Hello Everyone,

The second week starts with a new prof. @cryptokraze, and he has done a marvelous job with this tutorial about Market Structure Break (MSB) Strategy to Trade Reversals that he often use for his trading. I thoroughly enjoyed his detail explanation and would like to thank him giving this knowledge in such simple and understandable way.

What do you understand about Market Structure?

The market movement according to the price action creates specific patterns. The movements represents how prices moved in the past. In a market structure we can see 03 directional patterns, namely, uptrend, downtrend & sideways. Series of such directional moves creates Market Structure

To this particular strategy we have to focus on Uptrend and Downtrend Market Structures.

- Uptrend Market Structure

When the price action keep upswings longer than the downswings this uptrend structure formulate. Below in the BTC/USDT 01 hour time frame chart we can see a clear zig-zag pattern going up higher than to the next higher swing highs. Such consistency in swing highs can be known as Uptrend Market Structure

Market Structure for Uptrend

- Downtrend Market Structure

When Uptrend pattern inverted, we can see a downtrend. Here, the price action keep downswings longer than the upswings and the downtrend structure formulate. In the same chart we can see a clear zig-zag pattern going swing low than to the next swing low and highs. Such consistency in swing lows can be known as Downtrend Market Structure

Market Structure for Downtrend

Additionally, in the same chart you can see the market is neither go up nor down for a few hours but formatted in Sideways. In such case market has relatively equal buyer and seller pressure and does not indicate clear trend.

What do you understand about Lower High and Higher Low?

As to the last example we understood how the trends formed. When there is a Uptrend we saw successive swing highs and when there is a downtrend we saw successive swing lows. But in the case of uptrend or downtrend, according to the buyer pressure or seller pressure we can see Lower High and Higher Low. Let's discuss further with each topic,

- Lower High,

When the market is on Uptrend, if the price falls short of previous high swing we can see a Lower High on the chart. This lower high could be an indication or warning for a market reversal in case of a downtrend, but once this happen current trend become uncertain because buyers have not been able to push the market to the new highs.

Lower High point is formed below the previous high swing

In above figure you can clearly see that Lower High is not a confirmation for a trade reversal. After the lower high, market has reformed for a new high and continue the uptrend.

- Higher Low,

When the market is on Downtrend, if the price increase over previous low swing we can see a Higher Low on the chart. In this case, the new swing was unable to break the previous low swing and formed above the previous low swing. Similar to the Lower High, this again could be an indication for a market reversal for an uptrend yet it is uncertain

Higher low swing point is formed above the previous low point

In above figure you can see that the trend has been reversed.

Hence, 1st indication from Lower High and Higher Low is very important to get trade entry at right time and get out of at right time.

How will you identify Trend Reversal early using Market Structure Break?

Understanding the concept of Lower High and Higher Low enable us to identify the potential market reversals. Since there are only two trends available in a trading chart, it is obvious that there are two reversal applied to them because none of the trade are going to last forever.

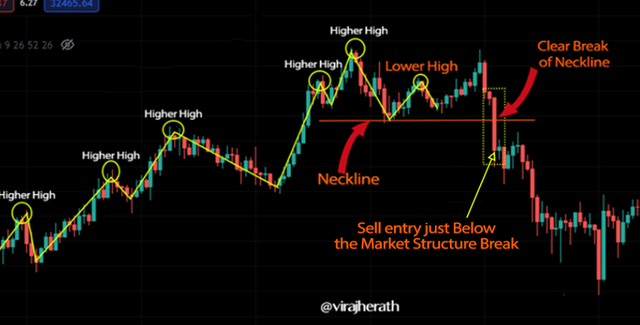

- Identify Uptrend Reversal

Uptrend Reversal is where the Downtrend will start off in a trading chart. When we use the theory of Market Structure Break (MSB) we will be able to assume reversals in a technical manner. There are 03 indication for such reversals.

- Formation of Lower high after higher highs.

- Marking the Neckline from the low swing point where the price bounced and gave a lower high. The neckline in uptrend reversal can act as a resistance level for a Sell entry.

- Waiting for the clear break of Neckline, Note: it has to be a clear break of market structure.

Uptrend Reversal

- Identify Downtrend Reversal

The same identification method applied with the formation of higher low. Once the reversal is confirmed there will be a Uptrend on the chart.

- Formation of Higher Low after lower lows.

- Marking the Neckline from the high swing point where the price dropped and gave a higher low. The neckline in downtrend reversal can act as a support level for a Buy entry.

- Waiting for the clear break of Neckline, Note: it has to be a clear break of market structure.

Downtrend Reversal

Explain Trade Entry and Exit Criteria on any Crypto Asset using any time frame of your choice

Professional traders always have a set of rules or guidelines to the strategy they use. When there is a market structure break with clear break of the neckline we can anticipate a reversal of current trend according to the MSB strategy. Let's see how we can use the same strategy to Buy & Sell entry.

- Exit Criteria: Sell trade entry

MSB strategy is very clear strategy because the first thing we need to understand is the market structure, When the market is an uptrend we want to sell our entry at the right point to make the profit because we already know that any trend will not last forever.

As to the previous point on lower high, it is an indication or can be consider as a warning for a potential market reversal. When we see a lower high, we have to draw a neckline and wait for the "clear" break of the line. I insist that clear word because at this area market can be consolidate for a while and continue the uptrend. Hence when we see a strong bearish candle breaking the neckline, then only we should initiate the sell trade entry just below the Market Structure Break.

Sell trade entry

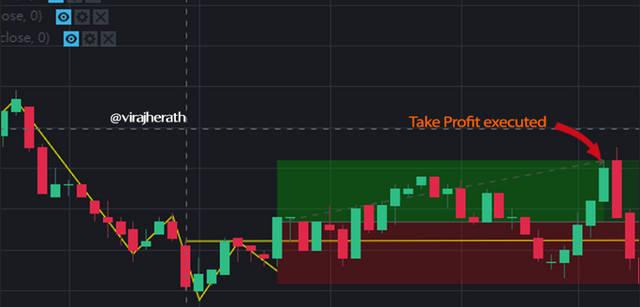

- Entry Criteria: Buy trade entry

Well, similar the sell trade entry, here too we have to wait for the neckline breakout but this time the market is on downtrend. Hence, we wait for the higher low then draw a neckline and when we see a strong bullish candle we enter to the market where the entry price is above the Market Structure Break.

Buy trade entry

However, any strategy will not give us 100% accuracy over our trades, It may or may not worked as to our our expectation, so we have to make sure that we implement a stop loss with every trade to protect the funds invested.

Usually, my implementation for a stop loss is 1 Risk : 1 Reward (1:1) ratio. But this ratio depends according to your risk taking capacity or the experience you have for your trade. Let me implement the same in next question.

Place 2 demo trades on crypto assets using Market Structure Break Strategy. You can use lower timeframe for these demo trades

- Trade 01:

I have used 01 min time frame for TRX/USDT pair on Binance Exchange with the 1:1 risk reward ratio for my first trade.

Buy trade entry: Binance TRX/USDT 01 Min chart

Take profit execution

Transaction details of the trade

First trade was a success. It was a close call for hitting the stop loss though. Let's move to the second trade.

- Trade 02:

This time, I have used 01 min time frame for ALICE/USDT pair on Binance Exchange with the 1:2 risk reward ratio. I saw a clear break on neckline and went with that ratio believing the strategy. Guess what, it was just 03 minutes and second trade was also a success.

Buy trade entry: Binance ALICE/USDT 01 Min chart

Transaction details of the trade

The only issue I had was, I had to be quick with my buy trade entry since I used 01 minute chart. The chart is quite happening and volatility is extreme. If we are slow to take decision the momentum might change within the next few minutes. Hence, entry right after the neckline break is impossible in 01 minute chart.

Conclusion

It was the first time I have used the Market Structure Break (MSB) strategy, I'm happy that both my trades were successful. It was quite challenging to wait for the signal in practical scenario. In theory it looked seriously simple. On the real time chart it is much of challenge to wait for the correct signal and to execute the trade when the neckline broken. I have to thank again for the crypto professor @cryptokraze for giving us the 5th question. I enjoyed the full homework.

Look forward to doing more such homework.