There has always enough opportunities for people in the world. However, the flow of numerous interesting opportunities currently is explosive. This is obviously unconnected with the advent of blockchain technology and the amazing aspects it brings.

Prof. @imagen has done noble by exposing us in the academy to indepth knowledge of available financial services in the blockchain space. I want to now give answers to the assignment questions.

Describe the Differences between Staking and Yield Farming

We can say that the Blockchain industry has opened doors of opportunities for people to have multiple streams of income. The upsurge of smart contracts have birthed and launched ideas, the most recent being the deFi projects which has had a massive outcome.

Among the mechanisms in which the deFi projects use to enable their users profit or earn dividends are the Yield farming and staking.

Yield farming is the process in which users lend and borrow money. Here, each user donates his money to the interface thereby making it available for others to use it however they intend to. If a person borrows, there is a reward to the user through fees and dividends when the borrower pays back.

This is simply a human action that allows people's assets to be used on the deFi platform to provide loan as seen in an offline banking system. The user in turn is rewarded, that is, given interest or incentives pending how long he decides to lock his funds away.

The yield farming adopts the banking system of borrowing and lending depending on the users account. Interest from loans can always be paid to the users if his money or assets was part of what was borrowed.

As users of this platform receive interest on their assets, the funds they lend to the platform is used to fund liquidity pools thereby enhancing and sustaining liquidity in the platform. The profits incurred are then distributed to the liquidity providers. The profits or revenue are provided in the native token while extra rewards acquired are given in form of other tokens.

Staking juat like the name implies, staking is all about making a stake, just like in games. Here, human actions are also obtainable here. Such that each user can support or obtain ownership and participation rights in a block chain project by making use of their coins or token units. When they do this, they are rewarded with commissions.

By staking, one shows commitment to a project through his funds, which helps in the proper functioning and development of such projects.

Such commitment validates the user's authority to take part in the operation and necessary transactions in a given project through the mining process.

In staking, each user is allowed to lick up his funds for the purpose of providing security and governance to the network. The user is rewarded with a stipulated percentage of the profits generated from the activities of the network.

A person's reward is dependent on the total holdings of their stakes and how long they're are being staked. That is, rewards is directly related to the quantity of stakes owned.

The word staking is not farfetched on the Blockchain projects because they are used in assigning mining quotas.

Users who stake can share in the rewards that is earned from mining new blocks in the Blockchain. Because theses stakes are uses in validating and verifying transactions. They determine the validating nodes while mining.

Users stake in the deFi project in order to have an edge in the operations of the projects by allowing their assets to be used.

This gives them some significance, they have a share in the the rewards as seen in corporate organisations where people own shares and can add to investments for development of their firms. They are rewarded by the interest accrued at the end of the project.

The difference between Yield Farming and Staking is explained in the table below.

| Yield Farming | Staking |

|---|---|

| In terms of technology or protocol, yield farming is concerned with automated market maker protocol. | Proof of stake is the underlying protocol for staking. |

| Locked funds are rewarded with interest. | Rewards are incurred through the process of block mining. |

| Yield farming deals with the regular transactions that occur on the network. | Staking focuses on the various activities in involved in verifying and validating transactions on the platform. |

| Yield Farming provides convenience for the user as it can be done for as long as the user intends. | Staking is associated with deadlines and puts the user on a spot. |

| In yield farming, tokens are used to ensure availability of liquidity through liquidity pools. | Tokens are used for security and governance of the network. |

| The probability of getting more rewards is high,and as the rewards are dependent on the amount or volume of transactions. | Here, rewards are less due to the limitation of the number of transactions at a particular mining section, as each one has to go through a verification process. |

| In yield farming, each provider of funds gets full reward. | Stakers share rewards based on the stipulated quota given. |

| There are no complexities in yield farming. | Staking follows due process that must be done to the latter as it is concerned with the governing and security of the project. |

Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Show screenshots.

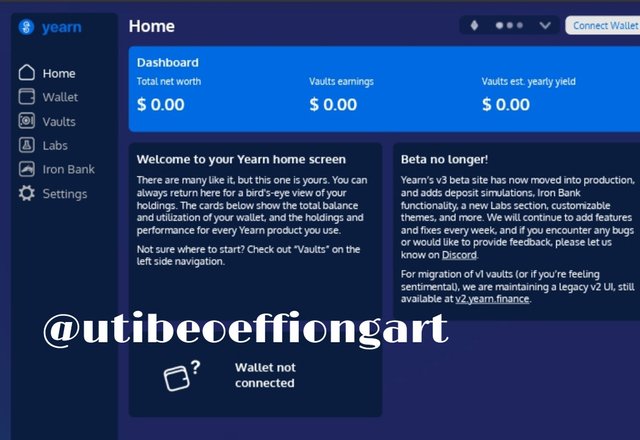

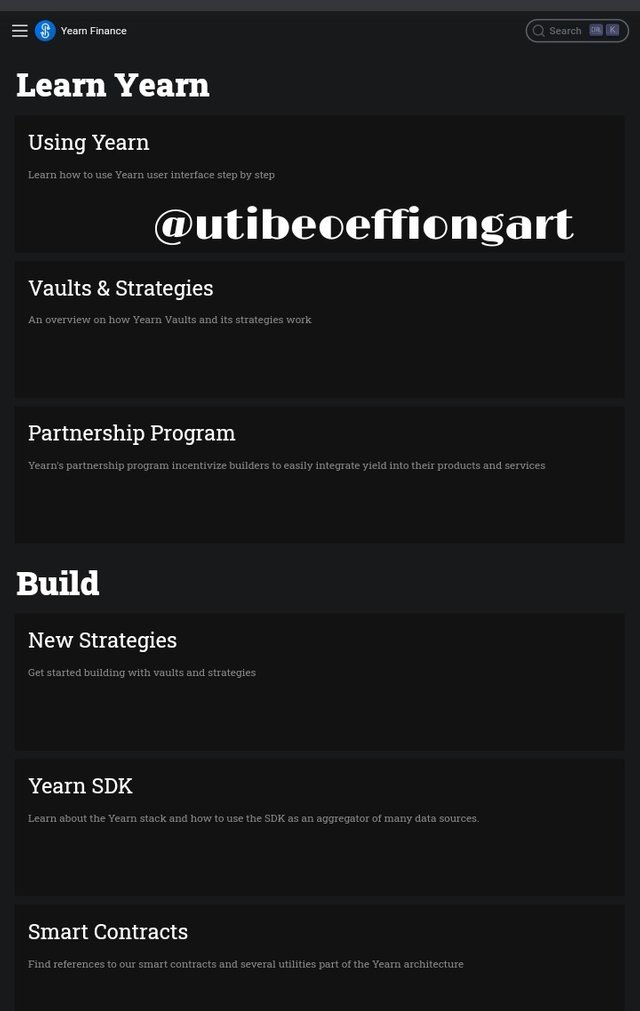

To explore the Yearn Finance deFi, I visited https://yearn.finance/#/ and found myself on the homepage. As a result, I was able to investigate the features. A welcome note can be found on the home page.

In addition, the user's dashboard is displayed

Some of the features as they are listed in the page are:

- WALLET

This is where a user's USD balance for their tokens is displayed. It displays the user's assets as they appear in the linked wallet.

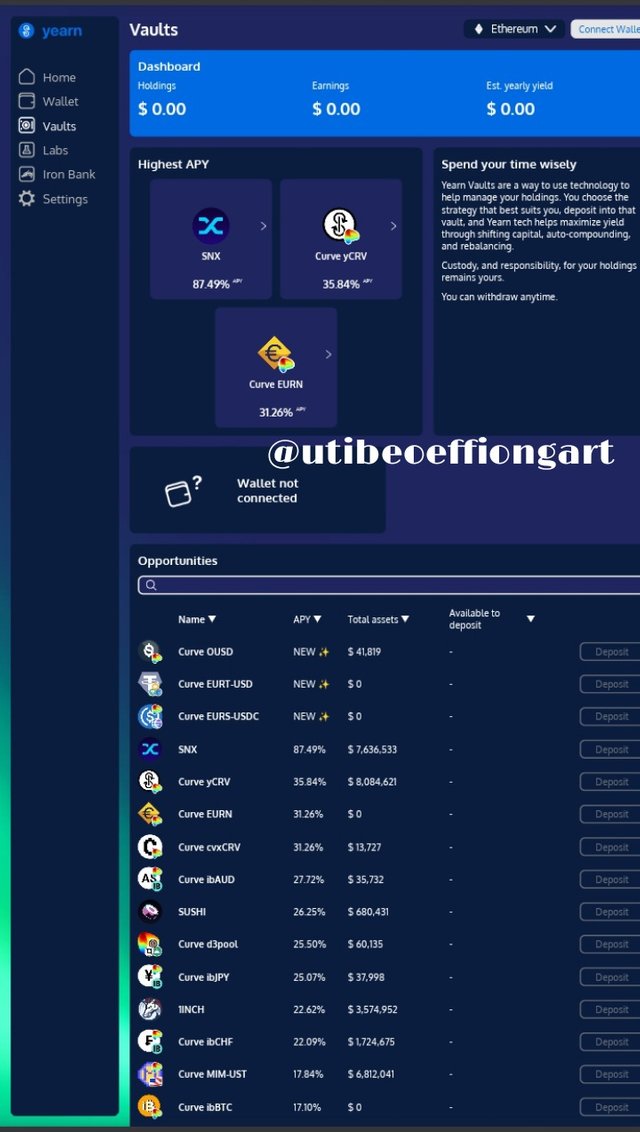

- VAULTS

As the name implies, this is a place where you can deposit your money and leave it to earn interest. Because the user has complete access and control over the funds, he can withdraw them at any moment.

By transferring capital, automatically compounding the deposited amount, and rebalancing it, the vault maximizes yield. The various components depict different portions of the vault. The interest rate on these assets is set at a specific percentage (APY)

- LABS

This seem to be a special feature for investment. Three items are listed in the lab: yvBOOST, pSLPyvBOOST, and yveCRV. These choices allow consumers to keep their money safe. Before withdrawing funds, funds must be set aside for a set length of time. These options also have different interest rates.

- IRON BANK

This is another investment area in the platform. Users can use their existing tokens and currencies as collateral to burrow tokens. This is particularly true with new tokens.

To obtain the new token, a user does not need to sell his old ones. He can just borrow them and use them to make investments. Users can also deposit their tokens here to help others burrow, and they will be paid interest.

- SETTINGS

This is the area where a user can update and adjust the platform's appearance and language. The platform can be set to dark or light mode. The theme can be altered or even customized depending on the situation.

- GOV

When this button is hit, this includes the project's governance system.

- DOC

There is also a section where the project's records and key information can be found.

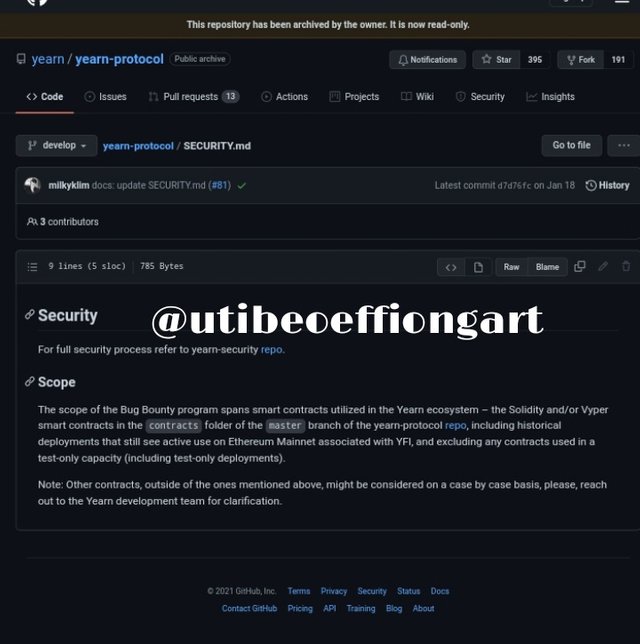

- SECURITY

Containes description of the platform's security. It displays data such as the smart contracts approach and more.

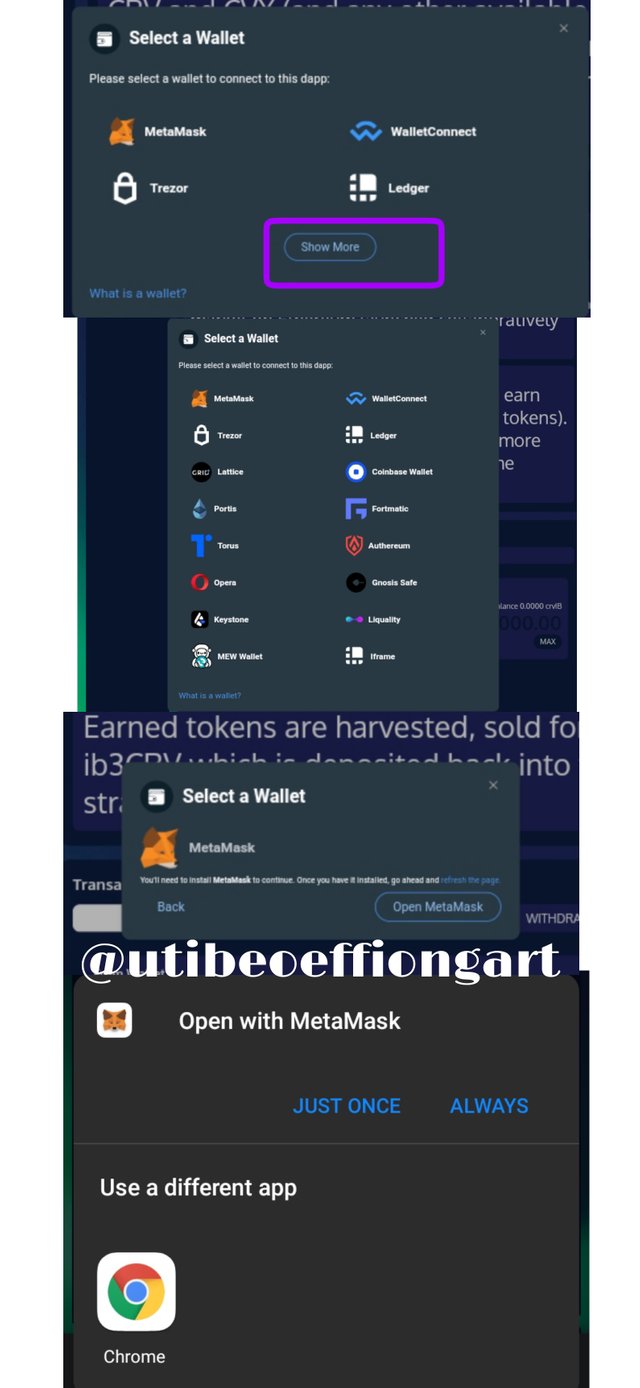

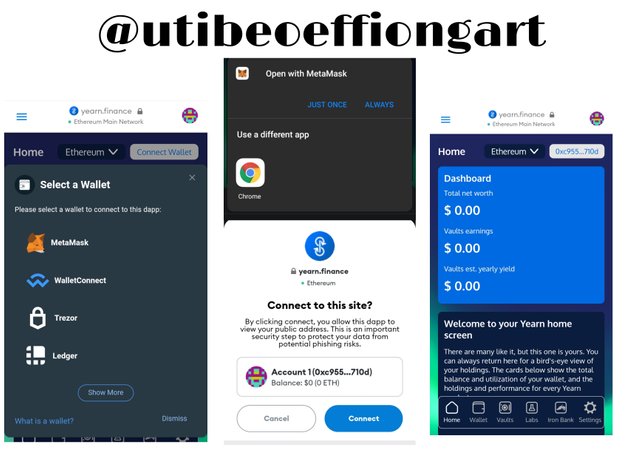

Connecting Wallet

The option to connect wallet on the top corner of the page. I clicked on this and I was given some options of wallets. I still went ahead to check for more options. I picked Metamask since it is a wallet I was currently operating.

I was asked to open the wallet which I did. I choose either to open with the app or a browser and I picked the app.

I was redirected to my Metamask wallet where the URL to the Yearn Finance deFi was connected after my wallet app gave me a prompt on whether I wanted to connect or not.

I had to go ahead and click connect and link the wallet. That was when the display was shown on the top right corner indicating that the wallet had been connected. That was when the homepage was displayed showing my balances which were all zeros.

Depositing into the Vault

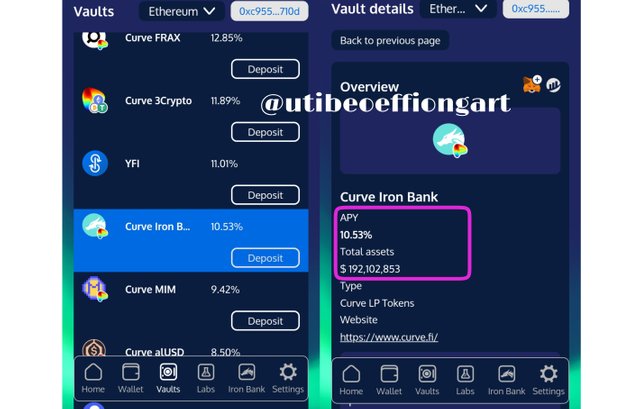

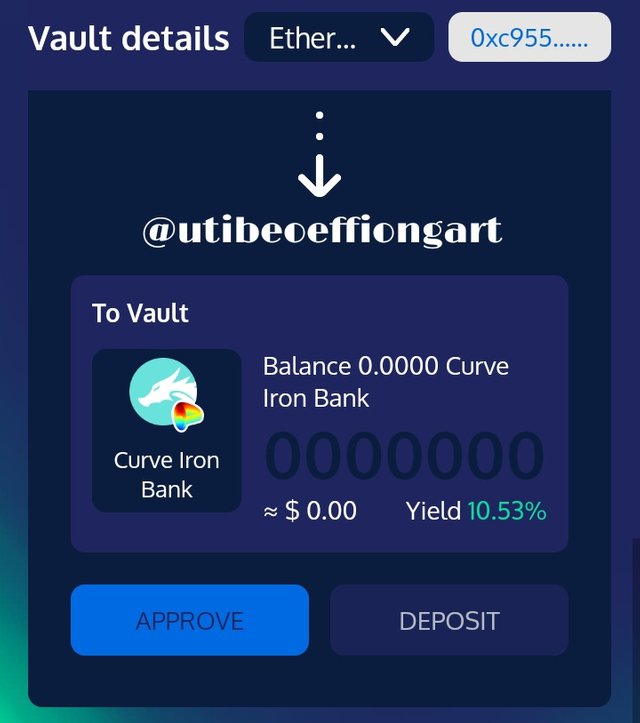

I decided to use the vault option to see how to transact on the platform. On the vault page, a list of different options was displayed.

I decided to invest on curve iron bank. This is because it had a large market share and an attractive interest percentage.

Details of the option I picked were displayed in the following page.

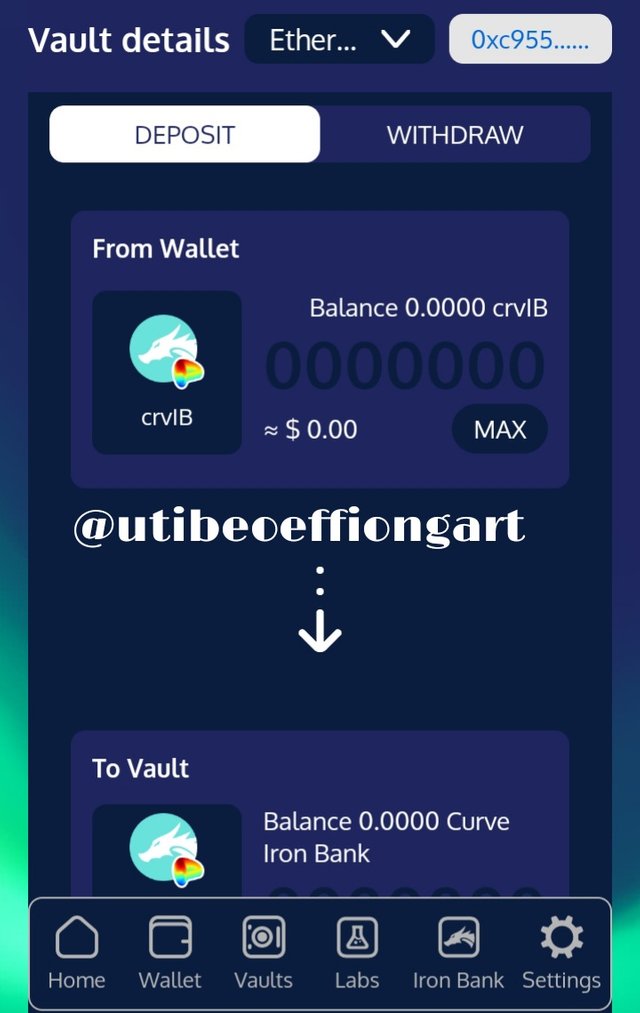

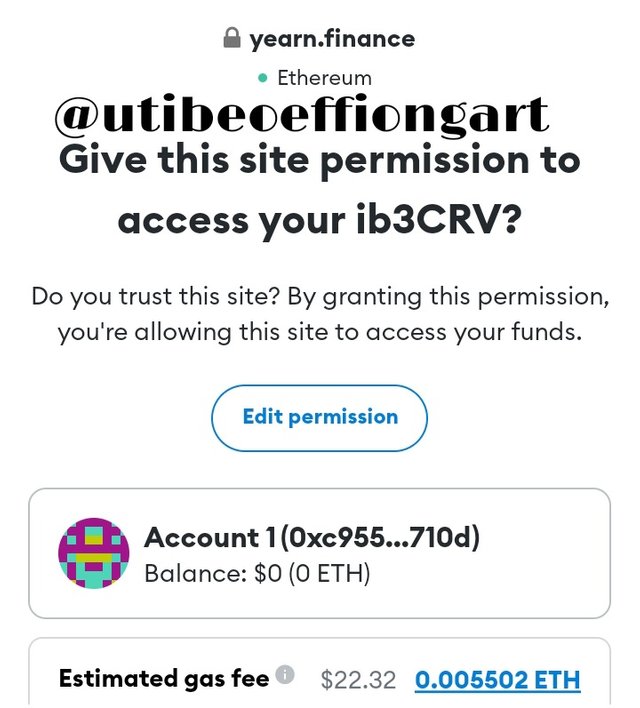

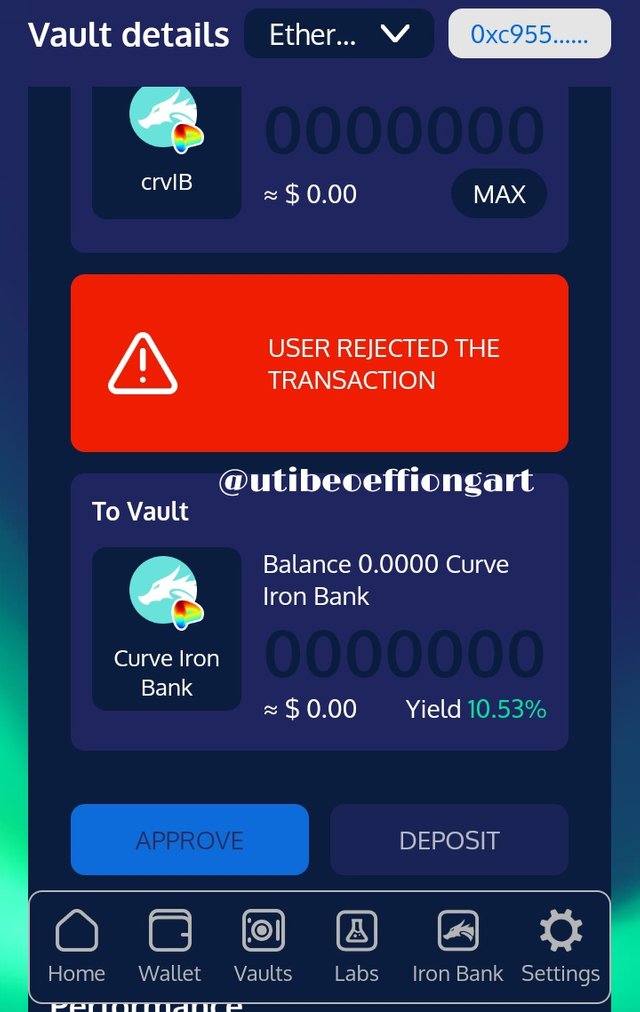

I proceeded to the deposit page and clicked in approve. I did not have any assets at the time so I did not input any values to be deposited.

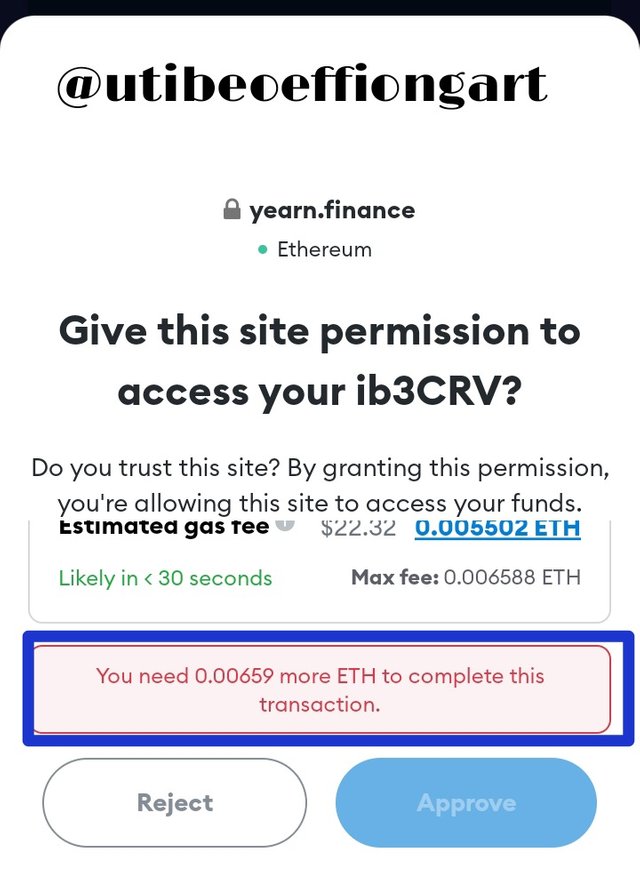

Metamask wallet requested for my permission for the transaction to go on. I was given a warning that my account was insufficient for the transaction.

Thus, it could not be approved even after I had pressed the approve button.

So, I decided to reject it and it was shown that the user had rejected the transaction.

All images here were gotten from the Yearn Finance page and Metamask Wallet app in my phone.

What is collateralization in Yield Farming? What is function?

I remember once that I needed to get an equipment from the lab in school and since it was not officially requested, I was asked to drop my student's identity card untill I returned the equipment.

Well, as I saw the word collateralization, this event just popped into my head. Collateralization could be defined as the process or act of obtaining a benefit by using a collateral. It involves making use of what you have to get what you want by depositing that thing you had.

In banks, to give out loan on most occasions, the individual is required to present a collateral which is a kind of security or deposit of something of value which is to serve as a backup or insurance such that if the loan is not paid back as at when due under the agreed terms, such Initial deposit would be used to settle the deficit.

Banks request for collaterals that if sold, would generate as much funds that is close or equivalent to the sump that was borrowed.

In yield farming which is also concerned with giving loans, the lending platforms also make use of a collateral system. For yield farming, the collateral is a deposit of other cryptocurrency assets owned by the individual in order to get units of the token requested.

Different yield farming platforms have separate ratios of collateralization. This asset to be deposited is always in an amount that is higher than the value of the loan requested.

The reasons for Collateralization are almost obvious. The major goal is have some sort of leverage in cases of emerging circumstances. It might happen that. User refuses or is not able to pay back a loan. In such a case, the collateral is used to settle the outstanding debt.

With collateralization, holders and investors have some kind of assurance of not loosing their investments or being robbed of their assets. A form of safeguard and guarantee is made possible by depositing collateral.

At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

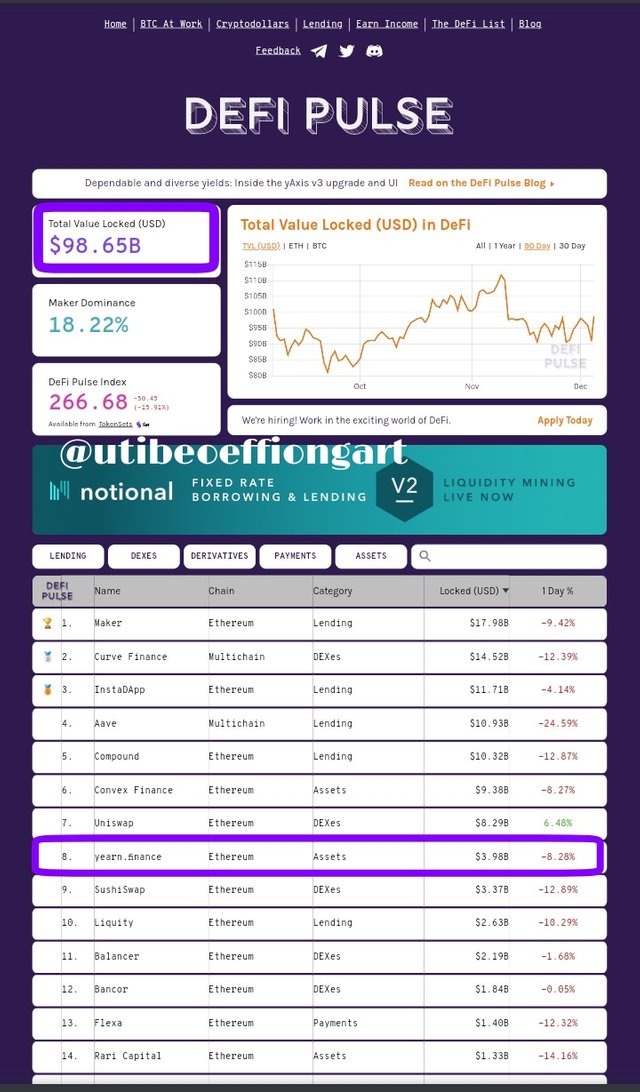

I used the site; https://defipulse.com/ to check these data. As at when I was writing, the total value locked (TVL) stood at $98.65 billion. The locked USD value for Yearn Finance on this site is $3.98 billion.

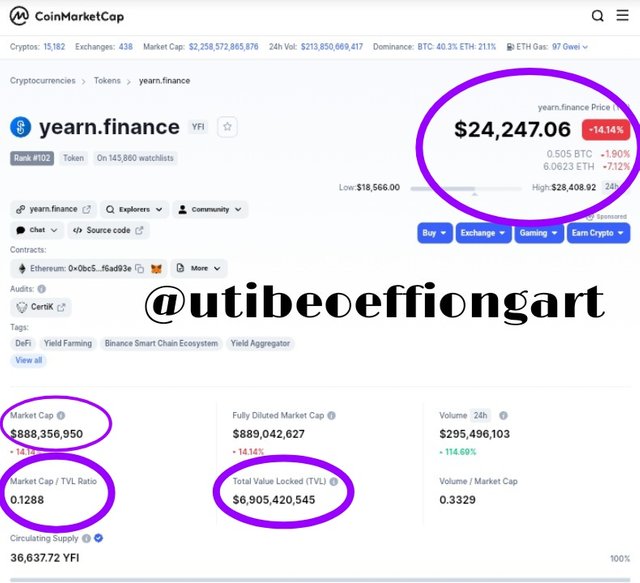

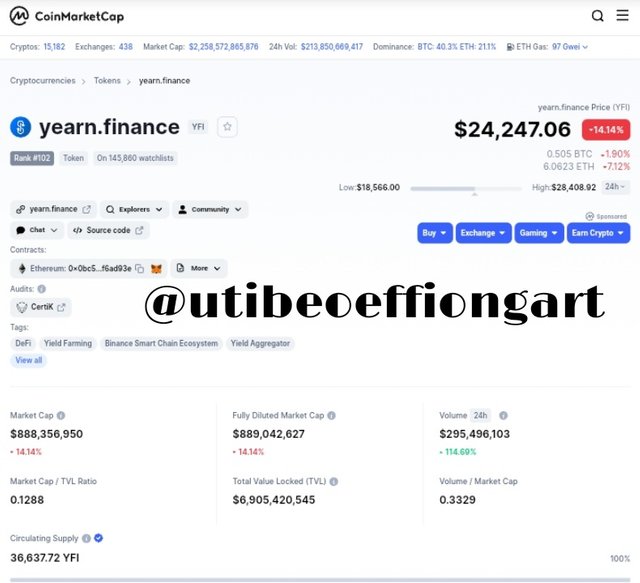

On CoinMarketCap, the total value locked (TVL) for Yearn Finance was $6,905,420,545 and total market capitalization value is at $$885,413,935.

Market Cap / TVL ratio of the YFI token is 0.1288.

The YFI token, is it overvalued or undervalued? State the reasons.

In the lesson, we were taught that a DeFi asset could be judged as being undervalued or overvalued. Overvalued assets are those which have a value of 1 and above for Market Cap / TVL ratio. If the value for this ratio is less than 1, then the asset is said to be undervalued.

The Market Cap / TVL ratio of the YFI token is 0.1288. This is less than 1. Therefore, it shows that the YFI token is undervalued.

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

BTC

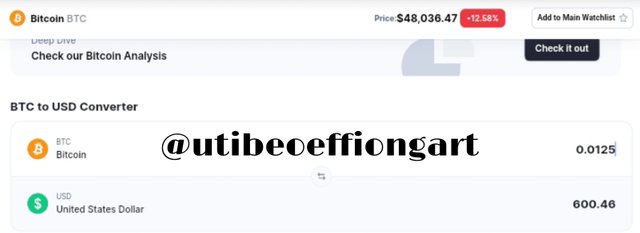

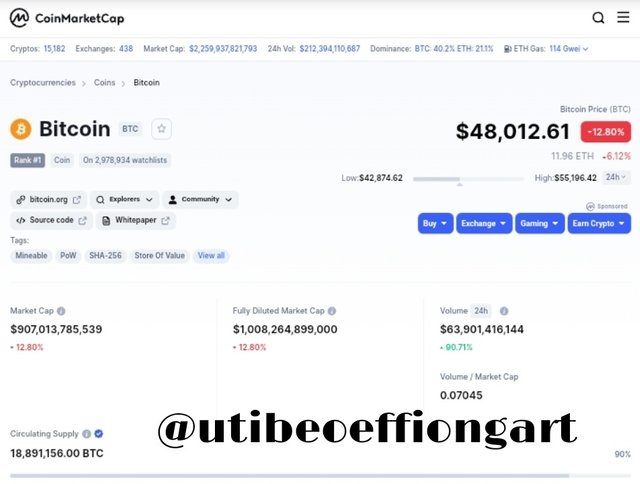

BTC had a closing price of $39,974.90 on 1st August, 2021.

$500 purchase of BTC would have given 0.0125BTC at the price of 1st August.

At the moment, BTC is $48,020.42. So, 0.0125BTC would cost $600.39.

Subtracting the initial cost price: $600.39-$500 = $100.39

This is the returns on investment from the purchase from 1st August, 2021.

Returns on investment percentage =$100.39/$500 × 100 = 0.20078 × 100 = 20.09%

Return on Investment in BTC for the period was 20.09%

YFI

YFI had a closing price of $31,779.15 on 1st August, 2021.

$500 purchase of YFI would have given 0.015733 YFI at the price of 1st August.

At the moment, YFI is $24,369.42 So, 0.015733 YFI would cost $383.47

(

Source

Subtracting this from the initial cost price: $383.47-$500 = -$116.53

This is the returns on investment from the purchase from 1st August, 2021. As can be seen, the investment was a failed one.

Returns on investment percentage =-$116.53/$500 × 100 = -0.23306 × 100 = -23.31%

Return on Investment in YFI for the period was -23.31%

Total Returns

Total, returns on investment = $100.39 from BTC purchase and -$116.53 from YFI purchase.

=100.39 -116.53 = -16.14

This represents $16.14/$1000 × 100= -1.614%

From the purchase, I had an overall loss of 1.614%

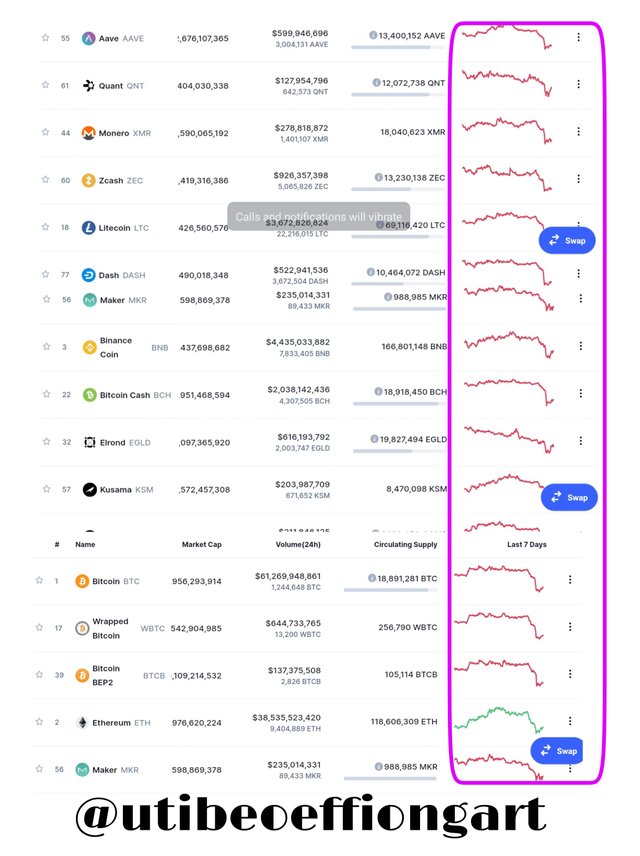

In the past few days, there has been a serious dip in the prices of cryptocurrencies globally. The value of even the top currencies are plummeting greatly. This has been going on for a while now.

Most of the prices are going down.

Anyone who invested before now have had the value of their investments reduced. It is my y hope that this downtrend will soon terminate and we will get back the bullish conditions that most investors look out for.

Images from CoinMarketCap

In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

There virtually nothing in this world that does not come with risks. In one form or another, there has to be some unwanted outcomes associated with a thing. Yield farming is not spared from having its own risks. Some of these risks include:

- Potential of Hacking

Almost everything digital these days are targets for hackers. The fact that yield farming platform even offer additional attraction in terms of the monetary value makes them more liable to be attacked. As such, with the open source of most decentralized projects, certain information can be expose which can be exploited by hackers. Also, considering that most of these projects are built on smart contracts which have less complex security systems.

- Bugs and Programming Failure

It has happened over time that protocol of a project crashes. This might be due to a wrong command and carelessness on the part of the developers. If the coding process is filled errors, it is possible that a project looses all its assets.

- Monopoly by Whales

Whales are know to always be in control of very large portion of a market. For a particular token, a whale can own a percentage that is very significant and the actions of whales can cause significant rippling effect in the entire ecosystem. Supposing a whale takes out the shade he controls, this could result in the value of the asset going down seriously and all held assets would eventually loose most of their values.

- Absence of Stability

Normally, in blockchain sector, there is little or no stability. Infact, the degree of volatility associated with blockchain is such that is not experienced in any other field. This makes it quite and uncertain place to invest. The staked or farmed assets may not yield any returns. It might even happen that the whole asset gets liquidated if there is a serious dip in prices.

To make money, one needs to make use of money, this is the principle of investment. A user needs to be informed about means to earning some income with the capital he or she owns. In today's world, things have shifted from the usual methods to news ways.

One prominent investment channel that we have now is the blockchain industry. With blockchain, any can make as much money as possible depending on how well skilled and informed the person is.

Through development of some platforms that operate financial services and portfolios, things like staking and yield farming have been introduced. There are still other means through which individuals can levarage the blockchain space. With special attention to decentralized finance platforms, funds in form of assets can be loaned, traded, swapped delegated and so on.

Of the numerous kinds of decentralized finance platforms offering these services, Yearn Finance seem to be a major player. The rate at which the platform along with its native token has experienced growth is wonderful. Individuals should however keep in mind some basic risk management measures while exploring these platforms. This has always been a regular advise from Prof. @imagen and the others.