Hey guys,

I welcome you'll to the 2nd week of the SteemitCryptoAcademy course by Professor @reminiscence01. In this course, I will run a comprehensive review of Trends Part 2.

All images used in this post unless otherwise stated are not mine and were extracted from [MT5](www.metatrader

5.com) and Tradingview for the purpose of this assignment.

Question One

Explain your Understanding of Trend Reversal

Trend Reversal

Having an in-depth knowledge of when to go long or short in a trending market will always go a long way in ensuring we don’t lose money as traders as well as entry-level that set up due to price action.

Trends in a simple term mean a period in which the market moves in a particular direction for a long extent of time. This however does not mean that trends will always last for long.

This is so since the market is bound to see bearish, bullish, and consolidating moves forming all as a result of active buyers and sellers trying to push the market into an uptrend or a downtrend.

However, this major push most times does always cause a major change, significantly affecting the overall movement of the market thereby leading to a trend reversal.

Understanding reversals and all that it comprises will always give you an understanding of trend movements and therefore aid in ensuring you leave the market as at when due.

An example of a trend reversal from a downtrend to an uptrend can be seen in the chart below.

We tend to see price action in the bearish move forming more successive lower highs (LH) and lower lows (LL). By this, we expect the market to continue in the trend in a bid to ascertain its downward move.

However, on getting to a certain point in the market, there was a major pullback which turned the price around and then continued with a bullish move which now form more subsequent higher highs (HH) and higher lows (HL).

Trend reversal cannot be significantly defined or determined unless traders watch out for certain signals or patterns. This nonetheless means as a price action trader, you will be doing an extra layer of work in ensuring that you are well familiar with different reversal patterns that do form on your chart.

- Price Action Reversal Patterns

Reversal patterns are quite efficient in indicating or giving out early clues whenever a movement either bullish or bearish is coming to an end.

Normally, trading reversals can be easily read through the market structure. Take a bearish trend for example in the chart placed below.

It can be seen that the market was unable to create a new lower high and then resulted in power being transferred from the sellers to the buyers. This created a break in market structure which before the pullback had more successive lower highs and lower lows.

This knowledge can however help traders be well educated of when to leave a bearish activity, confirm if there is a reversal or just a false pullback and then enter based on analysis of the market movement.

Yet, being informed of these alone cannot sufficiently guarantee a reversal sometimes as there is always more to trading in the financial market.

Your understanding of certain reversal patterns coupled with good technical analysis can enable you to take profits off trades and leave the market when reversals are bound to occur while also setting up for a new entry-level.

Quickly, let’s go through a few reversal patterns you can always use for confirmation whenever major reversal patterns tend to occur.

- Head and Shoulder Pattern

The head and shoulder pattern is a well-known pattern possessing a swing structure that is in comparison with a person’s head and shoulders.

An image of a bullish head and shoulder reversal pattern is shown below as formed on the 30 minutes chart of the Crash 500 Index.

These reversal patterns shown above do come in two variations. The first variation is the one shown above and is commonly referred to as a bullish head and shoulder pattern and the other is the bearish head and shoulder reversal pattern.

Merely looking at the pattern formed on the chart shown above, it can easily be likened to an individual standing with his head straight and his shoulders aligned with one another.

For instance, you can see a head and shoulder pattern form either with one of its shoulders a little bit higher than the other, or the distance of length between the head and the two shoulders can be a bit smaller or larger than what has been illustrated above.

These differences however do not alter what they indicate in any way. As long as the head is found in between the two shoulders, it is a head and shoulder reversal pattern.

Before moving on, below is another example of a bearish head and shoulder reversal pattern, otherwise known as an inverse head and shoulder pattern just for its inverted position.

Making use of these variations is a lot very efficient as they are made up of a swing structure you can always make good use of. Nevertheless, making use of this pattern to trade simply means waiting for the price to break through the neckline, which is formed as a result of the swing low that formed below after the move up creating the head and the swing low that formed creating the right shoulder.

- Wedge Reversal Pattern

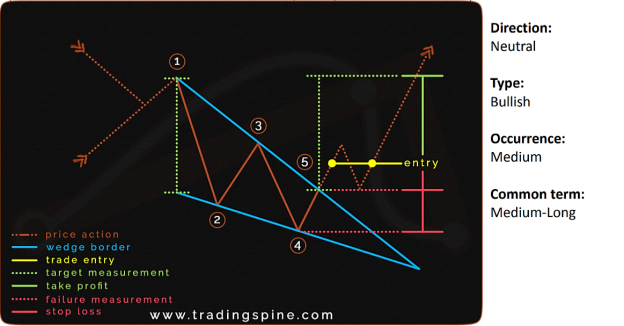

The wedge consists of falling and rising wedges in two patterns that got their name from the contraction that do occur in the market before the end of a bearish move or a bullish move.

Wedges typically are in different patterns in the financial market. i.e they can either be used to confirm a continuation of a trend or reversal into a new trend. Thus, the move before the pattern formation does not mean much. Above is an image that depicts what manner of market structure has to form before the use of a wedge can be fully utilized. The diagram above nevertheless is a falling wedge and is used to confirm a major pullback into an uptrend or simply trend continuation. However, this pattern should always be supported with other tools to check for valid confirmations.

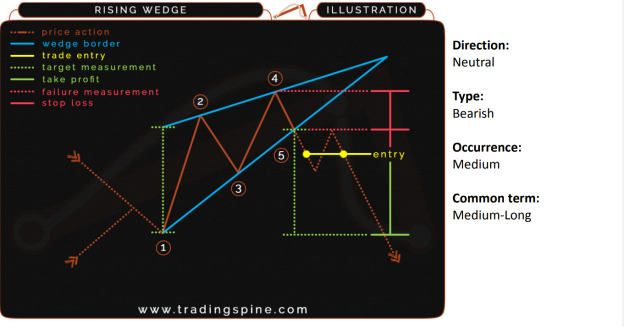

The image below illustrates also how a rising wedge can be used to detect trend movement.

- The Advantages of Recognizing Reversal Patterns in the Market

Understanding trend reversal patterns will be of very high importance if traders can quickly identify various patterns that form on charts, thereby, prompting them to take decisions on what next to do in the market.

Being able to recognize patterns formed as a trader does allow for quick withdrawal out of positions in a bid to protect profits and reduce loss while also giving traders the advantage of buying or selling the reversal whenever it is eventually established.

How a Fake Reversal Signal Can Be Avoided in the Market

Fake Breakouts as its name implies price suddenly reversing quickly but failing to continue beyond a certain level. It is when the price temporarily moves below or above a certain key level but later returns to that same level where it started.

Fake breakouts formation cannot be avoided in the financial market as it is always bound to occur in every market condition either ranging, trending, counter-trending, etc.

However, financial traders can always use them to their advantage if they are well informed of false breakout patterns and how to identify them whenever they form.

Below is an example of a false breakout on the 30 minutes timeframe of the Step Index.

Here, traders just starting in the financial market are tricked to think the market is starting to retrace just for the higher high and higher low that formed. However, the bullish trend lost steam and its forced to obey the trendline once more before the final pullback.

This is to say no method can signify a fake reversal accurately. Instead, you wait and follow up with the market structure identifying areas most possible with a pullback to occur.

Question Two

**Give a comprehensive explanation of the following Trend reversal identification and back up your findings using the original chart. **

A. BREAK OF MARKET STRUCTURE

It is often referred to as price action, market structure assists in detecting levels and understanding trends that happen in the market. In a market structure, there exists the uptrend known as the bullish trend, the downtrend, well-known as the bearish trend, and the consolidating, ranging, or sideways trend in the market. Moreover, market structure is mainly a series of price movements that form in the market creating support and resistance levels as well as swing lows and swing highs.

Break of market structure most times do signify a change in trend. And this is majorly confirmed with either an uptrend or a downtrend failing to form a new high higher than the preceding high or a new low lower than the preceding low.

The inability of the market to keep to its original trend and now move in a new trend all as a result of a major pushback do result in a break in the structure.

Break of Market Structure (BULLISH REVERSAL)

From the chart shown above, we see how a bullish move trended so successively until a major pullback occurred with price breaking below the previous low and setting out on a new trend. There was a strong transfer of control from buyers to sellers in the Step Index market and as a result, the price started plummeting until it broke the low to give us a downward movement.

A bearish reversal on the other hand is also of like manner but this time an inverse or opposite of the bullish reversal. As shown in the chart below, the bearish reversal of Step Index in a 30min timeframe shows price forming lower highs (LH) and lower lows (LL) until the market reversed significantly and failed to create a new low. This signals the inability on the part of the sellers to keep up with the trend and create more successive lower highs and lower lows. This indication of a change in trending power was established by the bearish trend reversal and hence, a transition from a bearish trend to a bullish trend.

B. BREAK OF TRENDLINE

The power of trend line is a dead-simple strategy to use in easily detecting swing highs and swing lows in a trending market. Using this reversal indicator, you can easily pinpoint with precision high probability entry levels and capture maximum profits with ease. It is a technical analysis instrument intended for detecting resistance and support levels in the market. Talking of resistance and support in a market, drawing a trend line for a downtrend can simply be conducted by connecting successive lower highs known as resistance together to identify key entry levels. Likewise, higher lows are connected in a downtrend (support) to identify opportunities and key entry levels at an increasingly higher trend.

However, it can also be efficiently used to check for price reversal and work on the setup of breakouts that occur on the line. Breakouts that do occur on trend lines can however be a strong breakout, breakout, and retest, or a fake breakout.

These patterns nevertheless, birth invalidation on these lines and can be used to know whether it is a major pullback or simply just a pullback for a trend continuation.

Taking a look at the current movement for Step Index on the 1-hour timeframe, we see price moving to the trend line drawn above it. However, with a continuous movement of the price in a plummeting move, a second trend line drawn to connect minor resistance got invalidated in the process and we tend to see a price change and then a move up.

Above is a trend line depicting a downward movement and also a major pullback indicating a change in trend.

Sellers took over this market from buyers and as result, the price broke the trendline and the market starts in a downward motion.

C. DIVERGENCE

Divergences are another main trend reversal pattern traders can always make use of in detecting the possibility of a pullback occurring.

Divergences form whenever signals are mixed between initial price action and an indicator confirmation.

This is usually known whenever market structure forms a lower low pattern for example and let's say the RSI or the ADX indicator goes on to form a higher high. This difference in the pattern shown by the price action and the indicator creates a divergence which signals a trend pullback in the market.

BULLISH DIVERGENCE

This occurs when an indicator signifies an uptrend by forming a higher high, but the price pattern signifies a downward movement forming a lower low.

This is how bullish divergence is mostly formed on charts and can also be used to detect when reversals are bound to happen.

An example of a bullish divergence is shown below.

BEARISH DIVERGENCE

A bearish divergence occurs when an indicator shows a higher high formation but the price pattern moves in an upward movement forming a higher high.

This shows a loss of momentum in the current upward movement giving way for sellers to come into the market and take over.

An example of a bearish divergence is shown in the chart below.

D. DOUBLE TOPS AND DOUBLE BOTTOM

DOUBLE TOPS

Double tops are reversal patterns that got their name from the market creating two upswings at similar price levels before reversing the trend. Weakness on the part of buyers makes the market fall to produce a new high higher than the preceding high but come back to touch that same level before reversing into a new trend.

This reversal pattern is mainly utilized by ensuring both prices form exactly on the same level as prices forming far away from the first top can be invalidated and seem not to hold. Thus, it is not a double top reversal pattern.

DOUBLE BOTTOM

Double bottoms are formed with two downswings forming at the same price level. This is as a result of the price failing to create a new low lower than the preceding lower. The price however retests this low without breaking it before pulling back into a new trend.

You can always see the first top of the reversal pattern form in the chart below after the price made a downswing followed by an upswing.

This pattern continues till we have two downswings which later form an overall swing structure that will later resemble the letter W after the pattern is fully formed. In the image below, we deal with an example of the double bottom pattern used to signal a bullish trend.

Question Three

Place a demo trade using any crypto trading platform and enter a buy or sell position using any of the above-mentioned trend reversal/continuation patterns.

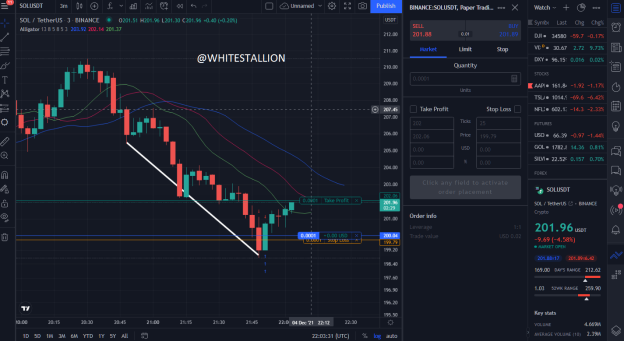

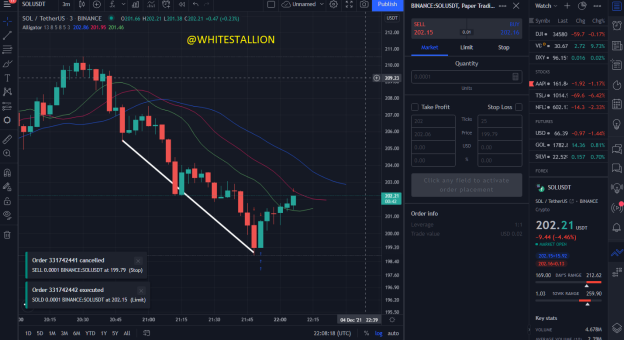

Trend lines are very vital tools in technical analysis such that you do not have to necessarily draw the trend line perfectly correct to get the desired results. So using a trend-reversal strategy I observed and placed a buy signal after connecting a few lower-lows in the SOL/TetherUS at 3 minutes trading duration

- Furthermore, I set my stop loss level and take profits level at 199.79 and 202.06 respectively equivalent of 25 ticks

After several trading duration, I was able to hit my take profit at 202.06.

I should also mention that I made use of the alligator indicator which although slow, corresponded to the new entry position.

Conclusion

Making use of reversal patterns is one great way traders can use to confirm pullbacks whenever the market signifies a change in pushing power. It is an efficient mode of detection where you can easily be informed whether to buy, sell or wait if a fake breakout is forming.

Yet, as long as this pattern remains useful, it still needs to be combined with other tools in a bid to get added confirmation. And with this, you can easily get into a market without fear of the market reversing.

Special thanks to Professor @reminiscence01

Hello @whitestallion , I’m glad you participated in the 3rd week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

This is not a clear example of bullish divergence.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing.. please someone should help me so that I will having upvote please

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit