap operating with the automated market maker protocol users are allowed to send tokens to the liquidity pool in an equilibrium proportion. By equilibrium proportion I mean sending an equal amount of the token to the two side of the pool say x and y for a constant or balance to be achieved on the pool.

So when a trader request a buy or swap the tokens at the pool are utilized and the user pays 0.3% fees to the pool and this is distributed to the liquidity providers as thier reward.

It is worthy of note that liquidity providers are in total control of thier token in that they can withdraw at any time of thier choice.

The Justswap platform is one platform that is very users friendly with is very easy to use features. Accessibility is very easy to users which make the platform attractive for exchange.

In the DEX projects mentioned in question 3, give a detailed illustration of how to swap cryptocurrencies by swapping any crypto asset of your choice. Show proof of transaction from block explorer. (Screenshots needed)

How to Swap on Justswap

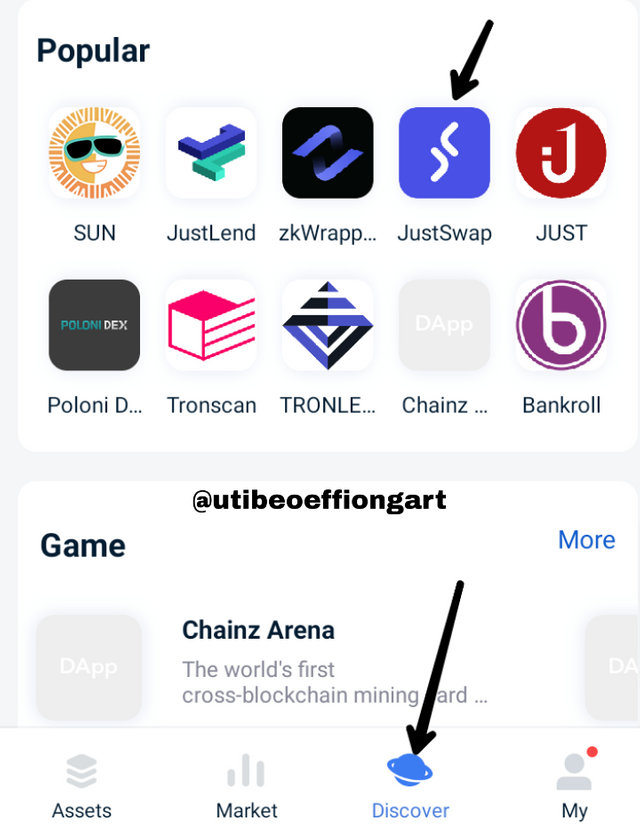

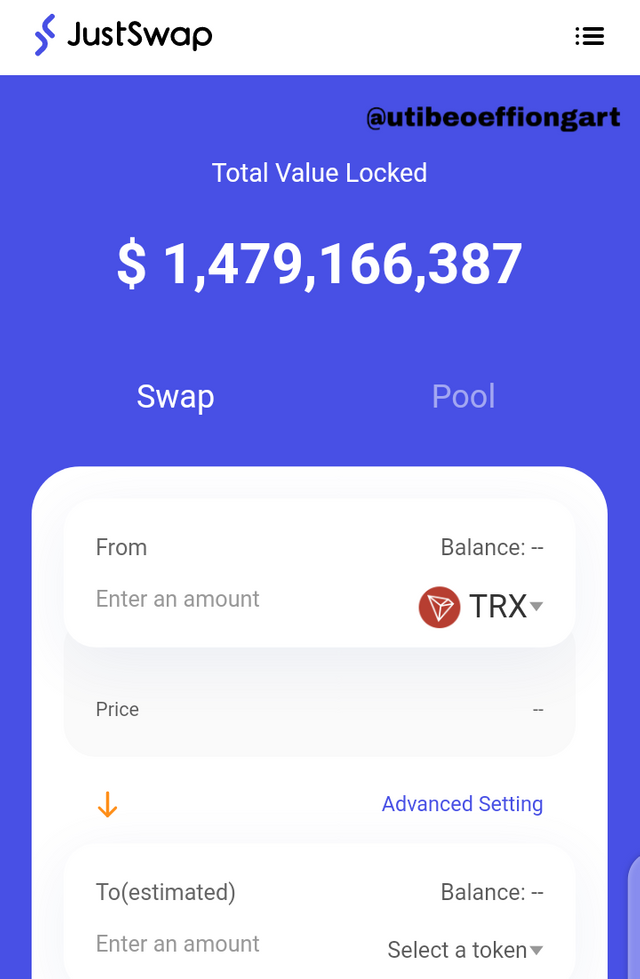

- First log into your tron wallet and then click in discover which will bring up the available dApps on the Tron Network then choose the Justswap.

Screenshot from tron wallet

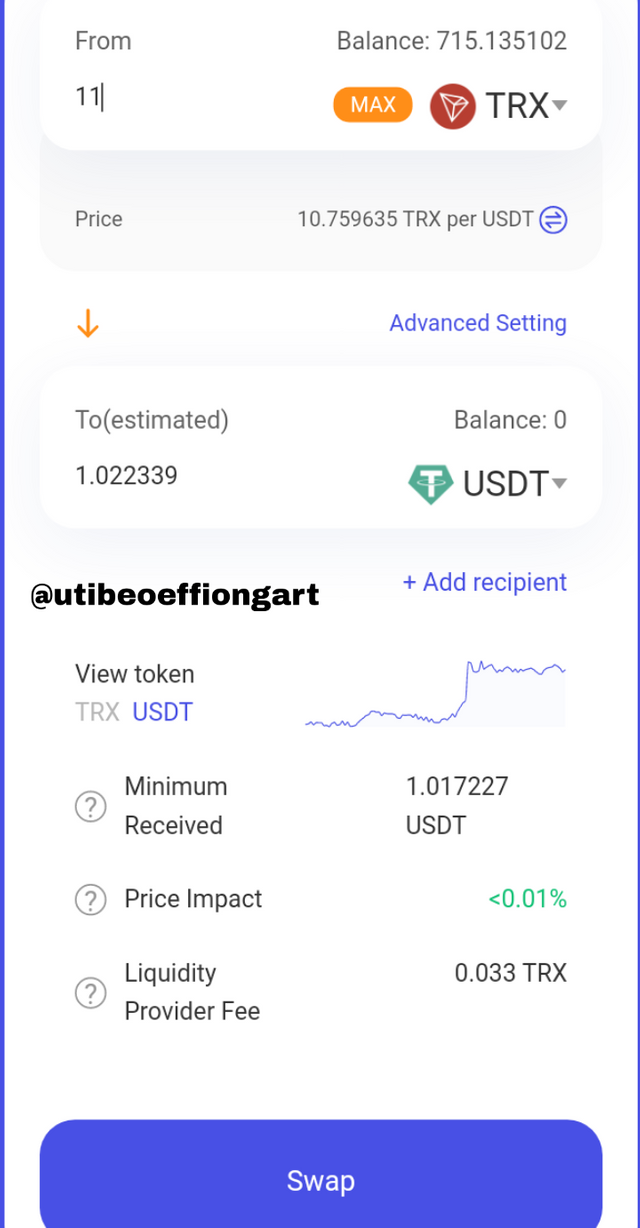

- After that the swap page comes up. Then I choosed the pair of asset I wanted to swap, here I swapped my Tron with Usdt.

Screenshot from tron wallet

- After that I clicked on swap to proceed.

Screenshot from tron wallet

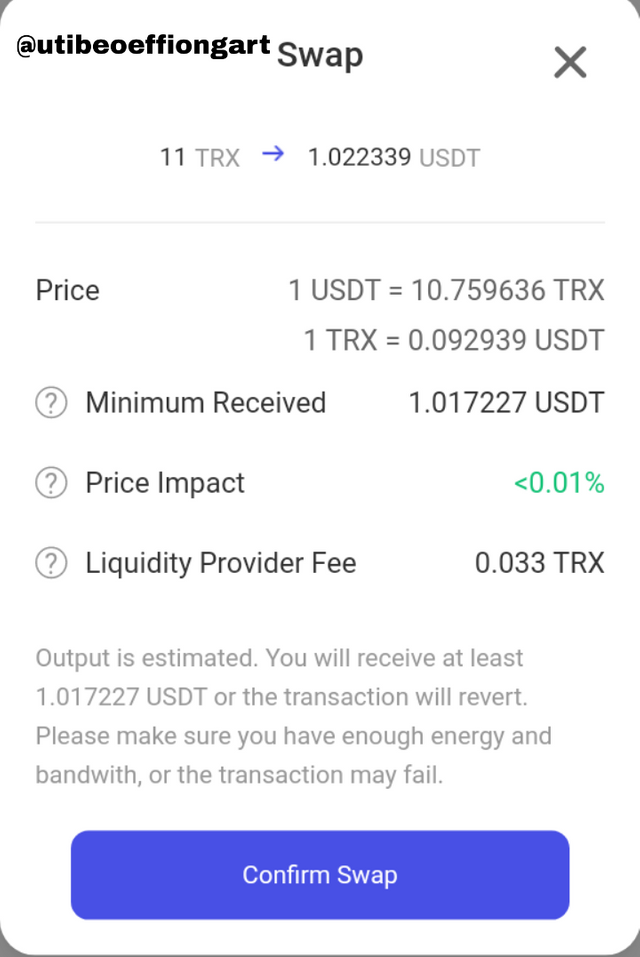

- The next page comes up so the swap can be confirmed. When you are sure of your transaction details you then click on confirm swap.

Screenshot from tron wallet

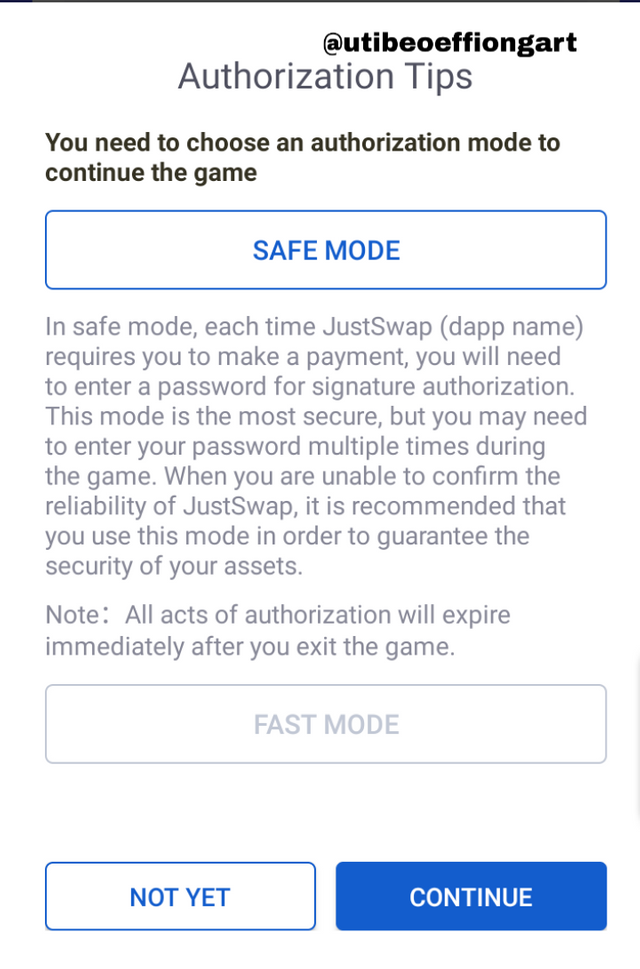

- Then an authorization page comes up were you give your consent for safety purpose. Click on continue to proceed.

Screenshot from tron wallet

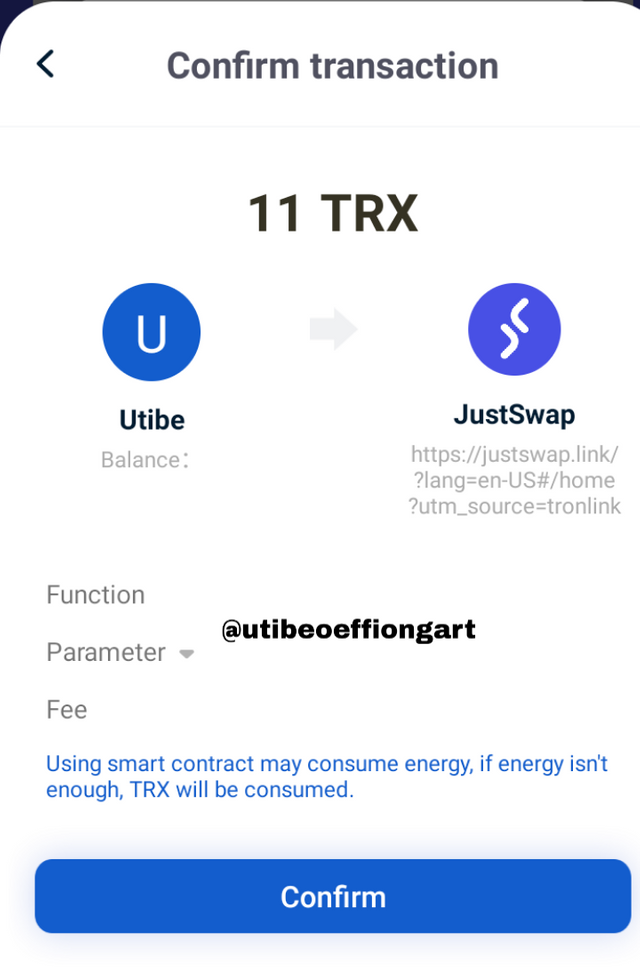

- After that your swap is ready, you then click on proceed and the page below comes up.

Screenshot from tron wallet

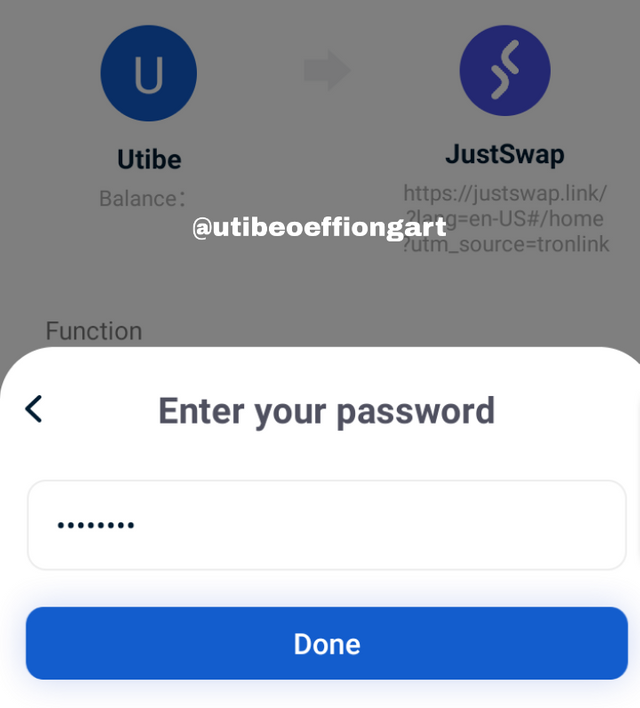

- Here your password is required for this transaction to go through, so you input that and click on done.

Screenshot from tron wallet

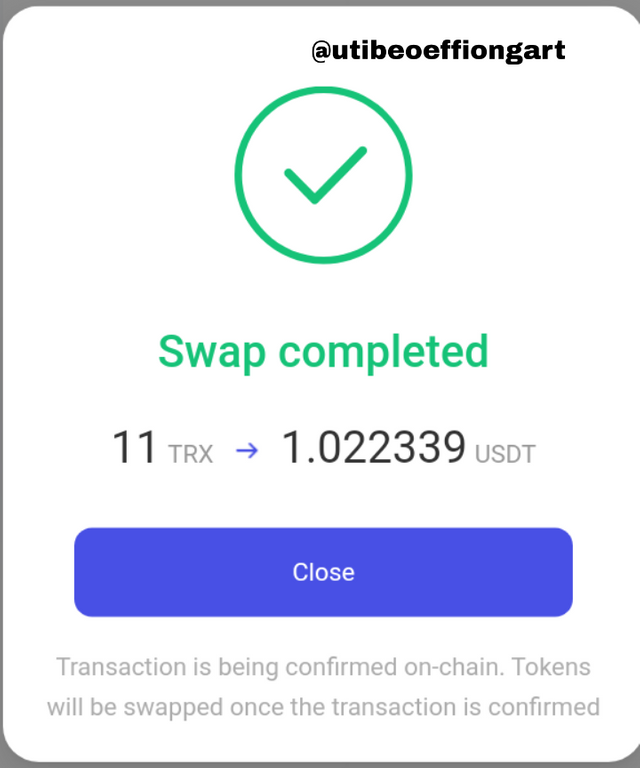

- Finally the transaction is done and successful.

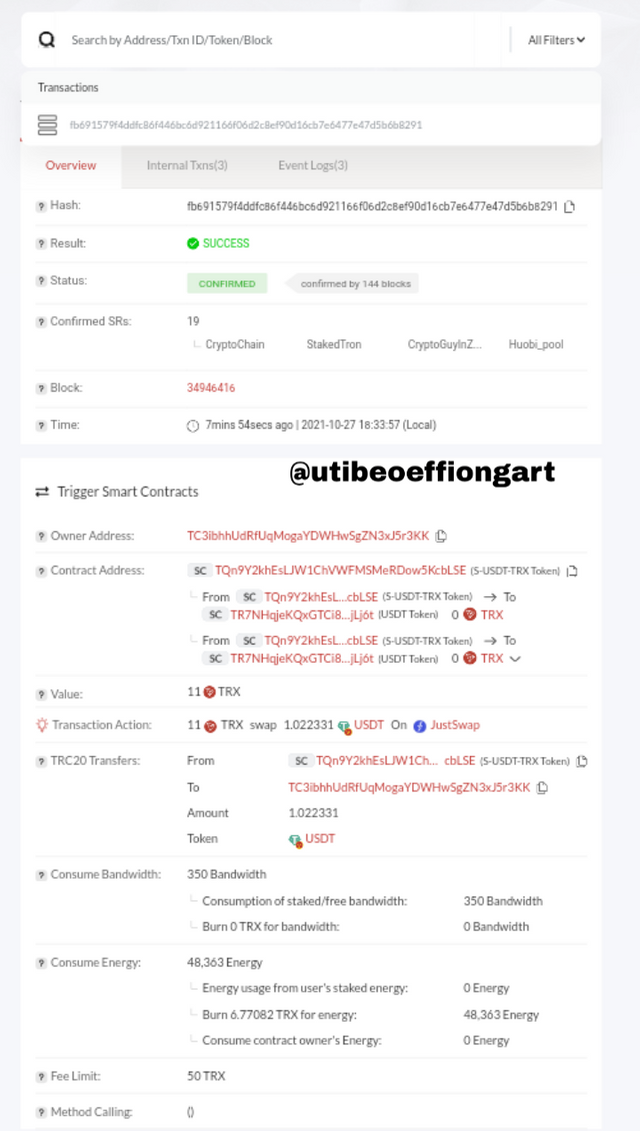

To confirm if the transaction was successful you log into the https://tronscan.org/ and input the transaction hash to get a view of the transaction details. And as I did that in the search tap all the details about the transaction came up as seen below.

Conclusion

In conclusion, DeFi is really a leverage for the limitations of the centralized finance and if the DeFi products are improved upon then in the coming years we are sure of having much more developed financial system.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit