Hello Everyone,

Welcome to the 03rd week of the Crypto Academy. Crypto Prof. @allbert went into detail about a tool that we can use in our trading operations. I think this is more of practical homework and I'm excited to learn about this tool named "Contractile Diagonals". Let's move on to the homework.

01- Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur.

- Define contractile diagonal

Contractile diagonal is a chart pattern which has converging upper and lower horizontal axis indicating more trading activity at that price level. The typical setup of this chart pattern is a set of closing prices that are either higher or lower than one another in one way of wave.

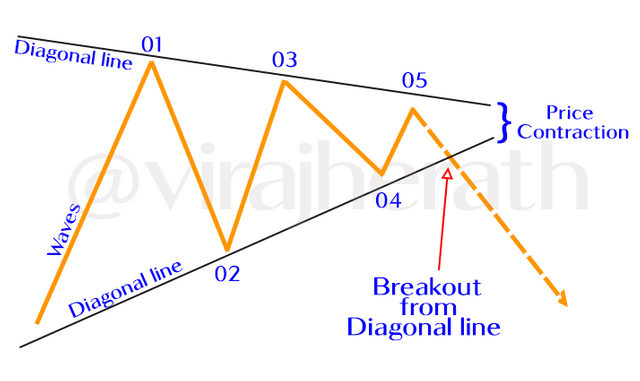

Hence, there are successive smaller swings either bullish or bearish direction, following a 1-2-3-4-5 wave structure. This is how the pattern looks like,

Formation of contractile diagonal

Near the 5th wave, we can see both diagonals converging with low volatility of price action, however at this point, we can expect a breakout from either of the diagonals.

- Why it is important to study?

There are different chart patterns such as flags, head and shoulder and double tops and bottoms, etc. These patterns have proven to work with different descriptions and strategies. Use of these patterns has become widely common for both buy and sell side traders. Patterns can provide signals for the future candlestick formation, and thereby the direction of the price.

Moreover, if a trader can identify such pattern set up, they can assume good breakout trades. Break of the trend has a good probability of changing the trend. Hence a trader can place a buy or sell order with some confidence even if the market doesn't directly respond.

Here is an example of this pattern in a trading chart,

Formation of contractile diagonal

BNB/USDT| 1m | tradingview.com

- What happens in the market for this chart pattern to occur?

Whatever happens in the cryptocurrency market that is because of buying and selling pressure in the market. The charts quantify and define the same on visualize manner representing the market. That makes it easier to inspect.

When it comes to contractile diagonals, they clearly show volatility compression in the market. In such an occurrence, the market tends to move within the equilibrium point until it breaks away from the pattern with high liquidity injected. One of the diagonal can be penetrated according to the market trend.

Hence, as traders when we recognize contractile diagonals patter we have to be on guard for a breakout from the converging ranges and potential trend reversal.

02- Give an example of a Contractile Diagonal that meets the criteria of operability and an example of a Contractile Diagonal that does NOT meet the criteria.

- Operating Criteria

I have already explained that contractile diagonal can be identified with certain 1-2-3-4-5 wave structure. When we see a bullish contraction, we can assume that the price will break from the lower diagonal and reverse the current trend. Conversely, when the contraction is bearish, we can assume that the price will break from the upper diagonal and reverse the current trend.

The correct form of the patter has certain rules to comply with,

Considering length of the waves,

Wave 1 must be larger than wave 3 (wave 01 > wave 3).

Wave 3 must be larger than wave 5 (wave 03 > wave 5).

Wave 2 must be larger than wave 4 (wave 02 > wave 4).

Considering diagonals,

No. 01 / 03 / 05 waves must reach to upper diagonal level.

No. 02 / 04 waves must reach to lower diagonal level.

Both diagonal lines must converge at some nearby point.

In case if we cannot find one of these rules true at any moment within the formation, we have to look for another setup. Accurate wave structure is very important to the success of the trade.

- Contractile Diagonal that meets the criteria Vs NOT meets the criteria

LUNA/USDT | 30m | tradingview.com

Contractile Diagonal that meets the criteria

In the above figure, we can see that all the rules are met concerning the length of the waves & converging diagonals. As expected the trend reversed from the bullish to bearish after the price movement within contractile diagonals.

This type of pattern usually indicates that sellers are active in the market, which reflects a weakening support level (lower converging line). The price contraction will eventually be exploded from the line to confirm the trend reversal.

AXS/USDT | 3m | tradingview.com

Contractile Diagonal that does NOT meet the criteria

Conversely, in this figure we can see that some rules are not regarded even though the price moved within the converging diagonals, According to the guideline for correct formation of this patter,

(i.) Wave 3 must be larger than wave 5 (wave 03 > wave 5): We can see that the wave 5 is bigger than wave 3 here.

(ii.) Waves must reach to diagonals: We can see that waves 2 & 3 was unable to reach the diagonals.

Hence, the expected breakout had not happened in this scenario and trend was not reversed. What we have to note here is that Contractile Diagonals are very much dependent on an accurate wave count and rules have to be precise. Otherwise we should look for another setup than getting signals out of an inaccurate pattern.

03- Through your Verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots.

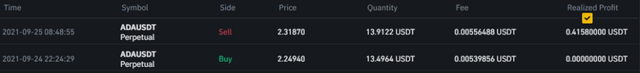

I have used 03min time frame for ADA/USDT pair on Binance Exchange with the 1:1 risk reward ratio for my first trade. The stop loss point was taken as per the risk reward ratio introduced by prof @allbert in this lesson. In this case, it is located on the touch point of 05th wave to the converging line.

- BUY ORDER

Buy trade entry: Binance ADA/USDT 03 Min chart

During the buy trade, I waited for the perfect pattern to appear before entering the market. Once the 5th wave completed and touched the lower converging line I was more alert for the bullish candlesticks as a start to the trend reversal, when the price broke the upper converging line, I waited till I get the confirmation from the next candle. As expected trend reversal continued and I place my buy order with some confidence.

Below is the transaction details for the trade.

Transaction details of the trade

Trade was a success and trend reversal continued as planned after some consolidation.

04- Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

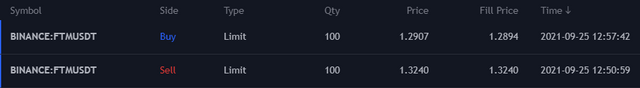

I have used 05min time frame for FTM/USDT pair on Trading view with the 1:1 risk reward ratio for this sell trade. I took the touch point of wave 05 as a guideline and set the stop loss slight above it.

- SELL ORDER

Sell trade entry: Trading view FTM/USDT 05 Min chart

Same as the buy order, I waited for the perfect pattern to appear. Once the 5th wave completed and touched the upper converging line I was waiting for a trend reversal, when the price broke the lower converging line with bearish candlesticks, I waited till I get the confirmation from the next candle. As expected trend reversal continued and I place my Sell order with some confidence. This time within just a few minutes order was filled.

Below is the transaction details for the trade.

Transaction details of the trade

Trade was a success and trend reversal continued as planned.

05- Explain and develop why not all contractile diagonals are operative from a practical point of view.

Traders look for any pattern to predict the market from previous scenarios. From the contractile diagonals also, traders particularly look for good breakout trades. To be successful with the trades, it is very important to follow the correct wave structure. But in practical view, there can be a lot of noise over particular candlesticks pattern over the period and identifying the correct formation can be quite difficult.

In below figure you can see that there are no perfect up and down waves but a lot of price consolidation movements in between. In such scenarios counting the wave pattern is a struggle, even if we count it correctly the confidence over the pattern could be low for a trade entry.

BNB/USDT | 1h | tradingview.com

Practical difficulties: Price consolidation movements

Further, nobody can guarantee that any signals from analysis, pattern or indicators are 100% certain. It all depends according to the market buy and sell pressure. In the below figure we can see even after all the rules / guidelines are met still the breakout happen from the conversion line which will continue the previous trend. Hence, if we expected a trend reversal from this trade we would have been in the wrong position.

ETH/USDT | 15m | tradingview.com

Practical difficulties: Not possible to make an accurate judgment every time

To avoid such scenarios, the best implication would be to have risk management first. That will be the best escape plan if we are on the wrong side of the trade. However, for contractile diagonals we do NOT use the typical 1 Risk : 1 Reward ratio. Instead, we have different risk management scheme available for this trading strategy.

Here we use the swing high or swing low point of the wave 02 & wave 05 as indication points to guide us on risk reward positioning.

ETH/USDT | 15m | tradingview.com

Risk Reward positioning

Once the risk reward ratio was positioned from the potential breakout point, we can see that the ratio percentage is about 0.82. Fundamentally, traders always look for a better reward ratio than the risk. Hence, the percentage must be greater than 1% to look for a successful trade.

Moreover, if we would have set up the stop loss below the 05th wave indication point we would simply limit the damage.

Conclusion

To conclude, converging lines occur when the price breaks from its trend but remains above or below the converging range until it breaks out. For contractile diagonals, we use this theory as a wave pattern / structure. The structure is simple at first glance. However, to observe the correct pattern and to position successful trade, there are certain guidelines to follow.

As per my own experience after researching this lesson, chart patterns are simple by the theory or when we look at it on the previous examples, However, it is a skill we should gather from experience and observation of others who use this technique. Risk management is a must when you trade and this lesson proved it again. Thank you prof. @allbert for this a little difficult but amazing lesson.

Hello, @virajherath Thank you for participating in Steemit Crypto Academy season 4 week 3.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the rating @allbert, both points accepted.

I waited about 4 days until I find best structure and couldn't wait longer. To finish the task I had to take those scenarios.

I look forward for your next lesson.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit