introduction

Seasons greetings steem community as the year is coming to an end I wish all those who are reading this a very beautiful 2022 and answers to their private intentions. Most especially I pray for my prof reminiscence01 thank you so much for all you have done for us this year. The reward of a teacher can never be paid or compensated for.

This week we learnt about about risk Management and Trade Criteria we learnt that is not enough knowing trade setups we should also know how to manage our risk in order to grow out account.

As proof of my understanding I will be attempting the assignment which was given.

1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

answer

Risk Management:

Trading crypto currencies is risky, as a trader we ought to know how to manage risk in other to better imporve our trading and make us better at what we do. The difference between an average trader and a good trader is in the ability to manage risk.

Risk Management is the process where by traders set various rules before entering a trade so as to enable them to manage thier possible loses to the bare minimum in the event that the trade doesn't go in the direction which was predicted.

Importance of risk Management.

Imporve trading

Risk Management in any trade helps to imporve the traders ability to read chart and build's his confidence.

Prevents unnecessary loses

Using risk Management we are able to prevent unnecessary losses by cutting down our loses before they grow. Small loses lead to big loses hence risk Management prevents our loses from getting to big loses.

Grows account size

with risk Management we are able to slowly grow our account size steadily by only taking trades which are profitable. Risk Management helps us lose less money and make more money.

Risk Management ensures small loses and big wins hence on the long run the value of the account would increase.

Fewer suprises

By anticipating what could happen if our anaylsis are wrong traders are hardly cut off-guard.

Risk Management offer traders a set of decisions to follow if the market doest react favorably, rather than panic when such happens we follow our rules and either exist the trade or remain.

Trades are made using better anaylsis

Using risk Management we are better able to anaylse the direction of the market rather than jumping into any trade we see, we would first check to see if such trades are worth taking . This imporves our anaylsis of the market and makes us more profitable.

2. Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit..

answer

When we talk about risk Management they are various forms of risk Management which we can apply in our trade, the forms of risk Management could be applied Individually or in combination with others.

1% rule

This is a form of risk Management which states that that for every trade we take, we are only to risk 1% of our total capital, in essence what this mean is that the maximum expected loss which you are to incure on any given trade should be 1% of the initial capital hence it mean for a trader to blow his account he would have lost 100 trades consecutively.

The 1% rule is very essential as it helps traders manage thier risk to the bare minimum and it helps traders to grow in the process. It can be said that in the process of trading we learn from our loses more than our winnings and by limiting our loses in each trade we developing our trading skills.

How to use the 1% rule

The 1% rule being one of the most important technique in risk Management is often very confusing and difficult to incorporate.

Often times we are unable to find an entry that would enable us to risk just 1% of our capital hence we hardly take trades.

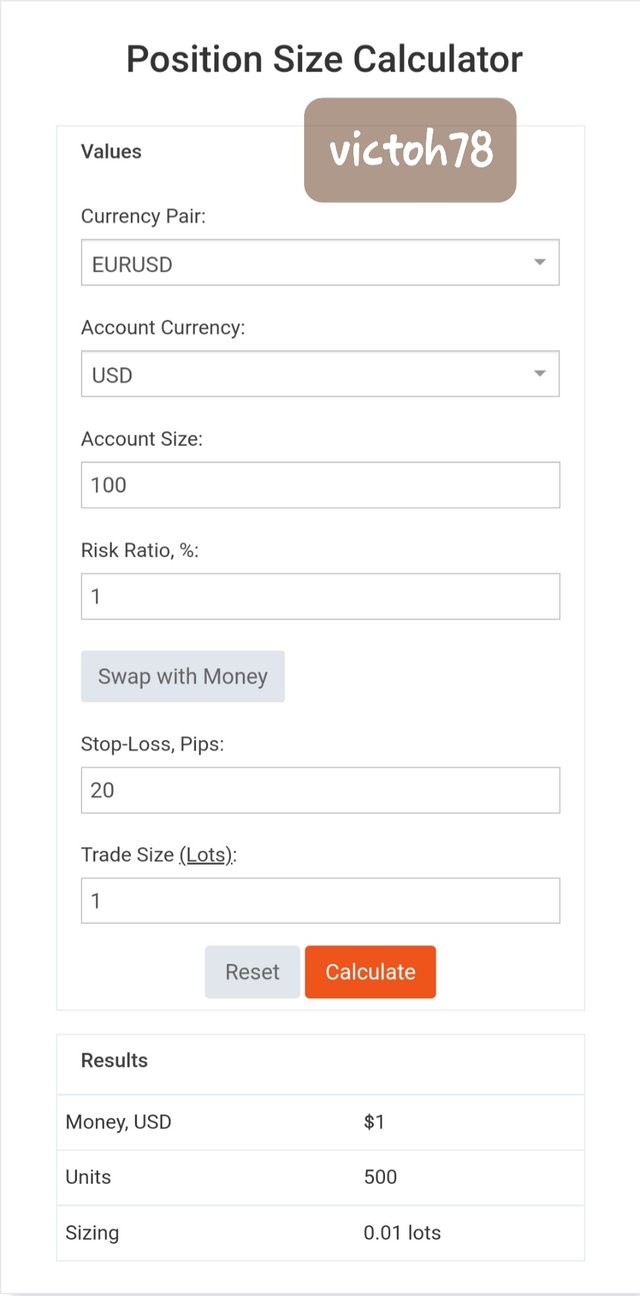

This problem can be solved using the position size calculator which estimates the lot size we should use in relation to the pip value or our stop loss.

Illustration

When opening the webpage above we are to fill the following information.

Input the currency pair we are dealing with

Input the current of our account

Input our account size

Input put our risk ratio

Input our stop loss (pips difference)

After inputing all this, the position calculator determines the lot size we should use to give us 1% risk using the stop loss and account value.

Risk to reward ratio

This is the second form of risk Management in trading. It entails a comparison between the amount in which a trader is willing to risk and the amount in which he would get if such a trade goes through.

Using risk to reward ratio we become aware that we should only take trades which would give us a bigger reward than risk . Trades with equal risk to reward should be avoided and even worse, trades with high risk and lower reward should equally be avoided.

We should only take trades which gives us double our risk and above.

By applying proper risk reward ratio it prevents us from entering trades which aren't worth it such as a trade to which we would be willing to risk $100 to make $40 we can see that such trades aren't profitable and if we keep on entering such trades we would blow our account sooner than later.

Illustration 1

QI/usdt

From the chart above we can see a situation where by the stop loss is bigger than the take profit. This is an example of a bad risk to reward ratio.

From the chart above we can we are risking alot to gain a little, such trade setups should be avoided as they are not profitable.

Illustration 2

Qi/usdt

The chart above shows a proper risk to reward ratio.

Where by we are risking less to gain more,taking such trades would result in making more money than losing.

Hence such trade set ups are encouraged.

Stop loss and take profit

This is the final process of risk Management , it is usually done at the last stage after we have filled the last two criteria for entering a trade.

Before entering a trade we ought to know where we would exist such trade if it goes against us and where we would exist such trade if it goes in our favor. We cannot be in a trade forever as the market changes direction with time.

Stop loss

This is an order given by a trader to his broker instructing the that if the trades goes against his prediction he should be taken out of the trade at a given price.

What this means is that onces a stop loss is set a trader can go about doing his daily activities knowing that if his trade should go against his direction he would only lose money up till a certain amount with which he is already aware of from his calculations. When the price gets to the stated amount his broker would automatically exist him from the trade.

This has proven to be one of the most efficient risk Management technique as it enables traders to limit their loss up till a certain point they are comfortable with. It also saves traders the stress of always looking at the market as this causes traders to make rash decisions.

Take Profit

Just like the stop loss the take profit is an order given by the trader to his broker instructing them to exist the trade on his behalf at a certain point.

Take profit is an indication of the point in which the trader wishes to exist his trade and like the name entails take out his Profit.

The take profit is significantly higher than the stop loss and in most times 2 times higher ensuring that the trader would make more money than he would loss when such a trade hits the take profit.

Illustration

From the image above we can see our take profit and stop loss .

The stop loss and take profit indicated on the chart.

3.Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

Explain how much you are risking on the $100 account using the 1% rule.

• Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

• Place your stop loss and take profit position using the exit criteria for market structure.

answer

Trend reversal using market structure.

trend reversal

This is the situation where by the overall direction of price changes in the opposite direction it could be from and uptrend to a downtrend.

Market structure

This is the use of candle stick patterns to interpret price movement in the future. Market structure could be used as a standalone indicator and can also be combined with other indicators.

trend reversal trade

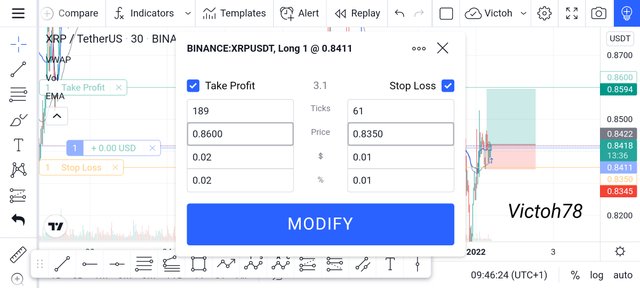

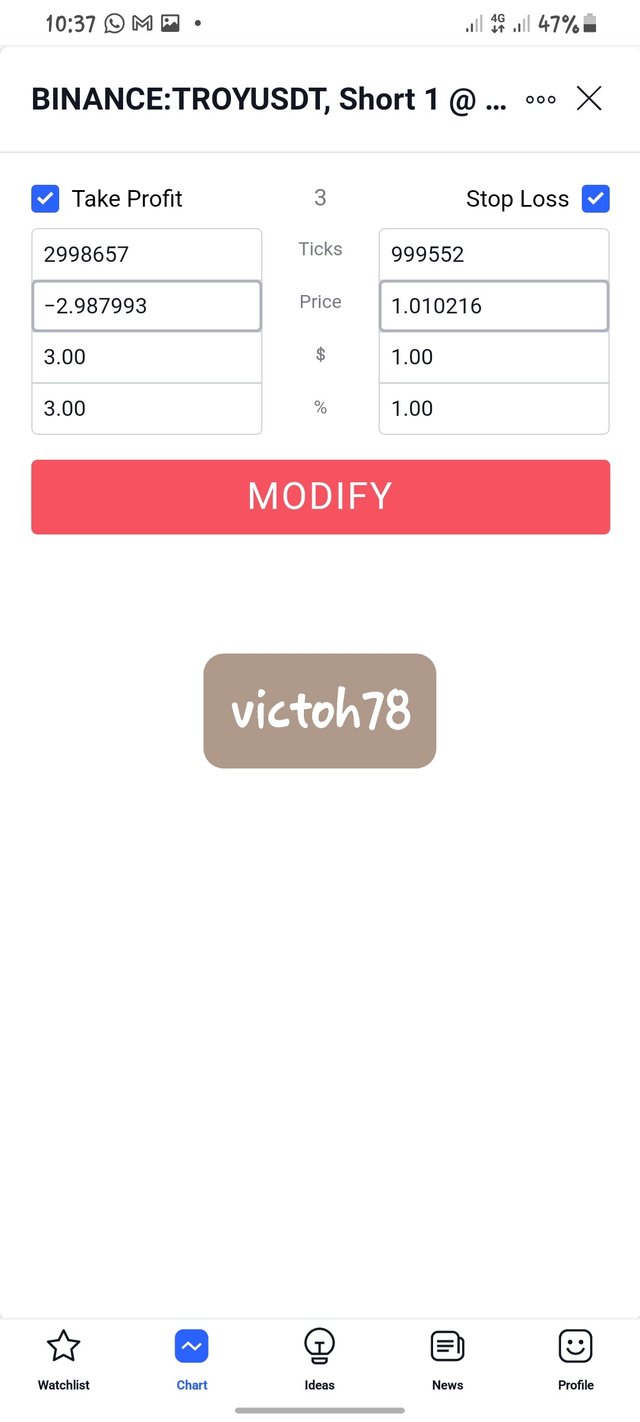

Troy//tetherUS- trading view

Interpretation

From the chart above we can interpret that the direction of price has changed from an uptrend to a downtrend this is seen from various factors on the chart.

Criteria for entry

Ema

Position of the price in respect to the moving average

Looking at the chart we can see that the price has crossed below the moving average and is now on a downtrend the moving average now serves as a dynamic resistance preventing price from going up.

Market structure

From the market structure we can see that the price has fallen below the previous low indicating that the structure of the market has changed from an uptrend to a downtrend and we can expect to see the price now make subsistence lower lows and lower highs.

Hence our trade criteria for entering the trade has been met.

Exit criteria.

In as much as I have conducted my anaylsis and I expect the price to go towards the downside I have to be prepared to exist the trade in case the markets decides to act irrationally or I am wrong. Additional I also have to know at what point I would exist the market if it goes favorably.

1% rule

The first exist criteria I will be using is the 1% rule since my account is a $100 I would be willing to risk at most 1 dollar on any trade I open, meaning that for this trade anything above -$1 I would exist the trade.

To use the 1% criteria I would need to go to the lower time frame to get a better entry point when the price comes to test the demand zone.

Risk to reward ratio

On the trade above I would be willing to risk 1% of my capital to gain 3%

This means that from the trade above I would be willing to risk at most $1 to get $3 at least

If I were to open 4 positions on this trade I would be risking 4% to gain 12%

Stop loss and take porfit

Stop loss

Our stop loss is set just above the previous lower lows @ 0.010731. at this point if price should get here it would mean that the reversal is invalid and that the uptrend is still active.

Take profit

Our take profit is set at the nearest area of significance which looking at the left hand side of the chart can be seen at 0.010424. it is assumed that at this point the price would face some price Action and might head up to create a new lower highs so we ought to take our take profit before the retracement comes in.

Summary

From the image above we can see the three risk Management we discussed being applied on our trade.

1% rule

We can see our the 1% rule which is shown on the last box.

Risk reward ratio

We can see the risk reward ratio which is 1:3

By looking at the two last boxed

Take profit and stop loss

We can see our take profit and stop loss in the second box

Additional we can see the dollar equivalent of how trade in the third box

Which shows we Would be risking 1 dollars to gain 3 dollars

Trend continuation

Trend continuation signals are validation in which traders look for in a chart in order to reassure themselves that the trend is still ongoing and won't be reversing anytime soon it is always best to trade in the direction of the trend.

Illustration

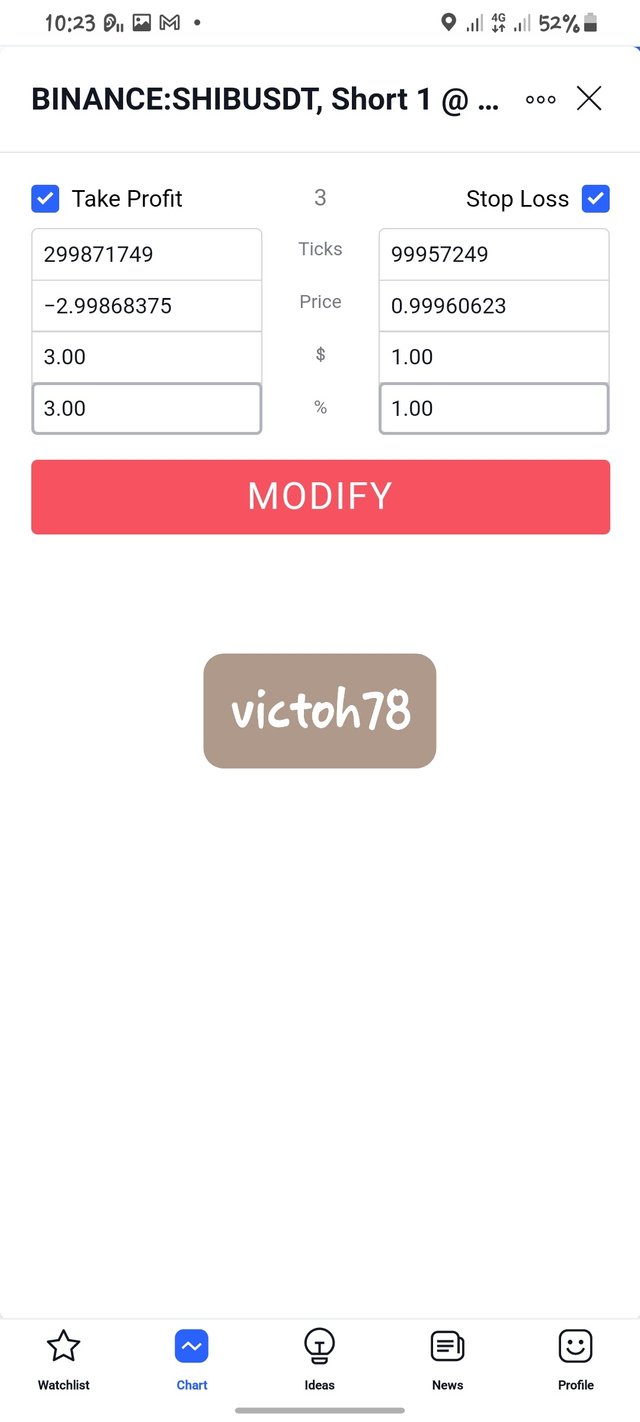

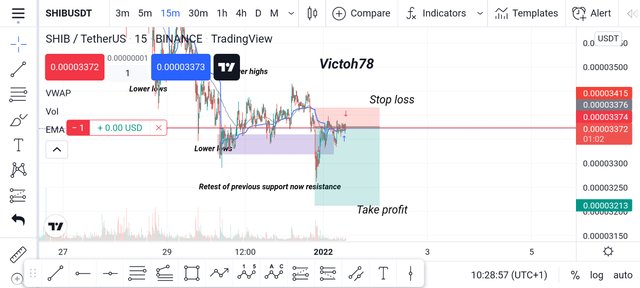

Shib/usdt-trading view

Interpretation

From the chart above we can see that the direction of the trend is still on going and that the downtrend is still strong . Knowing the trend is still ongoing, we would need to be follow it up with other signals which are as follows to time our entry.

Entry criteria

Moving average

From the chart above we can see that the price is below the moving average indicating that the price is on a downtrend. We can also see the moving average has been acting as a dynamic resistance pushing the price downward.

Market structure

Looking at the chart above we can see that the price has been making consistent lower lows and lower highs indicating that the price is in a downtrend.

The price has been respecting this structure and is yet to break the structure hence we can see that the price is going to do down.

To enter the trade we waited patiently for the price to test previous lower highs at that point we enter and ride the trade down.

Exist criteria

1% rule

Using the one percent rule we will only be risking 1% of our 100 dollars account.

1% of 100 is $1 hence the maximum amount of lose we can take on this trade will be $1.

Risk to reward ratio

The risk to reward ratio on the trade above is 1:3 meaning that we Would be risking 1% of our capital to gain 3% in return. Ordinarily I would have gone for a 1:2 risk to reward but looking at the present position of the price and the next critical level. The goal of 1:3 seems attainable.

Stop loss and take profit

Stop loss

Timing our entry at the point where the price comes to test previous lower lows gives us a very good entry and this allows us to set our stop loss just above the demand zone. If the price where to get to our stop loss at 0.00003364 it would mean that our analysis was wrong and we need to exist the trade and look for a better entry or to trade in the opposite direction.

Take profit.

Our take profit is set at 0.00003162. I decided to set my take profit using the 1:3 risk reward system due to the fact that there is no notable area of significance around the price hence we can assume that price would be making new levels. My take profit will be monitored closely and I would be trailing behind in the eventuality that the price doesn't gets Soo close but doesn't hitvtye take profit.

Summary

From the image above we can see the three

Risk Management we discussed.

1% rule

We can see our the 1% rule which is shown on the last box.

Risk reward ratio

We can see the risk reward ratio which is 1:3

By looking at the two last boxed

Take profit and stop loss

We can see our take profit and stop loss in the second box

Additional we can see the dollar equivalent of how trade in the third box

Which shows we Would be risking 1 dollars to gain 3 dollars

Stop loss and take Profit properly indicated cause it was diffcult to understand in previous image

All screenshots are taken on my device

Conclusion

The important of risk Management can never be over Stated knowing the different forms of risk Management would prove the difference between a profitable trader all this I have one to understand during the course of this assignment.

Thank you Prof I hope I have been able to answer all questions to your taste.

Hello @victoh78 , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit