Hey guys,

I welcome you'll to the 3rd week of the SteemitCryptoAcademy course by Professor @abdu.navi03. In this course, I will run a comprehensive review on CRYPTO TRADING STRATEGY WITH MEDIAN INDICATOR.

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

Explain your understanding with the median indicator.

Before we speak about the median indicator, we need to talk about what indicators are briefly. These are technical tools that traders use in the course of trading to help them forecast prices in the market. They are produced using calculations that consider the volume and price of a certain asset in the market either stock, cryptocurrency etc. They are used regularly by traders in the market to help them make a profit easily. These tools have the ability to help predict prices in the future and therefore help traders to be more profitable.

The main thing is that, before financial traders step into the market they tend to examine various data in the past market and how the market is performing and how it is liable to behave in the future. There are a number of good forex indicators such as trend indicator, momentum, volatility, and a volume indicator. With the ability of the indicator to predict future prices in the market, traders are likely to make more profits.

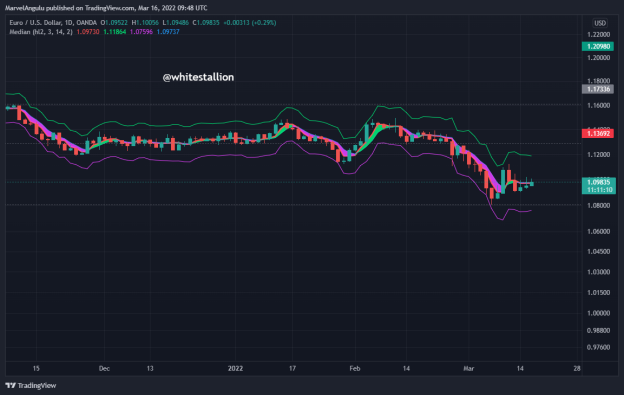

The Median Indicator

The median is one of the numerous available indicators in the market currently. It is a beautiful tool that traders can make use of to measure and ascertain the direction of the market. It also considers its volatility. The operational model of the indicator is that it forms a type of channel on the basis of how the ATR deviates from the center of the range. So in essence, the median indicator takes the average between the high and low in a specified length then proceeds to display it on the chart. The operational pattern of this indicator is that it works with trends. The moving line of the indicator depicts the direction of the flow of trend of an asset. The green and violet line of the indicator helps to depict buy and sell positions in the market. We can interpret the motions of a trade by monitoring the movements of the lines of the indicator which are the green and purple lines. The median indicator constitutes about three lines. The upper band, middle band, and lower band. It is common knowledge that the upper band serves as the resistance zone while the lower band serves as the support zone. The middle band usually gives meaning to the direction of the trend. If you check, the indicator operates like some other technical indicators such as the exponential moving averages and the Bollinger band. As explained, the indicator indicates two separate colors when the market is trending. The green thick line goes underneath the candlesticks in cases of an uptrend while the purple line goes above the candlestick in cases of a downtrend.

- We can understand the presence of a trend by ascertaining the color of the overlapping indicator line.

- From the image above, we can see that the green theme line is moving upward indicating an uptrend in the market. We can opt to open a buy entry immediately we observe the theme is green and moving upward. Downtrends can also be identified by watching the color of the overlapping indicator.

Just like the name indicates, the indicator gives the average or medium price of an asset in the market.

Average = Total buyers of the asset and total sellers of the asset

Question 2

Parameters and calculations of median indicator

As it is my custom, I need to describe how to add the indicator to the chart before we speak about adjusting its parameters and its calculation.

- The first thing to do is to visit the trading view site. Because I will be using trading view, I will have to use Chrome to access the site even though the platform has a desktop app. I visited the site www.tradingview.com and i arrived on the homepage of the site

- The second step in accessing the chart of the market is by clicking on the chart icon seen at the top middle region of the screen. After you do that, you will be taken to the charts of the asset

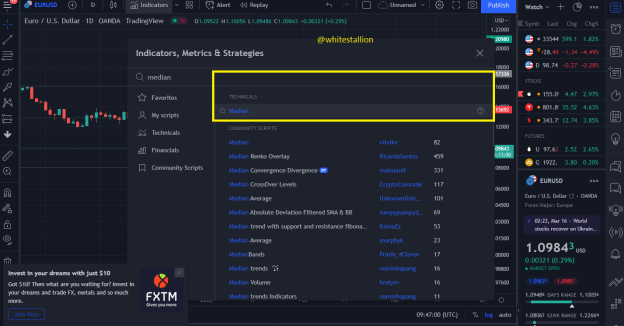

- The next step includes searching and adding the indicator from the search bar.

- After typing the name Median, it will automatically be completed, and click on it to add it to your chart

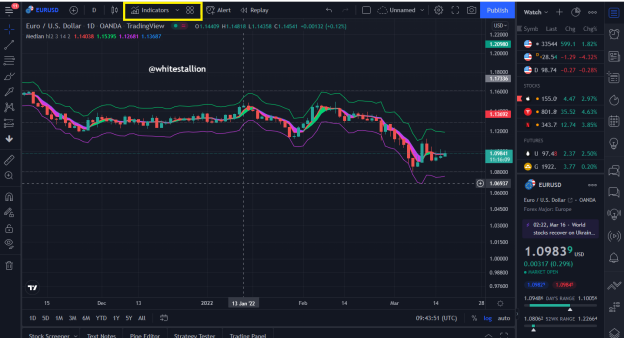

- The image below depicts the added median indicator to my chart.

Parameters

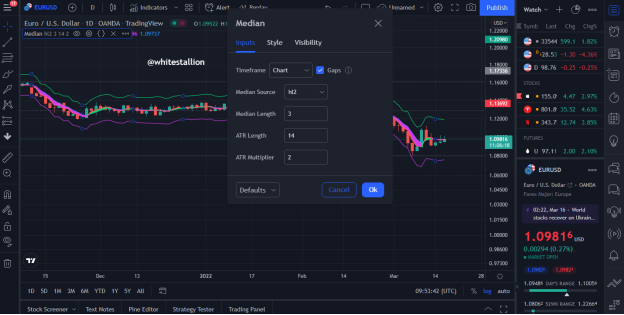

Now that we have successfully added the median indicator to our chart, its now time to observe the parameters of the indicator. To access the parameter of the indicator, do this by double-clicking on the indicator and a pop-up menu will appear in the center of the screen.

From the image below, we can see that under the Inputs section we have:

Timeframe: This is the timeframe of the chart. You can decide to change it from a range of 1 minute to weeks and even months.

Median Source: This is the origin from which the added median indicator operates

Median Length: This is the size of the median indicator in other words, it gives a representation of the amount of data that is used to calculate the indicator’s ATR.

ATR Length: Helps in ascertaining the ATR to be calculated by the indicator

ATR multiplier: This is just a multiplier for values to values to be calculated by the ATR.

You need to understand that any change in the above-listed parameter practically affects and alters the way the indicator operates.

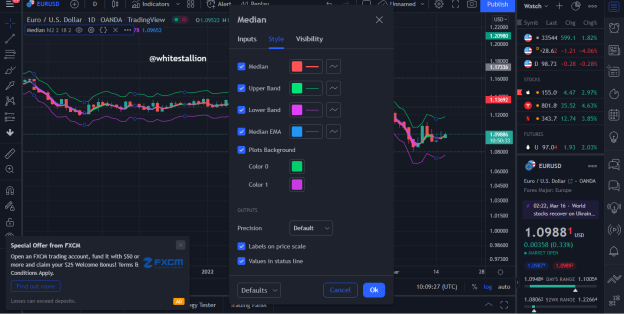

- Now that we have spoken about the input, it is time to speak about the Style.

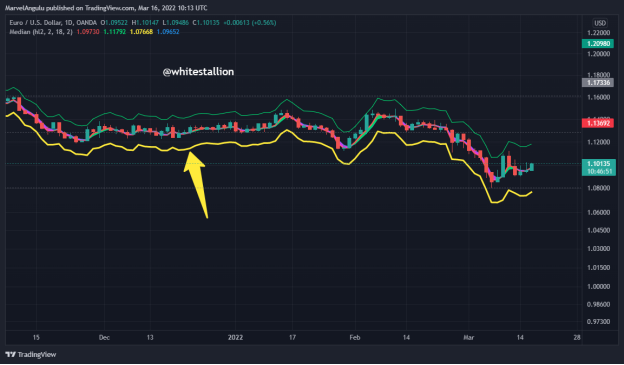

- The details included in this section do well to allow traders to change the aesthetics of the chart screen. The implication of this is that the trader can change the color of the EMA bands from green to any color or from purple to any other color. Let me site an example by changing the color of the lower band of the indicator from purple to yellow.

As you can see, the color and the thickness of the indicator changed from purple to yellow. You can as well change other features of the indicator via the style menu.

Calculation

Indicators make trading and technical analysis easy but, they mostly work with formulas. The formula for the median indicator is stated below. Interestingly, you don’t need to be worried about calculating the indicator before and during trades. Notwithstanding:

The pattern is such that an average of the price of a candlestick is obtained and added to the period of the average price. Furthermore,

The average price of candlestick = Highest price of candlestick – lowest price of a candlestick / 2

The median indicator = Average price of the asset + ATR / ATR

Depending on the value of your ATR. It is usually 14 but could be changed.

If at 14,

The median = Average price + 14 / 14

If at 12

The median = Average price + 12/12 respectively.

Question 3

Uptrend from Median indicator (screenshot required)

How can we find out when an uptrend is happening in a market? This question is a direct one, we can simply find out the nature of a trend whether it is an uptrend or downtrend by simply observing the motions of the indicator. Just like I stated earlier, the indicator is a type that shows trends.

As you can see the image above shows the Euro/U.S Dollar chart at the daily timeframe. After a period of a sustained downtrend, we can observe that there was a reversal in trend making it an uptrend. As you can see, the overlapping green thick line went below the candlesticks indicating an uptrend.

Question 4

Downtrend from median indicator?

It is also possible to identify downtrends in the market using the median indicator. During an uptrend, we observe that the green thick line rides below the candlesticks. But when it is a downtrend the reverse is the case.

When the median result displays a purple line, it is an indication that the market is bearish. This time around the thick purple line goes above the candlestick as graphically displayed on the chart above. In the screenshot above, we can see that after a period of uptrend a downtrend began which was indicated by the purple cloud.

Question 5

Identifying fake signals with median indicator (screenshots required)?

It is common knowledge that no indicator is 100% accurate. The implication of this is that these indicators are liable to depict wrong signals to traders. The median indicator is not an exception to this fact. It is possible for it to give wrong interpretation of the market. That is why its better to combine more than one indicator when trading, it helps to filter out inaccurate signals.

- From the above image, we can see that the indicator lagged in the little reversal of the trend. There was a little period of pause in the flow of trend which the indicator failed to identify.

- The image above is another example of how the median indictor lags. In essence, there can be a reversal in trend and the indicator would fail to register it immediately. Unfortunately, traders can miss important entries. These indicators, especially trend-based indicators work by utilizing past data points of assets in the market, this means they are liable to give out errors. The best way to maximize these indicators is by using them in combination with other indicators. In the images above, I was able to point out the lapses in the indicator by inspecting the candlesticks. But, I will be adding another technical indicator which will help me buttress this point. The indicator I will be adding is the relative strength indicator. The RSI indicator works based on volatility. In essence, it moves in respect to the volatility amount in the market. It moves from 0-100. When the RSI indicator moves to 70, it indicates that the market is bullish. When the indicator moves to around 30, it indicates a bearish market. I am going to use this information to point out the lapses in the median indicator.

- The image above shows the RSI indicator added to the median indicator. It is going to help me filter and pin point false signals in the median indicator.

From the image below, we can few instances where the indicator didn’t accurately agree with what was happening in the market. At level 70 which is an overbought region, the indicator turned in the opposite direction. This alone can make amateurs enter sell trades which will reverse almost immediately.

Question 6

Open two demo trades, long and short, with the help of the median indicator or combination that includes a median indicator?

I will proceed to open a demo trade. Just as I have been doing, I will use trading view for both my analysis and trade.

Sell Trade in Short Position

I proceed to open a short trade using the Euro/ U.S Dollar pair at 1-minute timeframe. As stated earlier, the purple cloud usually envelops the candlesticks indicating the beginning and sustenance of a downtrend. The cloud was initially green then it changed to purple, indicating a reversal in trend.

I entered the trade and I was in profit already.

Buy Trade in Long Position

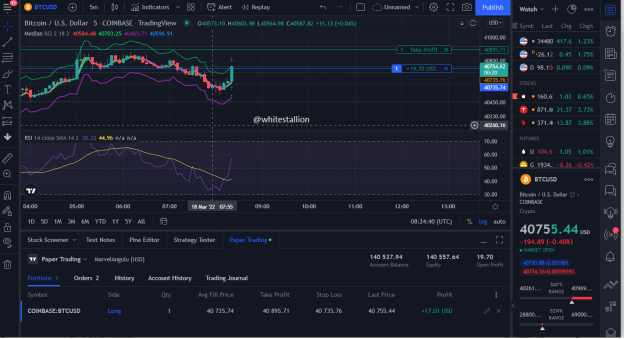

Bullish trends are usually signified by the green cloud under the candlesticks. As you can see in the image below, there was a period of downtrend just before the reversal in the trend. I used the Bitcoin/ U.S Dollar crypto pair for my trade. The median indicator was used in addition to the RSI indicator that I used to explain how to filter false signals. The green cloud signaled a perfect buy entry and I was in profit of 17 USD.

Conclusion

In this assignment, I have been to discuss what the median indicator is and how it functions. Furthermore, I have been able to highlight certain important aspects of trading using the indicator which includes trading uptrend and downtrend by the use of the indicator. Although, indicators aren’t 100% accurate, we can see how important and how easy to understand the median indicator really is.

Special thanks to Professor @abdu.navi03