Hey guys,

I welcome you'll to the 8th week of the SteemitCryptoAcademy course by Professor @reddileep. In this course, I will run a comprehensive review on Advanced Technical Analysis Using Fractals.

All images used in this post unless otherwise stated are not mine and were extracted from coinmarketcap, for the purpose of this assignment.

Question 1

Define Fractals in your own words

Fractals are known as a repeated pattern on the chart which can either be bullish or bearish. In fractals, a pattern that has happened in time past can still repeat itself later in the future, so fractals happen when the pattern has been repeated and it deals with the study of the repeated patterns.

It is important to know this analysis because it helps to predict accurately how that thing that had happened in the past can happen again in the future. Fractal is a technical analysis and technical analysis deals with the understanding of the candle pattern and how they are related to the market so as to be able to make effective trade. This analysis can’t be easily understood by beginners, because it is for professionals and the beginners have a lot of things to learn before they arrive here because it is an advanced analysis, but every professional that understood this pattern will make the best use of it as it will make good profit for them via the market and the trade.

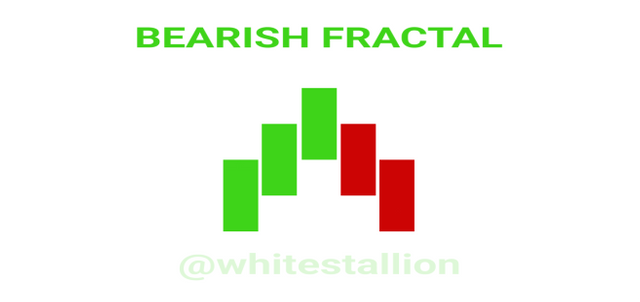

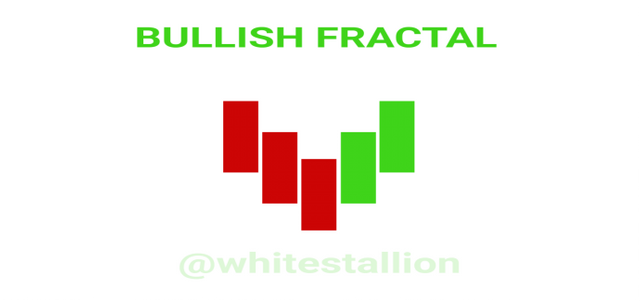

Fractal is part of the most basic repeating pattern in the market of technical analysis. Fractal consists of at least 5 bars i.e. the candle, 2 to the left, 2 to the right, and one at the middle, since it’s possible to be either bearish or bullish, for the bearish pattern of the fractal the market moves from a downtrend into an uptrend and it only constitutes of 4 higher lows and 1 lowest low, while the bearish pattern of the fractal the market moves from an uptrend into a downtrend and it constitutes of 4 lower high and 1 highest low.

The above fractals show the bearish trend formation and also the bullish trend formation in the market. As it is known and earlier stated that fractal is a repeated pattern in the market chart, which is also a part of the advanced chart technical analysis. Whenever a bearish pattern happens in the market the pattern is sure to be repeated in the market, so it will be discovered using fractals.

Question 2

Explain major rules for identifying fractals. (Screenshots required)

Identification of fractals, although might not be an easy job, is very easy to be identified or to be predicted using effective indicators and analysis. The pattern cannot be identified by a beginner except by a professional, and the basic rules of identifying fractals can be seen below;

A. In the formation, 5 candles must be seen or detected, to effectively identify a fractal as the will be either 4 lower high, 1 lowest high, or 4 higher low, 1 highest low. Although the number of the candles can also be more than 5, but if the number of the candles is less than 5, it cannot be said it will be effective or concluded that it's a fractal.

B.Fractals are divided into two. The bullish and the bearish fractals.

The bullish fractals happen (because basically fractals are said to consist of 5 candles) when there are the lowest lows and 4 lower low, while bearish happens when there's a highest low and 4 higher low.

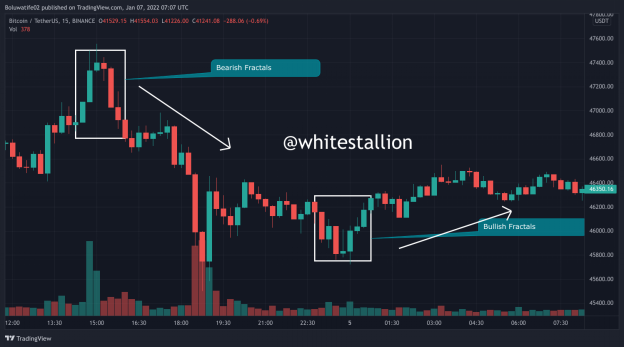

Since this is defined, then they can be identified on the market pattern, let us see them on the market pattern before continuing.

In the above image, the bearish fractals, bullish fractals, and also bearish fractals are identified in the above image. In the above image, a pattern has repeated itself already and that is the bearish fractals that happened twice.

C. As stated in B above, we have bullish fractals and bearish fractals, their identification is simple, as I have explained them and defined them when explaining fractals.

- Bullish Fractals: This can be identified by the candlesticks or bars, as fractals are technical analysis. So, bullish fractals can be identified by 4 lower low and the lowest low.

- Bearish Fractals: Bearish fractals can be identified by 4 lower high and a lowest high.

Question 3

What are the different Indicators that we can use for identifying Fractals easily? (Screenshots required)

The indicators used to identify fractals are listed below.

Fractal Support Resistance

Fractal Indicator

Williams fractal trading indicator.

Let’s take a look at each and every one of them.

- Fractal Support Resistance

To add Fractal Support resistance, do the following.

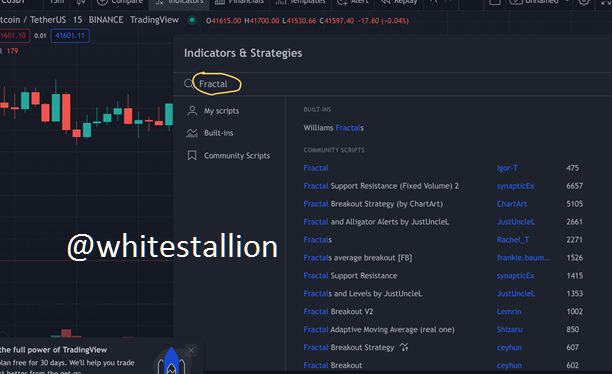

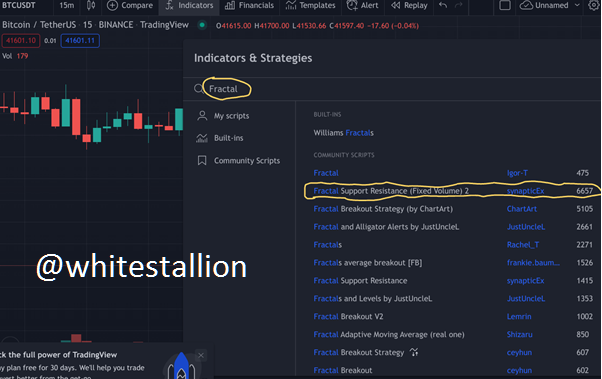

- Head to Tradingview and on the panel at the top, you would see indicators,

- Click on it and type in Fractal.

- Then click on Fractal support Resistance (fixed volume) 2.

- After then, it will then show on your chart and look like the image below

- Fractal Indicator

The below process is the method of adding a fractal indicator into the market chart.

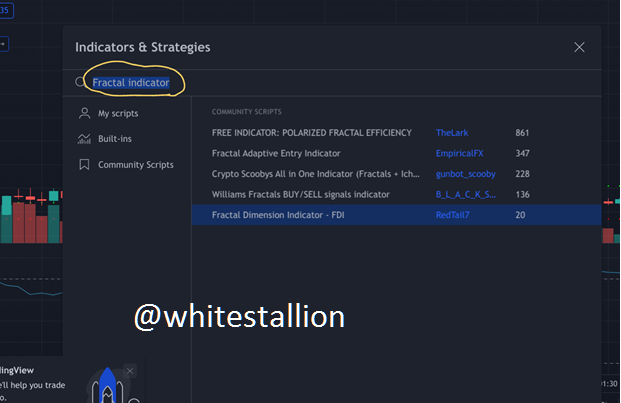

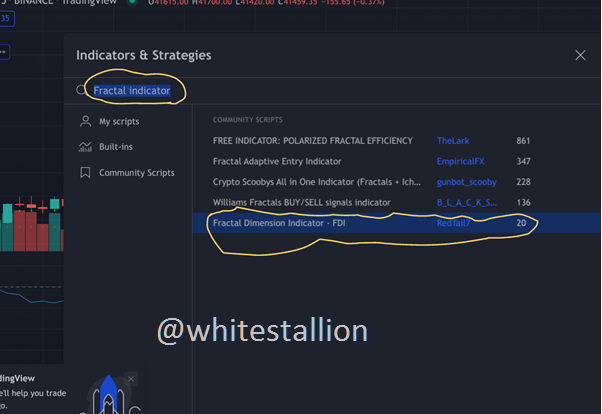

- Head to Tradingview and on the panel at the top, you would see indicators,

- Click on it and type in Fractal indicator, and select it.

- After it is selected, it will show on the chart like this.

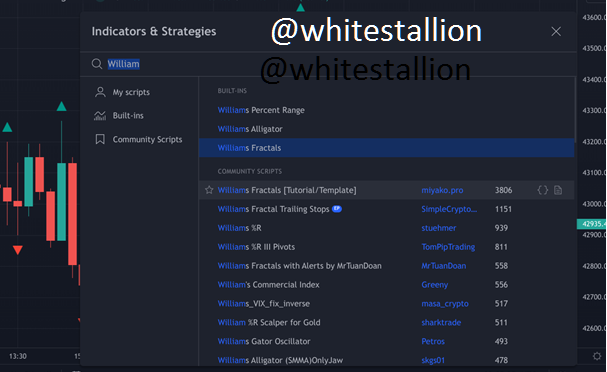

- William Fractal Trading Indicator

The following steps will help place the William fractal trading indicator on the market pattern.

- Head to Tradingview and on the panel at the top, you would see indicators,

- Click on it and type in the William Fractal Trading indicator, and select it.

Question 4

Graphically explore Fractals through charts. (Screenshots required)

The indicators mentioned above can be used to accurately identify fractals. However, this analysis will be limited to just an indicator.

Now, a comparison needs to be done on the chart with the past market formation. It is necessary to check, to confirm that maybe the pattern of the market in the past bull run is synonymous to the present chart.

In the tool panel of the trading view platform, there is a special tool to easily copy and paste chart patterns and it is named Bars pattern tool.

- Select this tool (Bar pattern), and draw a line (the tool) from left to right, at the market pattern that you want.

- Afterward, the chart pattern will be copy and pasted through this tool into a moveable market chart.

- Then we can now move the pattern (Copy and pasted pattern through the bar pattern tool) into a desired point on the chart.

Question 5

Do a better Technical Analysis identifying Fractals and make a real purchase of a coin at a suitable entry point. Then sell that purchased coin before the next resistance line. Here you can use any other suitable indicator to find the correct entry point in addition to the fractal. (Usually, You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern)

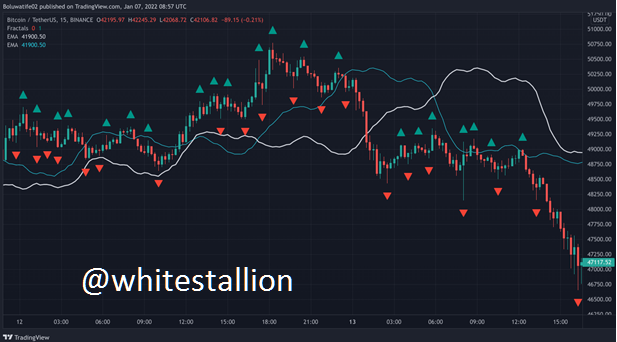

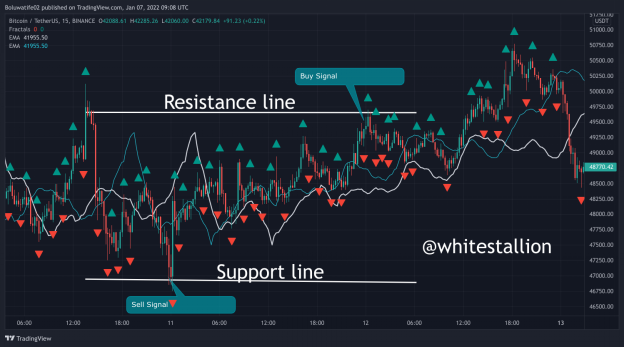

Since our instructor decided to use the William Fractal Indicator, and exponential moving average, I decided to do the same also.

This is the complete setup of my chart.

The william fractal indicator shows two arrows with different colors, Red and Green. The Red color shows the best time to buy assets, while on the other hand, the green color shows the best time to sell assets.

Also, signals from the exponential moving average should be confirmed. When placing the buying position the 20 periods EMA period should be above the 50 periods EMA period, but when placing the selling position the 20 periods EMA should be below the 50 periods EMA.

Conclusion

Fractal analysis is just one of the numerous technical tools that can aid traders to make profit in trades. One of the easiest way to make profits in trades is through riding the trend but, fractals make it even more interesting. Its ability to depict repeat in patterns can help all financial markets traders smile at the bank.

Special thanks to Professor @reddileep