Hello friends and welcome to my assignment task by professor @reddileep, in this assignment I will explain the concept and mechanics of Cryptocurrency Triangular Arbitrage trading, I hope you enjoy and learn from my assignment.

Question 1

Define Arbitrage Trading in your own words.

Arbitrage trading can be defined as the act of buying a coin, currency, assets or security in one market at a slightly lower price and simultaneously selling at a higher price in another market. Profit is made in the difference between the price it was bought and the one it was sold for. Arbitrage trading is understandable when viewed from the perspective of the definition above. First, it involves dealing with two markets or more. Secondly, it involves distributing our assets between these markets in such a way that we make profits from each market.

It can also be defined as “trading that exploits the tiny differences in price between identical assets in two or more markets”, this definition is hinged on understanding the happenings in the simultaneous market and taking advantage of price differences to make profit. This system is based on identifying what is known as market inefficiencies. Making a trader for instance buy a coin from an exchange and market it in another for a higher price or circulate his asset on different coins and eventually draw them back to one coin for profits.

Therefore with these explanations, I will define Arbitrage trading as a way of taking advantage of two or more markets, buying the asset of one and selling it in another or distributing your assets round several markets and returning them back to the original price for the sake of profit.

Question 2

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

According to the class, the problem with this classification is that there is no universal type of arbitrage trading and that what X may say it is would bear a different name from what Y would say it is but would still mean the same thing. For the purpose of attempting this answer, I went outside the class scope and got information on types of arbitrage.

Arbitrage can be classified into five types, which are: risk arbitrage, retail arbitrage, convertible arbitrage, negative arbitrage, and statistical arbitrage. However, these classifications do not all apply to the kind of trading intended in this discourse. So, my exposition here will sieve out the information to pick only those classifications that align.

Risk Arbitrage: according to the link above, this is also known as “merger arbitrage”. It involves according to them the “buying of stocks in the process of a merger and acquisition” it involves “buying the shares of the target and selling short the shares of the acquirer”. From these explanations, it connotes buying a particular stock or exchange at a price value and selling it elsewhere at another value. It is referred to as “risk” because there is only profit when the sales are made. If it is not made, the buyer/trader loses money. They usually occur in instances where a trader foresees fundamentals coming to swing the market in an uptrend, so he takes an early position, and then waits for the uptrend, then sells. The problem is when the uptrend does not happen, and he is left with the shares.

Convertible Arbitrage: this sort of arbitrage trading involves the trader taking two positions in the market (long and short), with the hope of profiting from any movement made at all in the market. And in an instance where price moves in a particular direction, let’s say price shorts, convertible arbitrage works with a sort of arrangement where the profit made on the short position neutralizes the loss on the long position, thereby compensating the trader. Compared to risk arbitrage, www.investopedia.com refers to this as a “risk-neutral strategy” and explains that the strategy is “often achieved through an options spread called a reversal conversion”.

Statistical Arbitrage: this arbitrage strategy here is involved with using statistical models to discover opportunities between market positions. Statistical models (particularly mean; how frequent it happens) are used to determine market swings.it involves “a group of trading strategies employing large, diverse portfolios that are traded on a very short-term basis”. This is one of the most rigorous arbitrage trading systems and is not reliant on human statistical capacity but computer models. Just like convertible arbitrage, it is a neutral market position; meaning it is less risky. It works in this manner; based on statistics if a trader feels that X market is undervalued, and Y is overvalued, the trader will make a profit by opening a long position in the undervalued market, and a short in the overvalued. It is also referred to as “pair trading”.

The totality of the Arbitrage strategies here is focused on making profits from more than one market, none of these strategies are limited to two securities or markets at a time and are capable of taking more. The only feature to look out for in adopting strategies is in how much risk the trader is willing to face. As seen, there are neutral positions, and highly risky ones; however, high risk brings greater reward, nevertheless, a trader may be comfortable with the reward that comes from a convenient strategy like that which statistical arbitrage offers by virtue of its digital statistical analysis procedures.

Question 3

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

The Triangular Arbitrage Strategy as explained in the class illustration is the most common arbitrage trading strategy. It is common because prior to my knowledge of this strategy, this is how I earned from crypto (my spot trading). I would simply use, for instance, my BTC to purchase ETH and later use it to purchase XRP in the same wallet, and after market prices move, I convert them back to BTC.

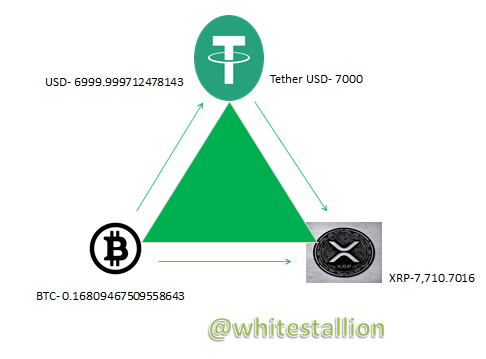

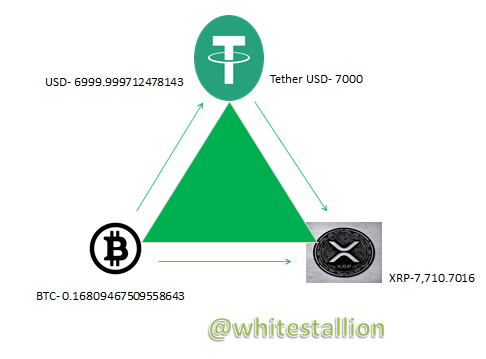

However, in a clearer picture, it involves a triangular pattern of exchange, like in the image below.

Fig 01: demonstration of an unsuccessful triangular arbitrage strategy

Though there is no profit made from the trade above, the illustration explains an attempt to take advantage of market swings to generate profit. The trader has 7000USDT and moves to make an exchange into XRP and in turn, gets 7,710.7016 XRP and with this amount, he makes a move to get BTC and later returns it to Tether USD. The idea of this triangular arbitrage strategy at the end of the movement is to make profit and not loss. For it to succeed it requires the trader to have knowledge of exchange rates. Prior to my research, I had no idea of the importance of this knowledge and that is why my trade bounces back with a 0.1 loss. Though the loss is somewhat intangible, the goal is to make profit. Nevertheless, this was done at a time when there was less liquidity in the trio market; hence no rapid movements to increase/decrease profit on a significant margin. However, let us look at the scenario below:

Fig 02: correct triangular arbitrage strategy.

Question 4

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

In attempting this, I chose to use two verified exchanges: Polonidex and Binance. Below is a picture of the verification page of my Binance account.

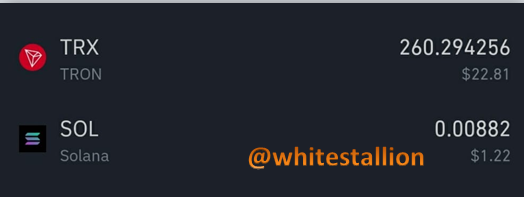

To perform this trade, I start on my Binance account and with a total of $22.92 I purchase TRX at the rate of 0.08802 and I get 260.29425600 TRX. Below is a representation of the price as at when this was performed.

And this reflects in my wallet.

- According to the image above, I was able to purchase a total of 260TRX at the rate of $22.81.

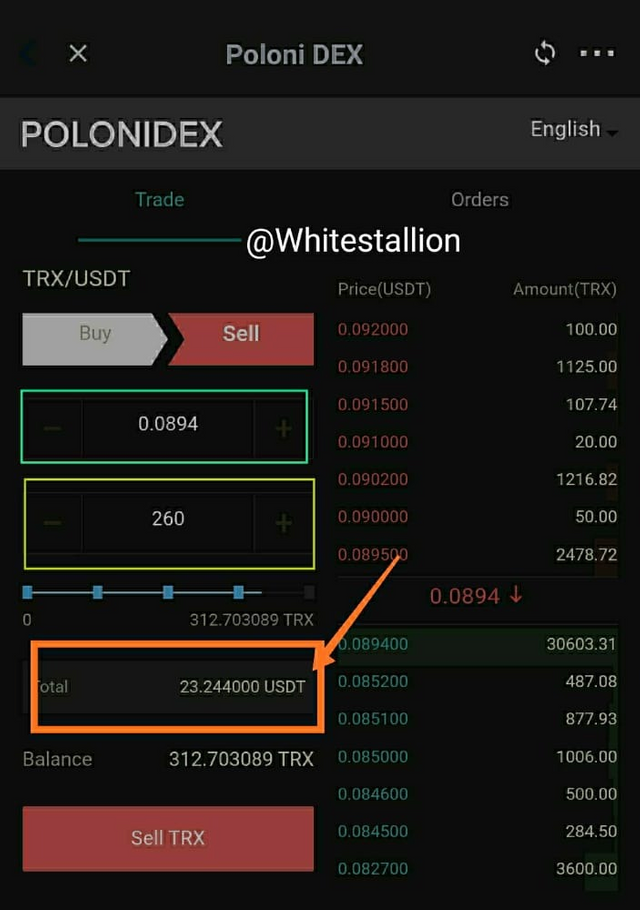

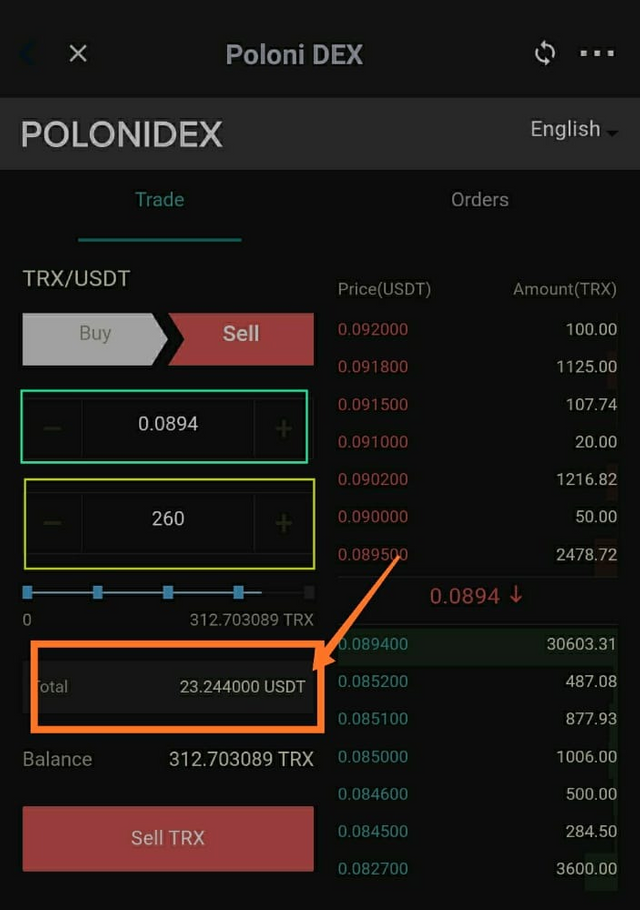

To bring the theories learned in class, I transferred and sold my TRX on another verified exchange called Polonidex. As will be seen in the image below, profit is made.

As can be seen in the above image, the profit made is when TRX is sold for 23.244 USDT(orange marker) which is 0.434 USD profit. If one would notice from the comparison of Fig 06 and fig 04, we can see that profit is made because of the price differences between the two exchanges from 0.8802 to 0.0894

Question 5

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

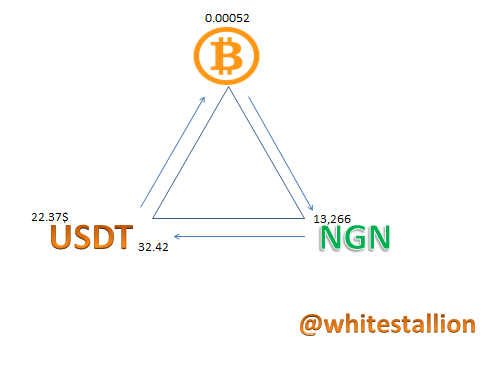

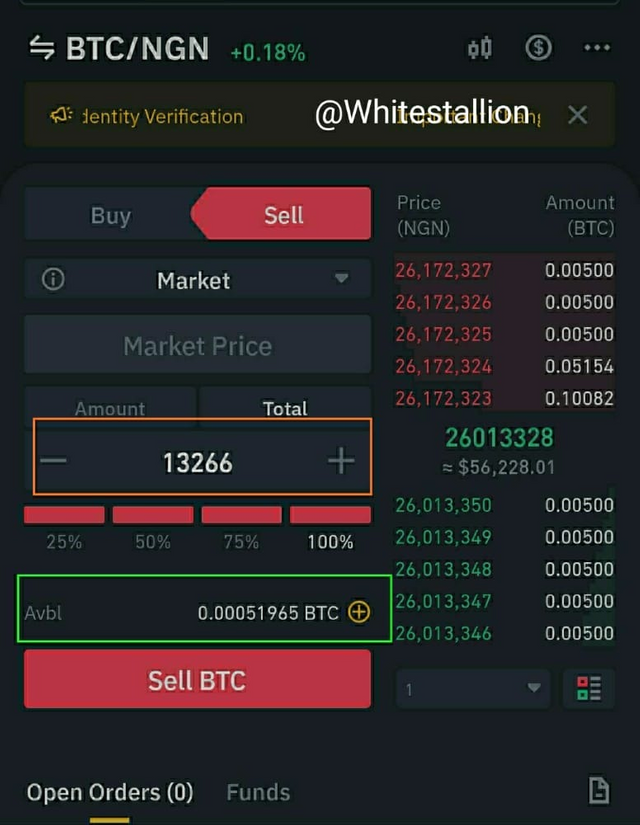

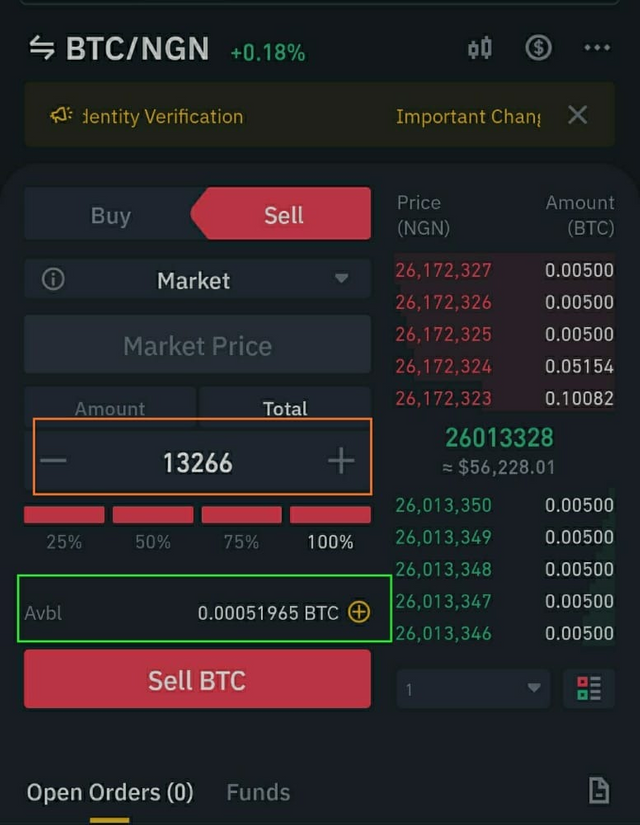

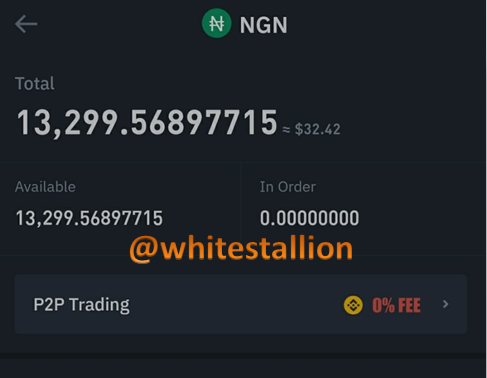

In achieving this, I used 22.57$ worth of USDT which was 22.58417371, as seen in the first picture in fig 07 below:

Then I used that amount to purchase BTC of which I got the value of 0.00052 as can be seen above. With this value of BTC, I converted to naira at the rate of 22.37$

After the conversion to NGN of which I have 13,299.56897715 NGN, which is equivalent to $32.42. At the end of this exercise, I was able to generate an extra $10.05 in profit.

Question 6

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Advantages

Having examined the Triangular Arbitrage method, it has proven to be of great benefits. Below are some of its advantages:

Neutral System: One of the benefit/ advantages of trading with this arbitrage system is that it is a neutral risk system. You do not have to be worried about losing too much as the position you staked first especially in crypto trading is likely to increase at the completion of the triangular system, or maintain minimal loss. It is also useful because it allows you take positions in markets that are doing well for the short period in which they are doing well. For instance, during the Doge coin price surge, if Doge had been part of one of these pairs in the triangle, it would mean much profit.

Time Saving: The triangular arbitrage method is also time-saving and it is responsible for

Increases Liquidity in the market: this happens, especially when big banks trade them. It causes pairs to be in constant motion

Less Technical Way to Trade: In my opinion, it is also a less technical way to benefit from the market.

Disadvantages

All these are the advantages of the triangular arbitrage method in cryptocurrency. Though it is an easy trading system with amazing features, it has its disadvantages. For example:

- Requires knowledge of so many factors: it is quite disadvantageous because it involves comprehensive knowledge of factors like market price, trading fees, exchange rates and to be aware and vigilant of price fluctuations. One or all of these factors is the reason why the below image does not result in a profit.

Prices may be Stagnant resulting in a loss: Yet another probable reason why the above trade could be that there was less liquidity in the market, thereby causing price to be stagnant. Because if one would look, the price difference between 6999.9999 and 7000 is minute and overlooked, and so the market is as good as said to be stagnant.

Prices may fluctuate; Another disadvantage of this system is that the final amount is still susceptible to decrease because of unexpected fluctuations in price. Earlier in this answer, an instance of Doge coin giving out profit as at that time was good, but what if it had occurred when Doge coin took a significant deep where it shed off nearly 35% of its price? That would have resulted in a loss when it is finally converted to BTC or the original pair.

Entry Price and Exit Price can ruin trades: just like analysis, it is important to have a good entry, buying when low and selling when high. This will result in profit. Otherwise the reverse will result in loss.

Trading Fees: trading fees may ruin the profit at the end of the day. The cost of completing one chain on the angle of the triangular arbitrage method may affect the value of the price at the end. To escape this disadvantage, the profit made must be in such a way that it covers trading fees gallantly.

Conclusion

It has been amazing learning new schemes and classes under the arbitrage trading system. Particularly, the triangular arbitrage trading system is easy and profitable, especially as it has the capacity to rake in profits that could surpass 50% of capital. Nevertheless, it can be risky at times, and it is better to understand it properly before it is used.

Special thanks to Professor @reddileep