Hey guys,

Hello, welcome to my homework post for the second week in the crypto academy, so far the lectures have been educative and I have been introduced to various trading concepts, in this week’s edition we will continue our trading journey by learning about price action and how we can employ it to our crypto trading, thank you for your time as you follow through.

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

Explain your understanding of price action.

In explaining my understanding of price action, we first need to understand some basic root and intricacies about its evolution. Price action is derived out of the need for the retail trader to understand the happenings in the market and analyze the market so as to predict the next possible direction the market might trade towards. Any financial market such as the crypto market is made up of market participants who buy and sell at different levels for the aim of making profit, these market participants can be grouped into two major spheres. The smart money, these are the big banks and the hedge funds institute who trades large pool of money and have the capacity to manipulate the market or bend it to their will and move it in any direction they so choose, this is possible because money moves the market and the smart money participants trade with a large pool of money such that they are able to easily drive the market up or down and make a massive profit depending on their interest. The second participant is the individual retail trader under which category you and I fall, we are retail because we are the last participants that price gets delivered to in the market, the retail trader's transaction volume is relatively low compared to the smart money and we cannot attempt to drive the market up to one point by our individual effort, this puts the retail trader in a confused and disadvantaged position in the market. Since we cannot manipulate price by ourselves to make us profitable, we are now left with trying to be on the right side of the market, this is a very confusing state to be in. However, understanding price action helps us to be able to effectively understand where the money is in the market and how to follow it.

Therefore, price action is a type of technical analysis trading style in which we use the information of price to analyze and determine the state of the market and the likely direction it will trade to next. In price action we believe that all the necessary information the trader needs to know about the market is already discounted in price, this means that price can show us all the information we need to know about the market without us having to look elsewhere for any other type of information, this understanding is very useful to the retail trader who needs all available information about the market to be able to accurately analyze and forecast the movement of price. Although there are other methods of forecasting price future movement such as fundamental analysis which uses the happenings in the economy to make financial decisions about the rise and fall of assets. However, the problem with fundamental analysis is that it doesn’t show us all the available information there is to the market, information such as key support and resistance levels, high demand and supply zones are kept hidden in fundamental analysis and are only known after the facts must have played us. Thus, I would say fundamental analysis offers us why a move should occur but does not necessarily tell us how we can be part of the move.

Price action is all about combining various technical analysis tools on the price chart efficiently to be able to develop a sound bias about the market, in price action we use tools such as chart pattern formation, technical indicators, support and resistance concepts, demand and supply zones, volume and even Wyckoff schematics to analyze the market. For instance, an example of a chart pattern formation is the divergence chart pattern, whose occurrence signifies to us that price has lost its steam and a reversal might be imminent, or a break and retest of an important support or resistance zone. When trading price action signals it is important to utilize an effective risk management module and to be in a good psychological state of mind. Below is an example of a trade that could have been taken on a crypto price chart utilizing price action knowledge.

In the chart above, we see price breaking through a short term resistance zone, upon the retest of this zone, it flips to become a support zone and a good spot to join the buys, our entry is based on the recent support zone that formed and our stop-loss below it is quite tight enough which increases the risk to reward ratio for the trade. Applying an adequate risk management method for this position is a very good trade to execute as we take profit at the next resistance zone up ahead.

While trading price action is efficient, however as a trader we must keep an eye out for fundamental factors, such as high impact news or government policies, because these events can drive up volatility in the market and cause the market to ‘behave wildly’ and move in any direction. We must also understand that every major move in the market is usually a result of a fundamental factor, but price action helps us to identify entry and exit points in the market to make profitable trades, therefore it is important for a trader to possess a good trading plan that entails efficient risk management criteria and sound discipline.

Question 2

What is the importance of price action? Will, you chose any other form of technical analysis apart from price action? Give reasons for your answer.

Having explained what I understand about price action, I will now be stating some major importance of price action to the trader, and the various ways it can help us trade better and profitably. We’ll be looking at three major importance of price action below.

Price Action Helps Us See Smart Money Footprints: we have earlier said that the market is heavily manipulated, and whatever move we see on the price chart is engineered by some big pocket entities such as the big banks and the hedge funds, due to the large volume they trade they can easily move price to their desired level. However, price action can be a powerful tool for traders like us to unravel the smart money presence in the market, and to identify their smart money footprints, with a perfect understanding of price action we can then be able to act on this information to enter and exit the market at profitable market levels to make profit. For instance, when we see the formation of a divergence pattern on the price chart we can be certain that the smart money is trying to lure traders to continue to follow the existing trend whereas they are getting prepared to reverse priced in the opposite direction, without this understanding if we follow the existing trend blindly we could find our trades being liquidated when the market suddenly reverses and take our position out. Therefore price action helps us to be on the same page with the big players and follow their lead in the market.

Price Action Helps Us Identify Important Market Levels: the market is not just a random, chaotic, free for all playground of buyers and sellers, it has some sort of hidden order which it follows, the order in the market is built at certain structural points and price levels such that when price trades to these levels and zones there is a tendency for the market to react in a particular way. Price action helps us know that these levels exist and that we can identify them on the price chart, for instance, we can identify major support and resistance levels, strong demand and supply zones, overbought and oversold regions, etc. when price trades into these zones we can expect a sort of reaction from the price at these levels, i.e. at these levels price can reverse on its initial direction and begin to trade in the opposite direction, or it can take a pause and continue to trade through the zone, with price action knowledge we highlight these specific zones and wait to see how price will react at them, the reaction at this levels will determine our next line of action. For instance, when price trades through a support level, that level automatically flips to become a resistance point and we expect price to retest the level and continue trading downward, knowing this we can easily put in a sell order in the market upon the retest of the broken support zone.

Helps Us Understand State of The Market (Emotions and Psychology): the market is a platform for continuous interactions between market participants. Chart patterns are formed as a result of these interactions among traders around the world, these patterns show the state of the mind of the traders as at when the trades are being made. With price action, we are able to understand the types of emotions present in the market at a particular time and also reveals to us the psychological state of mind of the participants. For instance in the case of a bearish divergence, because of the higher bullish leg that occurs in the market, the buyers get greedy and keep placing buy orders believing the market will continue going up, but as the saying goes nothing lasts forever hence the big players will also enter into a manipulative state of mind and begin to sell price aggressively in the opposite direction to take out the retail buy orders coming into the market. This tussle of conflicting emotions can move the market participants to swing between two extreme psychological states of mind in a matter of moment, from greed that propelled them to buy, to agonizing fear when they see the market begin to sell against their position. Price action helps us to identify and understand these interesting phenomena in the market and also to wisely select which side to be on in the market.

Having seen the advantage that price action gives to the trader, I think I will stick with price action and dedicate my time and effort to understanding its intricacies because I believe at the end of the day I will end up being a professional trader with in-depth knowledge of the market, and I don’t think any other form of technical analysis can rival the accuracy and profitability of price action trading methods.

Question 3

Explain the Japanese candlestick chart and its importance in technical analysis. Would you prefer any other technical chart apart from the candlestick chart?

The price chart is a tool that presents the delivery of price visually to the trader, it shows the trader the interactions happening between traders and how each price is being delivered in response to the orders entering the market. Therefore price chart shows price visually to the trader, however, this can be done using different tools in the market such as the line chart, bar chart, Japanese candlestick, hollow chart, and the Heikin Ashi chart, in this segment I will be explaining the Japanese candlestick chart and its importance to us as traders.

The Japanese candlestick as the name implies has its origin among the Japanese, it was designed and used by a Japanese rice trader called Homma Munehisa in early 1868 from the town of Meiji. Homma used it as a tool to represent the important price points of the day, such as the open, high, low, and close of the day. With these important parameters being captured it made it easier for him to analyze the movement of price more accurately since the candlestick conveys more information about price than other chart types. For instance, the line chart represents price in the form of a line, using the closing price only, for a sophisticated trader the close price is insufficient to accurately measure market information therefore the need for the Japanese candlestick is essential and vital.

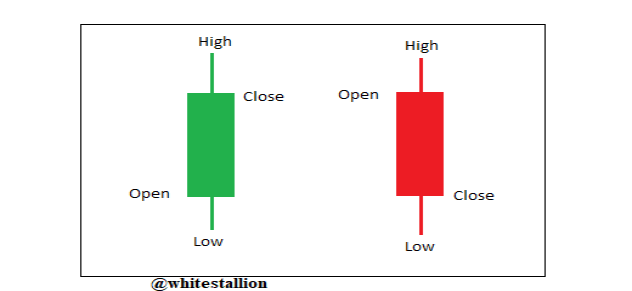

The image above depicts a typical Japanese candlestick, here we can identify the following;

OPEN: this is the level at which the market opens and price begins to trade from, this is an important reference point because it shows the level at which the business of the day begins.

CLOSE: this is the level at which the market closes for a particular timeframe, if we are on a daily chart timeframe, then the close would represent the level at which the market stopped receiving orders for the day, and one candle would represent one day worth of trading activities.

HIGH: This is the highest point in which price is traded for the trading period, it is also called the upper wick because it protrudes out like the wick of a burning candle.

LOW: this is the lowest level price trades to for a period of time, it is also called the lower wick, because of its protruding nature.

The Japanese candlestick chart is of importance to the trader in the following ways.

Helps us identify price visually; the Japanese candlestick does an excellent job at helping the trader identify price visually, because of the four key parameters which it shows clearly, with this information the trader can easily identify and take decisions based on these levels, for instance after the formation of a reliable chart pattern on the chart, a trader might decide to place a buy or sell order upon the open of the next candle to form, things like these are the edges the candlestick offers to the trader.

Candlestick patterns; while there are chart patterns, we also have what we call candlestick patterns, these are specific formation that occurs with one or more candlestick, examples include the doji candle, evening star, three white soldiers etc. the formation of these candlestick patterns at important levels on the price chart can serve as valid confirmations signals for us to place our entry or exit orders in the market.

Helps us identify volatility and momentum; due to the unique feature of the candlestick body, we can easily identify when the market is in a state of strong momentum, or volatile state. The market is said to be in a state of high volatility when orders are placed rapidly into the market, this drives prices up or down with great momentum. With the candlestick, we can easily identify a volatile state in the market by looking at the body of the candles, in a highly volatile market environment the bodies of the candle will be longer which indicates the large area's price traded through. While in a low volatile state the candles will be smaller, which shows the little movement of price.

Having seen the importance of the Japanese candlestick, I’ll prefer to stick with using the candlestick chart, because that is what is used in the crypto academy, also it offers more information about price and it looks less complicated than the other price chart.

Question 4

What do you understand by multi-timeframe analysis? State the importance of multi-timeframe analysis.

Multi timeframe analysis is a system of technical analysis where we make use of different timeframes to analyse the market and frame trade ideas. Most times when we look at a random price chart on a single timeframe it can be very hard, if not impossible for us to piece together any meaningful information about the price movement, for us to understand what the market is really doing we have to view it from different perspectives i.e. different timeframes.

The set of timeframes we employ will depend on the type of trader that we are. Usually, swing traders mostly use the monthly and weekly time frame to understand what the market is doing and frame their trade ideas while they use the daily and 4-hour charts to get suitable entry points in the market. However, for a scalper, the 4-hour and 1-hour timeframe would be used to understand the directional bias of the market, and they can use 5-1 minute timeframe to get their desired entry points, some professional scalpers even go as far as using the 30 seconds timeframe to supplement their analysis, indeed different stroke for different folks. Multi timeframe analysis is important to us as price action traders, in the following ways.

Brings Order To Our Analysis: as I’ve earlier said the market is not a chaotic place, therefore we have to approach it systematically, multi-timeframe analysis helps us to be orderly in our analysis of the market, with the multi-timeframe analysis we will start our analysis from the biggest timeframe and stop at the smallest timeframe. Most times, the big timeframes (weekly, daily) helps us to understand the present condition of the market and to foresee the next point that price will trade to, having gotten the directional bias, the smaller timeframes (4 hour- 30 minutes) can then be used to get an entry point to join the market as it moves towards our higher timeframe objective. Smaller timeframes such as (15-5minutes) can be used to refine our entry and get a tighter entry-level.

Helps Us To See The Market Clearly: multi-timeframe analysis helps us to see what the market is doing clearly, when we stay on just one timeframe, the market can be very confusing to decipher and we won’t be able to spot our chart pattern or even know where price is trading to next. With multi-timeframe analysis, we will be able to see the chart patterns clearly, for instance, what might appear as a random piece of price action that led to a massive sell-off in the market might actually be ahead and shoulder formation if we take our time to look at it from a higher time frame position. Chart patterns like divergences and others hold more weight when they are spotted on higher timeframes and then executed on the lower timeframes. When we develop the fluidity to use multiple time frame analysis, price action on any time frame will stop being confusing as we will simply zoom out to a higher timeframe to see clearly what is truly happening.

Helps Us To Understand The True State Of The Market: with multi-timeframe analysis we will be able to understand the true state of the market, price movement across different timeframes tend not to correlate with one another, for instance, a massive sell-off on the 15 minutes time frame could actually just be a minor retracement on the daily time frame, therefore if we had a buy position on based on the daily chart we would not be scared of the sell move on the lower timeframes because we know that it is just a minor retracement when we consider the whole picture. It is in-depth knowledge like this that helps us to stick to our analysis till we hit our profit target. Also, it can help us to be a diamond hand-holder in crypto spot trades especially when the market experiences short-term dips because we understand the true state of the market based on multi-timeframe analysis.

Question 5

With the aid of a crypto chart, explain how we can get a better entry position and tight stop loss using multi-timeframe analysis. You can use any timeframe of your choice.

I will be using the ONEUSDT price chart to show us how we can get a better entry position and tight stop-loss by using multi-timeframe analysis.

Looking at the ONEUSDT 4H chart above, we realize that it looks quite confusing and hard to determine which direction the market is actually trading towards, the chart does not present us with any recognizable candlestick pattern that we can identify or trade. Therefore, we will switch to the daily timeframe chart to see the true state of the market.

On the daily chart above the true picture of the state of the market becomes clearer to see, we observe that price has traded into a strong support level and looks set to bounce from there and begin to trade higher, this lets us know the directional bias is bullish and we should begin to look for entry to ride the incoming bullishness.

On the daily chart, we see an ‘evening star’ candlestick formation that just formed as price trades into the support level, normally the formation of this candlestick pattern is a viable entry point for us to join the buy-side, however using proper risk management we see that the risk required to trade this candle is quite large. The candle is about 3000 points, this is indeed massive for retail traders like ourselves, in order to get a smaller stop-loss we can apply the multi-timeframe knowledge taught in this class and go to a lower timeframe to spot a tighter entry.

Moving to the 15 minutes timeframe, we spot an engulfing candle resting inside our 1H entry zone. The engulfing candle looks likely to be retested as price retraces, and it provides a good entry-level we can place our buy position. Also, this level, is quite minimal compared to the 1H entry zone, as it has a tight risk of about 370 points, this offers us a very tight stop loss entry to take the trade with and greatly increased our risk to reward ratio.

Having seen how the multi-timeframe method can help us identify trade setups and also generate tight entry stop-loss for us, I have come to appreciate its usefulness and hope to incorporate it fully into my trading system.

Question 6

Carry out a multi-timeframe analysis on any crypto pair identifying support and resistance levels. Execute a buy or sell order using any demo account. (Explain your entry and exit strategies. Also, show proof of transaction).

In this final section, I will be utilizing my knowledge of multi-timeframe analysis to place a demo trade on a crypto pair, kindly follow through. The crypto pair I will be analyzing is $ZRXUSDT.

In the chart above, we first analyze the daily timeframe to understand the true state of the market and to know the direction the market will trade towards subsequently, on the daily timeframe, we highlight the resistance zone at the $0.76 level, while we observe that price just retraced into the support zone at $0.6. We observe that the support zone at $0.6 appears to have held, as price bounces off it aggressively with a bullish engulfing candle. This gives us the notion that price might resume its initial bullish run and towards the resistance level above, we are therefore in a bullish market environment and we will attempt to buy $ZRXUSDT at a good entry-level.

The engulfing candle on the daily chart serves as our ideal entry point, however, the candle is about 820 points wide, which is too big for a reasonable entry, hence we will apply our knowledge of multi-timeframe analysis and go to a lower timeframe to pick a smaller entry.

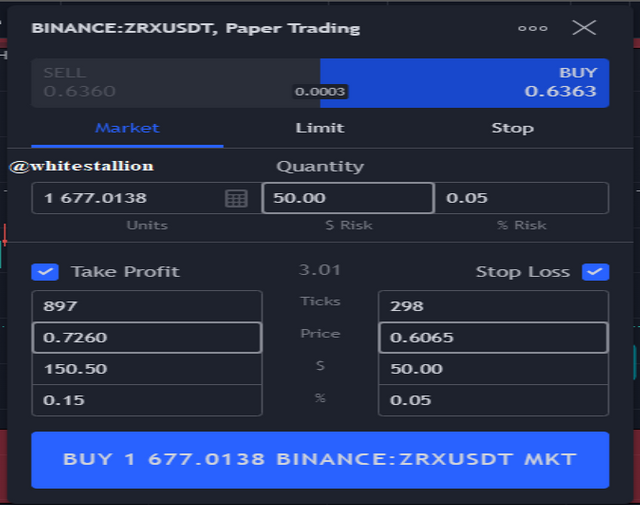

Going to the 2H timeframe we immediately spot a better and smaller entry at the most recent support zone on the chart, which is 182 points. This is a better and smaller entry when compared to the size of the initial daily engulfing candle. I then proceed to place my entry on a demo account on Tradingview platform, this is proof of my transaction below.

I entered a buy position at the current market price of $0.6363, and I staked $50 on the trade which is a risk of 0.05% of the total account size. Stop-loss was placed at 0.6065 and my take profit target is 0.7260 which is at the most recent resistance point price just formed, this gave me a risk to reward ratio of 1:3. Below is a screenshot of the trade.

Few hours later, the trade had started playing out in my favor, as the price started buying according to the multi-timeframe analysis, and it was halfway through to my take profit.

However, on the next day, due to Bitcoin volatile sell-off, $ZRXUSDT reversed and began to sell off massively, this led to price retracing back into the support zone and taking my buy order out, despite how close price was to my take profit level, the market reversed and took out my stop-loss. This occurrence made me see the importance of using a trailing stop-loss to safeguard trade positions that are already in profit.

Conclusion

In this session, I have gained valuable insight into the use of price action to analyze the current state of the market and to also determine the next direction it might trade towards, also I was introduced to the idea of multi-timeframe analysis which proves very useful in building trade ideas. Personally, I have also learned the importance of safeguarding an open position with a trailing stop-loss, due to the way price reversed and took out my buy position that was already in profit. I sincerely look forward to the next class where I hope to learn more exciting topics in trading.

Special thanks to Professor @reminiscence01

Hello @whitestallion , I’m glad you participated in the 2nd week Season 6 at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

Recommendation / Feedback:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit