Hello Everyone,

Crypto Prof. @kouba01 back with the Ichimoku-kinko-hyo Indicator - Part 2 lesson. Week 01 we had the part o1 lesson where we introduced to the Lines of Ichimoku-kinko-hyo Indicator. In this lesson, prof explained the Ichimoku cloud / Kumo cloud and how to use it for cryptocurrency trading.

Discuss your understanding of Kumo, as well as its two lines.

Kumo is a Japanese term which translate to The Cloud. Ichimoku-Kinko-Hyo Indicator consists of 5 lines and two of them represent kumo, namely Senkou span A and Senkou span B. The space between those lines on the chart is referred to as The Cloud / Kumo.

The Kumo provides traders with sufficient information that will be valuable for the trades to identify the market conditions & future trends in any time frame. Senkou span A and Senkou span B can act as precise support and resistance levels on the chart. The visual indication of Kumo helps trades to project future trends / patterns at a glance.

The interpretation of the cloud says 3 things,

- If price action is above the cloud, then the price is bullish and it could lead to an Uptrend.

- If the price is below the cloud, then the price is bearish and it could lead to a downtrend.

- If the price action seems to range through the cloud drifting sideways, the market has No trend.

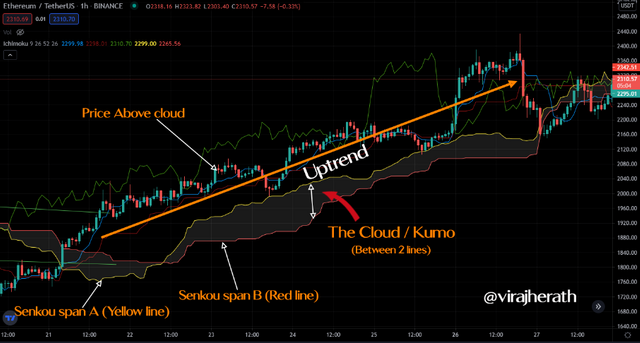

Let's figure out the above indication on a chart.

Uptrend

We can clearly see by the market structure that the price is above the cloud and it's a bullish trend. Traders can find buying opportunities in such trends. Senkou Span A line is acting as the support level in this scenario. Senkou span B line forms below the cloud.

ETH/USDT | 1h | tradingview.com

Kumo orientation in an uptrend with Senkou Span A & B act as a support zone

Downtrend

In this scenario, we can see by the market structure that the price is below the cloud and it's a bearish trend. Traders can find Selling opportunities in such trends. Senkou Span A line is acting as the Resistance level in this scenario. This time the Senkou span A line forms below the cloud.

ETH/USDT | 1h | tradingview.com

Kumo orientation in a Downtrend with Senkou Span A & B act as a resistance zone

A Trading Range

We can see that there is no clear pattern for the market structure and the price is ranging sideways. This happens when the buyers and sellers have relatively equal pressure on the market. When we see price inside the cloud we can say it is a neutral situation with no proper trend. The Senkou Span A & B lines will not act as support or resistance in this scenario.

ETH/USDT | 1h | tradingview.com

Kumo orientation in a Trading Range

The Two Lines

- Senkou Span A | SSA (Leading Span A)

As to the above figures you can see this line helps to identify the future trends forming the cloud. It also acts as a support when the trend is bullish and as resistance when the trend is bearish. Thereby, as a trader, we can get signals when the lines are crossed for buy and sell.

For the calculation it takes Tenkan and Kijun lines average and divide by 2: (Tenkan + Kijun) / 2. As a result, the line will shift 26 periods into the future.

- Senkou Span B | SSB (Leading Span B)

The strongest of the two lines. Senkou Span B helps to form solid support and resistance zone along with Senkou Span A. You can see the switch of the lines with trends. Usually, when there is a bullish trend SSA is above SSB and when there is a bearish trend SSA is below SSB.

Here we calculate the median of the Higher high and Lower low for the last 52 periods. Similar to the Senkou Span A, result will be projecting 26 periods into the future.

What is the relationship between this cloud and the price movement? And how do you determine resistance and support levels using Kumo?

Apart from the visual representation of trends as we mentioned in previous point, there is another indication we can see on the cloud. That is the thickness of the cloud changes all the time with price movement. It is a representation of market volatility. When the cloud seems thinner that indicates lower volatility, contrary when the cloud is thicker it indicates strong volatility.

ETH/USDT | 15m | tradingview.com

Orientation of the thickness of the cloud

Remember, we are not talking about the current market volatility here. The cloud is always forward looking, in fact it is projected to 26 periods into the future. Hence, the thickness of the cloud indicates many information about the price action in the future as well as potential market reverse.

Determine resistance and support levels using Kumo

To this point, we know that the cloud can form solid support and resistance as well as there is a relationship between price and cloud thickness. Now let's figure out how to determine the resistance and support levels using Kumo.

The Kumo can help us to identify the key levels of support and resistance. Senkou Span A is one of the two line of the cloud. If the price is above the cloud, then this line of Senkou Span A will act as a major support level. Contrary, if the price is below the cloud then the Senkou Span A will act as a major resistance level.

When the line is set as a level, the cloud itself serves as a Zone of resistance and support for both occasions. The line of Senkou Span B will act as a secondary level of support or resistance.

When the thickness becomes thinner support and resistance become more penetrable in the future price actions while more thicker cloud is indicating strong support and resistance.

However, when the price is inside the cloud and moving through, it will not serve as a support and resistance anymore. The support and resistance will only work on a trending market. Below are the two figures of examples for said scenarios.

ETH/USDT | 1h | tradingview.com

Uptrend: Senkou Span A & B act as a support levels while Kumo serve as a support Zone

Here, in the above figure, you can see that price trying to penetrate the support level but fails. The price action continued the direction until it breaks from a weaker support zone.

ETH/USDT | 1h | tradingview.com

Downtrend: Senkou Span A & B act as a resistance levels while Kumo serve as a resistance Zone

Here, in above figure you can see that price trying to penetrate the resistance level but fails. The price action continued the direction validating the downtrend until the resistance zone was broken.

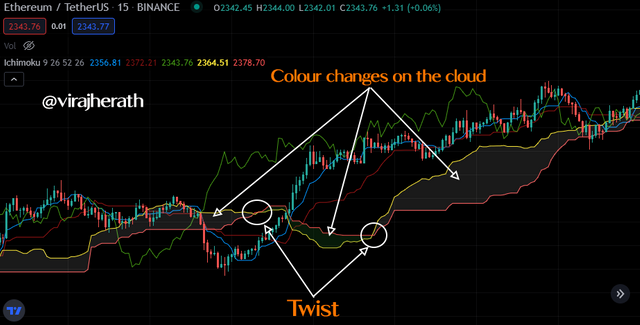

How and why is the twist formed? And once we've "seen" the twist, how do we use it in our trading?

Twist referred to the crossing of Senkou Span A line and Senkou Span B line on trading chart. Such occurrence takes as a sign of potential trend reversal. When there is twist happen colour of the cloud too change making it more visible for the traders.

ETH/USDT | 15m | tradingview.com

Kumo Twist: Potential trend reversal

The formation of this twist can happen in any trending market structure. The Senkou Span B slower than the Senkou Span A due to its input levels. Hence, sudden price movement will be represented in the Senkou Span A and then the twist will occur. It is a mathematical effect according to the buyers and sellers pressure. Whenever we see a twist on a trending market we can assume that there is a potential reversal is upcoming.

How to use twist in our trading

In the below figure you can see that there is a twist with SSA crossing SSB. Now the information is pretty clear as Kijun Sen also has crossed the price action. Here, we as traders has some clear indications of price reversal for bullish trend. Moreover, the forming cloud thickness is strong and it too validate the trend change.

Now, there is clear opportunity to buy from the swing lows and sell at swing highs.

ETH/USDT | 15m | tradingview.com

Kumo Twist: Potential trend reversal

Note that this twist has happened in the future as we are predicting the future price action with Kumo. Any direction is uncertain and therefore we have to make sure we set stop loss to our trades in case of a wrong entry.

However, the strategy would be to identify the potential trend as soon as the twist occurs and then onward buy at the swing lows and sell at swing highs to take the full advantage.

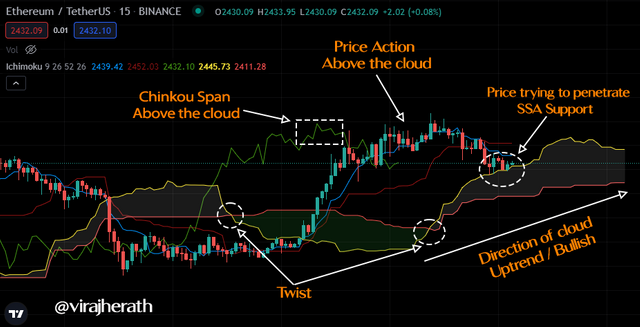

What is the Ichimoku trend confirmation strategy with the cloud (Kumo)? And what are the signals that detect a trend reversal?

Ichimoku Indicator delivers the visual indications of the market price movements and Kumo helps traders to distinguish the trend precisely. By now we know that there are three trends we look for on a trading chart. Those are Uptrend, Downtrend, and Neutral Trend.

ETH/USDT | 15m | tradingview.com

The trends on a trading chart

With above figure you can clearly see that Kumo gives at glance confirmation about the current trend. We do not have to look for the SSA or SSB position but the direction of the cloud itself with market structure.

Signals that detect a trend reversal

There are 4 signals that we must consider to determine the trend reversal.

- The Twist

This is the first potential sign of the trend inversion. Crossing SSA & SSB lines referred as the twist. The cloud changes it colours and gives visual indication as well. However, we must note that such twist may lead to neutral trend as well.

- Price Action

One thing for certain for trend reversal is that, price has to break through the cloud to set new direction. Until then formation of two Senkou Span lines will serve as support and resistance zone on trading chart. Hence whenever price reach to the Kumo, traders must keep an eye for the break.

- Chinkou Span (Delay Line or Lagging Span)

It is often used as a confirmation signal. If Chinkou Span able to penetrate the cloud that will be strong indication of start of trend reversals. Crossovers of Kijun Sen (Baseline or Slow line) or the SSB will further validate the movement.

- Direction of cloud

Finally, the orientation of the cloud is the ultimate confirmation of a trend reversal. Once SSB started moving the reversed direction cloud will form accordingly. If all 4 indication suggest the reversal we are to expect strong trend reversal.

ETH/USDT | 15m | tradingview.com

Trend reversal detection signals

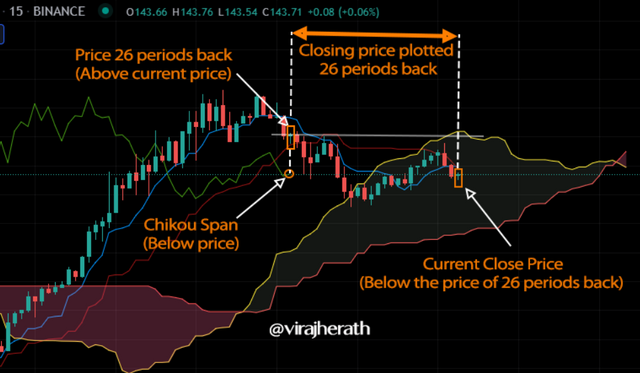

Explain the trading strategy using the cloud and the chikou span together

Chikou span line represents current closing prices for 26 periods backwards. The line consider as the market memory and provide many confirmation signals along with other lines of the indicator. It is assume that If the Chikou span line is above the cloud it is a bullish signal, and if the Chikou span line is below the cloud it is a bearish signal. Let's further dig deep to see if that is correct all the time.

LTC/USDT | 15m | tradingview.com

The Cloud | Chikou span | Price Action: Integration to make a strategy

Now, Chikou span line has to penetrate the cloud to give the bullish or bearish signals. As a strategy we use these crossing movements as signals. It is believed that chikou span line crossing the cloud is the most reliable signal for Ichimoku-kinko-hyo Indicator trading strategy.

We have a few signals to consider here.

Price action penetrated the cloud. Hence the 1st support breached and now the trend is in a neutral trend.

Chikou span line is above the cloud. Usually assumes as Bullish Trend.

Current price is below than the price 26 periods back, consider as a Bearish Trend.

Considering the above facts, especially the breach of support level, bearish trend according to price levels & twist at the end, I would recommend to take sell position after the breach point of the cloud. The twist at the end further confirms the potential downtrend.

LTC/USDT | 15m | tradingview.com

Determining the sell signal

So the strategy to look for would be,

When the current close price is below compared to the price 26 periods back (Where the chikou span line ends), It would indicate that the coming price action would take potential Bearish trend.

When the current close price is above compared to the price 26 periods back (Where the chikou span line ends), It would indicate that the coming price action would take potential Bullish trend.

This would be the best way to use the cloud and chikou span line to identify the trend confirmation.

Explain the use of the Ichimoku indicator for the scalping trading strategy

Scalping is a strategy used in shorter time frames such as 1min, 3mins , 5mins or 15mins. The main focus is to trade as many as trades in small profit percentage. This style of trading needs fast thinking and decision making to be spot on. Because you don't have the time to analyze much. A single wrong decision can wipe out you daily profit in a minute.

So the question that arise is, whether the Ichimoku indicator can help scalping trading?

The answer is Absolute YES, because Ichimoku literally translates to at a glance, hence as scalping traders they do not have much time to analyze but identify key signals at a glance. Ichimoku visual indicators can help scalpers to immediately recognize trends, price momentums & precise support & resistance levels easily. Let's see what we can see at a glance.

ETH/USDT | 1m | tradingview.com

Trade signals for scalping trading strategy

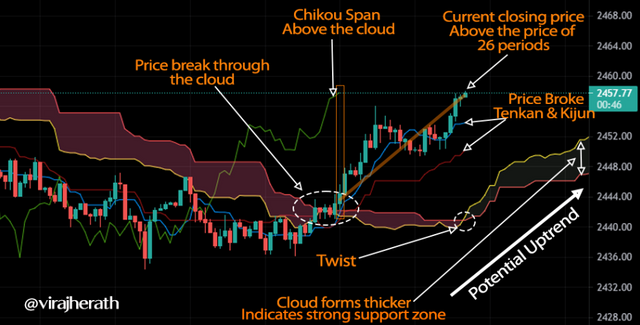

From the above figure,

We can see the price broke through the cloud / Kumo

Cloud orientation is forming as a bullish trend.

The twist is visible

Price broke both Tenkan & Kijun sen lines and moving upwards and that suggest an uptrend

Chikou span is above the cloud, which suggest an uptrend.

Current closing price above the price of 26 periods back, which suggest an uptrend.

We are able to see the thick Komu and that will act as a strong support zone for the uptrend.

Now from all these signal strong uptrend is on the card. As scalper we can go for Buy position with confidence. It is always recommended to set stop loss in case trade goes otherwise.

I believe, non of other indicators provide such visual components at once. That is simply why Ichimoku indicator is best for scalping trading strategy.

Conclusion

Ichimoku-kinko-hyo Indicator is a full HD map for traders to identify Support & Resistance, Trends and price momentum. The Kumo / Cloud is the magic in the indicator which offers an understanding at a glance to the market structure not only the past & present but also to the future for the next 26 periods as well.

The indicator name conclude everything see the balance of a graph at a glance

Personally, this indicator is one of the best I have come across and I find it useful for any time frame. However, with its visual components short term time frames will have an added advantage comparing to any other indicators.

Thank you prof. @kouba01 for the well described tutorial.

Hello @virajherath,

Thank you for participating in the 5th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve an 8/10 rating, according to the following scale:

My review :

In general, you did a good job answering the questions directly and clearly, with a laconic analysis of certain points.

You interpreted well the KUMO cloud and its two lines, providing an organized and clear set of information.

For the second question, you focused more on the cloud's relationship to identifying levels of support and resistance without delving into its relationship to the momentum of the price movement.

Your interpretation of trading using the twist technique was not clear and did not address all possible cases.

Your explanation of the rest of the questions was excellent and you delved well into analyzing what was required.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit