Hello steemians!

I welcome you all to the season 5 week 3 of the steemit crypto academy. Is nice being part of the wonderful lecture organized by professor @imagen about Yield Farming - Yearn Finance. I really benefit a lot from it. Lets go over to the questions.

(1.) DESCRIBE THE DIFFERENCES BETWEEN STAKING AND YIELD FARMING.

Lets understand yield farming- this a decentralized finance platform (DeFi) where investors and also the users receives earnings by providing token in the platform through liquidity pool. After the contribution, the token will be used for business and when the interest comes out, the platform will have to give the investors and users their own share because of the contribution the made. Well transaction and rewards are carrier out in Ethereun network, that is ERC-20 token. Yield farming is being participated in different platforms like Uniswap, Aave yearn finance and many others not mentioned.

In a simply terms, yield farming is decribed as borrowing or lending and aswell staking of crypto tokens in a platform in other to get rewards when the interest comes in to what you entrusted or lend. Yield farming in other words is one best way and safest way one can earn free or get reward with cryptocurrency when they lend token.

Understanding Staking- Staking is described as the process in which one engage in or devote his or her cryptocurrency in support of the blockchain network and also to validate transactions. When user devote or lock his assets, he is expected to make profit from it, so staking is just devoting your crypto asset to blockchain network, in order to make profit from it. While staking, user dont need any tool in order to stake on crypto, unlike mining. When you are staking on crypto, it aims in maintaining the security of blockchain network.

| Yield farming | Staking |

|---|---|

| It allows uses to make some deposit of their crypto asset in a defi platform so that can be able to lend | It just, when an investors are supporting the blockchain network when locked his asset and also it aims to confirm transation on the network. |

(2.) LOGIN TO YEARN FINANCE. EXPLORE THE PLATFORM COMPLETELY AND INDICATE ITS FUNCTIONS. DESCRIBE THE PROCESS FOR TRADING ON THE PLATFORM (WALLET CONNECTION, FUNDS TRANSFER, AVAILABLE OPTIONS) SHOW SCREENSHOTS.

Now, am going to explore https://yearn.finance/ and indicates it functions and how to trade with the platform.

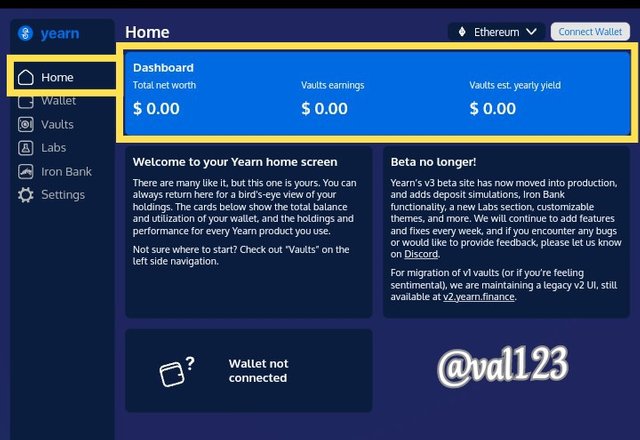

First of all explored https://yearn.finance/ and i have done the registration already. Now below shows the menu or the homepage of the platform. The homepage shows the dashboard, where you can view or see your earnings, your total net worth and vault est. Yearly yield. As you can see on the screenshot i provided below, mine is still 0.00 due to i just signed up.

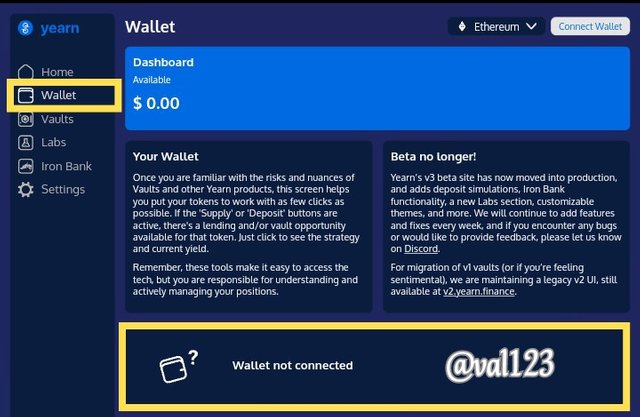

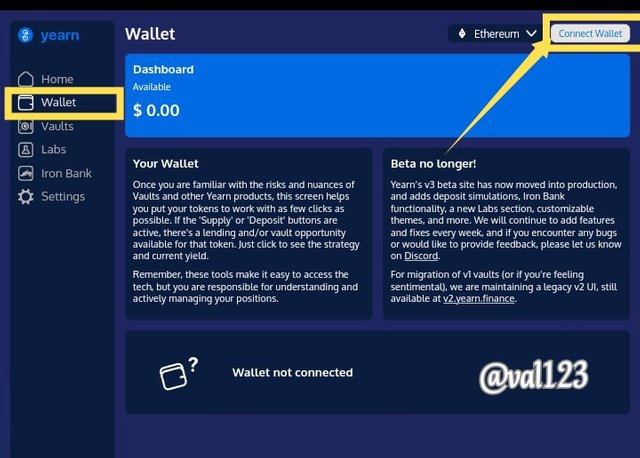

Now, the wallet, which is the second option on the platform located at the left corner of the page. The wallet also display the amount of wallet in which you have in your account. Meanwhile, at the down page of the wallet, where they wrote, wallet not connected this show that we need to connect our wallet(metamask) to it in order to perform actions in the platform. See screenshot below

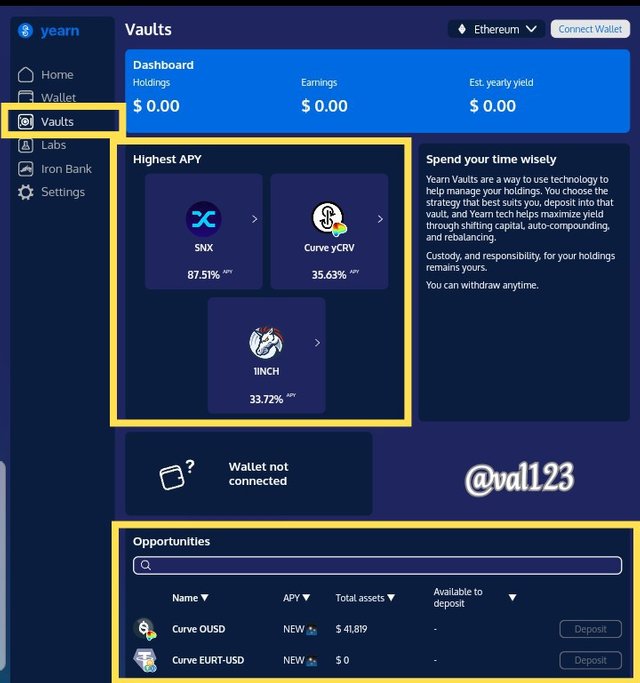

Now, the vault, which also contains or show the dashboard, which i mentioned in the homepage. But it also displays the highest APY and opportunities. See screenshot below.

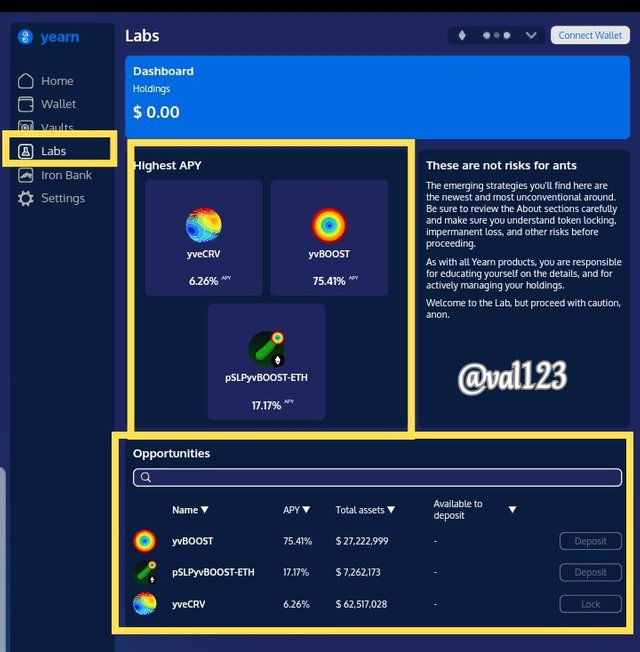

The labs, also contain the earnings , net worth and others. The labs is also looks similar to vault page, which contains the highest APY and opportunities. See screenshot below.

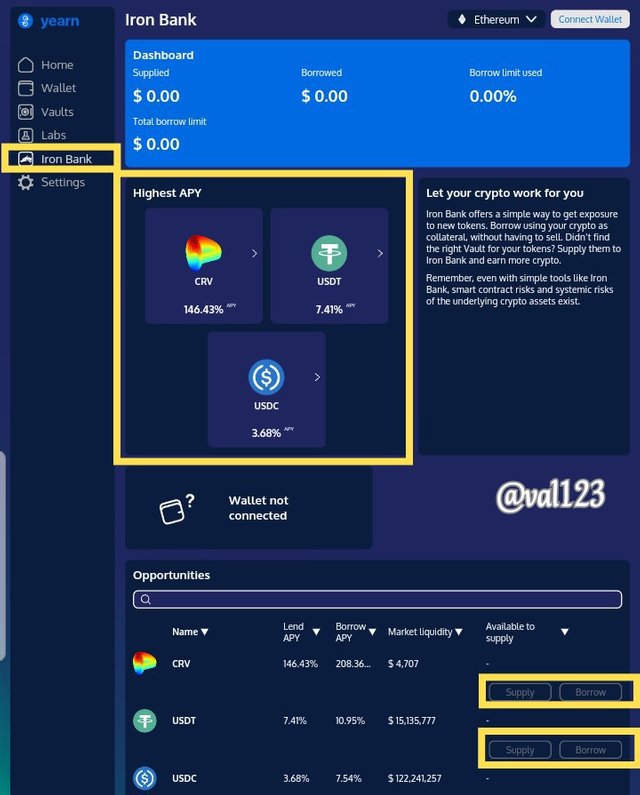

Now, the Iron bank, this also contain the dashboard and also the highest APY and opportunities, though here, you can see where you can borrow or supply by clicking on the supply or borrow button. See screenshot below.

Now, the setting. In the setting menu, the contains where you can change your theme, either light or dark, for those that love black theme. Also you can change the language to any language you wish to change it to. See screenshot below.

Lets look at how we can connect our wallet (metamask) to the platform, so that we can be able to perform actions on the platform( if you have some funds).

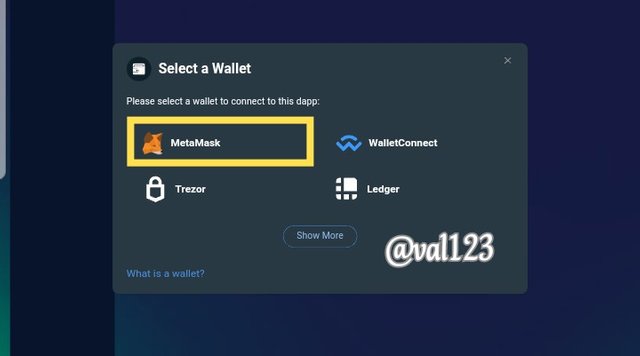

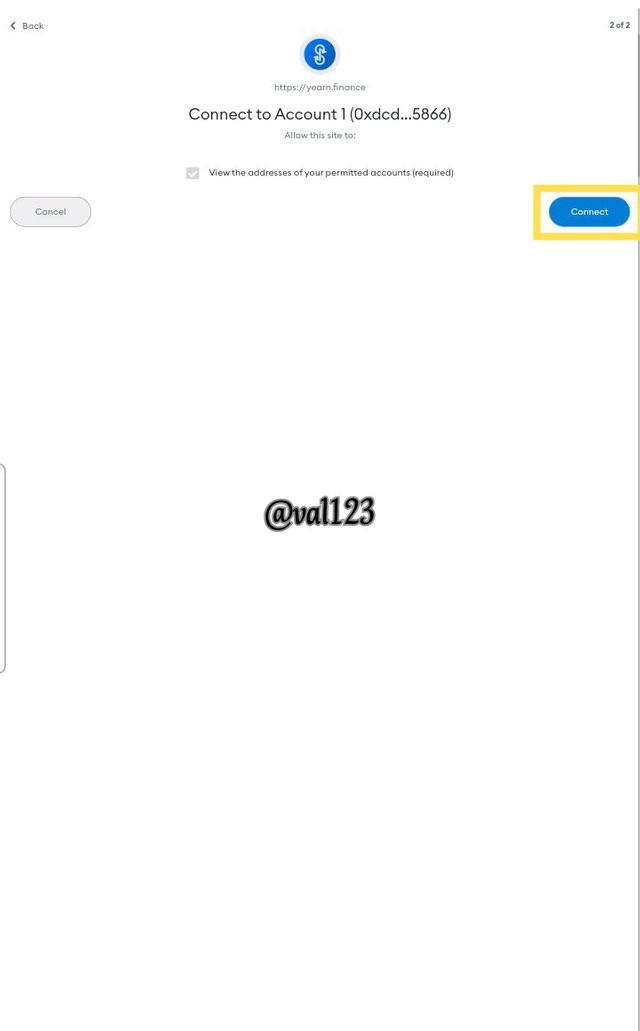

Go to the wallet menu, at the top right of the page, click on Connect wallet. Once you click on it, there will be a pop up, showing you wallets to connect with, select metamask

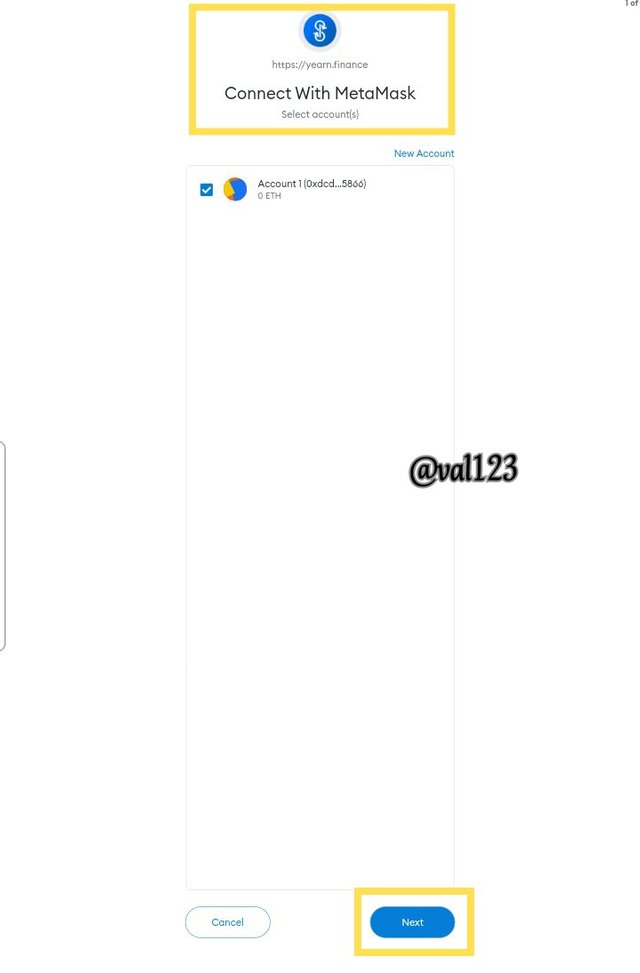

Then it will start processing. On your metamask wallet, you have to allow the site to connect with it. Click on next and then click on Connect to be able to connect with the platform.

By doing this, i have successfully connected my metamask wallet to yearn finance platform. See screenshot below.

(3.) WHAT IS COLLATERALIZATION IN YIELD FARMING? WHAT IS FUNCTION?

Just like banks or some app that usually lend you money, they just dont lend you some cash with a collateral, is either you use some of your property, as collateral or other valuable things. Meanwhile, the amount you borrow must be less than the worth of your collateral.

So now, collateralization in yield farming is just, when you want to borrow some assset from the platform and you will need a collateral so that they can be able to lend you the asset. Meanwhile you must first of all have to deposit amount that is greater than the amount you want to borrow fr them. Lets say, you want to borrow a worth of 2000$, now you have to make a deposit of about 5000$ d first before they can lend you the money.

Because they company dont want to be drawing back, that why you have to make a deposit greater than the amount you want to borrow from them. Now, sometimes, when someone borrows money from people, he or she cant be able to pay it back.

Now this is the reason, why you will be told to make deposit greater than the amount you wish to borrow, so that even if you can't pay back, they can use the money to replace with the one they lend you.

(4.) AT THE TIME OF WRITING YOUR ASSIGNMENT, WHAT IS THE TVL OF THE DEFI ECOSYSTEM? WHAT IS THE TVL OF THE YEARN FINANCE PROTOCOL? WHAT IS THE MARKET CAP / TVL RATIO OF THE YFI TOKEN? SHOW SCREENSHOTS.

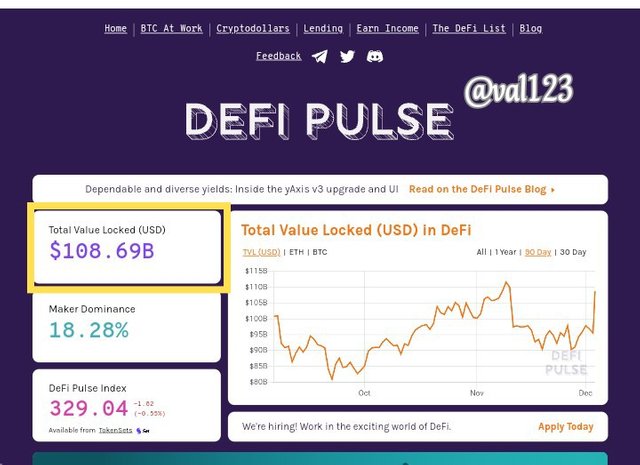

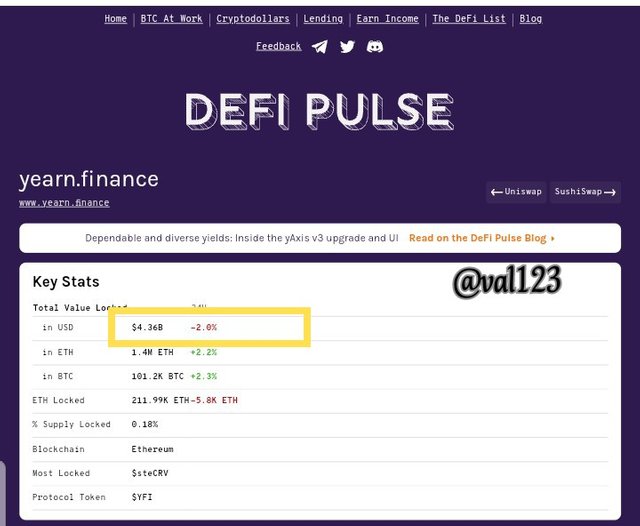

Well, to check this, i explored https://defipulse.com/

The Total Value Locked (USD) of the DeFi ecosystem was around $108.69B as of the time i was writing the assignment. The same time, the Total value locked of the yearn finance protocol is around $4.36B in USD. See screenshot below

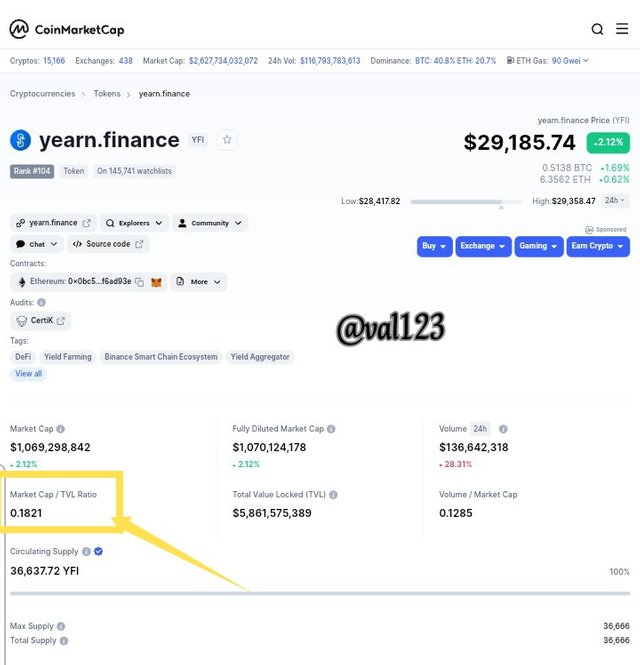

What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

Now, i will explore the market cap and show all the details and also the TVL ratio of the YFI, as of the time i was writing the assignment.

| yearn.finance price | $29,185.74 |

|---|---|

| Market Cap / TVL Ratio | 0.1821 |

| Rank | 104 |

| Market cap | $1,068,951,235 |

| Fully diluted marketcap | $1,068,951,235 |

| Volume | $136,491,699 |

| Total value locked (TVL) | $5,861,575,389 |

| Volume /marketcap | 0.1285 |

| Circulating Supply | 36,637.72 YFI |

(4.1.) THE YFI TOKEN, IS IT OVERVALUED OR UNDERVALUED? STATE THE REASONS.

Well, i will say that the YFI is undervalued, this is my reason÷ Since we know that, whenever the value of the market cap/ TVL worth less than below 1, we should know that the price is undervalued. At the screenshot in which i provided, the marketcap/TVL is at 0.1822, this is an evidence that shows us that the YFI is undervalued.

(5.) IF ON AUGUST 1, 2021, YOU HAD MADE AN INVESTMENT OF 1000 USD IN THE PURCHASE OF ASSETS: 500 USD IN BITCOIN AND THE REMAINING 500 USD IN THE YFI TOKEN, WHAT WOULD BE THE RETURN ON YOUR INVESTMENT IN THE ACTUALITY? EXPLAIN THE REASONS.

Looking at the chart i provided above, the price of BTC was at $42589.59 as of August 1st. Now, let assume i purchased with $500 at 1st August, the amount of BTC i will receive will be 0.0117399581 BTC i.e $500/$42589.59

So currently, at 3rd December 2021, the price of BTC increased to $56118.39, Now lets calculate.

0.0117399581 x $56118.39(current price) = **$658.82

My return investment will be, ($658.82-$500) = $158.82

Looking at the chart i provided above, the price of YFI was at $34154.2250 as of August 1st. Now, let assume i purchased with $500 at 1st August, the amount of YFI i will receive will be 0.0146394773 YFI i.e $500/$34154.2250

So currently, at 3rd December 2021, the price of YFI increased to $28758.2191, Now lets calculate.

0.0146394773 x $28758.2191(current price) = $421.00

My return investment will be, ($421.00-$500) = −79$. This shows that am loosing. Now to calculate the total return of my investment for both BTC and YFI ÷ $158.82 - 79$

| BTC | $158.82 |

|---|---|

| YFI | -79$ |

| TOTAL EARNING | $79.82 |

(6.) IN YOUR PERSONAL OPINION, WHAT ARE THE RISKS OF YIELD FARMING? GIVE REASONS FOR YOUR ANSWER.

The risk in yield farming, we all know that, when there is high gains, there is also high risk.

Remember before borrowing from the platform, you need a collateral. So its very important you pay good attention to the price if you want to participate in the business. Reason is because, if eventually, your cryptocurrency which you are using as collateral loooses value, your whole position can be liquidated and at las you will end up in loosing money.

When you are interacting with the platform, we should have in mind that we are using a hard wallet like metamask, which is used in connecting with the platform. So if you were not able to protect your funds and wallet, it can be hacked. So this are some of the risk in yield farming.

CONCLUSION

Participating in yield farming is cool, but we shoulf learn how to manage risk, like i stated, before participating, we shoulf first of pay attention to the price of the crypto asset we tend to borrow. Yield farming allows investors to lend or borrow crypto asset to the platform, and they will use it for business, once the profit comes out, you will receive your interest.

All thanks to professor @imagen for a well detailed lecture, i really learnt a lot.

Cc-

Professor @imagen