Hello Everyone,

Another indicator for my trading arsenal. This week we have Alligator Indicator. Let's see how I can cope with the assigned homework.

Discuss your understanding of the use of the Alligator indicator and show how it is calculated?

- Introduction to Alligator Indicator

Biomimicry, a term well suited for this indicator. Do you have any idea how many animals have been an inspiration for human inventions! Well, this is a certain example for the trading.

Alligator as an animal loves to sleep and hunt after it gets hungry. The more that the alligator gets sleep the more it becomes hungrier, when it is full after a good hunt, to restore the energy alligator will go to sleep again. The indicator developed by legendary trader Bill Williams does the same. But how?

The indicator has three (03) smoothed moving averages to represent the different parts of the alligator. Alligator's Lips, Teeth & Jaw.

The Alligator indicator on a trading chart

BTC/USDT| 15min | tradingview.com

◾ Alligator's Lips:

The default colour for this line is "Green". It is the closest to the price action and the fastest to move. The calculation of this line is made of 05 periods of the simple moving average, which is being smoothed by the last 03 periods.

◾ Alligator's Teeth:

The default colour for this line is "Red".This is the middle line between the Jaw & the lips. Little slow to move compared to Lips, but faster than the Jaw. The calculation of this line is made of 08 periods of the simple moving average, which is being smoothed by the last 05 periods.

◾ Alligator's Jaw:

The default colour for this line is "Blue". It is the furthest from the price action and the slowest to move. The calculation of this line is made of 13 periods of the simple moving average, which is being smoothed by the last 08 periods.

Using the position of these lines in accordance with the price action can assume the formation, direction of a trend, strength of a trend and reversal of a trend.

- How it is calculated?

In order to get the formula we should first determine the average price of each period.

Average Price = (High + Low) / 2

Then the calculation involves 03 different smoothed moving averages as below:

Alligator Jaw (Blue Line) = SMMA (Average Price, 13, 8)

Alligator Teeth (Red Line) = SMMA (Average Price, 8, 5)

Alligator Lips (Green Line) = SMMA (Average Price, 5, 3)

These three sets of formulas belong to each line described above representing a part of the ‘alligator’.

The Alligator Lips (Green Line), takes minimum periods (05 periods ) to get the smoothed Moving Averages (SMMA) hence moves first as to the market new information. The line travels 3 periods into the future reacting to the current buyers and sellers pressure.

Alligator Teeth (Red Line), is not reacting to the price action as fast as the green line. To get the calculation 08 periods previous data will be calculated. The line travels 5 periods into the future and often this line is considered as a support or resistance level indicating a trend reversal when there's a trend.

Alligator Jaw (Blue Line), is the strongest line from the previous two and is slow to react to the new information. Hence when the price action crosses over this line it usually signals out a trend reversal confirmation. The line travels 8 periods into the future acting as a balance line.

Show how to add the indicator to the chart, How to configure the Alligator indicator and is it advisable to change its default settings?

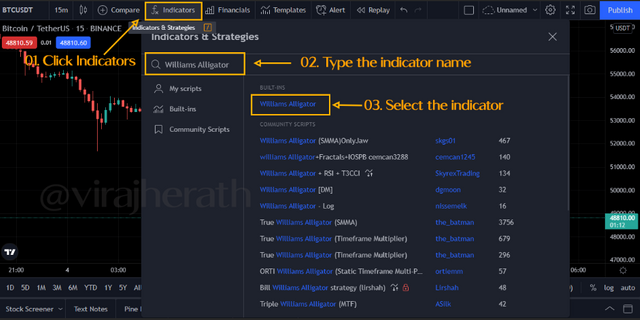

To perform this task I'm using the tradingview platform. Once the trading pair is selected I have clicked the "indicators" to choose the preferred indicator. Then in the search bar, I have searched for "Williams Alligator".

Adding Alligator indicator to the trading chart

BTC/USDT| 15min | tradingview.com

Once selected, three lines will be appeared on top of market structure,

Alligator indicator on the trading chart

BTC/USDT| 15min | tradingview.com

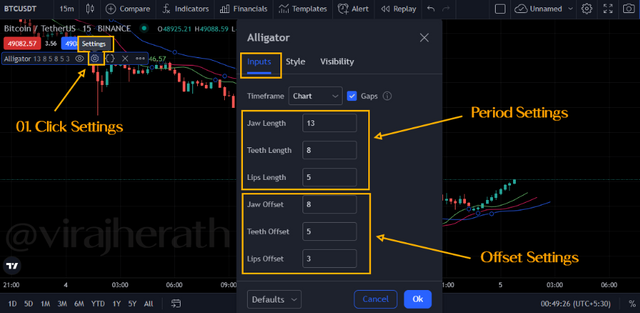

The default settings of the alligator indicator are as follows,

| Alligator Line | Colour of the line | Period | offset |

|---|---|---|---|

| Lips | Green | 5 | 3 |

| Teeth | Red | 8 | 5 |

| Jaw | Blue | 13 | 8 |

To change these settings we can simply go over "Settings" and according to the trading preference and strategies we can change the Input of these periods and offset.

Alligator indicator Input settings

BTC/USDT| 15min | tradingview.com

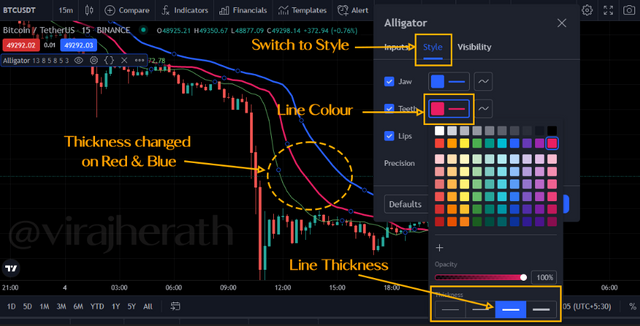

If we need any changes to the line appearance we can change that through the Style. Here, I will change the line thickness in order to make it clear.

Alligator indicator style settings

BTC/USDT| 15min | tradingview.com

- Is it advisable to change its default settings?

The default settings have a direct relationship to the Fibonacci numbers. Hence, the inputs which introduced by Bill Williams have a lot of thought in them. Therefore, changing the default settings might not be the best suggestion for a naïve user.

However, if you wish to change the settings, the lines will react according to the input given. If we put lesser numbers than what default is, the lines will get extracted and move faster to the price action. Contrary, if we put higher numbers than what default is, the lines will further out from the price action and will react slowly to the new information.

How do we interpret this indicator from its 3 phases: the period of rest(or sleep), awakening, and the meal phase?

- Interpretations to alligator's behavior: Sleepy alligator

This is the Rest phase for the alligator, when the alligator is in sleep, market structure is stuck in small trading ranges consolidating most of the time. The three lines will intertwine from time to time indicating that there is no certain market information whether the market turns into an up or downtrend. The best option would be to stay out of the market while the alligator sleeps because the current trend is too weak to take a position.

Sleepy alligator: Rest phase

BTC/USDT| 15min | tradingview.com

- Interpretations to alligator's behavior: Hungry alligator

After a good rest, this is the Awakening phase. The time the alligator sleeps usually indicates how hungrier it becomes. Now the alligator seems to take down bulls and bears in the market. With open jaws, (three lines get apart with a divergence) alligator will start the hunt. The lips (green line) will be the first to act biased in one direction followed by the teeth (red line). Buyers or sellers in the market will gain control of the market in this phase and decide the market trend. This would be considered as a perfect time to enter the market.

Hungry alligator: Awakening phase

BTC/USDT| 15min | tradingview.com

- Interpretations to alligator's behavior: Alligator eats

This is the Meal phase. The three lines will move further away from each other and price action would stay above the Alligator's lips. The momentum will stay until the Alligator lost interest in the food (Buyer and sellers have no disagreement over price). The price action would get closer to the lips and that is an indication for a closing mouth. When that happen Alligator would probably go to sleep again (Market will consolidate). When Alligator closing the mouth it signals exit entry from the positions.

Alligator Eats: Meal phase

BTC/USDT| 15min | tradingview.com

Based on the layout of its three moving averages that make up the Alligator indicator, how can one predict whether the trend will be bullish or bearish

Now that we know how to interpret different stages of the indicator, it is utmost important to understand the direction of the trend. We already discussed when the market is in range the three lines will intertwine. Then in the awakening we were able to see the divergence of the line. Particularly, the fast moving green line: the lips is the first to react. With that we can set some general rules to follow as a guideline to understand bullish and bearish trends.

◾ Bullish Trend:

(i). The green line will diverge from the other two line with wider gaps to the upward direction.

(ii). The lines will position as Green, Red & Blue from the up.

(iii). Price action will move upward from the green line.

Identifying bullish trend

BTC/USDT| 15min | tradingview.com

◾ Bearish Trend:

(i). The green line will diverge from the other two line with wider gaps to the downward direction.

(ii). The lines will position as Blue, Red & Green from the up.

(iii). Price action will move downward from the green line.

Identifying bearish trend

BTC/USDT| 15min | tradingview.com

Explain how the Alligator indicator is also used to understand sell / buy signals, by analyzing its different movements.

From the previous point we understood how to identify the trend. Now in order to enter to the market we must carefully analyze which point we should take position for buy and sell.

As a fact, market moves to a bullish or bearish trend when only sleeping alligator wakes up. Hence, when these conditions are met we can go for a buy and sell positions.

- Buy position

✔️ The green line will cross over red line and blue line respectively in upward direction. The formation of the lines from up should be: Green, Red & Blue

✔️ To confirm the bullish movement wait at least 3/4 periods.

- Sell position

✔️ The green line will cross over red line and blue line respectively in downward direction. The formation of the lines from up should be: Blue, Red & Green

✔️ To confirm the bullish movement wait at least 3/4 periods.

Buy and Sell signal using Alligator indicator

BTC/USDT| 15min | tradingview.com

Do you see the effectiveness of using the Alligator indicator in scalping trading style? Explain this based on a clear example.

There are different trading styles used by different traders according to their personalities and skills. Scalping can be identified as one of the popular trading styles. Such traders are known as "Scalpers". The strategy is to focus on large number of trades with smaller percentage of profits. Scalpers tend to use shorter time frames in order to scalp because they can gain more trades when there is high volatility.

The Alligator indicator is a somewhat reliable indicator to identify the trend directions. However, we know that 70% of the time market behaves in consolidation periods. In such periods, the indicator shows us many intertwine between the three lines. In fact, it was explained before as a "Stay out" period. The Hence, effectiveness of the indicator might not be in full use in a strategy like scalping.

Alligator indicator vs Scalping opportunities

BTC/USDT| 03min | tradingview.com

In the above figure, we can see that many volatility ups and downs are presented in this 03min BTC/USDT time frame. However, circles represent buy and sell opportunities of the indicator. Now, fundamentally, scalpers do not wait that long to make opportunities for their trade. Hence, I believe apart from identifying the trend Alligator Indicator might not be that useful for scalpers.

Is it necessary to add another indicator in order for the indicator to work better as a filter and help get rid of unnecessary and false signals? Use a graph to support your answer.

None of the technical indicators can assure a 100% success rate. False signals can occur in any indicator. However the percentage consistency is what matters. Hence, to confirm whatever the signal generated from an indicator we can use conjunction.

For this exercise, I like to use the Awesome Oscillator (AO) to confirm my decisions. It is a momentum indicator which goes well with the Alligator Indicator due to the capability of identifying the changes in the market forces.

Alligator indicator with Awesome Oscillator

BTC/USDT| 15min | tradingview.com

Let's assume that I wanted to enter the market at highlighted "Sell Entry" point. According to the Alligator indicator all the conditions are well met for my decision. However, to confirm I take the help of Awesome Oscillator. There we can see that the oscillator starts to descend with the colour Red. That would be a confirmation to the seller's strength in the market.

Likewise, I'll be able to filter out my decision to good use when there's a false signal.

List the advantages and disadvantages of the Alligator indicator

- The advantages

◾ It is one of the easiest to interpret.

◾ Since the indicator use 03 SMMA's it has a higher percentage for accurate signals.

◾ Can be used in any time frame.

◾ Can clearly define the trends of the market.

- The disadvantages

◾ Might not be that useful during the ranging markets for trade entry.

◾ Indicator reacts to the price action with a time lag, hence the market would move before the indicator identifies the certain signals. This could lead to traps and extreme losses.

Conclusion

Personally, this is one of the simplest trading indicators that I have come across. Yet it is so powerful to provide all the necessary market information. With such an awesome indicator we can keep the trading charts simple. It is always better to confirm the signal with other indicators such as RSI, MACD or AO.

Thank you prof. @kouba01 for sharing the knowledge of this valuable technical analysis tool.

Great, Good explanation about Crypto Trading With Alligator Indicator. Success for you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit