Hey guys,

I welcome you'll to the 4th week of the SteemitCryptoAcademy course by Professor @reminiscence01. In this course, I will run a comprehensive review on the Psychology of Trends Cycle.

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

Explain your understanding of the Dow Jones Theory. Do you think Dow Jones theory is important in technical analysis?

The Dow Jones theory was postulated by Charles Dow. This theory was developed in the year 1879. The Dow Jones theory is obviously a financial theory that states that the financial market is in a bullish trend if at least, one of the averages which are industrials or transport goes above a former important high. This causes a similar advance in the remnant averages. Charles Dow observed certain characteristics in the market. He observed that the prices of stocks principally move up or down in essence, bullish and bearish trends. Furthermore, the trends move together even though how far this movement occurs, differs. In the year 1897, Charles was able to craft two moving averages. They are now known as the Dow Jones Transportation Average. The indicator is the foundation to all principles of modern technical analysis. By the way, Charles did not use his findings to predict movements of prices in the market. What he did was to use it as a metric in the general business climate. After the death of Charles, William P. Hamilton did well in refining the principles Charles operated with. The refinement was done by Robert Rhea too, making what we have now as The Dow Theory.

Principally, the theory is such that every facet of economic activity ranging from economic news, demand and supply and every other facet is at discounted prices. The implication is that when a trader analyses the price, it may help him find out the potential direction of a trend. In fact, the theory favors the usage of volume to judge a market. When there is a high volume of buy orders, the market will be bullish. When the volume of sell orders is much, we have a downtrend. Furthermore, I will be speaking about the phases of prices not excluding the psychological implication of all of them. More so, the theory speaks about the accumulation and distribution phases of prices, for instance, during a bull market. There is a presence of higher highs and when we speak about a bearish market, we have lower highs. The theory subscribes to the opinion that when there is an accumulation phase, the next phase will be a distribution phase which is either in a bullish or bearish trend. So, when a particular trend continues, the reaccumulating phase. So long as there is no reversal in the market, all the prior mentioned phases continue.

Yes, I think the theory is important in technical analysis. The theory is very practical in operation. As I stated earlier, the theory implies that when considering volume, the trend moves in tandem with the orders that cause volumes. The implication of this is that, when there is a high volume of buy orders, the market will be bullish. When there Is a high volume of sell orders, the market will be bearish. Most times, as practical as trading can be, traders may close positions, open more positions or take profit. All of these actions make sure that the distribution, accumulation, and re-accumulation phase is obeyed. When traders open more orders and the volume increases, we tend to have higher highs. When the reverse is the case, we have lower lows and lower highs. There is always a posture of accumulation, distribution, and re-accumulation, and the cycle repeats. The theory is very practical. During trades, the market makers in the financial market are responsible for how the direction goes. They open big trades and the volume ridiculously skyrockets or plummet furthermore, the little traders decide to follow suit by opening and taking profits of positions quickly. Funnily, when the heavyweights in the market pull the market in a direction and little traders decide to follow suit thereby increasing the volume of the market in the prior direction either bullish or bearish. The market makers may then decide to take profit and close position which will quieten the market. A re-accumulation phase kicks in and then the cycle repeats.

The image above is a simple, illustration of what I explained above, how the price of an asset accumulates, distributes, and re-accumulate. When people notice the price of an asset going up, they jump into the market. More people jump on the train till the big guys take profits and the market retraces and ranges for a while, without trending in a particular direction yet. It continues that way until traders capitalize in the low buying price then they open buy orders and the trend continues.

During the Distribution phase, market makers who initially caused the uptrend to begin to sell the positions. Most of them close positions after they hit take profit or they open sell trades. Psychological effects come in and the little traders begin to panic. The panic increases as more traders begin to sell off their positions. Finally, the trend reverses as more traders open sell trades to ride the trend.

Question Two

In your own words, explain the psychology behind the accumulation and distribution phases of the market?

The background of accumulation and distribution is that they consider the prices at which prices close in respect to high and lows. During a phase of accumulation in which there is a period of higher highs and higher lows, the bullish trend is likely to continue. Similarly, when the price begins to depict lower highs and lower lows, it means that the bearish trend is likely to continue.

As you can see in the image below, in an accumulation stage, big financial bodies open positions, this triggers other small traders to open the same positions. The period where all of these happens is at the bottom of the chart known as the accumulation stage. We can see in the image below that after the ranging period, the market broke the range and started a bullish trend.

After a while, the big market makers may decide to take profit. This makes the market to the range, serve as an opportunity for other traders to enter or buy at a lesser price called re-accumulation. Usually, a break happens and the bullish trend continues.

When we talk about the accumulation phase, we see that it is a period where traders open buy orders. Typically, the institutional buyers known as market makers make big moves during this period. Usually, during this phase, big market makers open buy entries then they ride the trend before deciding to close positions. Usually, because of their volume, their entries make the market move powerfully in a direction. The prompts other users to open buy orders in order to ride the trend. After some time, the market makers begin to close positions and the market begins to range. The price rocks the support and resistance level until the position weakens further as little traders begin to panic sell. The volume gets increased as more sellers open more sell orders at the distribution phase.

In the screenshot above, we see that the market makers entered the market after a little period of gathering momentum. The position was a short one as they took profit and some traders panicked sold. After a little period of ranging, other buyers came into the market and the market gathered enough momentum and the bullish trend continued.

There are times when trends reverse. The confirmation is usually that the new high must go beyond the previous low to ensure that the market is not just going through a range of confirmation or testing.

During a distribution phase, the market makers twist the market around. This usually happens at the peak of a bullish trend. I stated earlier how that the market is determined by a variety of big financial institutions. After the market makers open positions and smaller traders ride the trend with them, it gets to a point where they take profit and close the positions. It is even sadder for those who in an attempt to milk the trend, entered the trade late. The immediate reversal causes them to lose money. Just like the accumulation stage, the market ranges for a while as sellers take profit. More people are open positions here and the trend continues in the bearish direction.

In the image below, there was a period of accumulation at the top of the price chart. The breakout happened and the downtrend began. Furthermore, the big guys began to take profit-making the market to range for a while. This was an opportunity for other traders to open sell positions, the trend continued. At the end of the trend, the point of reversal was when the new high touched the prior low.

Question 3

Explain the 3 phases of the market and how they can be identified on the chart..

Before I talk about how to identify market structures by the instrumentality of what we are currently discussing in this assignment. I need to give a brief introduction to what trends are. Trends are basically the directional flow of the price of assets. A bullish trend signifies an uptrend while bearish trends signify downtrends. The sideways market also indicates a ranging market. Interestingly there are a number of ways a trader can use to identify all of the aforementioned trends. We can use trend lines, market structure, technical indicators such as the EMA, Bollinger bands to identify the direction of the market. All of these tools can be used to identify trends in the market although they have cons and pros. For instance, if you use the median indicator to trade, the lagging nature of the indicator may make you enter trades late. You may even miss the perfect entry points for trades.

- Downtrend Trend

As you can see in the image above, you can see that there are regions of lower lows and lower highs indicating the presence of a downtrend. The volume is high, with sell trades being predominant.

- Uptrend Trend

In the case of an uptrend, we can observe higher highs and higher lows. This is caused by an increase in the volume of buy orders in the market.

During trends, there are periods where the trends continue in the direction of the former trend it is called the impulse trend. This is a more popular kind of trend as it is commonly seen used by traders. It is the usual higher high and higher low during a bull trend.

- Sideways Trend

When we speak about sideway trends, we are speaking about a period in the market when there is an equilibrium between buying and sell orders. In situations like this in the market, the market keeps bouncing off the support and resistance level. It is quite interesting that after such moments in the market, the market launches in a direction after gathering enough momentum. Sometimes, when the price of a market ranges, the trend may continue in the prior direction or break in a new direction. The image above is an illustration of this:

Having spoken about what bullish, bearish, and sideways markets are. Trends are embedded in all of these; the reason is that sometimes corrective waves happen during markets and traders may take them to be reversals. As I explained earlier, during the course of a trade, multiple take-profit levels are hit, and sometimes, when this happens there can be corrective waves in the market.

The answer is simple, it is that, during corrective waves, the trend is most likely to continue. The pause is only because of the trader’s willingness to leave prior positions or take profits. The way to confirm that the trend is actually reversing is by using technical tools such as support and resistance lines. The thing Is, during a reversal, the trend must break the prior low. The image below shows a trend reversal, the new high broke the previous low.

Question 4

Explain the importance of the volume indicator. How does volume confirm a trend? Don this for the 3 phases of the market?

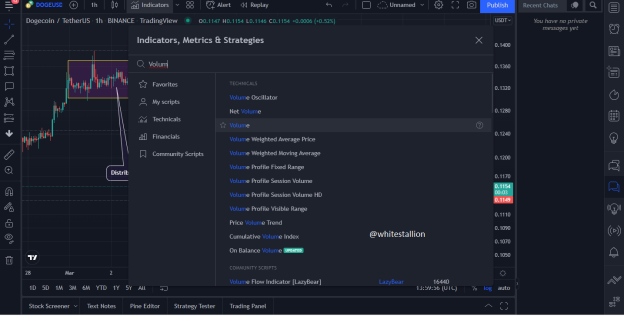

The job of the volume indicator is simple. Its job is to depict volume in the market. I stated earlier that the volume in the market can determine the trend in the market. There is a direct relationship between volume and the trend available in the market. So, when there is a high-volume quantity for sell orders, there will be a great bearish market. When there is a high volume for buy orders, there will automatically be a great bull market. When there is an equilibrium between buy and sell orders in the market, we have what is known as ranging or sideways market. In fact, there is a volume indicator in trading view. I use the tradingview site to carry out technical analysis. You can add the volume indicator to your chart by simply searching for the volume indicator in the taskbar after you click on the indicator sign on top of the screen.

- After searching and clicking on it, it will be added to the chart.

- Finding the volume of the market becomes easier with this indicator.

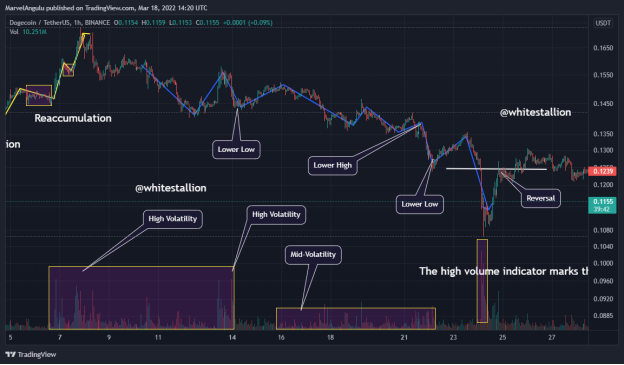

In the image above, we can see that there is a bullish trend before the reversal. The Dogecoin / Tether U.S crypto pair at a one-hour timeframe just came out of a downtrend and the market reversed for a while then entered the accumulation stage. In essence, it means that the market was being gathered together in preparation to launch into a new trade. In the image below, you can see that the volume was low prior to the big move in the bearish direction. The high volatility is pointing out to a big sell order that was opened. The position was opened for a while until the positions were beginning to close and the volume began to reduce.

In the image below, we see that there was a period of high volatility immediately after the bullish reversal. The market reversed abruptly and there was a register of high volatility in the volume indicator. This obviously means someone, most likely a market maker or a big financial institution closed their position. Anyway, the market began to distribute, in other words, it gathered momentum as buy and sell orders rocked the market. If you check the indicator, you will notice high volatility around the region. This connotes a period of massive demand and supply before the break out in the bearish direction finally happened.

- Finally, during a ranging market, the volume of the market is usually low as shown in the screenshot below.

Question 5

Explain the trade criteria for the three criteria for the three phases of the market?

Before I explain the three criteria for the phases of the market, I need to state the three markets.

- Bullish

- Bearish

- Sideways

The first and basic criteria for us to carry out the uptrend market is to make sure that the market is in a bullish direction or trend. What I mean by this is that the market must do well to obey the higher highs and higher lows principle. In addition, since we just finished making use of the volume indicator, there should be an agreement between the trend and the volume indicator. Volatility must be high. After making sure that the trend is bullish, the next thing to watch out for is to ascertain a good entry point. I stated earlier that during an uptrend, there is usually a point where financial institutions and traders take profit. This makes the market retrace and it ranges for a while. This is a good point for the trader to make entry. The implication of this is that it will be easier for the trader to buy at a lower price.

Just like how the uptrend operates, during a downtrend, ensure that the motions of the price obey the lower highs and lowers lows of a normal downtrend market. After observing this, proceed by making an entry using a bearish engulfing pattern by making sure that the price must have created a retracement trend forming a peak point.

When trading the ranging market, it is important that one becomes very careful. In fact, it is better to avoid trading a ranging market because it is unpredictable. This is the point where the market gathers momentum to flow in a specific direction. The criteria hence are that traders should use the support zone as an entry point for long positions. You can decide to set the take profit at the resistance level. In case of a short position, you may decide to use the resistance level as an entry point. Obviously, the support zone becomes the take profit level. I used the support and resistance zones to open my short and long positions respectively. I set my stop loss for the long position at the bottom of the support line. I utilized the ratio 1:2 risk management system.

Question 6

With the trade criteria discussed in the previous question, open a demo trade for both buy/sell positions

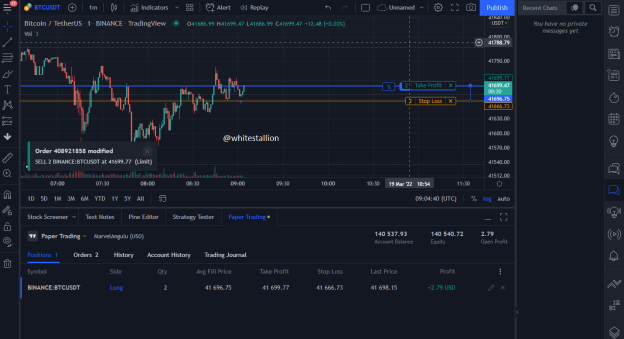

After a study on the Dow theory and learning about the phases of the market. I am going to use these principles to place demo trades using tradingview. Just like I stated earlier, the volume indicator must register high volatility and the market must obey either a bullish or bearish trend.

Buy Trade

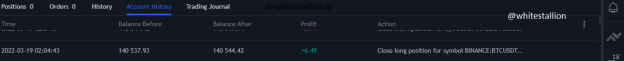

I placed my buy trade in a long position using the Bitcoin/Tether U.S crypto pair at the 1-minute time frame. I was able to identify a bullish trend which means I noticed the candlesticks exhibiting higher highs and higher lows. During the trend there was a retracement in the market which possibly connotes that traders were taking profit from the market thus, the market dropped a bit giving me an opportunity to buy at a cheaper rate. I entered the market when a=I noticed a bullish candle at 41 698.15. I set my stop loss at 41666.73 and my take profit at 41699.47

- I was able to hit my take profit and I made a profit of 6.49 USDT

Sell Trade

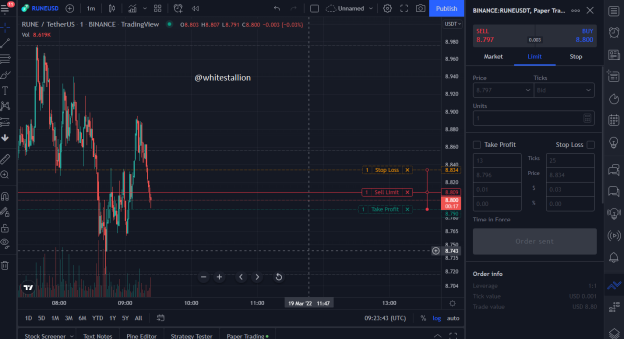

In trading the sell market, I made ensure to apply the prior criteria. I ensured that the market was clearly in a bearish trend. I selected my crypto pair being the RUNE/ Tether U.S. The market had just started off after a distribution phase. I was specific about this kind of market and when I found it, I was already a little bit late. I couldn’t enter the market at the peak of the market, now withstanding I enjoyed the trend and opened a short position.

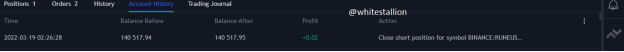

- I placed my stop loss at 8.834 and my take profit at 8.790. The volume of the market was intense and the volume indicator pinpointed it at about 8.619 thousand. I initially entered the market at point 8.809 and I hit my take profit as shown in the image below.

- I was able to hit my take profit and made about 0.02 USDT.

Conclusion

It really was an interesting journey, learning about this theory and the phases of the market. I am certain that I will attend to these lessons more and apply them in my subsequent journey in trading the financial market. The criteria for the trades will forever be in my brain as I will as well do well in implementing them during trading. Thank you, my professor.

Special thanks to Professor @reminiscence01

Hello @whitestallion , I’m glad you participated in the 4th week Season 6 at the Steemit Crypto Academy. Your grades in this Homework task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit