Hello friends and welcome to my assignment task by professor @reddileep, In this assignment, I will provide a detailed review of How to Trade Cryptocurrencies Profitably Using TD Sequential . I hope you enjoy the class.

All images used in this post unless otherwise stated are not mine and were extracted from Tradingview, and Binance, for the purpose of this assignment.

Question one

Define TD Sequential Indicator in your own words.

This is another technical analysis discussion, last week we had learnt how powerful technical analysis is to trading and we had learnt also that there are several tools under technical analysis that helps in putting guarantee on price movements as far as anticipation is concerned. A TD Sequential Indicator is basically a type of indicator first, or if I would say, a type of tool under technical analysis. It was discovered by Tom Denmark (hence TD) and it serves to trace out points in markets where there is likely to be a reversal in price trend. It basically identifies instances of trend exhaustion, for instance where a bearish market is likely going to be bullish.

To utilize this indicator on a trade, the analysis will be done in this format:

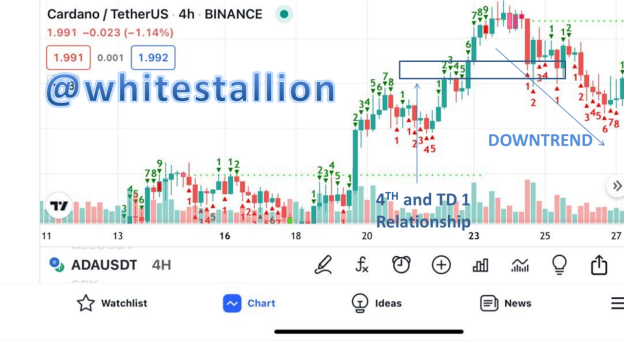

The TD Sequential indicator consists of three main elements: “the countdown”; which involves a calculation of trend lengths to determine if it is fading or strengthening (from the picture above, they consist of the numbers under the highs and lows of the waves). All of which would determine the existence of another element: “the Price Flip” which is basically a sign that there is a potential reversal in trend. The final element is “Set-up” this is basically a clarification on disparities between new trends and a simple correction in a particular trend.

How trends reversal or corrections are spotted is simply by a study of numbers made on each waves as would be explained later on. However, summarily, the buy signal (Setup) would be possible when there is a presence of at least 9 consecutive waves that follow each other in the pattern that they appear to be lower than early corresponding closes.

Question 2

Explain the Psychology behind TD Sequential. (Screenshots required)

From the definition above; one thing clear is that the TD Sequential was made to distinguish between reversals and corrections as well as anticipate them. It consists of two major phases: the Setup and the Countdown.

Setups are usually characterized by a numbering on the waves which is usually inserted by the analytical tool; there can be a TD buy setup and a TD sell setup. Quite the opposite, the TD buy setup happens when the market goes down, and the TD sell set up happens when the market goes up simply because to benefit from a buy market, you have to buy when it is low and to make profit from a sell market, you sell when price is high. Understanding this psychology is essential to using the TD Sequential analytical tool. More clarifications on this will be made in the next question.

On the other hand, the TD Countdown is basically a spot for trends; they serve to help the trader discover low risk movements that guarantee directions. The idea of a TD countdown is a lean on the general rule of TD sequence that once a movement has hit sequence 8 or 9, then a reversal is supposed to happen, but if it does not, or when it does not, this is a TD countdown. Typically when a TD countdown happens, it can exist for 13 more times before it expires, therefore the emphasis on a TD countdown in 13 sequences and not 9. However, what I learnt from the class is that the TD countdown is less used when compared to the TD setup.

Question 3

Explain the TD Setup during a bullish and a bearish market. (Screenshots required)

TD Support in a Bearish Scenario

Before proceeding here, it is important to remember the rule of buying and selling with the TD Sequence analytical tool; you buy when the market goes down, and sell when it goes up. It is this idea that guides us through the explanation of TD setup in a bullish (buy) and bearish (sell) market. For the bearish market, all we have to spot is that the close of the trend is a bearish candle; indicating that there is now a switch from bullish to bearish. This is the first thing that usually happens and after this happens, then one needs to look that the close of any of the candles on the bear trend is above at least any of the last four candles that were preceding it.

Basically, the expectation is that we see a bullish (typically green candle) emerge, and is usually represented as number 1 when the TD Sequence indicator is used on the chart. This number one candle often times closed above the 4th cycle in the previous trend. When it has fulfilled all these, then it can be said to be a good bearish set up. See below a pictorial representation:

TD Support in a Bullish Scenario

It is quite the opposite as explained above; the guideline being however that you buy when the market goes down; basically defining the buy scenario as recognition of trends moving towards a low. Meaning that first a bearish scenario has to occur and then it will be monitored when there is a reversal to know if it is valid or not, and when it proves valid, there will be a counting. The TD 1 in the setup is expected to close below the preceding four candles and it is when this scenario happens that a bullish scenario can be said to be spotted. However, it is subject to the formation of 8 or nine numbers.

See below a pictorial representation:

Question 4

Graphically explain how to identify a trend reversal using TD Sequential Indicator in a chart. (Screenshots required)

A Graphical Representation of Trend Reversal Using TD Sequential Indicator in a Bearish Scenario

In a Bearish scenario, what we are expecting to see is market characterized by uptrend scenarios; so the graphical scenery would consist of Higher Highs and Higher Lows till it get to a region we can say is overbought and then a reversal occurs. This occurs as a result of price exhaustion, being that the market had bought for a long while, it loses its buying pressure and a bearish trend occurs as seen below:

A Graphical Representation of Trend Reversal Using TD Sequential Indicator in a Bullish Scenario

This is quite the opposite as in the bearish scenario. While the Bearish consists of HH and HL, here it is LL (Lower Low) and LH (Lower High); showing TD 9 at the LL and here price exhaustion is preceded by sell trends in the market. After consistent selling, market gets to a point where it can be said to have oversold and then price reverses. This can be explained through the diagram below:

Question 5

Using the knowledge gained from previous lessons, do a better Technical Analysis combining TD Sequential Indicator and make a real purchase of a coin at a point in which TD 9 or 8 count occurs. Then sell it before the next resistance line. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern such as Double bottom, Falling wedge and Inverse Head and Shoulders patterns.)

For the sake of this analysis, I would love to implement the technical analytical tool I learnt during the course of last week’s training: the RSI. I indicated last week that the RSI indicates prices strength simply by comparison the movement of the closing prices. The RSI functions by scales (0-100), measuring instances of overbuy and oversell and it does this by giving confirmation in chart patterns. Confirmation of an over buy would be made when the RSI scores about 70% and above. This will then indicate that the trader can partake in the sell market, however, 0-30% indicates an oversell, and a preparation for a buy.

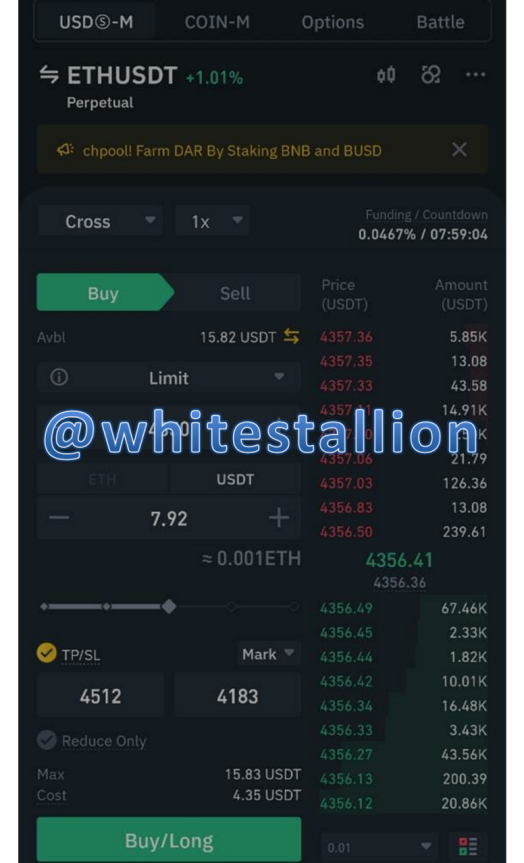

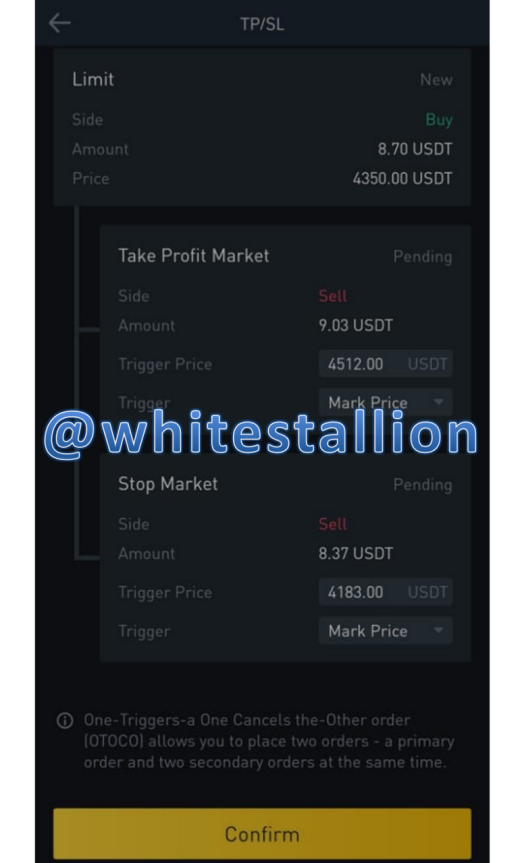

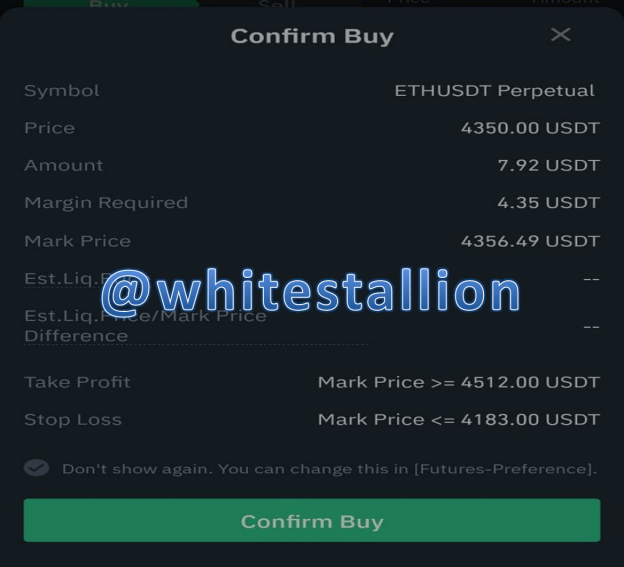

For the sake of attempting the above, I would use the RSI tool in line with the TD sequential indicator to trade ETH/USDT; below is my analysis:

As can be seen, TD 9 is formed, and there is an overbought region. In my opinion, price is expected to return to the first support line indicated above with a blue arrow, and perhaps depending on fundamentals, we may even see a return to the second support line. So I take down my entry to be: 4346.99, my TP: 4183.82, and based on a 1:2 RRR, I set my SL as 4512.00. So I move to Binance to implement this setup.

Conclusion

In my opinion, the TD Sequential indicator is a quite easy trading technique when paired with RSI; however it also requires knowledge of support and resistance. It is a brilliant tool to provide traders with direction of the market and also instances for which traders can anticipate price reversal or correction and use it to their favor. When paired with the RSI tool, it guarantees reversal predictions by identifying if the market had been overbought or oversold. Quite a useful tool.

Special thanks to Professor @reddileep

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-172186/@hamza009/achievement-1through-my-introduction-at-steemit-by-hamza009

@whitestallion

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-172186/@hamza009/achievement-1through-my-introduction-at-steemit-by-hamza009

@whitestallion verify and vote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit