Hey guys,

I welcome you'll to the 3rd week of the SteemitCryptoAcademy course by Professor @pelon53. In this course, I will run a comprehensive review on Fibonacci Tools

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

Explain in your own words what you mean by Fibonacci retracement. Show an example with screenshot.

Fibonacci is used majorly in mathematics because it deals with numbers and the calculation of some set of numbers called Fibonacci numbers. Fibonacci is a man who is known as Leonardo Bonacci, Leonardo of Pisa, or Leonardo Bigollo Pisano, he is an Italian mathematician who worked on several projects and invented the Fibonacci numbers, according to history, he was considered to be the most talented mathematician of the middle ages, he was from the republic of Pisa. The name Fibonacci was given to him, and he was usually addressed by it by a man called Guillaume Libri, Fibonacci is an abbreviation for Fillus Bonacci which means the son of Bonacci. So, the popular anime he was referred

to was to identify him with his father's name.

Fibonacci Retracement is a popular tool that traders use, especially technical traders. They are based on some cogent numbers developed by Leonardo, it is developed or came from the Fibonacci sequence, and it is horizontal lines that are used as a means of identification wherever support and resistance occur. According to technical analysis, the Fibonacci retracement is created by taking two extreme points, in which most of the time, it’s a support or a resistance, a trough, or a peak, on a market chart, in which afterward the market char is now divided into some percentages and ratio of 23.6%, 38.2%, 50%, 61.8%, and 100%. When the levels stated in the previous percentages have been identified, horizontal lines are drawn and used to locate the support and resistance levels.

Fibonacci number series is gotten by adding the number that follows the number before, e.g. 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233. The numbers written in this sequence are gotten by adding the numbers to each other, for example, 1+1=2, 1+2=3, 2+3=5, 3+5=8., the numbers continue till infinity. The fantastic thing about this series and its number is that each number is 1.618, Leonard’s disciples came up with a postulation that if nature 0bey the Fibonacci ruler, then also the stock markets should obey it, and part of the uses of Fibonacci’s rule is the Fibonacci Retracement which talks about the identification of support and resistant lines by the use of horizontal lines drawn via the Fibonacci Retracement rule.

There are basic trends that happen in the market, like an uptrend, downtrend, choppy, and ranging market. In the case of an uptrend, the market prices do not move in a straight line because there are forces imputed into the market that will want to pull it down, which will cause retracement in the market a number of times, so this in a way make the market to move Zig-Zag like in nature. It is now during this time that the usefulness of the Fibonacci tool comes into place as it is used to decipher the movement of how the falling of the market price would be before the uptrend continues. It is this same pattern and rule that the other market follows like a downtrend. In the same way, the Fibonacci Retracement is used to calculate the retracement of a price after a trend has happened then an extension of the Fibonacci gives details for the net trend that will happen in the market.

To be able to use the Fibonacci retracement, we will be using some principles and we will need to locate the Fibonacci retracement on a chart.

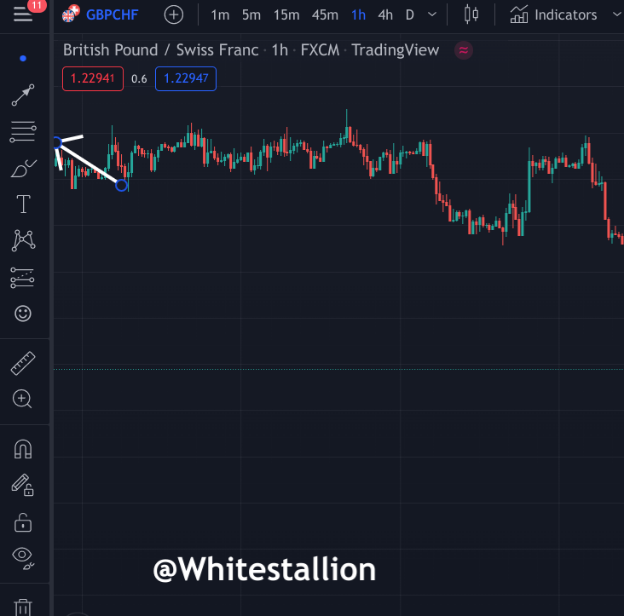

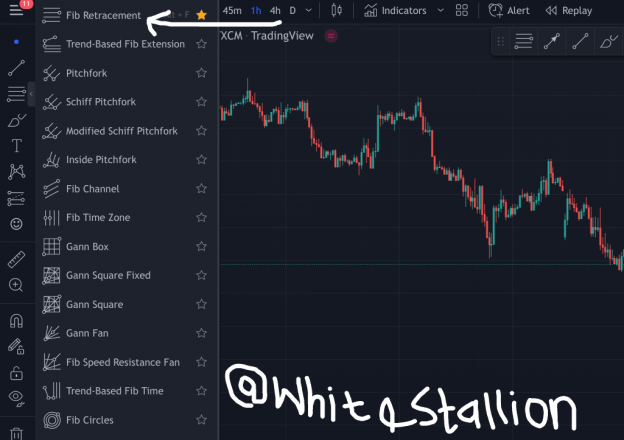

On the tradingview platform, the bars are at the left-hand side of the platform, you will click on the third button there and select Fibonacci retracement, the way it is shown in the images

If it is an uptrend, it is needed to select the tool and go the ending part of the trend, and then click on the left part of your mouse, drag it to the point with which you desire, to make the tool enlarged. To use the Fibonacci retracement tool, only 2 points are needed in the market pattern, and they are the beginning of the trend and the ending of the trend. The image below practicalizes what is being explained here.

Question 2

Explain in your own words what you mean by the Fibonacci extension. Show an example with a screenshot.

Fibonacci Extension helps a lot in establishing the price target and to locate them, they also help to understand the current trend of the market, and they show the projected area of the support and the resistance level where other tools will not identify the support and the resistance, or they are not applicable. If the price successfully moves through one of the extension levels, the probability of its movement towards the next one is so high.

Fibonacci Extension is basically the point that shows interest. To identify the Fibonacci Extension tool in the market, the left corner of the platform has some buttons, the third one is where the Fibonacci tool is located.

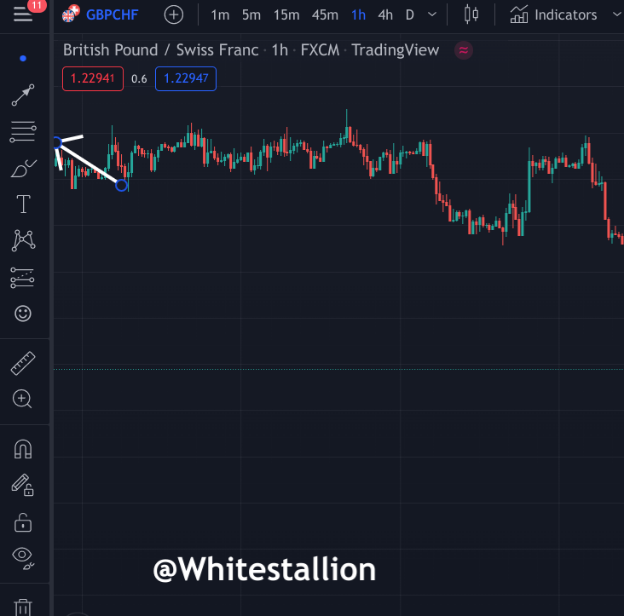

- The GBP/CHF chart, 1 hour, the bottom (o), if it is an uptrend, go there and click on the left of your mouse to the ending of the uptrend (a) and take it back to the retracement point. To effectively use the Fibonacci extension, three points needed to be located, the beginning of a trend, the ending of a trend and the end of the retracement that happened in the market.

- In the picture above, the price hit point C, at the level of 1.618 in the extension of the Fibonacci

Question 3

Carry out the calculation of the Fibonacci retracement, for the levels of: 0.618 and 0.236. Pick a crypto pair of your choice. Show a screenshot and explain the calculation you made.

There is a laid down formula used in calculating the Fibonacci’s retracement, and it is as follows. R1 = X + [(1 - % Retrace1/100) multiplied by (Y – X)]

X = Initial value price of the beginning of the Fibonacci Retracement

Y = Maximum value price of the ending of Fibonacci Retracement.

% Retrace 1 equals to 23.6%

% Retrace 2 equals to 38.2%

% Retrace 3 equals to 50%

% Retrace 4 equals to 61.8%

% Retrace 5 equals to 78.6%

For the formula above, the retrace 1 is 23.6/100=0.236, so it is necessary to input it in the equation and write it the way it is written below.

R1 = X + [(1 - 0.236) multiplied by (Y – X)]

The image below shows it all, as we will consider it as an example.

X=64,689.01 USDT

Y=50,572.12 USDT

To calculate the recoil, R2 = 0.5

R2= 50,572.12 + [1 - 0.5 * (64,689.01 - 50,572.12)]

R2=50,572 + [0.5 * (14,116.89)]

R2= 50,572.12 + 7,058.445

R2= 57, 560.565 USDT

Fibonacci Retracement level of 0.618, and 0.236

For Level 0.618, the choice of the crypto pair would be BTC/USDT

X=64,689.01 USDT

Y=50,572.12 USDT

To calculate the recoil, R2 = 0.618

R2= 50,572.12 + [1 - 0.618 * (64,689.01 - 50,572.12)]

R2=50,572 + [0.382 * (14,116.89)]

R2= 50,572.12 + 5,392.65198

R2= 55,964.772 USDT

For the Level 0.236, the choice of the crypto pair would be BTC/USDT

X=64,689.01 USDT

Y=50,572.12 USDT

To calculate the recoil, R2 = 0.236

R2= 50,572.12 + [1 - 0.236 * (64,689.01 - 50,572.12)]

R2=50,572 + [0.764 * (14,116.89)]

R2= 50,572.12 + 10,785.304

R2= 61,357.424 USDT

5.- On a Demo account, make a trade operation using the Fibonacci extension. Screenshots are required.

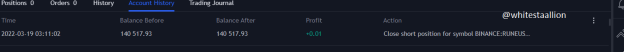

I chose the Rune/ Tether U.S crypto pair. The market was in a great downtrend, confirmed by the price touching my resistance line multiple times. If you look at the chart above, the trend during the time of my trade was an uptrend. It was just a reversal in the prior market. The former trend was a bearish one and the reversal broke past the prior lower high. The prior lower high was around 8.770. After drawing my Fibonacci extension from my high to a low point, I was able to get the market structure information. In other words, I was able to ascertain the bearish trend. Furthermore, I executed my buy trade immediately price shot past the prior lower high indicating high volume in the market. This pushed up the volume and I hit my take profit level which was set at 8.788, making a 0.1 USDT profit

Special thanks to Professor @pelon53

Hi @whitestallion

Do you want to join any community curators team?? If you are willing to join you can contact me on discord ashkhan#8433

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit