Hey Guys..!!

Meet again with me Wahyu Nahrul on the other Steemit Crypto Academy homework. Today I will be working on homework given by one of our professors @pelon53.

The homework given by our professor this week is about Support and Resistance Breakouts.

Okay, just get to the discussion. Happy Reading !!

The Advantages Of Locating Support and Resistance On a Chart Before Trading

.png)

In trading in a cryptocurrency market, there is a basic thing in analyzing charts that everyone should know, this is the most important thing because it will greatly affect the results of the trades that will be made. What I mean is identify Support and Resistance before entering into a trade.

Support and Resistance levels are levels created by drawing 2 trend lines on the chart which will serve as upper and lower limits. The upper limit specified is the highest price reached in a market in a certain period while the lower limit is the opposite where this level is determined based on the lowest price reached in a market within a certain period of time.

These two limits will be used as a benchmark where if the candlestick on the chart breaks through one of these limits, the trader can make a decision to buy or sell their crypto asset. So from this, we can know that by knowing the Support and Resistance Levels before trading, the trader will have the advantage of making more informed decisions to enter trading in the crypto market.

Then, these two levels can also be used as a benchmark to determine the correct Stop Loss Level and Take Profit Level. Usually, traders will place the Stop Loss Level slightly above the Support Level if the Support Level is penetrated, while if the Resistance Level is broken then the Stop level Loss will be placed below the Resistance Level. The Take Profit Level will be determined using the Risk/Reward Ratio chosen by the trader based on the Stop Loss Level that has been determined previously.

In addition, the Support and Resistance Levels can also be used as a place where traders make short-term trades by targeting small profits that are obtained when the candlestick moves repeatedly to touch these two levels.

For example, we can see in the graphic image below where at point A the candlestick touches the Support Level where it is the lowest price reached in that period so that at that price it can be used as the first point for the Support Level. Then the chart increases in price to make a new high at point B, and point B can be used as the first point for the Resistance Level.

After that, the candlestick decreased and touched the Support Level at Point C, then at that time the trader could make a purchase. Then when the candlestick starts to move back up until it touches the Resistance Level at point D, the trader starts selling his crypto asset and takes a profit.

From these two things, you can continue to do it repeatedly at subsequent points as long as the candlestick has not broken out with these two levels so that traders can get profit in a short period of time even though the candlestick moves horizontally and the market is not in any trend.

The Breakout of Support and Resistance, and Example of Using Another Indicator as a Filter When The Breakout of Resistance

As I explained earlier that one of the advantages of determining Support and Resistance Levels is that we can more quickly find out where the trend direction will be headed by a cryptocurrency market more precisely. We can know this by looking at where the candlestick moves until it breaks out with one of the predetermined limits. There are two breakouts, namely Breakout of Support Level and Breakout of Resistance Level.

.png)

Breakout of Support Level is a condition where the candlestick moves downwards until it breaks the predetermined lower limit, and this indicates that the trend in the market will experience a Bearish Trend in the near future and the price will begin to decline.

Meanwhile, Breakout of Resistance Level is the opposite of Breakout Of Support Level. Breakout of Resistance Level is a condition where the candlestick moves upwards until it breaks the predetermined upper limit, and this indicates that the trend in the market will experience a Bullish Trend in the near future and the price will start to bounce higher than the price at that time.

However, we should not immediately make a decision to enter a cryptocurrency market even though the candlestick has broken through one of the predetermined limits, this is because it could be just a temporary breakout (false signal) and the candlestick will re-enter the predetermined limit. To avoid this, we should use other technical indicators as filters or additional signals that can give us certainty about the breakout made by the candlestick.

Now I will show you how to use additional indicators as filters of the breakout of resistance level signals. The indicator that I use this time is Average Directional Index Indicator which has been modified so that it has 2 additional lines that will signal the direction of the trend that is occurring in the market, the lines mean are DI+ and DI-.

In the graphic image above, we can see that I drew Resistance Levels at some of the highest points reached by BNB over a period of several periods, then I also included the ADX indicator in the chart. At the point where I circled the blue color, we can see that there is a crossover between the green DI+ line and the red DI- line. DI+ which was initially below DI- started moving upwards until finally above DI-, this is a signal from the ADX indicator that the trend will turn into a Bullish Trend.

After that, we can see that the movement of the candlestick continues to increase until it finally breaks the Resistance Level that I previously set, by looking at the two signals given by the ADX indicator and the breakout of this resistance level, we can say that the trend in the market has indeed started to enter the Bullish Trend.

Using Another Indicator as a Filter When The Breakout of Support

After previously showing how to use the indicator as a filter for the breakout of the resistance level moment, now I will show you how to use additional indicators as a filter for the breakout of the support level signal. The indicator I use this time is still Average Directional Index Indicator which has been modified so that it has 2 additional lines DI+ and D-.

In the BNB/USD chart image above, we can see that I drew Support Levels at some of the lowest points reached by BNB in several periods, then I also included the ADX indicator on the chart.

At the point where I put a blue circle on the ADX indicator, we can see that there is a crossover between the DI+ line and the DI- line. DI+ which was initially above DI- started moving downwards until finally the DI- the line was above the DI+ line, this is a signal from the ADX indicator that the trend will turn into a Bearish Trend.

After that, we can see the movement of the candlestick continues to decline until it finally breaks through the Support Level that I have previously determined, by looking at the two signals given by the ADX indicator and the breakout of this resistance level, we can say that the trend in the market has indeed begun to enter a trend. Bearish.

False Breakout and How To Avoid It

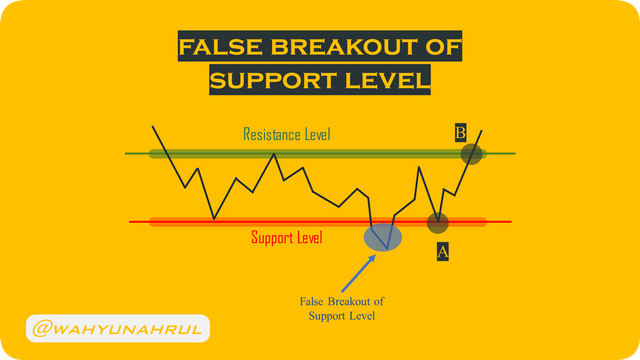

After previously I explained the Breakout that occurred at the Support Level or Resistance Level, we must have known that we should not rush into making a decision to enter a trade based on the signal from the Breakout, because the signal given could be a false signal or often referred to as False Breakout.

False Breakouts very often make many traders trapped just relying on the breakout signal, therefore we are encouraged to continue to be careful and not trade immediately on the breakout occurs. A simple way that we can do is to wait for the candlestick to return to the level area that has just been broken and experience a retest, after touching the level area that has been penetrated once again and the candlestick instead re-enters the zone between the Support Level and Resistance Level, then it can it is said that the Breakout that occurs is a False Breakout.

False Breakouts can occur at Resistance Levels or Support Levels, and usually, after a False Breakout with one of the benchmark levels, candlesticks will tend to reverse direction and breakthrough other benchmark levels, although this doesn't always happen, we can use this as a guideline that if there is a False Breakout at one level, it is likely that a true breakout will occur at another level.

In the illustration above, we can see an example of a False Breakout with a Support Level, initially, the price chart started to penetrate the Support Level but it was only temporary until the price chart finally started to return to the top and penetrated the Support Level again. Then the price fell again until it touched the Support Level once to retest as shown in point A in the picture above, but after that, the price chart began to increase in price until it broke the Resistance Level as shown in point B.

From this, we can say that the previous breakout between the price chart and the Support Level was a False Breakout. Then after the price passes the Resistance Level shown in point B, we can start entering the market when the Bullish price line has started to form.

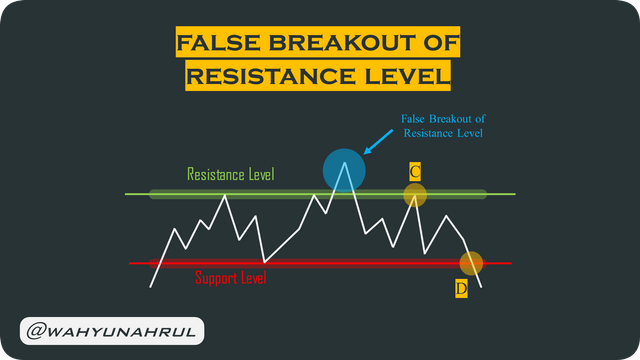

Similar to False Breakout Level Support, False Breakout Level Resistance also has the same pattern. The difference between the two is only which level breaks out with the chart line first.

In the illustration above we can see an example of a False Breakout with a Resistance Level, initially, the price chart started to break the Resistance Level but it was only temporary until the price chart finally started to go back down and penetrated the Resistance Level again. Then the price rose again until it touched the Resistance Level once to retest as shown in point C in the picture above, but after that, the price chart began to experience a decline in price until it broke through the Support Level as shown in point D.

From this, we can say that the previous breakout between the price chart and the Resistance Level was a False Breakout. Then after the price passes the Support Level shown in point D then we can start entering the market when the Bearish price line has started to form.

In order to better understand the False Breakout, I will show you a real example that I took from the chart on the TradingView platform, the market chart I took was the ETH/USD market with a 4-hour timeframe.

In the picture above we can see an example of a False Breakout with a Resistance Level. Initially, the candlesticks that were not in any trend started moving upwards until they broke the Resistance Level, but it was only temporary until the price chart started to go back down and penetrated the Resistance Level again.

Then the price went up again to retest by touching the Resistance Level once, but after that, the candlestick began to decline in price until it broke the Support Level as shown in the picture above.

This can indicate that the previous breakout between the candlestick and the Resistance Level is a False Breakout and is a false signal. Therefore we must first monitor the movement of the candlestick after the breakout, don't be in a hurry to enter the trade immediately.

There is an additional way that we can use to neutralize the false signal from the False Breakout, we can use an additional indicator as an additional signal that will be a filter for the False Breakout, this can be seen in the image below.

In the chart above, I added 2 Exponential Moving Average (EMA) lines with different lengths, one of the EMA lines I used was long 50 which I colored blue, then the other EMA line I used was length 100 which I colored orange.

Long before the False Breakout was formed, the EMA indicator gave a "Death Cross" signal indicating that the trend in the ETH/USD market was in a Bearish Trend, and even then the False Breakout occurred the EMA indicator still showed that the ETH/USD market was still in a Bearish Trend, which means the EMA does not provide any confirmation of the breakout that occurred.

From this, we can see that by using additional indicators such as the EMA indicator, we can filter out False Breakouts that occur in the market.

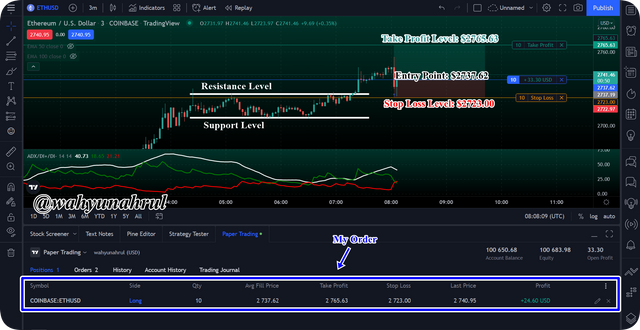

Performing Trading Analysis on Demo Accounts When Resistance Breakout

Now I will show you an example of trading analysis using Resistance Breakout on a demo account on the TradingView platform. In carrying out this trade I will use the auxiliary indicator, namely ADX as in the previous example as a filter for the signal given by the Resistance Breakout. The timeframe I use is 3 minutes.

The ETH/USD market chart was initially in a Bullish Trend, then after a while, the ETH/USD market began to experience a price that tends to be stable so I pulled the Trendline Support Level at $2706.54 and the Resistance Level at $2725.83.

In addition, the ADX indicator also shows a crossover between the DI+ and DI- lines, where the DI+ line is above DI- and this indicates a bullish trend. Then after a while, the candlestick has increased in price until it breaks the Resistance Level, this gives a signal that the trend in the market is indeed in a Bullish Trend and the price will soon rise.

Then I started to enter trades between a few candlesticks after the break of the Resistance Level. The position I entered is Long Position at the price of $2737.62, then I set the Stop Loss Level to be below the Resistance Level which is at the price of $2723.00. By using Risk/Reward Ratio 1:2 then I set the Take Profit Level at the price $2765.63.

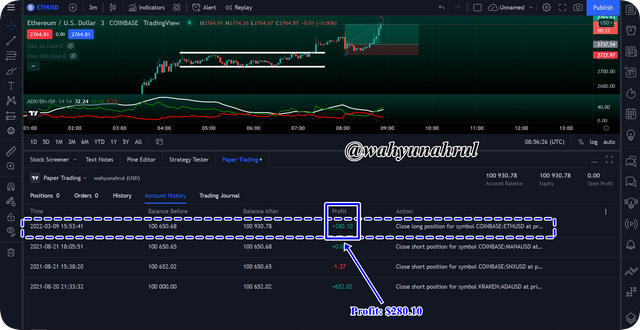

After the price reached my target take profit level, then my trading process on the ETH/USD market was over and I got an additional $280.10 on my demo account.

Performing Trading Analysis on Demo Accounts When Support Breakout

Next, I will show an example of how to analyze a trade with a Breakout candlestick with a Support Level. This example is also a trade made on a demo account on the TradingView platform.

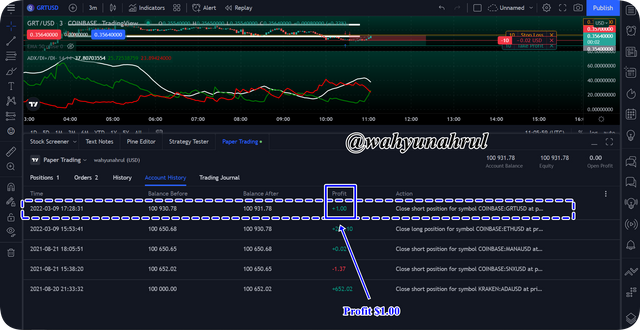

I will still use the ADX indicator as an auxiliary indicator in trading, ADX serves as a filter for the signals given by the Support Breakout. The timeframe I use is still 3 minutes.

The GRT/USD market chart was initially in a Bullish Trend, then after a while, the GRT/USD market began to experience a stable price, so I drew the Trendline Resistance Level at $0.3630 and the Support Level at $0.3563.

In addition, the ADX indicator also shows a crossover between the DI+ and DI- lines where the DI- line is above DI+ and this indicates a Bearish Trend. Then after a while, the candlestick experienced a decrease in price until it broke the Support Level, this gave a signal that the trend in the market was indeed in a Bearish Trend and the price would soon fall.

Then there was a retest on the GRT/USD market where the candlestick moved up and touched the Support Level and then reversed back until it passed the previous low. At this moment, I started to enter the trade with the position I entered was Short Position at the price $0.354, then I set the Stop Loss Level to be above the Support Level which was at the price $0.357. By using Risk/Reward Ratio 1:1 then I set the Take Profit Level at the price $0.351.

After the price reached my target take profit level, then my trading process on the GRT/USD market was over and I got an additional $1.00 on my demo account.

Last Word (Conclusion)

The breakout that occurs at the Support and Resistance Levels is a momentum that we can use to start entering trades with the most ideal price, this moment of Breakout Support and Resistance Levels is actually the most basic lesson that traders must know, because of how easy it is to use. to understand, then the accuracy of the signal accuracy is also pretty good even for beginners.

But it must be underlined that the False Breakout is part of the Breakout itself, so we also need to be patient and don't be in a hurry to make a decision to start trading, it's possible to use auxiliary indicators so that the breakout signal given by the candlestick can be more accurate and not trapped by false breakouts.

Those are some of my explanations regarding Support and Resistance Breakouts, I apologize if there are still many mistakes that you can get when reading my explanation earlier, I would be very grateful if you told me in the comments column below.

Thank you for reading my blog, hope it will be useful for all of you. 😁