The influence Bitcoin has over other cryptocurrencies cannot be over emphasized. Apart from being a trendsetter since its introduction in 2009, it has become a standard which every other cryptocurrency strive to attain.

As of the time it was developed, Bitcoin enjoy a monopoly in the cryptocurrency market, but with the introduction of other Altcoins such as Litecoin, Etherum, Ripples e.t.c, it's market dominance keeps reducing. Although these altcoins are still dependent on Bitcoin, many analysts believe that one day they will develop to an extent that they won't depend on Bitcoin anymore.

In today's class, Professor @imagen while teaching on the topic "Cryptocurrency Market" showed us how Bitcoin dominates the crypto market, and how altcoins are influenced by Bitcoins price movement. This post is my response to the assignment he gave after the class.

Question 1: EXPLAIN IN YOUR OWN WORDS, THE CONCEPT OF DOMINANCE IN THE WORLD OF CRYPTOCURRENCY. WHAT IS THE DOMINANCE OF BITCOIN AT THE TIME OF PERFORMING THIS TASK? (Present at least 1 graph).

When the word "Dominance" is used in cryptocurrency, it simply implies the level of influence a particular coin has over other coins in the crypto market. Since the concept of dominance involves comparison, the dominance of a coin is represented in terms of the ratio of its market capitalization to that of the whole crypto market.

To better understand this, let's say, that during a certain period, the crypto market's total market cap is about $300 billion and the market cap for Ripple coins at that same time is $100 billion, what this implies is that Ripples has a 33.3% dominance in the crypto market at that time.

What is the Dominance of Bitcoin at the time of the assignment

Just as explained earlier, Dominance of Bitcoin simply means the influence the Bitcoin market captalization has over the whole cryptocurrency market. As of the time when Bitcoin was created, it had a 100% dominance in the cryptocurrency market, as there were no other cryptocurrency in market competing with it.

Between 2011 and 2012, its dominance dropped to 95% due to the introduction of coins such as Litecoin. Its dominance further decreased in 2015 with the introduction of Ethereum, and by the end of 2017, it was around 37% because the total number of alternate coins were over 2,500. This is shown in the graph below.

After the unexpected crash of Bitcoin in 2017, so many alternative coins projects that couldn't withstand the fall in price of Bitcoin failed (as their prices are influenced by the price of Bitcoin). In 2018, as Bitcoin began to rise again, it's dominance grew to about 60% at the end of 2018. In 2019 it rose to 70% while the dominance of Altcoins further reduced.

In today's market, we have seen the dominance of Bitcoin declining again. This is because of the increase in the number of DeFi projects, as well as the increasing rate at which investors are investing heavily on them. As of the time of this post, Bitcoin has a dominance of 42.88%. It is followed by Ethereum which has a dominance of 20.44% and Ripple with a dominance of 2.08%. The rest of the dominance proportion are filled up by other cryptocurrencies such as Litecoin, Tether etc, as shown in the graph below.

Question 2: MENTION AT LEAST 2 TIMES WHERE THE MARKET HAD STRONG FALLS, MENTION SEVERAL AFFECTED CURRENCIES. (Use screenshots)

1ST STRONG FALL IN THE MARKET

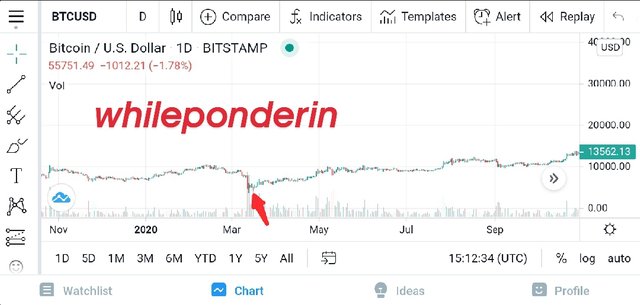

The most notable crash in the crypto market happened last year as a result of the Covid-19 pandemic. The crash didn't only affect the cryptocurrency market, it also affected the world's financial market as a whole.

As almost many parts of the world was in lockdown, most persons considered that at that moment survival was more important than investing. We even saw great business men like Jack Ma of Alibaba allegedly calling 2020 "a year of survival". This lead to a massive selling of assets. People considered having their money in Fiats than in cryptocurrency. This lead to a massive sell-of of cryptocurrencies. Some of the cryptocurrency affected includes:

Bitcoin:- Covid 19 pandemic affected Bitcoin considerably. So many persons wanted to convert their BTC to Fiat, causing so much supply of BTC in the market. As we know, whenever the supply is greater than demand, there is always a reduction in the price of the supplied asset. Thus, it didn't take up to a week for Bitcoin to fall from approximately $9100 to $4000. This can be seen from the chart below.

Ripples (XRP):- Ripples (XRP) was affected considerably by the Covid 19 pandemic. The price of Ripples (XRP) fell from about $0.243 to about $0.12 and even lower. Most analysts believed that if the value went any lower, it might been the end of the cryptocurrency, because this is Ripple's all-time low since the last market crash that happened in 2018.

Etherum:- Another coin that was affected in the market crash was Ethereum. The price of Ethereum went down from about $245 to $95 within one week. This is about 61% reduction in price of ethereum. The last time Ethereum experienced this kind of fall was in December 2018, when their was a crash in the crypto market. Below is a chart showing the Ethereum price crash in 2020.

SECOND NOTABLE FALL IN THE MARKET

Another notable crash in the market happened early this year in February. This crash was as a result of a statement issued by a government offical.

Bitcoin:- Around ending of February 2021, the US Treasury Secretary Janet Yellen during a press conference said that Bitcoin posed more threat to investors and to the public, as it was unstable and used mainly for illicit finance. As of the time she made this statement, 1 BTC was worth about $53,000 but after the statement, we saw the value of BTC falls steadily till it got to $43,000 by the end of the same week. This crash can be seen in the chart below.

BTC/USD Chart from my TradingView

Etherum:- Bitcoin wasn't the only cryptocurrencies affected after the statement. Cryptocurrencies that depends on Bitcoin began to fall within this period. For instance, Ethereum (ETH), which has hit it's all time high of $2,000 fell within this period from that $2,000 to about $1,200 in the same week. This can be seen in the chart below.

ETH/USD Chart from my TradingView

Although it didn't take time for people to forget about the statement the US Treasury Secretary made, and for them to regain their confidence in cryptocurrency, the statement has already done lots of damage, as so many persons sold their Bitcoins within the period thinking the crash will last for a long time like what happened during the Covid 19 period.

Question 3: WHAT IS ALTCOIN SEASON?

Normally, Altcoins are affected by the price movement of Bitcoin. Whenever Bitcoin falls, they fall also, just like what happens during crypto market crash. But there are certain periods or season when Bitcoin will be experiencing a price fall in the market, while the prices of alternative cryptocurrencies are rising. These periods are refered to as Altcoin Seasons.

Altcoin season occurs whenever investors channel the resources they have in Bitcoin to other alternative cryptocurrencies. Investors always do this whenever Bitcoin remains in the Bearish market for a long time, or stagnant, and therefore no longer profitable. Since the major interest of every Investor is to make profit, what they do is to remove their funds from Bitcoin and invest in other cryptocurrencies like Ether, ADA, Ripple, Binance Coin e.t.c. Immediately these investment are made, the prices of these altcoins will begin to rise outperforming Bitcoin in terms of percentage increment in price.

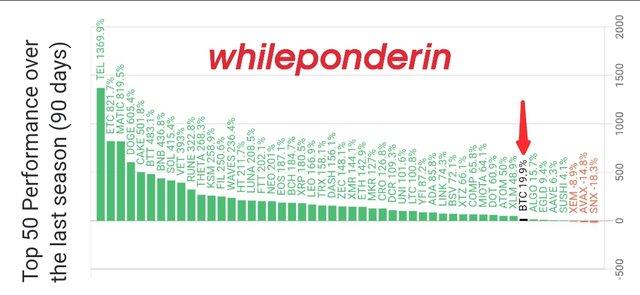

A trader can confirm if we are in the Altcoin season by studying the performance of the top fifty alternative coins. Once coins like Ether, ADA, Ripple, Polkadot, Binance Coin e.t.c perform better than Bitcoin for about 30 or 90days, then it's clear that we are truly in the Altcoin season. Below is a histogram chart showing the performance of the top 50 coins in the last 90days.

Looking at the histogram chart above, we can clearly see that Bitcoin has done very poorly within the last 90 days, when compared to lots of Altcoins. Based on this, we can say that we are in an Altcoin season.

Question 4: GIVE A BRIEF DESCRIPTION OF AT LEAST 2 ALTCOINS THAT ARE IN THE TOP 50.

To answer this question, I will be describing Ether (ETH) and Tether (USDT).

Ether

Ether (ETH) is a notable cryptocurrency built on the Etherum blockchain. The Etherum blockchain is a peer-to-peer platform that runs on smart contract. Every payment to be made on the Etherum blockchain must be paid using Ether. This is why Ether is considered to be the fuel of the Ethereum blockchain. Unlike Bitcoin whose supply is fixed, the supply of Ethereum is not fixed, rather it is determined by those who make up the Ethereum’s community.

The number of decentralized applications which run on the Etherum blockchain have increased over the year, and it still increasing. This has lead to an increase in demand for Ether, which in turn has caused the value of Ether to rise. As at the time of this post, 1 ETH is worth about $4,270. Based on market cap, Ether is currently the second largest cryptocurrency after Bitcoin.

Features of Ether

You can own, buy or sell very little fractions of Ether as it can be divided to about 18 decimal places.

You don't require the services of a third party to control your funds. You can simply managed your funds using your wallet.

Ether is secured, as all records of transactions are stored in blockchains.

Ether is both global and decentralized. This means no one has complete control of the system, and every decision or changes to be done on the platform must be done unanimously.

Ether Market Stats, coinmarketcap

| Market Stats | Overview |

|---|---|

| Ethereum Price (at the time of assignment) | $4,270.65 |

| Price Change 24h | $214.77 |

| 24h Low / 24h High | $3,901.47 / $4,360.43 |

| Trading Volume 24h | $54,531,284,496.39 |

| Volume / Market Cap | 0.1109 |

| Market Dominance | 19.72% |

| Market Rank | #2 |

Tether (USDT)

Tether (USDT) was designed to be a stablecoin. This implies that it was designed not to have a volatile nature like most cryptocurrencies in the market such as Bitcoin and Ether. Tether became popular among investors in 2018 after the world experienced a market crash.

The non-volatile nature of Tether is based on the fact that it is designed to always have a worth of about $1, and even if their is a crash in the market, it not expected to be more than 9 to 10 cents below the value of $1. This makes it a very safe coin to save your cryptocurrencies in, as you won't lose lot of money even if the cryptocurrency market crashes.

Features of Tether (USDT)

Tether is designed to be always at a ratio of 1:1 to the US dollar. This gives the investor a peace of mind that his coin can always be converted back from cryptocurrency to it's equivalent amount in USD, regardless of if the market crashes or not.

Due to its 1:1 ratio with USD, platforms such as PayPal use it as a global means of payment. This is because making payment using USDT is like making payment with the USD. For instance let's say you wish to send someone $10, you can send the person 10USDT as both of them are valued the same.

Tether Market Stats, coinmarketcap

| Market Stats | Overview |

|---|---|

| Tether Price (at the time of assignment) | $1.00 |

| Price Change 24h | $-0.00004026 |

| 24h Low / 24h High | $0.9998 / $1.00 |

| Trading Volume 24h | $162,085,052,705.79 |

| Volume / Market Cap | 2.83 |

| Market Dominance | 2.29% |

| Market Rank | #5 |

Question 5: HOW CAN RELEVANT NEWS INFLUENCE THE PRICE OF THE CRYPTOCURRENCY POSITIVELY OR NEGATIVELY? NAME AT LEAST 3 EXAMPLES. (Use screenshots) (Example: SENSO announced a 70% token burn, in a week the price increased more than 100%)

Cryptocurrencies are very volatile, and due to the fact their investors make decisions based on current happens, every news related in any way to cryptocurrency can either increase or decrease it's value. I will be giving three examples that shows how the price of cryptocurrencies were affected greatly by events broadcasted on the news.

1. SHIBA INU (SHB)

Earlier this week, Binance announced that they will be listing SHIBA INU to the exchange. This news came around past 8 in the morning. Everyone knows that Binance is the most reputable exchange in the world, and before they list a coin into its exchange they must have verified it, and they are certain investing in it is going to be profitable. So, the listing of SHIBA INU to the exchange wasn't a small news at all.

During the time this was announced, SHIBA INU was worth about $0.00001746, not too long after its enlistment, it's price rose to $0.00003531, almost 100% increment. This rapid rise in value can be clearly seen by considering the chart below.

2. Bitcoin and Elon musk's tweets

On 29th January 2021, Elon Musk, the founder of Tesla, Inc., an American car company, changed his Twitter bio to #Bitcoin, the tweet was carried by several blogs and news outlets that within the next few hours, we saw the price of Bitcoin rise from $32,000 to almost $38,000.

Effect of the tweet on BTC.

Another time in March 2021, he tweeted, "You can now buy a Tesla with Bitcoin" immediately, the price of Bitcoin rose to $55,000.

Effect of the tweet on BTC.

For both of these tweet, one thing is common; Elon musk was able to change the price of BTC by influencing the sentiments of the investors. The news outlets made it very easy for him by broadcasting it to a larger audience, even to those that are not on twitter.

3. Ripple and the US SEC lawsuit

United States SEC sued Ripple on 22nd of December 2020 for unregistered security offerings. According to the claims made by the US SEC, the tokens sold by Ripple in 2013 during their initial coin offering was not registered under SEC. The lawsuit was about $1.3 Billion.

The SEC lawsuit caused a lot of panic, as investors began to sell their Ripples. This massive selling of XRP caused the price of Ripples to fall considerably. Even the move by many exchanges to suspended the buying and selling of XRP in their platforms, made matters worst and caused further devaluation of ripples (XRP). The news caused the value of Ripple to fall from $0.58 to $0.22 within 5days.

From all these, we can see that what people read on the news influences their decision of whether to invest or not to invest in a cryptocurrency. This is why it's important as a cryptotrader to carry out a fundamental and sentimental analysis in addition to technical analysis when investing on a cryptocurrency.

Question 6: DESCRIBE ONE OF THE FOLLOWING PENNY CRYPTOCURRENCY: SHIBA INU, SAFEMOON, OR ECLIPSE.

I will be describing Safemoon.

SAFEMOON

Safemoon is one of the penny cryptocurrencies that have drawn lots of attention to itself since it was launched. Built on the Binance Smart Chain (BSC), this Safemoon is a community-driven DeFi token. What this implies is that the growth of the token is totally dependent on how large and strong its community is, and how frequently the token is used.

The reason why most penny cryptocurrencies fail is because of the fact that their investors sell off all their asset after the token has yielded a reasonable amount of profit. In other to avoid this, Safemoon was designed to reward the users who hold it more than the user who sells it. Each time a seller wishes to sell some of his Safemoon tokens, he is expected to pay a 10% fee. The first 5% of this 10% fee is redistributed to everyone who holds safemoon. The remaining 5% is used to increase the liquidity of BNB on PancakeSwap.

Currently, there are about 1.9 million Safemoon holders, and Safemoon has a strong community of about 638k followers on Twitter and 135K members on Telegram. These numbers are increasing daily as many persons are joining the community.

To further increase the worth of Safemoon tokens, on 27th of April, Safemoon announced through their tweeter handle the burning of 41% of the total supply of Safemoon using the proof of Burn consensus algorithm. This news resulted to an increment in the size of their community. Apart from that, the burning of 41% of their token raised the value of Safemoon, as the scarcity of Safemoon tokens resulted to an increase in the value of the remaining Safemoon tokens. As of the time of this post, Safemoon is worth $0.00000821.

The graph below shows the constant progress Safemoon have made since it was launched.

Safemoon intend on having it's not own exchange in the nearest future with Safemoon as it's native currency, (just like Binance and BNB). If they ever achieve this, it will be a launching pad that will shoot Safemoon from a penny cryptocurrency to a more relevant cryptocurrency.

CONCLUSION

Although Bitcoin still reigns supreme, it seems as if investors are now investing heavily on alternative coins, such as Ether (ETH) and even on penny cryptocurrencies like Safemoon, while they use Bitcoin majorly to pay for the things they buy.

One may not see the danger in this at first glance, but it's worth noting that what's grows a cryptocurrency is not just it's usage, but rather the rate at which investors invest in it. With the way things are going, Bitcoin will soon have a strong contender for it's number one position, as it's losing its dominance in the crypto market. I can't actually say if this is a good thing or a bad thing, but I believe that the best thing every trader should do is to be on alert, so as not to miss the train just as most of us did the last time (in the "Bitcoin train").

Thank you professor @imagen for the amazing lesson.

Hi professor @imagen, you still haven't reviewed my post. Pls sir. This is the fourth day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Professor @imagen and Professor @pelon53. Please, my assignment is now five days, and am really getting worried sir. Pls review my post sir.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola @whileponderin

Gracias por participar en la Academia Cripto de Steemit.

En líneas generales tu publicación está bien completa.

Calificación: 8

Si la publicación se vence y no has recibido el voto del curador, por favor escríbeme a mi Discord.

andriuh#7029

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @imagen. Although I sincerely hoped to get more than grade 8 in the assignment, but am sincerely grateful that you have reviewed it. I will let you know if @steemcurator02 doesn't curate it before it expires. Thank you again professor @imagen. God bless you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Professor @imagen please, am yet to be curated by @steemcurator02 after being reviewed by you. In the review, you rated me 8. Pls professor, can you help me? The post will expire in few hours from now pls.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much Professor @imagen. Am so grateful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit