Hello friends and welcome to my assignment task by professor @fredquantum, In this assignment, I will provide a detailed review of Zethyr Finance and lending services. I hope you enjoy the class.

All images used in this post unless otherwise stated are not mine and were extracted from Tradingview, Binance, and MT5 for the purpose of this assignment.

Question one

What is Zethyr Finance?

Breaking both words, we get the concepts “Zethyr” and “Finance”. Zethyr is basically a financial system. Financial systems are as old as a man as it has been in existence since the time of trade by barter system of transactions up until our present-day system of trade. It has been a big drive in the progress of financial systems all over the world.

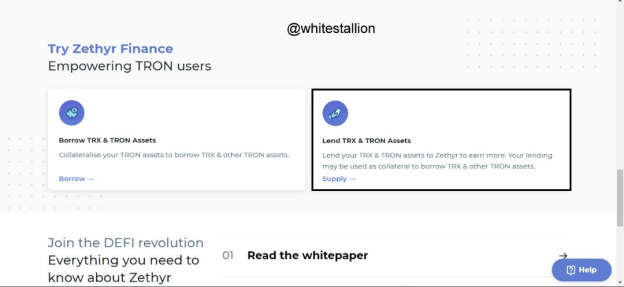

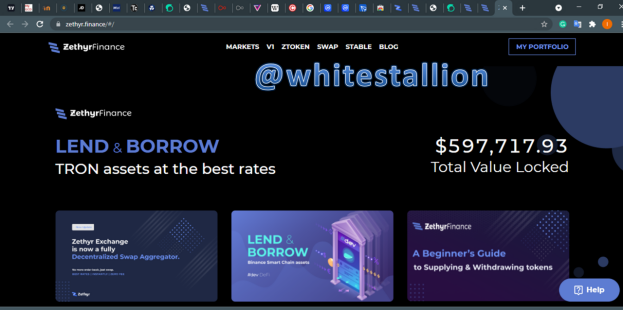

That brings us down to our question –WHAT IS ZETHYR FINANCE? Zethyr finance is a TRON decentralized financial system combining profits from both centralized and decentralized systems across the market for the best profit combined. Zethyr is the top trending application on the TRON blockchain, making it easy for users to borrow and lend their TRX &TRON assets profitably. This is done through a process known as supply and Borrow. Zethyr has come to make a change. It has made it easier for us to either leave money in our local account or in cryptocurrencies. On its white paper, it regards itself as the missing piece that TRON requires to be a robust financial system like the USD helping its use cases in general. It consists of a DEX aggregator also based on Tron basically that syncs centralized and decentralized exchanges across all markets.

Question 2

What are the features of Zethyr Finance? Discuss them.

Zethyr Finance has quite amazing features; as stated in the definition earlier, it includes platforms that allow for borrowing and lending. It usually does this by allowing those who intend to be a part to have Z-Token (more of this is to be explained later in the course of answering this assignment) however, for this process to occur, users lend through a means called “supply in order” and the process of borrowing is called “Borrow”.

Aside from it being a tool for lending and borrowing, it aids cross-chain swap of stable coins. The swapping of stable coins is known as “cross-swap”, it is mostly used in instances of swap between TRC 20 and ERC 20 but it is not limited to these assets, although this is only available on the USDT platform. The feature that allows this exchange to manifest is referred to as DEX. Zethyr exchange is the only borrow/lending platform that allows this exchange to manifest.

The Aggregator feature is another stand out feature of Zethyr, while the next question on it will be on the definition of DEX aggregators, the Zethyr DEX aggregator is a compilation mechanism of swaps and exchanges, this compilation is for the sake of comparison; providing instance to obtain best rates for the user.

What's your understanding of DEX Aggregator?

A DEX is short for Decentralised Exchange. A DEX Aggregator is a financial feature for DEX’s that offers best swap rates on DEX’s by optimizing slippages, and token prices. They came about as a result of the increase in DeFi’s.

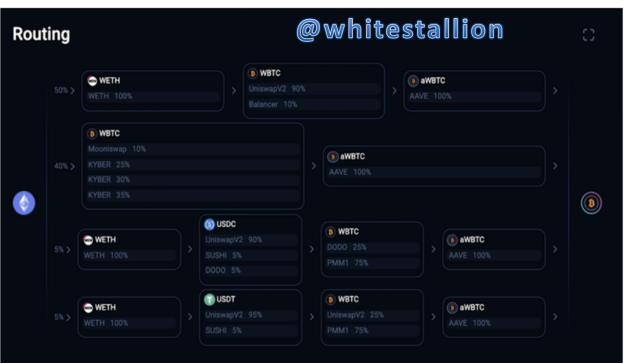

The DEX aggregator in the Zethry Finance Market is basically Zethry Finance feature that as its name suggests allows for aggregation or compilation of information and provides for comparison of fundamental components like price of security, liquidity, etc.

Another instance of a DEX aggregator is the Pathfinder Swap, it looks like this:

The Pathfinder Swap is available on 1inch’s recently released protocol (version 2), it supports swapping of 21 currencies and it boasts to be the “leading DEX aggregator”, this is because when users want to make a swap on the platform, it handles this by splitting the process across different protocols for the sake of getting the best rates and the Pathfinder DEX is able to work on multiple blockchains.

Question 3

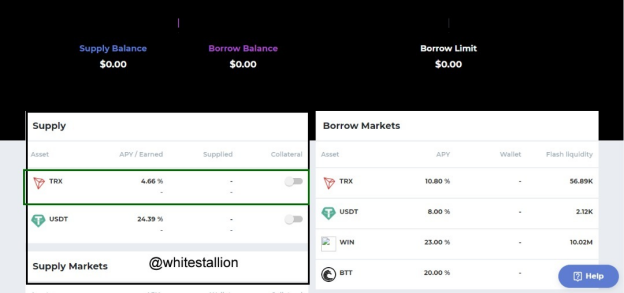

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

On the Zethyr finance market platform as said earlier, lending/borrowing is one of its features and the aim here is to show how much efficiency can be accorded to the finance market especially as it relates to a comparison based on APY’s (annual percentage yields). In other to access the Zethyr Finance Market, you use the website

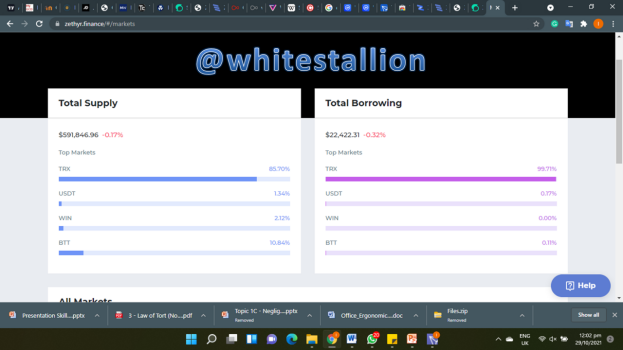

After this, one can see the ZToken feature the Market feature and a whole lot of others, but for this section, the main feature is the market feature. When we click on the market feature, we see this:

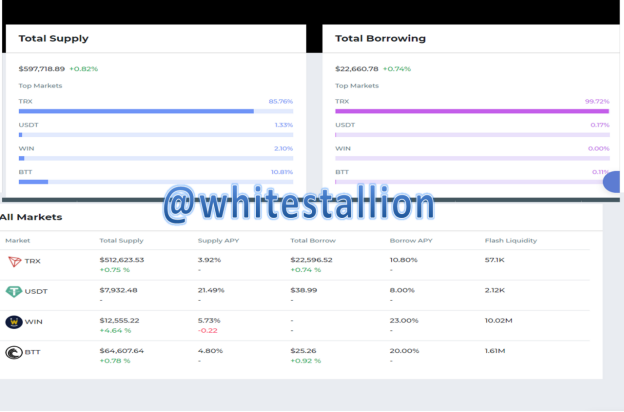

The deduction from this exploration is that the total supply as at the time this was done is $597,718.89 with TRX contributing to 85.76%, USDT contributing to 1.33%, WIN contributing to 2.10%, and BTT contributing to 10.81%. On this deduction, we see also that the total borrowing is $22,660.78 with TRX taking 99.72% majority of transactions, USDT on 0.17%, WIN on 0%, and BTT on 0.11%. These percentages make up the APY’s on the system and the Best Supply APY is conclusively the TRX while the highest Borrow APY is the TRX as well.

Question 4

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

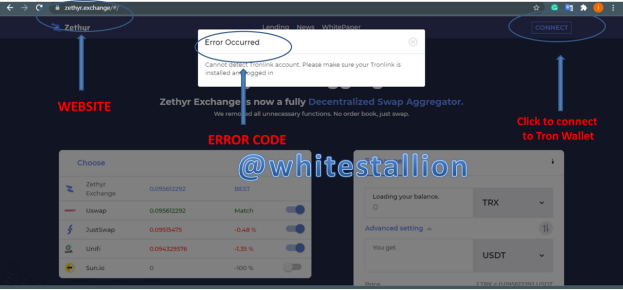

- The first step is to log into the Zethyr Finance exchange website: www.zethyr.exchange and below is what we see at login:

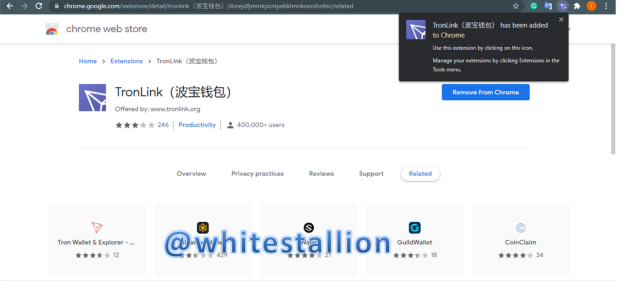

- From the above, it is visible that the website was entered, and just at the right-hand corner is a connect icon, when clicked, the error code pops up indicating that this is done without linking of the PC to Tron Wallet and this is essential, so I do this first as can be seen below.

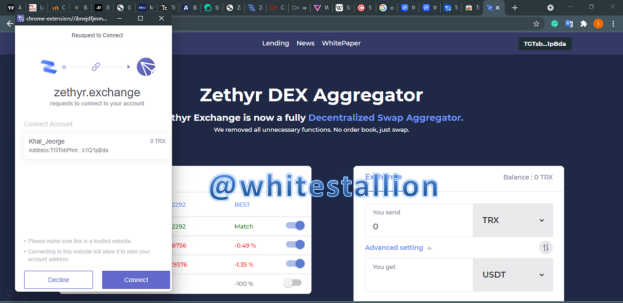

- After I link up and log in to my Tron account, I return to the previous page and click on the connect icon, and below is what I get.

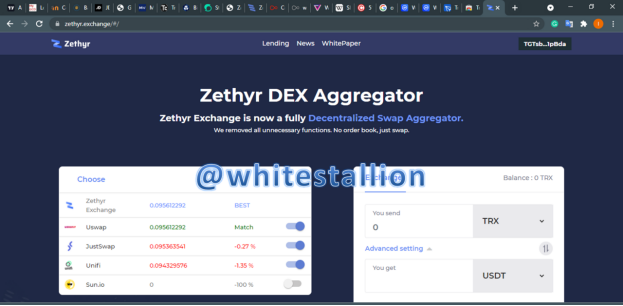

- I get an option to connect Zethyr exchange to Tron Wallet, and so I proceed to do so, and boom! I am connected in as can be seen below.

Question 5

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

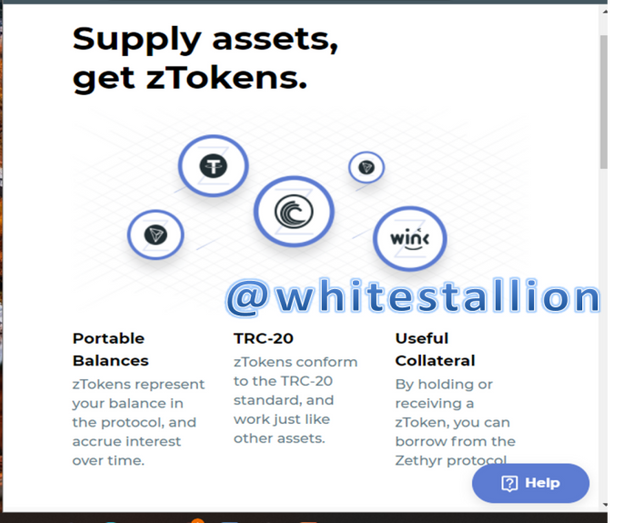

It was quite tough to find anything on Z-Token to make my research on without visiting its host website: Zethyr.finance. The reason for this is unknown to me, but to the best of my knowledge, Z-Token is a digital representation of earnings and expenditure exchange on the Zethyr finance platform. Basically, it is the means of spending for users of the Zethyr Finance protocol, it aids in borrowing as well as it is a representation of profits made.

They are usually pegged 1:1 to the currency brought as exchange. They are like wrapped currencies but with “Z” as initial. For instance, a user that brings in BTC to trade on the Zethyr platform would have his BTC changed to ZBTC; BTC=ZBTC. Basically, like the explanation of wrapped coins in the previous class, Ztokens give full benefits of the Zethyr platform to users who hold their token in another platform; however, it is limited to 4 securities: USDT, TRX, BTT, and WIN.

Furthermore, holders of the Z-token are those who have the power to make changes or suggest them on the protocol simply by voting.

Question 6

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

- There above is the home page for Zethyr Finance Market where I want to make my transactions for this assignment. To accomplish this, I will use TRX as can be seen below.

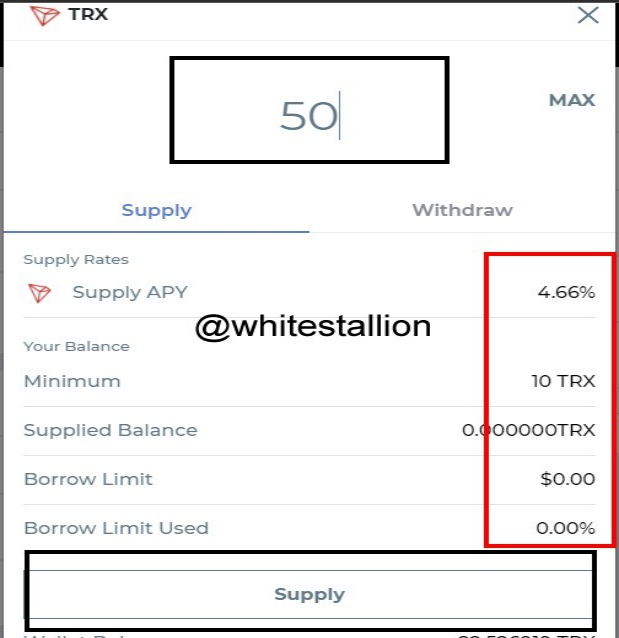

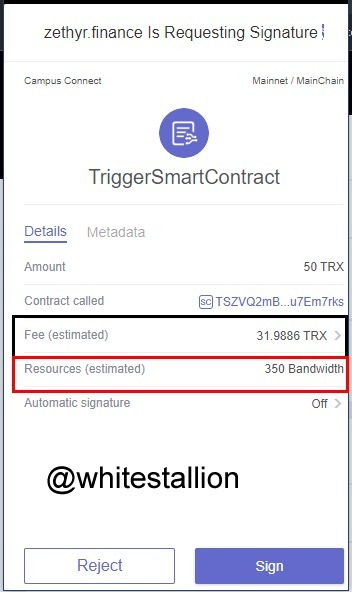

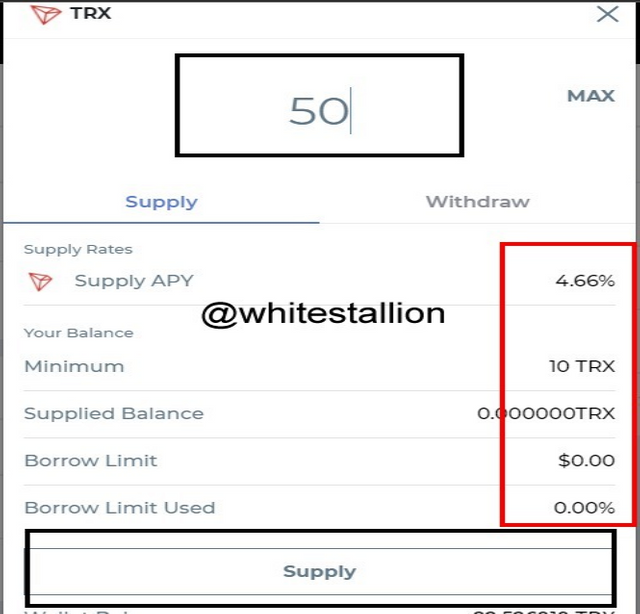

- Having clicked on the supply icon as seen above, of which I choose to use 50TRX as can be seen below:

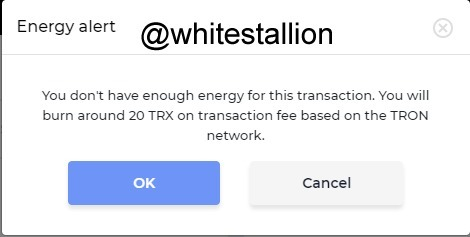

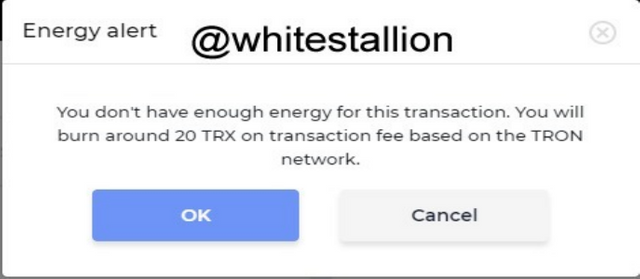

- Burnt 20 TRX in order to have enough energy to process the transaction.

- Transaction Summary.

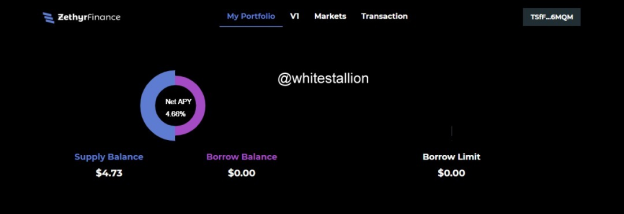

- As can be seen here, the estimated fee is 31.9886 TRX. I am then made to sign in for confirmation and below is the end result.

Question 7

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

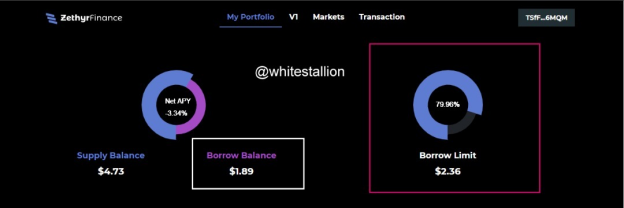

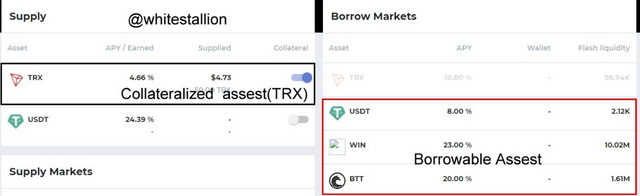

- A similar process done in the supply is done in this process but after accessing the first page (the home page as seen below:

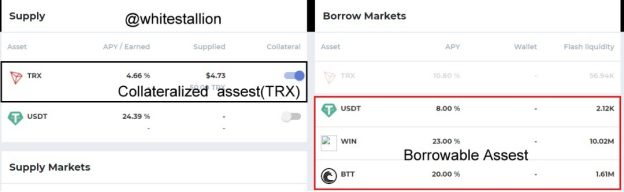

- I click on borrow having been prepared to collateralize my TRX (50 USD worth) for USDT/WIN/BTT as can be seen below:

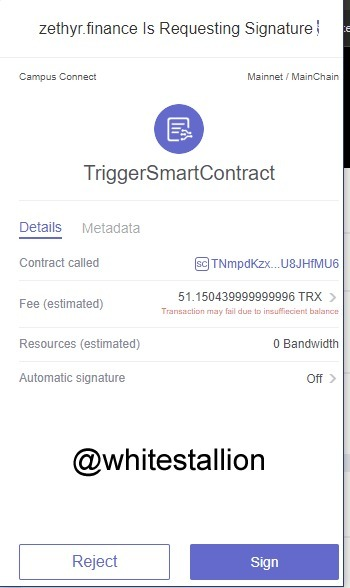

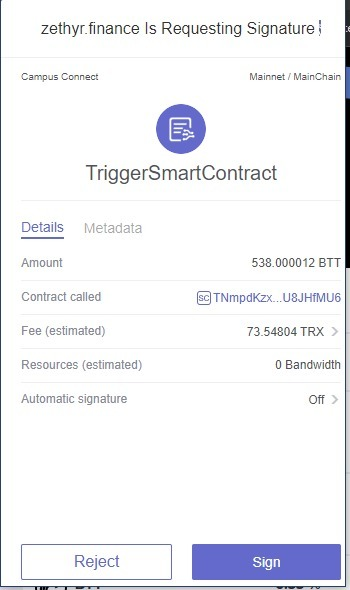

- I then have to confirm this transaction by signing in as can be seen below:

- The estimated fee involved for this transaction in 51.1504399999999996 TRX. And behold! The end result!

Repayment and Decolatarization

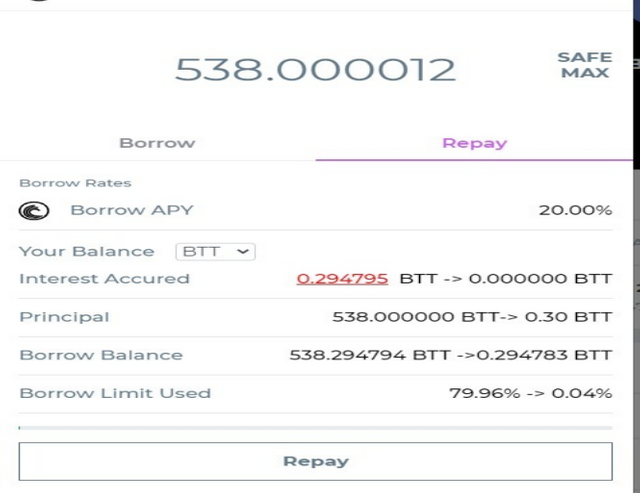

- Repayment and Decolatarization is just as easy and straightforward as the initial action, first, we have access the borrowing page and select Repay.

- Confirm and Authorise transaction by signing, and its done.

Decolatarization

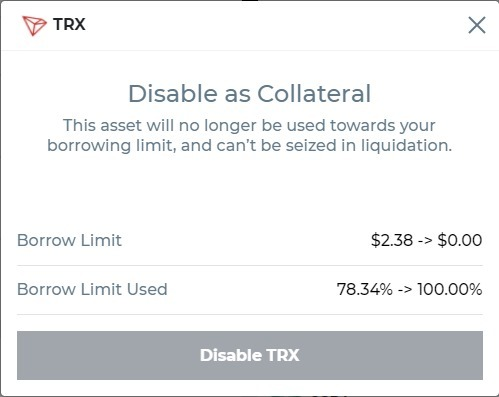

- Click on the switch icon to decolorize your asset, in this case, TRX

- Confirm Decolatarization and the asset will be decolorized.

Question 8

What do you think of Zethyr Finance? Is it great or not? State your reasons.

In my opinion, the Zethyr finance is great for many reasons, it tackles user issues related to decentralized exchange and most enticingly, its lending/borrowing feature is fair. Its collateral ratio is one of the reasons I think it is great being:

The fact that it is built on the TRC-20 token makes it more delightful to me. It also has a liquidation mechanism that helps protect the principal (interest accrued) of lenders through multiple means like refilling of lending pools, etc. However, I think that these great features suffer from being known to people and being exorbitant in the prices it charges for its processes, for instance in the situation of lending/borrowing and withdrawal, a 5% fee is charged and in my opinion that is quite outrageous. However, on the exchange’s whitepaper, there is a promise to see that things get cheaper as time goes by.

Conclusion

In my opinion, this part of this essay should be fused with my opinions on Zethyr Finance, however, for the sake of an overall deduction, I would say that conclusively, this has been an enlightening encounter, learning about DEX swaps, DEX aggregators, Zethyr Finance Market, etc. Particularly in the course of my research, I stumble upon the white paper of Zethyr exchange and the first paragraph sounded rather boastful of Zethyr claiming they were what needed Tron to be complete but this entire assignment pursuit has been enlightening as to why they take that stance; especially as it can be seen from the above.

Special thanks to Professor @fredquantum

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit