Hello friends and welcome to my assignment task by professor @kouba01, In this assignment, I will talk about the basis and concept of Crypto Trading With Chaikin Money Flow . I hope you enjoy the class.

Question 1

In your own words, give a simplified explanation of the CMF indicator with an example of how to calculate its value?

From my understanding of what indicators represent, we are made to define, understand and identify indicators as a result of the actions they carry out; these actions indicate the state and level at which a financial asset is at. An example of the types of indicators that exist is the Chaikin money flow indicator.

The Chaikin Money flow indicator was introduced by Marc Chaikin in the 1980s. Chaikin Money Flow indicator is also known as CMF Indicator is a technical analysis tool that measures the money/cash flow into a financial asset within a specified period.

For a more detailed, yet simplified understanding of the CMF Indicator, it is an Indicator that monitors/measures the volume, momentum, and/or the flow of money into a financial asset by Investors with the intention to accumulate or distribute (Buy/Sell) a financial asset within a stipulated period.

The CMF Indicator mode of operation includes determining if an accumulation or distribution is going on, on a financial asset at a set period, this is done by comparing the closing price to the high & low of a trading session.

The Chaikin Money Flow Indicator uses an arithmetic method to measure the degree of buying and selling pressure. Remember from the previous paragraph, I made mention of CMF Indicator mode of operation. I said it determines if an accumulation or distribution is taking place on a financial asset by comparing the closing price of the high and low within a trading range or session.

Hence, to get the calculation of the CMF indicator, we need to divide this process into distinctive phases, which includes;

- Money Flow Multiplier

- Money Flow Volume.

- CMFI

These data are important to calculating Chaikin Money Flow, without them we cannot calculate the CMF. Hence, we need to figure out what money flow multiplier and money flow volume represents.

- The Money Flow Multiplier identifies where the close took place, i.e. Does the close takes place above or below the trading session range? If it closes above the trading session range, the money multiplier will be positive and if it closes below the trading session range, the money multiplier will be negative.

This is calculated as;

- The Money flow volume is calculated as the product of money flow multiplier and volume. I.e. Money Flow Multiplier * Volume

When the data above are ascertained, we can now calculate for CMFI;

Note: The N period = Number of periods (Usually within 20 to 21)

Question 2

Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).(screenshot required)*

To answer this question, after installing the MT5 trader software on my PC I searched for the CMF indicator on the indicator list but I could not find it. Knowing fully well that the CMF is not a default indicator that comes with the application

So I proceeded to https://www.mql5.com/en/code/1809 to download the CMF indicator so I would be able to add it to my custom indicators on my MT5 account. However, I discovered that the indicator wasn’t available for downloads at the time of writing this assignment.

To proceed, I decided to use another trading platform called Bittrex. This platform is a well-known cryptocurrency exchange platform globally.

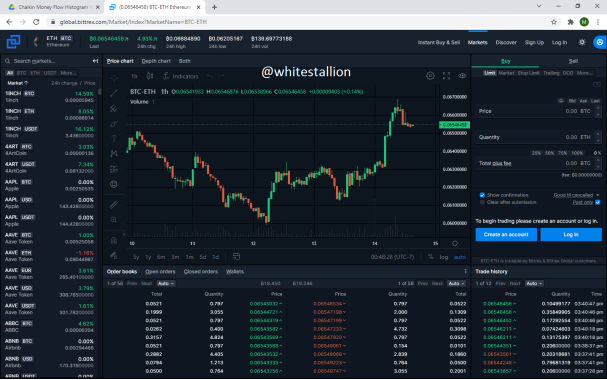

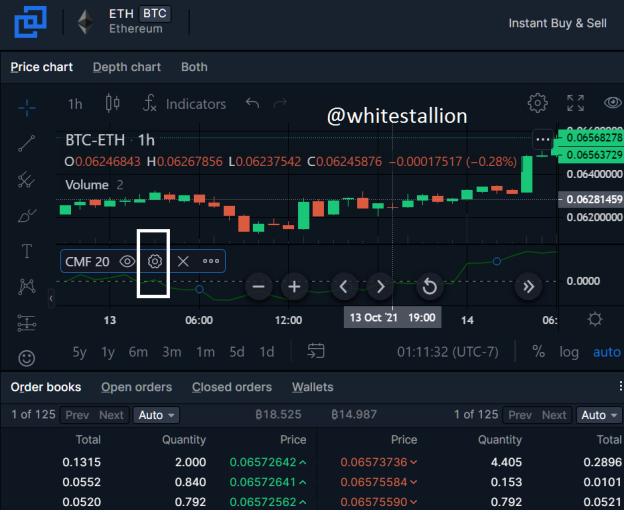

The first step in adding the CMF indicator to the Bittrex platform is to visit the site. The screenshot below depicts the view you will see when you visit the site.

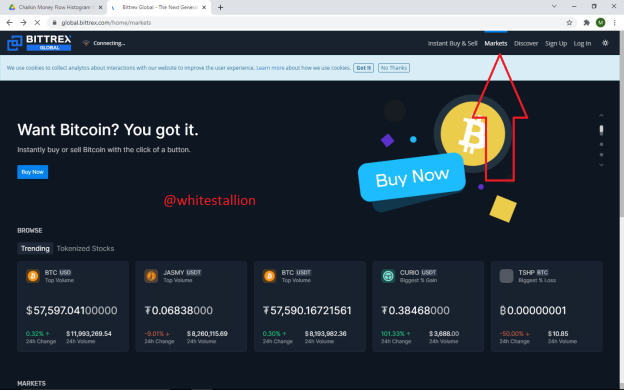

- If you observe the screenshot you will see some options at the top right corner of the screen which is Instant Buy & Sell, Markets, Discover, etc. To proceed, we are to click on the Markets option

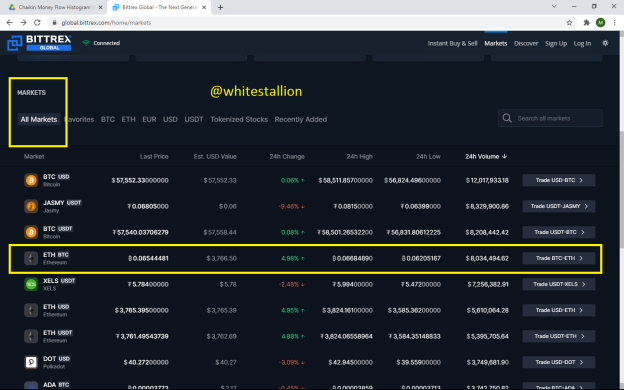

The next step is to scroll down the homepage and locate ‘All Markets ’. By doing this we will be having a list of all available assets for trading. We will be trading the ETH/BTC pair.

After clicking on the ETH/BTC pair we will be directed to another page

- As I began explaining in the point above, we will be directed to a totally different page showing several features ranging from the Charts to prices of assets and so on as shown in the screenshot below

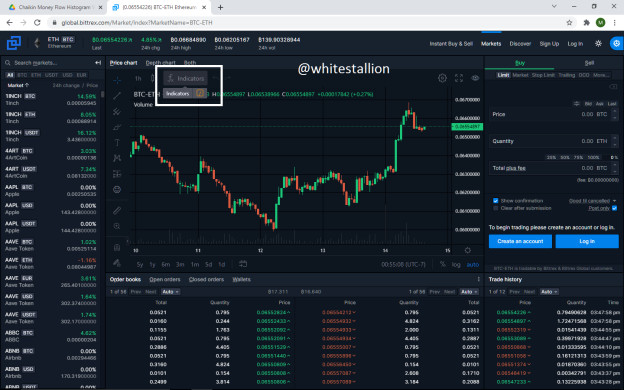

- The next step is to locate and add our desired indicator, in third case the Chaikin Money Flow indicator, To do this, locate the indicators icon by the top left corner of the screen as shown in the screenshot below

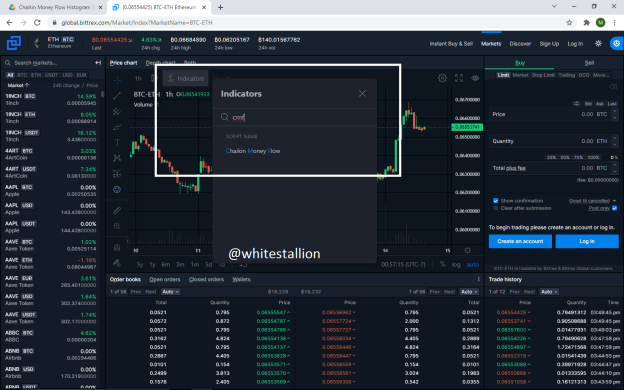

- Now that we are aware where our Indicator icon is, we will proceed by clicking on it. By a result of clicking on it, it will bring out a search bar for which we can type in the name of the indicator we desire to search for which is the CMF indicator

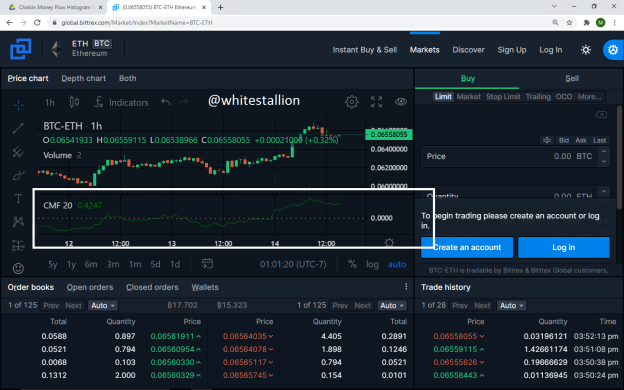

- By clicking on the indicator once, it will be added to the Live Chart as shown below

- We can get a clearer picture by clicking on the full-screen icon

- Meanwhile the question also demands that we explain how to modify the period of the indicator. To do this, I right-clicked on the applied CMF indicator so I could access the options. I clicked on the GEARING icon as shown below

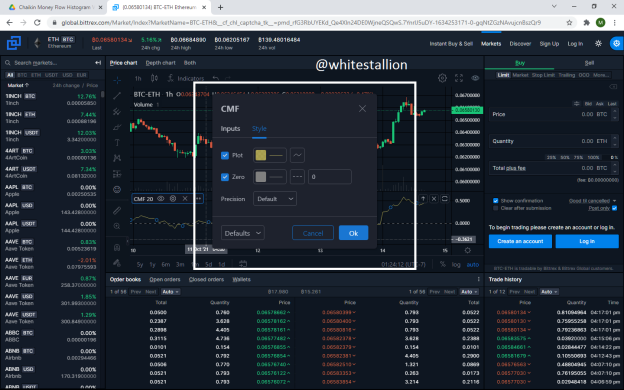

- In the settings feature, we can modify a number of things such as the Style and the period. The style denotes the way the CMF indicator appears on our chart. We can modify the thickness of the line, the color, and as well the type of line that is used to depict our indicator.

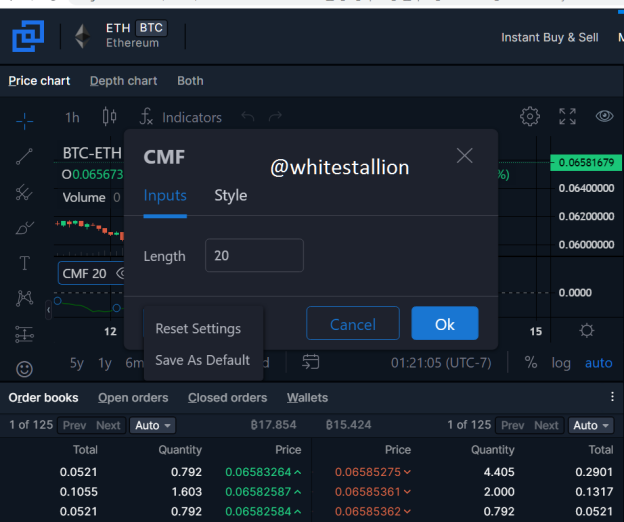

- Another thing that we can modify in the settings of this indicator is the INPUT (Period) which is principally the length of the indicator as shown in the screenshot below

Furthermore, the length of this indicator can be changed as it connotes the prior periods. As shown above, the default length of the indicator is 20. It means that the CMF operates based on the data available for the last 20 periods.

So, different strokes for different individuals, the default length which is 20 is best suitable for long-term traders but for short-term traders, they can modify the length to be lesser than 20. Using the longer length of about 20-21 periods will help traders filter some false signals this indicator might give out.

Question 3

What is the indicator’s role in confirming the direction of trend and determining entry and exit points (buy/sell)؟(screenshot required)

Before I deep dive into the Indicator’s role in confirming the direction of trend, I would like to remind us, that the key factor in the use of CMF indicator, is the fact that it measures the amount of buying and/or selling volume of a financial asset within a set given period.

The period is usually within a 20 to 21 periodicity, depending on individual preferences. Although, the default setup is mostly 20period.

Hence, the role of the Chaikin Money Flow Indicator is to inform us of what direction is gaining momentum based on the volume accumulated or distributed, so we can make a trading decision based on it, either as to confirm by riding along or question a trend, by either staying off the market or take profits.

In confirming the direction of the trend, the chaikin money flow indicator is of extreme importance, as it denotes the market condition. The CMF values moves between 0, +1, and -1. Here are some of the factors to put into consideration in confirming the direction of the trend;

- Once the CMF value crosses the zero line and moves above it indicates sign of strength existing in the market. An illustration is shown in the screenshot below

The screenshot above shows the CMF value crossing the zero line at different intervals and different market conditions are experienced.

- It is important to note that depending on the direction the CMF values cross to, that is what will determine where the momentum is moving to.

source

- As seen in the screenshot above, the CMF crosses the zero values to move upward, which shows a bullish momentum or bias.

Immediately prices cross the 0.1 CMF line and moves upward from below, you enter a buy order, and place a stop loss at the next block below from the last low. This is because, If or/and when the price moves away from that block and close below that low, it is most likely changing market trend, and the Chaikin money flow indicator will be negative.

Also, if or/and when the price crosses -0.1 CMF line to move downwards from above, you enter into a sell order, and then place a stop loss at the block above, from the previous high. This is because, this has indicated to us the closing price of a financial asset is near its highest, which indicates a buying pressure.

A screenshot of this is below

source

Question 4

Trade with a crossover signal between the CMF and wider lines such as +/- 0.1 or +/- 0.15 or it can also be +/- 0.2, identify the most important signals that can be extracted using several examples. (screenshot required)

- From the screenshots above, I will take a buy order when the CMF line crosses the +0.1 line from below to move above, as we can see on the screenshots, price made an impulsive move after it crossed 0.1, which means there’s strong accumulation taking place in the market.

The second scenario is illustrated in the screenshot below;

- From the screenshot above, I will take a sell entry when the CMF line crosses the -0.1 line from above to move below, as we can see price made an impulsive move after it crossed -0.1, which means there’s strong distribution taking place in the market.

How to identify the Most Important Signal

To identify the most important signal, you want to take trades that are in tandem with CMF and wider lines i.e. A trade that correlates with the change in trend, and has also crossed the wider line (+/- 0.1) to either move upward or below.

An illustration for better understanding is shown in the screenshot below;

The first one shows the Sell opportunity that exists in the market (chart).

While the second one shows the Buy opportunity that exists on this chart.

We can also find an entry and exit point. The entry point is the price level to enter the trade while the exit point is the price level to get stopped out i.e. should in case the price reverses and approach the block below, we want it to take us out of the market to avoid further loss.

An Important Keynote

To Identify the most important signal, price has to move from below to above the +0.1 wider line for buy entry to take place while price has to move from above to below the wider line to take a sell entry. This is the most important part of this, reason being for price to move above the +0.1 or below the -0.1 wider line, it means large orders are present in the market (accumulation and distribution)

The Most Important Decision That a Trader can take are

Do not be in a hurry or too excited to take a trade.

Confirm the strength of the trend, by looking out for the wider lines and the candle formed on the chart.

Take into consideration the close of the candle, and where it’s closing at.

Do not make trades based on the CMF indicator alone.

Understand the overall market direction, structure, and pattern, and take note of what you’re trading i.e. Are you trading a reversal or taking a pro-trade?

Determine a stop loss level price before taking the trade.

Determine a take profit level before a trade, unfortunately, the CMF does not indicate that, which further proves you can’t use it in Isolation.

Determine the type of market it is, before you use he indicator. Don’t forget the Chaikin money flow indicator is a trend strength indicator and it’s not suitable for a ranging market.

Take buy trades only on positive CMF value (+0.1, +0.15, +0.2), after you must have put into consideration other factors.

Take sell trades only on negative CMF value (-0.1, -0.15, -0.2), after you must have put into consideration other factors.

Don’t take trades based on divergence immediately, it is only warning you of an imminent reversal, so you want to confirm it with other factors before taking the trade.

Question 5

How to trade with divergence between the CMF and the price line? Does this trading strategy produce false signals?(screenshot required)

Before we move forward to the subject matter, I will like to introduce us to the concept of divergence.

What Does Divergence Mean?

Divergence is simply a scenario in the financial market where the price of a financial asset is moving in an opposite direction of an Indicator. What divergence does is, it warns and inform us of a likely change in trend, so we can be on the lookout for a change in trend.

How to Trade with Divergence Between The CMF and The Price Line?

In trading divergence with CMF, you adopt the divergence rule which was stated above and correlate it with CMF rule. So in a situation where the price of a financial asset is making higher highs, while the CMF is making lower highs, this indicates that the upward trend we are experiencing is moving to an end, and a reversal is imminent. So as a trader we should start closing our long/buy trades and start looking for an opportunity to short or sell. Hence, you open a sell order on confirmation of -0.1 Price line.

This type of divergence is known as a Bearish Divergence and a screenshot is shown below to illustrate this;

The second type of divergence is known as a “Bullish Divergence”.

In the bullish divergence, a financial asset is experiencing lower lows while the CMF is making higher lows. In such a situation, the price is experiencing a downward trend, and the downward trend is losing its grip on the market because a bullish momentum is stepping in. So, as a trader on a short trade prior to the divergence, you want to start closing out on your sell/short trades to enter a long/buy trade on confirmation of +0.1 price line.

A screenshot is shown below to illustrate this;

Does this trading strategy produce false signals?(screenshot required)

Before answering this, I will like to remind us that the CMF indicator is usually an indicator that is best used in a trending market i.e. it might not give more or useful financial insights during a consolidation phase or in a ranging market, hence it has a limitation.

Also, the CMF indicator does not provide us with information such as a potential take profit or stop loss, hence we have to use our intuition and other market knowledge or combine it with another indicator to be able to draw this conclusion.

The CMF indicator is strictly an indicator that measures the level to which an accumulation or distribution is taking place in the market.

Now to answer the question “Does this trading strategy produce a false signal?”

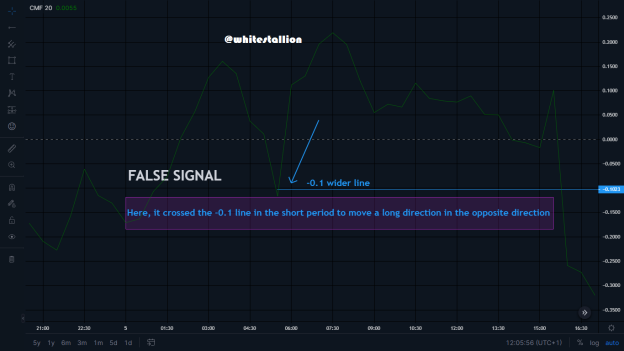

The answer is “Yes” it does produce a false signal, most especially within a consolidation phase or a ranging market, hence it shouldn’t be used in isolation.

Also, it can cross the CMF and wider line to make a short movement in that direction and instantly change direction by making a longer movement in the opposite direction, thereby hitting your top loss.

An example is in the screenshot below;

As we can see from the screenshot above, this is a false signal for anyone who took the sell entry at exactly -0.1 wider line.

So Yes, this strategy does give false signals, which is the reason you must not use it in isolation or alone.

Conclusion

The Chaikin money flow Indicator is an awesome indicator that gives us trading insights into the accumulation and distribution pressure of a financial asset, it has been effective when backtested and proven to work best in a trending market. Its basic feature consists of a period and the wider lines which are used to determine the strength of the market.

It is highly important to note that it has been effective in determining the strength of the market but it is not prone to false signals, hence it is very important to not use it in isolation.

Special thanks to Professor @kouba01

Hello @whitestallion,

Thank you for participating in the 6th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|7/10 rating, according to the following scale:

My review :

A good article in which you were able to answer most of the questions ably, and you have some notes that I made.

Chaikins suggests 21 days as the default setting. That corresponds approximately to a trading month. If the number of periods is larger, the indicator is less volatile and less prone to sideways movements. In a weekly or monthly chart, the number of periods should be reduced.

You did not go into depth in answering the third question.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

amazing information thanks for sharing :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit