Hey guys,

I welcome you'll to the 8th week of the SteemitCryptoAcademy course by Professor @fredquantum. In this course, I will run a comprehensive review on Dark Pools in Cryptocurrency.

All images used in this post unless otherwise stated are not mine and were extracted from coinmarketcap, renproject, and krakenfor the purpose of this assignment.

Question 1

Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

As the name implies, “dark” pools are private exchanges (opposite of public exchanges). Private exchanges are not guided by standard exchanges, for example, NYSE, and they allow investors and organizations of great magnitude to trade volumes of financial instruments of similar magnitude while being incognito. Dark pools are also referred to as “dark pools of liquidity” and this lays even more emphasis on their lack of visibility and accessibility to the public. Furthermore, I can say dark pools are exchange platforms that are privy to certain people or users, not the general public and they are used for actions such as trading securities. The emergence of dark pools was basically to aid what is known as block trading by big institutions that have the capacity to be market makers. As we know that market makers can influence the financial markets through the number of their trade volumes.

Dark pools in cryptocurrency are private exchange platforms used to trade cryptocurrency at a pre-set price, ensuring the avoidance of slippage. In cryptocurrency, dark pools need either cross-chain transactions or transactions amongst numerous blockchains of digital currencies. Cryptocurrency orders are divided into several parts after which they are matched with each other with the use of zero-knowledge proofs by decentralized dark pools.

Cropping up in the 80s, dark pools have been majorly utilized by institutional investors, coming into existence principally to promote the selling or buying of sizable quantities of securities at a predetermined price (block trading). Traditionally, dark pools make the order book and trade invisible to the public, or at least till the trades have been executed. Essentially, the order books are set apart and concealed, allowing traders to sell or purchase bulky orders while remaining unidentified.

Prior to the creation of dark pools, the large and institutional investors were subjected to restricted options concerning the sale of large amounts of shares. Most, if not all, of these options, involve the sharing of the sale into numerous orders of different sizes to diminish the effect on the on-exchange price of a stock, although reducing the effect was almost impossible to accomplish as the seller’s identity was hard to conceal.

It is important to mention Limit Order and Market Order. Limit order allows the selling or buying at a predetermined price which gives the trader the advantage of not having a price worse than the one already set In essence, limit order helps users set the number of assets they desire to trade. Market order is defined by the immediate execution of orders.

In that regard, if we look at the present day scenario, where a big investor can utilize a dark pool to sell a few million of a block we will see that the nature of the bad transparency that dark pools operate with will favor the investor. This is because there is a chance for the block to be bought at a higher price in the dark pool than when the block is sold in a verified and legal exchange platform. According to the security and exchange commission SEC, we understand that there are a total of about 50 dark pool networks, all of which were registered under the SEC.

Question 2

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Kraken

Kraken, a cryptocurrency exchange and bank based in the United States of America, offers dark pool services to its clients. In 2015, four years after its establishment, Kraken introduced the dark pool feature enabling its clients to inconspicuously place huge Bitcoin orders and execute said orders against orders of comparable sizes at possibly better prices. At the period of its implementation, the dark pool feature intended to proffer a way for traders to move over 50 BTC (approximately equivalent to $12,500) anonymously. There are certain features of this platform that make it stand out from other platforms, an example of these features includes low transaction fees and outstanding security features.

These, combined make it a honeycomb, for users. In fact, for international citizens, there is an added advantage because of the operating nature of the network.

The dark pool on this exchange accepts orders for trading between BTC and EUR, USD, JPY or GBP. Also, pairings on dark pool are identified by a “.d” extension. For instance, XBT/JPY.d or XBT/GBP.d).

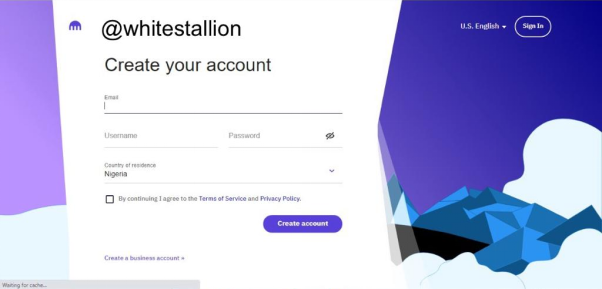

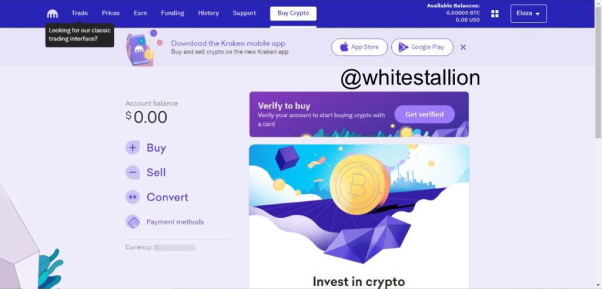

To access the dark pool feature on Kraken, visit the site https://www.kraken.com to create an account. Click “create account”. This can be found at the top of the page, towards your right.

- You would be redirected to a page to input your email address, username, and password.

- After this step, you would be sent an activation code via email to be inputted in the slot made available.

- Once the code is inputted, you would be redirected to the “Buy Crypto” page.

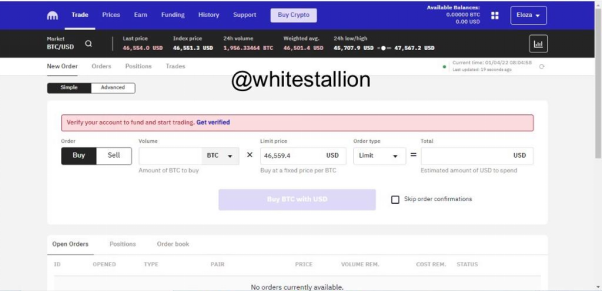

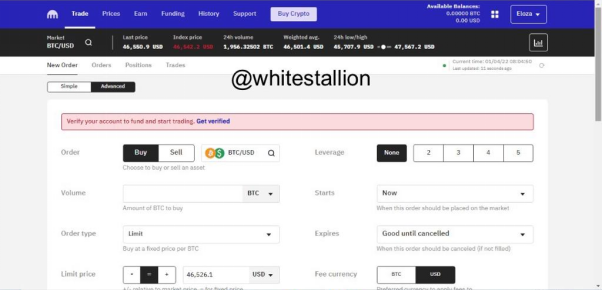

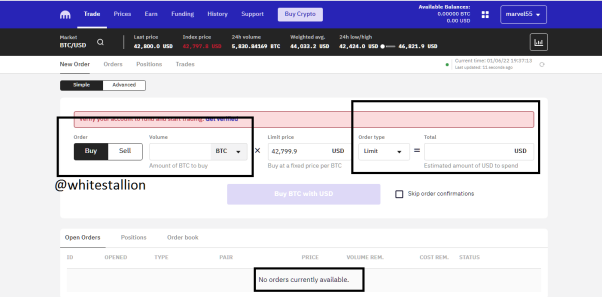

- To access the dark pool feature, click “Trade” at the top left corner of the screen then click “New Order” directly beneath “Trade”.

- Select “Advanced”. Click the search icon in the order slot, scroll down and select dark pool pairs.

- The Kraken platform is notable for its security as a team of world-class security experts ensures that no attack is launched at your cryptocurrency investments. In addition to this, other notable features include low transaction fees, easy use, and so on.

Question 3

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

Supported assets are the assets able to work with the dark pool feature. Concerning Kraken, it is only available for Bitcoin and Ethereum. Some BTC pairs are

- BTC/USD

- BTC/EUR

- BTC/JPY

While some ETH pairs are

- ETH/USD

- ETH/EUR

- ETH/JPY.

Furthermore, there is also the BTC/ETH pair.

I opine that from the above list, the main pairs used or traded on this platform are BTC and ETH pairs.

Requirements;

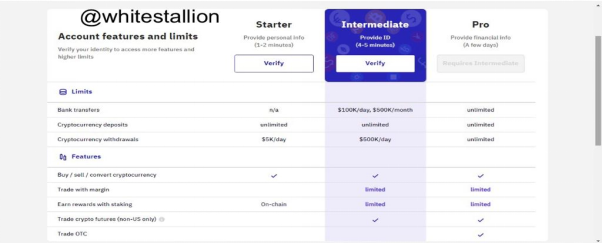

The dark pool feature is only available to clients who have met some key requirements. What you can do on your Kraken account is limited to your verification level.

- It is available to clients who have been verified to the Pro level. The Pro level is divided into; Personal or Business. Personal Pro limits offer the highest level of verification while Business Pro limits the focus on business purposes and entities.

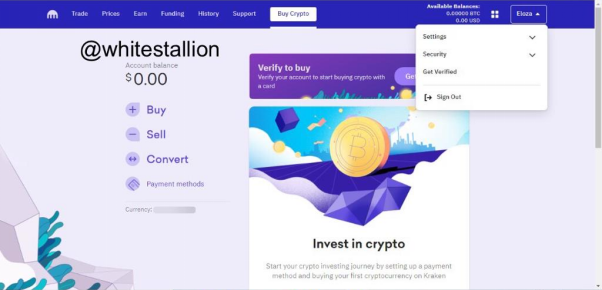

To view the verification options, visit https://www.kraken.com and click the arrow next to your username at the top right corner of the page.

- Select “Get verified” and you would be able to view verification levels.

Bitcoin pairs have a minimum order size, that is, the size of the order must be roughly equivalent to 100,000 USD.

In the same vein, Ethereum pairs have a minimum order size which must be roughly equivalent to 50,000 USD.

Limit orders are supported only.

Is there any fee involved in the transaction?

Making use of the Dark pool feature attracts certain fees and charges. Generally, the rates are subject to what your trading volume amasses to within a 30-day period. The fees span between 0.20% to 0.36%. The regular rates are from 0% to 0.16%. In other words, dark pool attracts higher charges.

Question Four

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).*

Around late 2018, Kraken announced the expansion of their OTC crypto trading platform to accommodate and enhance the carrying out of huge block trades for their clients around the world, distinguishing itself by providing top-notch quality and service right from the first step of consultation to the last step of settlement.

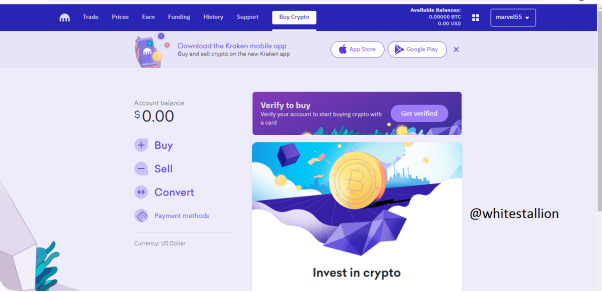

- To access the Kraken OTC (Over the Counter) Block Trading Services, which is the block trading service available on the platform, one has to create an account.

- Visit the site https://kraken.com and follow the steps stated earlier. But since I have already created my account, all I have to do is just to log in my account as shown in the screenshot below

- After gaining access, navigate to the trade page by clicking on trade option on the upper left section of the screen

Question Five

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Just as there are dark pools available in the equity markets, some trading platforms offer dark pools services to trade crypto assets. Decentralized dark pools are used to avoid price slippage by concealing larger trades in the mainstream markets. As stated earlier, in decentralized dark pools, cryptocurrency orders are divided into several parts after which they are matched with each other with the use of zero-knowledge proofs by decentralized dark pools. When you compare Decentralized dark pools with the typical dark pool networks, decentralized dark pools seem to have a safer method when it comes to digital verification. The world’s first decentralized pool exchange was launched in late 2018 by Republic Protocol. RenEx has at its core, a completely hidden order book, and no parties including Republic protocol can observe any trade before it is executed. What this means is that details of a trade can only be made public when it has been realized. We need to understand also that, not all exchange platforms are decentralized.

Zero-Knowledge Proofs

Zero-knowledge proofs or Zero-knowledge protocols (ZKP) make it possible for a party involved in a transaction to present evidence of that transaction without actually disclosing sensitive details of the transaction. It is an authentication method whereby there is no sharing of passwords, which prevents them from being stolen. Private chats and transactions are safe, secure, and protected as the confirmation of information can be done with ZKPs without the revelation of data to anyone outside the parties involved. Private transactions can be posted to the blockchain and be private because ZKPs create a method by which successful confirmation of transactions can be done without revealing any confidential information used in the transaction. The prover can prove the truthfulness of a statement to the second party, the verifier, without disclosing any further information other than the truthfulness of the given statement. In summary, Decentralized dark pools are dark pools that are not centralized, when gaining access to such platforms you need not provide private or sensitive data about yourself such as a residential address, date of birth, and so on.

Question Six

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Formerly known as Republic Protocol, Ren Protocol is a typical example of a decentralized dark pool in cryptocurrency and it is Singapore-based with Taiyang Zhang as its CEO. It is a project concerning decentralized dark pool protocol that sought to create a protocol for atomic, cross-chain trading. It was forged to bear trades with large volumes without making any changes or affecting the price of the assets. Not only does it have built-in privacy mechanisms but it also utilizes a network of Dark nodes as well as secure multi-party computation (sMPC). All this is used to match orders without revealing price or even volume. Ren also allows tokenized assets to be cross-chain traded in their private order book. The REN EXCHANGE is characterized by its decentralized nature which connotes that you don’t have to release sensitive information about yourself before you can participate on the platform.

How it Works

- The can be accessed by vising the website www.renproject.io. As boldly shown in the screenshot above, the system is particular about liquidity. The platform is like a house for all because it permits interaction between itself and other blockchains. The nature is such that interoperability is seamless and as such, even when dark nodes behave maliciously, the network doesn’t get interrupted. Furthermore, it helps by making liquidity an addition to the Ethereum ecosystem. It doesn’t matter what kind of DeFi app is being used, REN’s ability to add liquidity easily makes it possible for each user to experience seamless transactions on it.

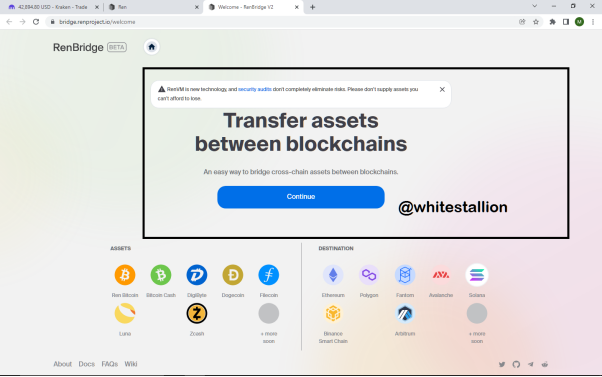

As shown in the screenshot above, Renbridge makes it possible for users to transfer assets from any location to any of the blockchains on the network. You can see the list of assets you can transfer for example-

- Doge

- Bitcoin cash

- Dogecoin and so on

You can move these assets to networks such as

- Ethereum

- Polygon

- Solana and much more

Question 7

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Cryptocurrency exchanges are platforms on which an individual can either sell or buy cryptocurrency. Cryptocurrency exchanges that have dark pool are such that restrict access to their order books, that is, there is no visibility.

A centralized cryptocurrency exchange represents a third party between the seller and buyer. Some examples of centralized exchanges are Kraken, Coinbase etc. However, decentralized exchanges do not need a third party as it provides the opportunity for users to make use of the peer-to-peer feature. This allows its users to execute peer-to-peer transactions without involving an intermediary. For example, Blocknet, AirSwap.

Cryptocurrency centralized and decentralized dark pool is block trading types that occur on both exchanges and the key difference between the two is basically that one is centralized and the other is decentralized. The centralized exchange dark pool involves a third party. It is different from the decentralized exchange dark pool that does not require any third-party presence. There is a debate on which dark pool exchange platform is more secure. It is important to note that the decentralized dark pool has a higher level of anonymity provided for its users.

Principally, during the operation of a centralized dark pool, there is a need for third-party meanwhile, during the running of a decentralized dark pool, there is no need for any third-party engagement. Other contrasting features between centralized and decentralized platforms is such that, you can execute an order successfully by just using a confirmed address on a decentralized platform, meanwhile, you can’t do that on a centralized platform as you will be required to make use of stop-limit order rather than an address.

Question 8

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

As at December 3, 2021, there was a huge sell-off in the market that rocked the crypto ecosystem. This sell-off started Friday and continued through the weekend with a continuous fall in price in the new week. Even with the effort put in by the president of El Salvador to buy the dip, Nayib Bukele could not prop the market up. Although there was regaining of prices on the 5th (Sunday), cryptocurrency prices still continued to crash. Major currencies such as Bitcoin, Ethereum and Binance’s BNB, polkadot amongst others took a major hit, going down between 4%-12%.

A major benefit of using dark pool and one of their primary reasons for coming into existence is for trades with large volumes to have a restricted effect on the market while concealing the order book. Yes, if dark pool was used to execute the sales, there would have been a difference in the level of impact the sell-off had on the crypto market as there would have been diminished effect on the market resulting from the use of dark pool.

Since this event occurred approximately a day after the 3rd December 2021, I would like to discuss the crash in Bitcoin, on the 4th or 5th December 2021. Anytime whales happen to take profit or buy an asset there is often a huge aftermath effect of such action. After some huge investors took profit probably for Christmas hahaha, it psychologically affected other holders who also began to panic sell and this cumulatively caused a plummeting in the price of Bitcoin. The initial price of the asset was $57, 495 but as a result of the panic, the price plummeted to about $45,967 on that same day.

As shown in the screenshot above at 3am on the 4th December, 2021, the price of Bitcoin went down to about $46,581and has been on a bearish trend ever since with little rises here and there.

What difference would it have made if the dark pool was utilized for such sales?

Basically, although the dark pool lacks transparency but, if this huge sale was carried out on the platform, the incognito nature of dark pools would have made it difficult or even impossible for other users to see and cause them to oanic sell.

Question Nine

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

Typically, when institutional investors need huge amounts of shares to be traded, such large orders would most likely have a drastic effect on the market. Let’s assume that a company is opting to sell millions of shares, the chances of stock price plummeting when these shares are traded on a public exchange are high. This results in poor execution of price on the path of the investor, also creating higher volatility in the market.

In the event, however, that a company secretly sells a large amount of its stock (dark pool utilization), releasing the details of the sale after the trade execution to the public, there would be reduced impact on the market price of an asset. With this illustration, it is evident the effect executing trades anonymously has on the price of assets and it explains why investors with larges orders opt for dark pool trading because the selling point of this is its privacy. Hence, in my opinion, trades carried out on dark pool have little impact on the price of an asset. A major advantage of dark pool is that for sizable orders, market impact is lessened. However, a rather detrimental factor is the level at which prices of executed trades on dark pool differ from the prices reflected in the public markets, serving as a major disadvantage to retail investors.

Question Ten

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Like most things that have advantages, there are often downsides and the use of Dark pool in Cryptocurrency is not an exception. Below are a few advantages of Dark pool;

Shielded intentions

It gives traders who want to place orders with large volume the opportunity to shroud their intentions and keep them out of the eye of the public market.Privacy in trading

Dark pools ensure anonymity in trade executions and by extension, the market place, facilitating trades that have the tendency to garner either overreactions or under reactions in the market.Improvement in price

The most favourable bid and ask price are used when matching trades. When compared to the open market, sellers and buyers using dark pool get the best prices and trades available.High-quality trade execution

Public exchanges face the problem of filling orders as well as slippage, however, traders that operate within a dark pool do not encounter such faults as the problem is alleviated.

Below are the disadvantages;

Tendency of investment fraud

Due to the lack of transparency associated with dark pools, there is the potential for broker-dealers to hoodwink investors on the basis of the management of their dark pool trading platform. Such occurrences have taken place as investment banks like Barclays have been penalized by the SEC. Also, high frequency traders (HTFs) can take advantage of dark pools to prey on unsuspecting traders if they can view the order book data by privileged access (predatory practices).No guarantee of superior trade execution

As a result of the private nature of the order books, there is no assurance that a trade was executed at the most favourable price.Lack of transparency

Because of the lack of visibility, dark pools have drawn lots of controversy and scrutiny and as a result, people feel that they run at a loss unlike those who trade on such exchanges. The lack of transparency can also conceal conflict of interests.

Conclusion

The ever changing nature of cryptocurrency transactions and operations is a blessing as numerous improvements have been actualized, such as faster transactions, more security and much more. Although dark pools aren’t totally good or advantageous, I think the pros outweigh the cons. I appreciate you, Professor Fred for granting me this opportunity to participate in this assignment.

Special thanks to Professor @fredquantum