Hello Everyone,

So far we learned MSB & BRB price action strategies from our beloved crypto prof. @cryptokraze, this week continuing price action trading strategies, he brought us another strategy Trading the Dynamic Support and Resistance. After two successful weeks, I'm ready and excited for this lesson. Let's move on to the homework.

What do you understand about the Concept of Dynamic Support and Resistance? Give Chart Examples from Crypto Assets.

- Concept of Support and Resistance,

The one thing that constant in cryptocurrency market is the price volatility. According to the demand and supply of the market price may change any moment. We track these changes through a trading chart comparative to a price pair. When the price moves directions we call them trends. In such trends there can be certain swing points where price might hold / stop and rebound.

We identify these visible swing points and mark as horizontal lines on the chart. Traders refer this lines as Trendline and use it as support and resistance level for trading. These levels should be considered as a zone than a precise line. Also, nobody can guarantee that this levels cannot penetrate beyond and continue its original trend, but these levels have higher probability of reversing the current trend.

ETH/USDT | 1D | tradingview.com - Support and Resistance Levels

From the above figure you can see that how many time price reached to these levels and reversed from that zone to a new direction. Otherwise, trend will continue on the same direction breaking the line. If it is a downtrend and if the break happens on support level as to above figure, from that onwards support will become the new resistance. Conversely, when there is a broken uptrend resistance will become the new support level.

- Concept of Dynamic Support and Resistance,

In previous figure, I used the past market structure to identify the swing highs and lows with previous price action static records. This static records helps me to draw the lines. However, in dynamic state price action can create market movements and adjust this level while moving.

These price fluctuations are more visible on a lower time frames. Hence, to identify the fluctuation we can use the Exponential Moving Average (EMA) on anytime frame as a Dynamic Support and Resistance.

Example of Dynamic Support on Chart

You can see as to the below figure, whenever price moved to the EMA, price has rejected and bounced back moving up the trend. In this case EMA is acting as dynamic support to the chart.

BTC/USDT | 1D | tradingview.com - EMA acting as a Dynamic Support on Chart

Example of Dynamic Resistance on Chart

Here on the next figure you can see that EMA is acting as dynamic resistance to the chart and whenever price moved to the EMA line price moves down and kept moving with the price action.

BTC/USDT | 1h | tradingview.com - EMA acting as a Dynamic Resistance on Chart

Make a combination of Two different EMAs other than 50 and 100 and show them on Crypto charts as Support and Resistance.

When we use exponential moving average in our trading decisions, it gives us better reflection of the market. What ever the length we choose will determine the sensitivity of the average. The reason to use more EMA's would be to make sound decisions for entries and exits with controlled risk.

I have explained earlier that we have to think support and resistance as a Zone more than a precise line. The exact theory apply here when we use two EMA's to support our decisions. The two EMA's would act as a zone of resistance or support.

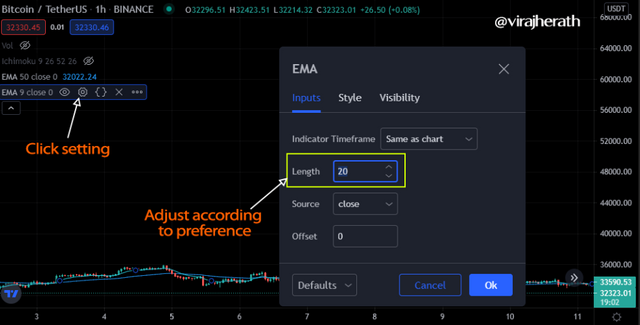

For this task, I'm going to use the Combination of 20 EMA and 60 EMA as Dynamic Support and Resistance. The length can be adjusted in the setting section of the indicator.

BTC/USDT | 1h | tradingview.com - EMA length setup

20 and 60 EMA's as a Support level

BTC/USDT | 1h | tradingview.com - 20 and 60 EMA's as a Support level

20 and 60 EMA's as a Resistance level

BTC/USDT | 1h | tradingview.com - 20 and 60 EMA's as a Resistance level

It is noticeable in both resistance and support level, when the price reached to EMA's zone it quickly rejected and shot away to reverse the trend. The length of the EMA's can be adjusted according to the traders strategy. When the gap between two EMA's are high it will relatively affect the gap on the chart as well.

Explain Trade Entry and Exit Criteria for both Buy and Sell Positions using dynamic support and resistance on any Crypto Asset using any time frame of your choice

Finding the precise entry points on a chart is important for a trader to make profits. For Dynamic Support & Resistance we can identify such 4 entry point scenarios. Those are, two trade entry criteria for Buy & Sell and two trade exit criteria for Buy & Sell. Let's discuss one by one.

Trade Entry Criteria

Entry Criteria for Buy Position

Add two EMA's on the chart according to your trading strategy. I'm going to use same EMA's that prof used. That would be 50 and 100 EMA's.

Make sure price are moving above both EMAs.

Wait till the price moves to the EMA's zone, when it does cross the first line (50 EMA) don't rush into the entry yet. Because it might pierce through both the line and invalidate the setup.

If it is a valid set up, even after piercing both line it will bounce back to continue the trend. That is exactly the set up we are looking for entry.

When it does moving upward, wait till the price moved back again from 50 EMA line and soon after the candle leave the line that is where the Buy order should take place.

BTC/USDT | 1h | tradingview.com - Entry Criteria for Buy Position

Note: You can see that there are many opportunities for an entry point, try to get in early positions as it can maximize the profit margin of your trade.

Entry Criteria for Sell Position

Similar to the Buy position, add two EMA's on the chart according to your trading strategy. I'm using 50 and 100 EMA's.

Make sure price are moving below both EMAs.

Wait till the price moves to the EMA's zone, when it does cross the first line (50 EMA) don't rush into the entry yet. Because it might pierce through both the line and invalidate the setup.

If it is a valid set up, even after piercing both line it will pull back to continue the trend. That is exactly the set up we are looking for entry.

When it does moving downward, wait till the price move below 50 EMA line and soon after the candle leave the line that is where the Sell order should take place.

BTC/USDT | 1h | tradingview.com - Entry Criteria for Sell Position

Note: You can see that there are many opportunities for an entry point, try to get in early positions as it can maximize the profit margin of your trade.

Trade Exit Criteria

Exit Criteria for Buy Position

Note that this strategy might not work in your favour and price could always pierce through the EMA lines. To avoid that, we have to set Stop Loss.

The Stop Loss level should be below the 100 EMA because if the setup is invalidated crossing stop loss we have a chance to minimize our loss and wait for another set up.

If it is a valid set up, we should have a take profit level too. We can implement 1 Risk : 1 Reward (1:1) ratio for this.

Once our trade hit our take profit target, we can Exit for our trade with profits.

BTC/USDT | 1h | tradingview.com - Exit Criteria for Buy Position

Exit Criteria for Sell Position

Note that this strategy might not work in your favour and price could always pierce through the EMA lines. To avoid that, we have to set Stop Loss.

The Stop Loss level should be above the 100 EMA because if the setup is invalidated crossing stop loss we have a chance to minimize our loss and wait for another set up.

If it is a valid set up, we should have a take profit level too. We can implement 1 Risk : 1 Reward (1:1) ratio for this.

Once our trade hit our take profit target, we can Exit for our trade with profits.

BTC/USDT | 1h | tradingview.com - Exit Criteria for Sell Position

Place 2 demo trades on crypto assets using Dynamic Support and Resistance strategy. You can use lower timeframe for these demo trades

Since prof @cryptokraze recommended this for scalping I'm going to use 1 minute time frame to practice this strategy.

- Trade 01:

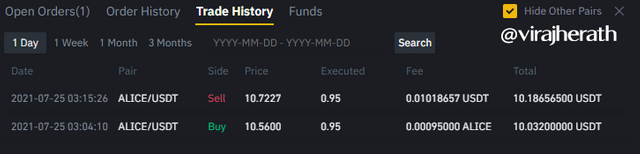

I have used 01 min time frame for ALICE/USDT pair on Binance Exchange with the 1:1 risk reward ratio for my first trade.

ALICE/USDT | 1m | Binance - Trade 01

Transaction details of the trade

Trade was successful.

- Trade 02:

I have used 01 min time frame for TLM/USDT pair on Binance Exchange with the 1:1 risk reward ratio for my second trade.

TLM/USDT | 1m | Binance - Trade 02

Transaction details of the trade

Trade was successful.

Conclusion

To conclude, this price strategy is very useful to identify support resistance level using Exponential Moving Average (EMA). The dynamic nature provides significant signal for trade entry and exits. However, we must be fast to make decisions to maximize the profit in shorter time frames. If we can find and ride the trend early this could be a wonderful strategy to use in any time frame.

From my learning experience, I found it very useful for trading style scalping as there were many set up within a few minutes. There are many opportunities to entry or exits in case if we miss one. However, it is crucial to set stop loss because price can move on different direction very easily.

Thank you.

Dear @virajherath

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 10/10 Grade Points according to the following Scale;

Key Notes:

We appreciate your efforts in Crypto academy and look forward for your next homework tasks.

Regards

@cryptokraze

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the rating prof

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow viraj you did awesome in crypto Academy. You are a talented blogger about cryptos, I wish more success.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the wishes @shohana1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome dear friend 💖💕💖

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit