Introduction

Greetings fellow student and distinguished Professors of the academy, I hope this meets you well. Am glad to have been part of this amazing class by Professor @awesononso which talks about the "Bid-Ask Spread" bellow is my homework.

Properly explain the Bid-Ask Spread.

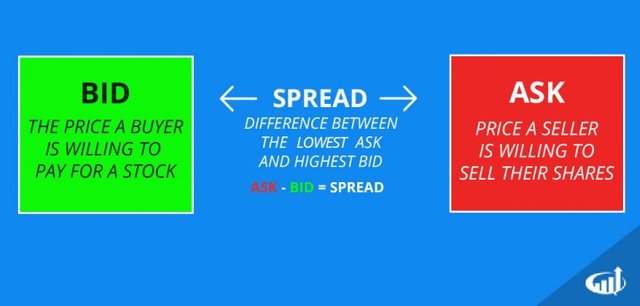

Bid oftentimes refer to the highest bidder at a given time. source

The Bid price is the best price a prospective buyer is willing to buy and also the price the trader on the screen at the other end is willing to sell.

Ask Often times, the term "ask" refers to the lowest selling price at the time source

Ask Price is the price the other party is willing to sell his coin and it is also the price the trader on screen here is willing to buy.

The distance between the Bid price and and Ask Price (on screen) is known as the Bid-Ask Spread

The Bid-Ask Spread is otherwise known as THE SPREAD. ThIs is the difference between the buy and the sell price of a coin in the crypto market.

Kindly see bellow screenshot for a better understanding.

Why is the Bid-Ask Spread important in a market?

The importance of the Bid-Ask Spread in the crypto market may include;

- It is used to determine the trading risk of a stock.

- With just a look at the size of the Bid-Ask Spread, a trader will understand the movement direction of the market.

- It serves as a measurement yardstick to a trader. He uses it to determine the liquidity ratio of a stock.

- It also serves as a guide to the trader while he places order.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

- A. Calculation of the Bid-Ask Spread

Using the formula:

The Spread = Ask Price - Buy Price.

Subtitute the figures into the formula, where;

- Ask Price= 5.20

- Buy Price = 5.00

= 5.20 - 5.00

= 0.20

- B. Calculate the Bid-Ask spread in percentage.

% spred = (Spread/Ask Price) x 100

Where;

- The Spread = 0.2

- Ask Price = 5.20

= (0.20/5.20)x100

= 0.0385 x 100

= 3.85

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

- A. Calculate the Bid-Ask spread.

Using the formula:

The Spread= Ask Price - Buy Price.

Where;

- Ask Price= 8.80

- Buy Price = 8.40

Subtitute the figures into the formula.

= 8.80 - 8.40

= 0.40

-B Calculate the Bid-Ask spread in percentage.

% spred = (Spread/Ask Price) x 100

Where;

- The Spread = 0.40

- Ask Price = 8.80

Subtitute the figures into the formula.

= (0.40/8.80)x100

= 0.0455 x 100

= 4.55

In one statement, which of the assets above has the higher liquidity and why?

From the calculation above, crypto X has higher liquidity because his spred is slimmer than that of crpto Y who has a wider spred of 4.55.

Explain Slippage.

With regard to futures contracts as well as other financial instruments, slippage is the difference between where the computer signaled the entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer’s signals. source

Because of the flexible nature of the crypto market, a trade can happen at a price diffrent from the intended price when this happens, it is known as Slippage. The wider the Bid-Ask Spread, the more often a slippage can occur.

Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage:-

Positive Slippage is when the difference in price is favourable to the trader. It can also happen when you want to sell and when you want to buy.

Example of when you want to buy. trader plans to buy a coin at $50 and ends up buying the coin at $49.5.

The Slipage = $50 - $49.5 = 0.5

Negative Slippage:-

This happens when an order is filled at a price not favourable to the trader. This can happen both when the trader wants to sell and when he wants to buy.

Example of when he wants to buy;

If a trader plans to buy Steem at at $2 per coin and ends up buying it at $2.1.

Here, the negative Slipage is 2.1 - 2 = 0.1

Example of when he wants to sell;

If a trader wants to see his steem dollars at $450 and ends up selling it at $448.

Here, the negative Slipage is $450 - $448 = $2

Conclusion

We have been made to know of the activities of the market Masters and the effects of the natural forces of demand and supply. Regardless, Bid-Ask Spread is the difference between the buy and sell price of a coin. It is advantageous to the trader.

Slippage is the difference between an intended price and the actual price a coin is exchanged. It can be possible (favourable) or negative (unfavorable)

Hello @uzoma24,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should not quote so many sites. Try to come up with more original content to make up the presentation.

The answers to number 2 are vague.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You Professor.

I will continue to improve

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit