Hey guys,

I welcome you'll to the 5th week of the SteemitCryptoAcademy course by Professor @lenonmc21. In this course, I will run a comprehensive review on Trading strategy with the VWAP indicator.

All images used in this post unless otherwise stated are not mine and were extracted from Tradingview and Powerpoint Images designed by me for the purpose of this assignment.

Question 1

Explain and define in your own words what the “VWAP” indicator is and how it is calculated (Nothing taken from the internet)?

Volume Weighted Average Price is a very useful tool that is used by traders around the world, due to its historic efficiency and profitability. It also goes by the name “Precio medio ponderado por volumen”.

It has something that many indicators in the market lack during of calculation; it has a unique feature that takes into calculation the volume of money traded or “volumen de dinero negociado” in a specific duration of time, something that is really powerful during trading because it gives the idea of the total money flow during a specific trading session. It measures the total cash flow in a particular trading session for example money movement big institutions and banks giving the retail trader the idea of where the market pressure is.

How To Add Vwap Indicator

The formula with which this indicator is calculated takes into account the following details

Price

Volume of money traded

Number of daily candles

Now, the way in which these data are arranged to get the calculation is stated below:\

Price + Volume of Money Traded / Number of daily candles

This indicator is one that can be used in the place of indicators that work using moving averages. The VWAP is a type of indicator that works by taking volume into account. The volume-weighted average price indicator works by sorting the cumulative average price with volume in the market.

Just as each indicator has a way it is calculated, this indicator has its own formula

The volume-weighted price indicator = ∑〖Price x Volume/ ∑Volume 〗

So, what happens Is that the price and number of assets are multiplied by the total number of assets traded during that period.

The reality that this indicator took this information in order to calculate it gives a valuable advantage since it offers us an accurate average price, It resets its value on a daily basis which distinguishes it from other indicators as it refreshes its data after the daily candle is completed giving it an advantage at its prevents previous days values from overlapping or messing with today’s market money volume. It is often compared with the EMA (Exponential Moving Average), because, as popularly known, It is part of those indicators that reacts with more precision to the movement and/or development of the price, but even with this, The EMA is out of date from what the real-time price really is, because it has accumulated data from previous days and therefore it lags. The VWAP solves one of the most common problems that we find with various amounts of indicators that are being used in the market, and that is that the “VWAP” value always remains the same in all time frames being applied and doesn’t repaint.

It may seem insignificant but it allows traders that operate at different times and different methods to carry out their operations with the same standards, therefore, making it available for usage to everyone.

Question 2

Explain in your own words how the “Strategy with the VWAP indicator should be applied correctly

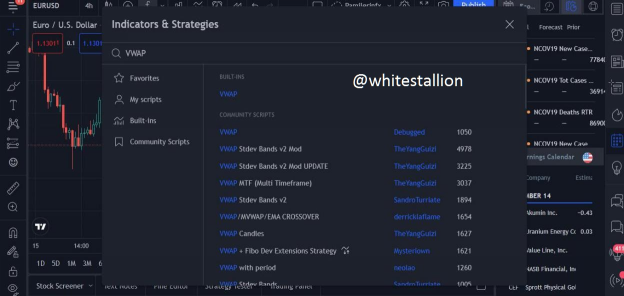

Before showing you how this indicator is useful for being a strategy, firstly I would show you how to add the indicator to your charts using the trading view platform Steps:

The first thing to do is go to the top of the screen, select "Indicators", place the word "VWAP" and add it to the chart

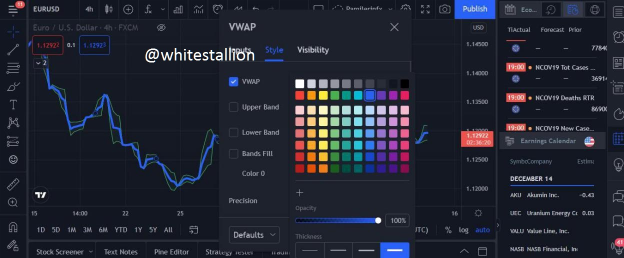

- Once added to the graph, we go to the chart and click on the eye icon and when the screen appears to observe only the details of the indicator, right-click on the indicator which is currently showing alone.

- on your chart and scroll to settings, style, here we will uncheck the options (Upper Band, Lower Band and Bands Fill) and click on ok.

- Finally, what we must do is press where the blue line of the "VWAP" is, select the maximum thickness for this line and click on accept then go back and click on the eye icon again.

- When all this is done the indicator will be ready for use.

With this indicator, this is how the strategy works, the "VWAP" works as a magnet for the market price, since it is always attracting and moving it away, this shows that it is a very efficient trading tool to determine "Supports and Resistances present in the market ", In order to use this indicator to maximum efficiency, we must wait for the price to return to the" VWAP "to be able to make an entry, this will eliminate prevent us from using a weak trend or getting caught in small market moves, due to this, We will take advantage of the indicator giving us a very precise average price that is in line with the volume of money traded to increase our chances of success.

The Steps Of The Strategy

Breakdown of Structure from Bearish to Bullish and Vice Versa: The first thing is to wait for the last previous high or low to be broken depending on current market trend (bullish or bearish) and that then the price makes a clear breakout of the VWAP to be able to take that break as valid and we then follow the other steps of this strategy to be able to take an efficient operation with this strategy.

Retracement to the VWAP (Use of the Fibonacci): The next thing that we must watch out for, is that the price begins to make a retracement after the last bearish breakout made causing the break of the last swing low,

the price starts to retrace, when we observe this movement we should take our Fibonacci tool,(Fibonacci Retracements) and measure that last momentum from the swing high. Once this is done, we must be very attentive to the 50% and 61.8% levels or (0.50 and 0.618) levels depending on your Fibonacci default settings, because that is the best entry zone as long as the price returns to the “VWAP” and it is within the aforementioned zone.

Correct Management: If the price reaches the zones where we have planned (the

50% and 61.8%) zone, our “Stop Loss must go below the aforementioned zone, that is, a little below the 61.8%. On the other hand, the “Take Profit” should be 1.5 times

More than our SL, this will give us a risk-benefit ratio of 1-1.5 to 1-2 as maximum.

Question 3

Explain in detail the trade entry and exit criteria to take into account to correctly apply the strategy with the VWAP indicator?

The trading entry and exit criteria of this strategy are easy, but it is necessary to follow all rules to the core to ensure efficiency and obtain the best results with it. Below I will present these steps taking into account both setting, (bullish and bearish).

When the price shows the last swing high or swing low, we must make sure that the price clearly breaks this zone, it must clearly break the zone either by little or large, it must be visible that swing high or swing low has been broken. If this does not happen the strategy will not work correctly and it is better to look for another opportunity where this specific condition is met.

Validated Break

After we notice the break is validated, we must wait for the price to begin to retracement irrespective of its direction (Bullish or Bearish), After this plays out, we must trace our "Fibonacci Retracement" at the last impulsive move and wait for that the price in conjunction with the "VWAP" enters the zone of 50% and 61.8% of the Fibonacci. If the market doesn't play out exactly as I'm describing, it is advisable to look for another entry as the strategy would be invalid.

To have proper and safe risk management, our "Stop Loss" must be below the 50% and 61.8% zone, since it will not give enough room in the event that the price drops just a little bit. Our "Take profit" must be 1.5 times above based on our SL, which means that our risk and benefit ratio will be 1-1.5 and a maximum of 1-2

Bearish Trade

Bullish Trend

Conclusion

This is a simple strategy but with high-performance thanks to the factors that make up the "VWAP" indicator such as the volume of money traded. I hope you can take advantage of the “VWAP” indicator by using its accuracy.

Special thanks to Professor @lenonmc21