Hello Everyone,

For week 06 we have back to back lessons from prof. @kuoba, I'm sure this lessons also as knowledge as the previous ones. Let's step into home work of Crypto Trading With Chaikin Money Flow Indicator.

01). In your own words, give a simplified explanation of the CMF indicator with an example of how to calculate its value?

- Introduction to Chaikin Money Flow (CMF) indicator

Developed in 1980 by Marc Chaikin, the Chaikin Money Flow (CMF) indicator is a technical analysis tool. Traders can use this tool as an oscillator that measures buying and selling pressure of a security over a specific period. It is typically used on a 20 or 21 days timeframe to predict the direction of near-term price movement by calculating the amount of money flowing into and out of a security.

Chaikin Money Flow (CMF) indicator

As to the above figure, you can see that the indicator shows -0.1226 as CMF value and the CMF line is below the centerline of "0" which ranges between 1 to -1. What this negative value represents is more selling pressure. A trader can assume by looking at this value, security's price should decrease over time because it has more selling pressure than buying pressure. If the CMF value is positive, then the security's price should increase over time because it has more buying pressure than selling pressure.

Thus the CMF value can be interpreted as follows:

- Value above 0 - The security is trending higher with more volume accumulation, The price momentum should be bullish, Market has more buying pressure

- Value below 0 - The security is trending lower with more volume distribution, The price momentum should be bearish, Market has more selling pressure

That's the simplest idea we can take from this indicator.

- How to calculate its value

The CMF indicator can be calculated using three parameters, which are volume, price change, and time. The higher these three values are over a period of time, the stronger the buying pressure on a security will be. Conversely, the lower these values over a period of time indicate selling pressure on a security.

The indicator is calculated using three distinct steps:

☑️ Step 01: Determine the Money Flow Multiplier

E.g.

Determine the Money Flow Multiplier

XRP/USDT| 1D | binance.com/

High of the day - 1.0689

Low of the day - 0.9436

Close of the day - 1.0421

MFM = [(1.0421- 0.9436) - (1.0689- 1.0421)] / (1.0689- 0.9436)

MFM = 0.572/-

☑️ Step 02: Find Money Flow Volume

E.g.

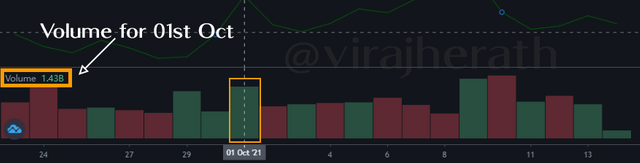

Find Money Flow Volume

XRP/USDT| 1D | binance.com/

Money flow multiplier (MFM) - 0.572

Volume for the period - 1.43 B

MFV = 0.572 x 1.43

MFV = 0.818

☑️ Step 03: Calculate The CMF

For the calculation purpose I will take the n Period as 12, and for the easy calculation the 03 steps formula can be extracted as below,

Now, I will take the data from the XRP/USDT 1 day chart and check whether I can get the correct CMF for the result. Here is the summary of my calculation data.

| Date | High | Low | Close | MFM | Volume | MFV | |

|---|---|---|---|---|---|---|---|

| 1-Oct | 1.0689 | 0.9436 | 1.0421 | 0.572 | 1.430 | 0.818 | |

| 2-Oct | 1.0728 | 1.0074 | 1.0362 | -0.119 | 0.875 | -0.104 | |

| 3-Oct | 1.0888 | 1.0203 | 1.0558 | 0.036 | 0.929 | 0.034 | |

| 4-Oct | 1.0604 | 1.0055 | 1.0435 | 0.384 | 0.981 | 0.377 | |

| 5-Oct | 1.0895 | 1.0382 | 1.0848 | 0.817 | 0.992 | 0.810 | |

| 6-Oct | 1.1096 | 1.0164 | 1.0773 | 0.307 | 1.128 | 0.346 | |

| 7-Oct | 1.0958 | 1.0434 | 1.0686 | -0.038 | 0.910 | -0.035 | |

| 8-Oct | 1.0937 | 1.0531 | 1.0641 | -0.458 | 0.669 | -0.307 | |

| 9-Oct | 1.209 | 1.057 | 1.1618 | 0.379 | 1.649 | 0.625 | |

| 10-Oct | 1.2319 | 1.1261 | 1.1359 | -0.815 | 1.753 | -1.428 | |

| 11-Oct | 1.1833 | 1.101 | 1.1368 | -0.130 | 1.011 | -0.131 | |

| 12-Oct | 1.1369 | 1.063 | 1.1023 | 0.064 | 1.171 | 0.074 | 0.0800 |

| 13-Oct | 1.1397 | 1.0758 | 1.1284 | 0.646 | 0.939 | 0.607 | 0.0667 |

* Volume: rounded to the nearest billion

The CMF Volume of 12th & 13th Oct 2021 | It works 😱

XRP/USDT| 1D | binance.com

Both positive values suggest buying pressure and we can see the CMF line is above the centerline "0".

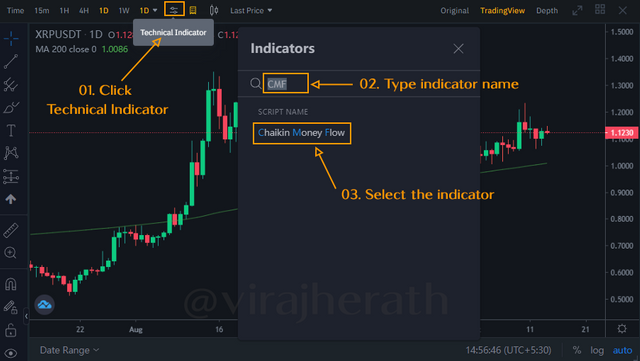

02). Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).

I wish to use binance.com to demonstrate this task. After the sign in process, I click the trading and the BTC/USDT chart will be one the window as a default. There we can choose any pair of cryptocurrencies as to our trading choice. I'm going to choose XRP/USDT.

The chart will be in "Original" mode in default, in this mode too we can add a few essential indicators, but not everything. To search for CMF, I have to switch from Original to "Trading View". Let's see what are the steps to add the indicator to the chart.

Adding CMF indicator to the trading chart

XRP/USDT| 1D | binance.com

Once selected, CMF will appear bottom of the trading chart.

CMF indicator on the trading chart

XRP/USDT| 1D | binance.com

By default, the setting for the number of periods is "20". We can change this and the style of the indicator as to our preference. All we have to do is click the settings on the indicator and adjust both input & style accordingly.

CMF indicator Input settings

XRP/USDT| 1D | binance.com

◾ Length: Number of time periods to look-back when calculating the CMF value.

CMF indicator style settings for visibility

XRP/USDT| 1D | binance.com

◾ Plot: Here we can change how the CMF value line should look like. Mainly the colour, opacity of the colour, the thickness of the line and many options for the line style as well.

◾ Zero: We can change the centerline value and the visual components such as the colour, opacity and the thickness.

◾ Precision: By default, we can see 4 decimals on the indicator's value. We can adjust that on the precisions. For example, if we choose 6 as our precision there will be 6 decimals to the indicator's value.

Easy as that, most of the indicators follow the exact same steps to add to the chart as well as configure the settings.

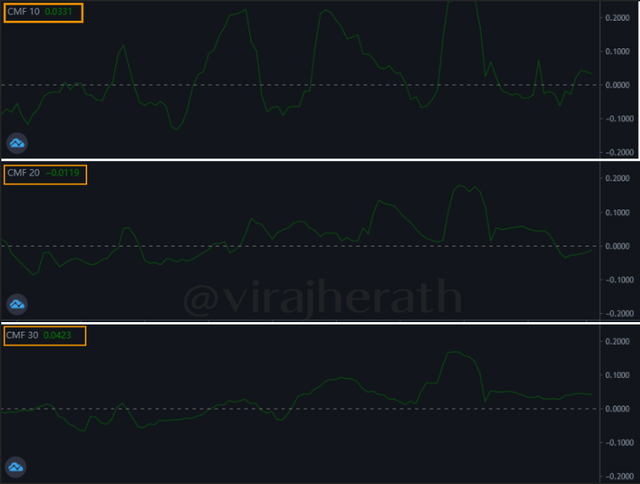

- Best Settings for CMF

As to my observation, many platforms use 20 days as the default setting. However, the founder of this indicator suggests 21 days periods which approximately corresponds to a trading month. Hence, 20 & 21 are the most popular settings for the look-back period.

Thus, what we have to understand from this setting is that, If the number of periods is larger (e.g. 30), the indicator is less volatile and less prone to sideways movements. Conversely, if the number of periods is smaller(e.g. 10), the indicator is highly volatile with more noise reacting to price action fast. Hence, according to your trade pattern and deciding how much signal you want to generate from this indicator it is best to choose a value for this setting. For that as a trader we have to consider the time frame we use and the risk management strategy.

Demonstration of different look-back periods

03). What is the indicator’s role in confirming the direction of trend and determining entry and exit points (buy/sell)

We already discussed that CMF value interprets the shift in the balance of power between buyers and sellers pressure of security over a given period of time. The values over the centerline is a sign of Buying Pressure in the market while below centerline indicates Selling Pressure in the market. This indication of market pressure can be very useful to identify and confirm an ongoing trend.

CMF Buying & Selling Pressure interpretation

LTC/USDT| 1D | binance.com

As to the above figure, whenever it crosses over and below the centerline, we can see the trend continues in its direction. This is not true for every single occasion but more often it can generate some reliable signals for traders decision making. So as a theory we are looking for crossovers of centerline as to the below figure.

CMF Buying & Selling indications

DOT/USDT| 1h | binance.com

However, this strategy is not effective as it seems and many times it could generate false signals and trader might end up losing his trades. Therefore we can set a buffer range between a value of 0.005 to 0.015 for positive direction and -0.005 to -0.015 negative direction to filter the potential false signals. The wider the range gets it will generate fewer opportunities to trade but with better results.

As an example, I will use the range of 0.01 to -0.01 to demonstrate Buy & Sell position,

- Entry points

Continuing the above described point, traders can wait until the CMF value make some momentum from the centerline and move towards to 0.01 line for Buy opportunities, conversely - 0.01 line for Sell opportunities. As to the figure you can see we can avoid many false signals while using this strategy. Thus, this is also not 100% accurate and that can be seen on the 03rd buying opportunity where trend didn't continue, but reversed to a bearish one.

The disadvantage of this strategy is we might be a bit late to catch the trend if it going the way we want.

Setting a buffer to make trading decision

ADA/USDT| 1h | binance.com

- Exit points

Now that we discussed the entry point, here we can use two strategies for exit points.

◾ Exit - 01: If the trend continues as we wish we can wait until it reaches the opposite number of the range. Here in this example, I have a sell position and the trend worked for me continuing its bearish trend and I exit from the 0.01 line. Conversely, for the buy position, I would have exited from the - 0.01 line.

◾ Exit - 02: If the trend didn't work as planned, I can close my position when it reaches to the centerline and minimizes the damage. In this example, you can see that the 02nd sell position has not entered the bearish trend but continues its bullish pattern. So, the better option would be to close the position once it goes beyond the center without waiting until it reaches the 0.01 line.

Entry and exit for sell position

ADA/USDT| 1h | binance.com

04). Trade with a crossover signal between the CMF and wider lines such as +/- 0.1 or +/- 0.15 or it can also be +/- 0.2, identify the most important signals that can be extracted using several examples.

As explained in the early point, the wider this range gets the less volatile it will be. Hence, crossovers from +/- 0.2 or above are very rare. To happen such price action should always close near the high or low for 20 consecutive days in same pattern. But that scenario is nearly impossible. Hence most markets range between +/- 0.2 and in rare cases with high liquidity accumulation or distribution it goes beyond this level.

Let's investigate few markets,

◾ SOL/USDT | 1h time frame for 15 days, CMF 20

Crossover distribution

SOL/USDT| 1h | binance.com

◾ ETH/USDT | 4h time frame for 30days, CMF 20

Crossover distribution

ETH/USDT| 4h | binance.com

◾ BNB/USDT | 1D time frame for 01 year, CMF 20

Crossover distribution

BNB/USDT| 1D | binance.com

In the above figures, I have taken 03 crypto pairs and different time frames to demonstrate when the range gets wider the lower the signals provided by the CMF indicator. However, the success rate for the trade can be significantly high as well because this method filtered out false signals which will crossover centerline. However, if a trader wishes to generate more signals even in higher time frames, he can change the number of look-back periods to a lesser number and get more signals.

With said reason, according to the market & time frame trader should decide which range and what is the number of periods he should use to get signals.

As of the trading strategy, I would like to ask crypto prof. @kuoba what if we use the same crossover line for entry and exit point rather than using the range. I found more success rate using this strategy from previous few examples.

Crossover distribution

SOL/USDT| 1h | binance.com

◾ TP: 01 - Buy entry as the CMF crosses over + 0.1 line and take profit when it crosses back from its momentum. Advantage is that we don't wait until the selling pressure takes place and close the position in advance. Disadvantage is that as we are still in the territory where the buying pressure is high the trend can continue.

◾ TP: 02 - Buy entry as the CMF crosses over + 0.1 line and take profit when its crosses - 0.1 line. The momentum is already switched and trader more often has lesser success.

05). How to trade with divergence between the CMF and the price line? Does this trading strategy produce false signals?

- False signals

None of the indicators are perfect or produce 100% correct results. Hence, we can't expect CMF to be 100%. Hence it is obvious it generate false signals.

CMF generate false signals

ADA/USDT| 1h | binance.com

We can see many centerline crossovers in the above figure but not many continued in there direction but change the momentum very fast. In the highlight scenarios CMF value crossover below centerline and enters to the negative territory. This indicates selling pressure and traders might expect a bearish movement. However, price action did not support the same. This is the reason why we can not depend on a single strategy but to use this as a tool to confirm the thought process for exit and entry points for trading.

- How to trade with divergence between the CMF and the price line?

Divergence can be found when there is a contrast between the the directions of price trend line and the CMF line. Simply the both directions will have different patterns which not comply with the price action. This phenomenon may suggest that the current trend is diminishing its strength and there a trader can take advantage to enter the market early.

We can discuss this scenario in two possible ways,

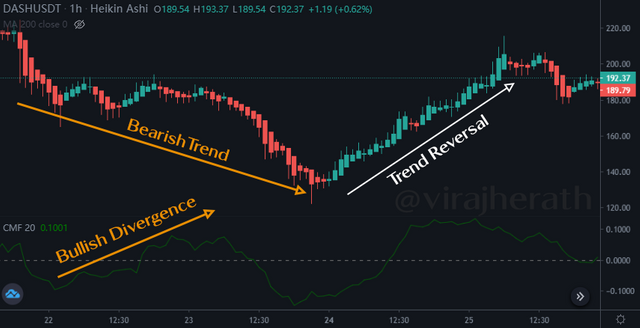

◾ 01). Bullish divergence:

This can occur when there is buying pressure in the market while the selling pressure get weaken. The CMF indicator will capture the buying pressure and move upwards though the price action falls and move downwards.

In the below figure, we can see that CMF captures the selling pressure and moves further down crossing the centerline. This will be a good opportunity to enter the market for long position as we can assume a trend reversal soon. Eventually, when sellers exhausted Buying pressure will be notified by the indicator to further confirm the reversal.

Bullish divergence

DASH/USDT| 1h | binance.com

◾ 02). Bearish Divergence:

Similarly, bearish divergence can occur when there is selling pressure in the market while the buying pressure gets weaken. The CMF indicator will capture the selling pressure and move downwards though the price action moves upward.

In the below figure, we can see that CMF captures the pressure as it stays above centerline but moves towards centerline without supporting the price action bullish trend. When the CMF value crosses the centerline it will be a good opportunity to enter the market for a short position as we can assume a trend reversal soon. Eventually, when buyers exhausted selling pressure will take over to further confirm the reversal.

Bearish divergence

LTC/USDT| 1h | binance.com

Conclusion

As an oscillator, this indicator seems great to find the accumulation and distribution levels over a set period of time. It can help the traders to measure the trend strength as well as its direction. The indicator works by giving a value range between +1 to -1. Positive numbers indicate buying pressure of the market while negative numbers indicate selling pressure.

The centerline of this measurement divide in "0" and whenever it crosses over traders assume the change in price action to trend lines. However there can be false signals and to avoid or limit false signals there are certain strategies can be implemented. To further confirm the signals it is a must to use other indicators and chart patters, candlestick patterns as well.

Thank you prof. @kuoba this valuable lesson.

Hello @virajherath,

Thank you for participating in the 6th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|10/10 rating, according to the following scale:

My review :

Work with excellent content, because you have taken every question seriously, allowing you to get answers that are precise and in-depth in its analysis and clear in its methodology.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review prof., look forward to doing your next homework.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow. Great job!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the compliment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My pleasure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good Homework My Friend, about Crypto Trading With Chaikin Money Flow Indicator. Always Soccess for You My Friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks buddy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit