Hello Everyone,

Well, this is the exact reason why I'm writing to this community throughout all seasons. Crypto Academy is the best place to gather knowledge and update myself with all this cool lessons. In the first season professor @stream4u has brought the lesson about indicators for the first time, since then I got to know about RSI, MACD and Bollinger bands indicators in the previous season. This is the first time I'm going to learn about this new indicator Ichimoku-kinko-hyo

What is the Ichimoku Kinko Hyo indicator? What are the different lines that make it up?

- Name, history & the use,

Ichimoku Kinko Hyo is a Japanese word, which translate to the balance chart from one look. From the word itself you might not get a better idea about this indicator. It is a all in one technical indicator which helps to provide information on diverse trading parameters. Though it developed in 1960s by a Japanese journalist Hosoda Goichi, early adaptation to this tool was minimal in Europe region until two decades back. The reason for less popularity is the language. There was no publication to this indicator in English for almost 30 years.

The concept of this indicator has been developed with the idea of State of Balance, Hosoda Goichi found that humans tend to behave abnormally for some situations but soon they return to an ordinary state. Applying same theory he developed State of Equilibrium for a trade chart which can distinguish trends and price behaviors of a crypto asset. The indicator since has helped traders to predict support, resistance and trend direction.

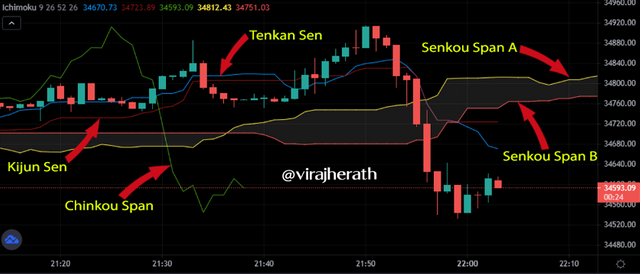

- 05 Different Lines In Ichimoku-kinko-hyo Indicator,

(01). Tenkan Sen (Fast line, Conversion line or Signal line)

The volatility of the market price is the key signal. The calculation is - (Highest high + lowest low) / 2, calculated over 9 periods. The line is useful to understand the supports and resistances and also the potential trend reversals.

(02). Kijun Sen (Baseline or Slow line)

This too indicates the market volatility, but in a longer period. Kijun Sen also calculated by same formula but calculated over 26 periods. That is the reason behind long-term price volatility. This line is useful to confirm the trend changes and supports and resistances levels created using Tenkan Sen. The support level can act as a trailing stop loss too.

(03). Senkou Span A (Leading Span A)

The line helps to identify the future trends. The space between Senkou Span A line & Senkou Span B line on the chart referred as The Cloud. For the calculation it takes Tenkan and Kijun lines average and divide by 2: (Tenkan + Kijun) / 2. As a result the line will shifted 26 periods into the future.

(04). Senkou Span B (Leading Span B)

Here we calculate the median of the Higher high and Lower low for the last 52 periods. Similar to the Senkou Span A, result will be projecting 26 periods into the future. The identification would be, If the market forms above the cloud it considered as a bullish & If the market forms below the cloud, it indicates considered bearish. When the price moves within the cloud, that considered as a ranging market.

(05). Chinkou Span (Delay Line or Lagging Span)

This line represents the closing prices for past 26 periods. It is often used as a confirmation signal to Tenkan Sen and Kiijun Sen. If the line is above the price of 26 periods, that indicate a bullish market & if not it considered to be a bearish market.

How to add the Ichimoku indicator to the chart? What are its default settings? And should it be changed or not?

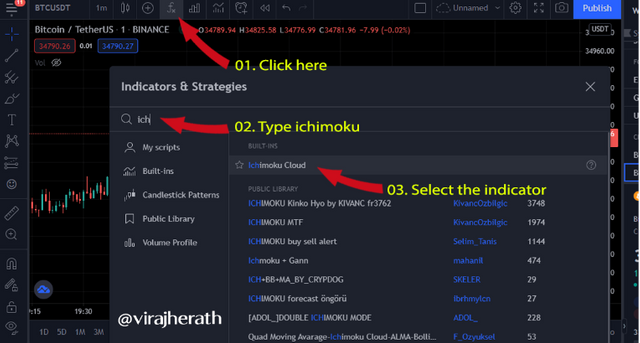

I'm using Tradingview: BTC/USDT cryptocurrency pair for this task,

- Click the "fx" to find all the indicators. Then search the "Ichimoku" in the search field. Once the indicator appeared in the list select it. You can see that indicator has been applied to your chart.

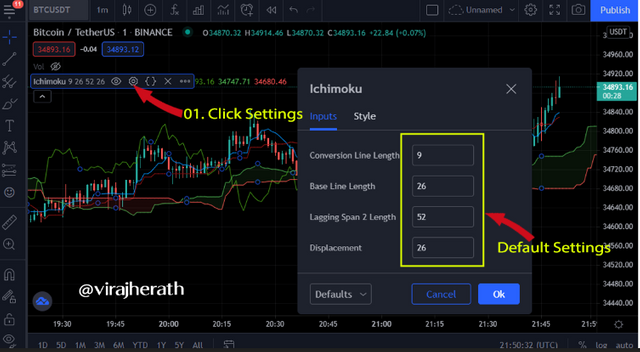

- All the indicators have two types of settings, inputs and style. To change setting you can simply click Settings icon as to the picture and change how it looked according to your preference.

You can see that the default setting is (9,26,52), I understood that this setting was fixed according to the Japanese working days. When the indicator was developed Japan considered Saturday as a full working day, hence to represent one and a half a week (6 + 3 = 9) 9 periods were used in Tenkan sen. Similarly to represent one month they have used 26 periods for Kijun Sen.

I don't think there should be an argument over what should be the settings, anyone according to their preference and strategies these settings can be changed. However many believed as the crypto market is available for 24/7 the settings should be changed to (10, 30, 60) or (20, 60, 120). But it always up to individual traders. I wouldn't dare to recommend any settings without proper analytics.

How to use the Tenkan Sen line? How to use the Kijun Sen line? And How to use them simultaneously?

Both this lines represent the market volatility in different time periods (9 periods & 26 periods). Let's see the interpretations on a chart.

- Use of the Tenkan Sen line

Tenkan sen is a fast line which represent higher high and lower low of an asset only over a period of 9. Hence the sensitivity of this line is quite high. It will indicate the downtrend and uptrends according to the price changes in the market.

- Use of the Kijun Sen line

In contrast to Tenkan Sen line, Kijun Sen line is a slow line which determines price movement over a longer period. This line also considered as a market volatility signal. This line is useful to confirm the trend changes and supports and resistances levels created using Tenkan Sen. The support level can act as a trailing stop loss too.

- Using both lines simultaneously

The efficient way to use this indicator is to take all lines into consideration. Hence, watching over Tenkan Sen & Kijun Sen simultaneously will produce a better result than concentrating on one.

Usually, when the Tenkan Sen line moves upwards crossing the Kijun Sen line that could indicate a signal for a upward trend. This is the best time for to make a buying decision in the market. On contrary, if the Tenkan Sen line moves downwards crossing the Kijun Sen line that could indicate a signal for a downtrend. In such scenarios it is better to sell the asset immediately without occurring much damage.

What is the chikou span line? And how to use it? And Why is it often neglected?

Whatever the signals produced over Tenkan Sen & Kijun Sen can be confirmed with the help of chikou span line. Since it calculate past 26 periods for closing prices it can assume the market reversals. Hence, whenever Tenkan Sen & Kijun Sen produce a uptrend or downtrend on the chart we can further investigate using chikou span line whether that signal is correct.

The usual signal indicate that when the market price is below the chikou span line the movement is uptrend and when the market price is above the chikou span line the movement is downtrend. However, sometimes the chikou span line cross over above and below the market price without much clear signs of a trend.

What's the best time frame to use Ichimoku? And what is the best indicator to use with it?

As Ichimoku-kinko-hyo indicator provide sufficient information on both short and long term analytics in a single look with 05 different lines, it has to be compatible with any time frame. It is useful for any visual traders to just feel the market by a glance.

Most prefered indicator to use with Ichimoku would be the RSI indicator. Both can works together trade reversals and is the potential reversal signals a trade exit.

Conclusion

In conclusion, though it might look like a complicated indicator with lines all over the chart it can give many details about the current market with a single look. Ichimoku-kinko-hyo is able to provide diverse signals such as support level, Resistance level, current trend , future trend, trend reversal, that's why it is a special indicator which does not require other indicator to support. However, using RSI would give you confirmation on reversal trends and thereby provide buy/ sell signals.

Thank you!

Look forward to the Part 2

Hello @virajherath,

Thank you for participating in the 1st Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve a 4/10 rating, according to the following scale:

My review :

An article with an under-average content in which the analyzes of the points raised were absent, in addition to the lack of illustrations containing examples to support your idea, which made the work lose the critical aspect.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very helpful blog, thanks for your upvote support 💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit