Hey guys,

I welcome you'll to the 3rd week of the SteemitCryptoAcademy course by Professor @shemul21. In this course, I will run a comprehensive review on Crypto Trading by Identifying Support and Resistance.

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

What is the support and resistance zone?

The concept of support and resistance zone is a widely practiced phenomenon among traders of various sorts in the world right now. So much so, almost every other technical indicator makes use of the support and resistance principle.

From the above illustration, we can basically see that support levels or zone are generally found beneath while resistance lines are lines above. The connotation is that, when the price of an asset moves upward, it gets to a peak before it retracts or pulls back. The highest point it gets to before retracement is called the resistance line. Resistance zones are major characterized by a surplus of sell orders. Let’s assume that the price of the asset in question continues to go up, the lowest point it was before it started to rise can be termed as a support level. Contrary to resistance levels, support levels are characterized by multiple buy orders.

There is a way to draw these levels on your chart. One important thing to be conscious of is that the support and resistance lines are not necessarily exact figures or numbers on your chart. When using traditional Japanese candlesticks, the tests of these levels are done using the shadows of the candlesticks. You may choose to use line charts in drawing your support and resistance lines, that is because they don’t have shadow wicks thus, making it easier for you to differentiate those levels. Furthermore, there is a possibility of a prior resistance level to be our new support level if the price shoots up. Am area of support or resistance is stronger when it is tested several times. It may take you at least two confirmations or tests for a support or resistance line to be accurate although you could make do with three.

As you can see in the image above, I drew a support line which after several tests, the price of the asset being British / Japanese Yen retraced and didn’t breakout. In support, a downtrend or dip is expected to tale a break due to several reasons, the chief reason being that a high concentration of buy orders are opened thus, forcing the price to retract. On the contrary, when we speak of the resistance line, It is characterized by multiple sell interests when price shoots up.

More so, when traders identify the support or resistance zone as the case may be, those zones may serve as entry or exit points. You may ask why? The reason is that immediately the price of an asset hits the support or resistance line the next thing in line is for it to bounce away or break past the prior levels. The good news about this concept is that traders can bet or make assumptions about the direction of the trend of an asset and jubilate to the bank if the price journeys in the right direction or close the trade quickly if the reverse is the case. If you observe the screenshot below, the support line acts as a floor mechanism that prevents the price of the asset to drop below that level. Since I mentioned that support levels are characterized by buying interests, the support levels could serve as points for buyers to enter the market thus, pushing the market upwards

Historically speaking, the more times the price of an asset hit an identified support or resistance level, the more valid those levels are. Many traders use these levels to ultimately decide whether to make entry or exits of trades. Another interesting fact about these levels is that prices of assets may find it a little bit difficult to break past round numbers such as $70 or $100. The determining factor is that whales and market makers place stop orders at these round figures and because of this, these numbers act as strong barriers. A market characterized by strong and sharp upward motions is sure to be met with an enthusiasm that will produce a strong resistance level. Just like I mentioned earlier, the zones of support/resistance that have been tested regularly over some period of time tend to be more valid.

Traders make use of this technical analysis tool to make certain, points in the market where the motions can favor a pause or reversal. This is due to the concentration of demand and supply levels. Psychology is a big factor when we talk about trading the financial markets. There are few levels of traders at any given price in a market:

There are those who trade long and wait for the prices of assets to go up

There are those who are short, they wait for the prices of assets to drop

Furthermore, as the prices of assets rise from the floor of the chart, the traders who are interested in long trades may decide to add to their prior positions, especially if the price of the asset comes down to the same support zone. The short traders at this point are likely to have double thoughts about the trade and may decide to close the trade to cover for losses. As the price goes down, other traders may feel it’s a good time to buy so they will open more buy orders thus, strengthening the support level. If there is a shortage in entries, the price may likely rebound and reverse. If the price of the asset continues to drop, people would observe that the support is getting weakened. The traders who are interested in long trades may calm down for the for asset’s price to go back up the former support level which will then act as resistance. They will proceed to close their entries here.

In summary, you can think of the support level to be the floor and the resistance to be the ceiling for prices in the market. Prices of different assets fall and they test the support level that may either hold or reverse, in some scenarios the price may violate the support levels. These points are important in trading because they serve as entry or exit points for traders.

Question 2

Explain different types of support and resistance with proper demonstrations?

The concept of support and resistance is a solid foundation upon which all other technical analysis is built. Traders are able to plan their entry and exits, plan their stop losses and take profit levels using this tool.

This type of resistance/support level is a popular and important one. When using the traditional swing high and lows, we consider using longer time frames such as the monthly and weekly charts. This helps us by giving us a general and major outlook of important points in the market. The simple way of using this method is observing the points where prices reversed higher or lower and then proceeding to draw horizontal lines on those levels. It is important that mention that some of these levels may not be laser beam accurate what I mean by that is, the levels may intersect price bars.

- If we decide to dial down to the daily timeframe, it will still function by fine-tuning the levels.

- In the above screenshot, I didn’t touch the prior drawn support and resistance levels at weekly timeframe. I only changed the timeframe to daily and some of the previously drawn levels were still in play.

I mentioned earlier that old or previous support levels can become new resistance levels in charts and vice versa. This statement is particularly true for a market structure that makes higher highs and higher lows. It could also be applied for markets with lower highs and lower lows. In working with this type of resistance and support level, ensure you draw out these stepping swing points as they form. After doing so, we may choose to enter trades on retracement called pullback trading. The good thing about this type of technique is that it allows you to ascertain solid trends. You may decide to set losses at these points or enter the market if you are searching for good entry points.

From the screenshot above, we can see that there is a solid downtrend but interesting the market retraces back to the previous support points. As the price of the asset went below the previous support point, it then flips to become the new resistant level.

The other name for this is called the moving averages. A moving average is a technical tool that can be configured to your taste depending on the number of bars you desire for your trade. There are the 21 and 50-period exponential moving averages. This can be used in different kinds of timeframes such as daily or weekly timeframes. You can use the exponential moving averages to ascertain the trend and zones in the market. After a period of testing of support and resistance levels, you may decide to enter the market.

I added my 21 and 50 EMA lines on my chart at weekly timeframe. It is noteworthy that the shorter the exponential moving average period, in essence, it is better to use a shorter EMA such as the one I used in the image above, being the 21 EMA rather than a longer one such as 50. The 21 EMA line apparently tested the resistance level which then flowed into the support region.

The trading range as the name implies involves you drawing support and resistance lines just between two levels the trading in the opposite direction. The image below is a weekly chart of the British Pound / Japanese Yen asset. It is a perfect example of a trading range as I have identified two resistance regions and the price was already in the genesis phase to retrace back into the market. The next option here would be to open a sell order immediately. You continue to milk the market using this strategy until the price breaks out of range. The image below shows clearly how there was a strong swing from the ceili9ng to the floor and back to the ceiling of the market. I can decide to enter the market at this second test.

Question 3

Identify the false and successful breakouts. Demonstrate with screenshots

We need to have a brief understanding of what breakouts are before we consider false and accurate breakouts. Breakouts refer to a time in a market where the price of an asset pushes through a resistance area or a support area. When this happens, there is a tendency for the price of the asset to continue to trend in that direction. In essence, when the price breaks above the ceiling of a market, it is called resistance breakout. A breakout move usually pictures a considerable change in supply and demand of an asset. When there is a breakout in the direction of the former trend, it may serve as a test or confirmation of the trend, making it valid. If there is a breakout in the opposite direction of the prior trend then the implication is that the market is probably reversing and the best thing to do is to close your trade.

The power arm of a breakout is the penetration of the resistance zone or the support levels. The second step is the confirmation of this breakout as either false or correct. When we have a support or resistance zone, there is a choppy ride in the market and the price loses momentum as it gets close to these levels. But when the price breaks pass the prior support zone, it means that the entire level has been compromised. Furthermore, we have false and successful breakouts. A successful breakout is one in which the price of an asset pushes beyond the resistance or support level and the trend continues. It is characterized by a continuation and eventually, a reversal of the prices.

After a breakout happens, there is a flow of confirmation of this level. Usually, the price retracts to its prior level before eventually continuing. The screenshot above shows a series of successful breakouts. The initial price broke out of the ceiling of the market then it eventually continued to ride to the key resistance level confirmed by a reversal in the downtrend direction. From there, the price continued to be tested

False Breakouts

Most amateur traders are a victim of this. They observe the price as it approaches the resistance line, and it peeps out and they jump into the market but meet their waterloo as the market reverses after they may have made entry. It is important that you have an idea of how these breakouts work, whether from a range of price consolidation or just a triangle pattern. As good as trading breakouts is, you are likely to get frustrated when the market doesn’t continue in the direction of the prior breakouts. Interestingly, some of these false breakouts are worth trading, for instance, if the market is in an uptrend and a triangle pattern develops, you may choose to maintain a long position as the price is likely to move higher. Sometimes, the assets such as commodities, stocks, crypto trade within a range or narrow channel thereby producing a parallel support and resistance level. In a situation like this, a trader can make buy orders at the support levels and come short at the resistance levels. Anyway, there is always a point where the prices of the asset break past the support or the resistance line to begin a new trend. When it makes a break and reverses, it is termed false breakout.

How False Breakouts Appear in Charts

As you can above, the resistance level was drawn with three levels confirming the resistance zone. At the fourth test, we see that there was a rise in the price to about 1.22000. This caused a psychological effect in the market with traders especially amateurs attempting to join the market. Due to the absence of enough buy entries, the market came crashing down and the reversal confirmed that the initial breakout was a false one.

There are essentially two types of false breakouts. They are:

The bull trap

The bear trap.

The bull trap occurs when the price of an asset crosses a major or key resistance level and it pulls back or reverses after a while.

The bear trap as the name implies happens during a downtrend. It occurs primarily when the price of an asset moves below a support level and then returns to the channel. The major reason for missing correct breakouts is assumptions. It is good to note that because a market has traded a level a couple of times doesn’t necessarily mean that it is a support or resistance level. It just has to be a region where there is a shift or demand.

Successful Breakouts

False breakouts are not a scarce commodity in the financial market, whenever they happen, many traders may not be able to cut losses talk more of making a profit from the market. Identifying potentially good breakouts is not an easy task I must say. It is a popular saying that when you have identified a problem, you have gotten half of its solution. In retrospect, a breakout trade works when a stock shatters above or below a major support or resistance level. The breaking of this level may likely be the harbinger of a huge price move.

As you can see in the image above, there was a period of testing that occurred after drawing my horizontal resistance line. The more times the level is tested, the more valid the zone is. Afterward, there was a severe move in the uptrend direction as the price skyrocketed away from the previous resistance level. Interestingly, these levels are most times accurate because of their choppy-like the movement of the Uptrend. It has support levels that support the new forming resistance levels. When there is a market breakout, it is an indication that there is a shift in the supply a d demand of an asset. The aggressive nature of the bears and bulls serves as sustaining power for the new levels. Successful breakouts happen from very obvious-looking support or resistance levels. These are regions that have massive supply and demand which can lead to sporadic selling or buying orders. The successful breakouts are characterized by an increase in volatility. The candlestick that breaks out should have a good range. Furthermore, one of the strongest signs of an impending successful breakout is a narrowing pattern into the region.

Question Four

Use volume and RSI indicator combined with breakouts and identify the entry point?

The RSI indicator is just an acronym for the relative strength index. This indicator was built by J. Welles Wilder. This type of indicator is a type of tool that operates using momentum. It takes into consideration, speed and the price change movements. The indicator flips between zero and 100. In traditional scenes, the RSI indicator is seen to be overbought when it is above 70 and it is oversold when it is below 30. We can use this indicator to ascertain general trends.

How the RSI Indicator Operates

The relative strength indicator is seen as overbought when it is above 70 and oversold when it gets to size 30. Interestingly, during a strong trend, the indicator may remain in an overbought or oversold region for long periods of time. The indicator also can show patterns in the chart such as double bottoms and tops, trends, etc. It can also show forth support and resistance level. When the market is in an uptrend, the indicator may remain stable at levels 40 to 90. These levels all depend on the settings of the indicator.

The indicator can easily be calculated using a simple formula. The formula is

RSI = 100 – [ 100 / (1 + (The average of the change in upward price / the average of the change in the downward price))]

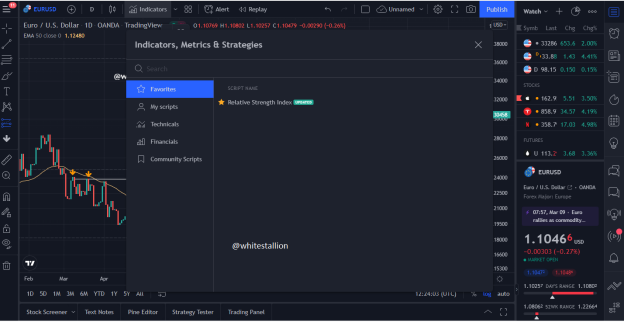

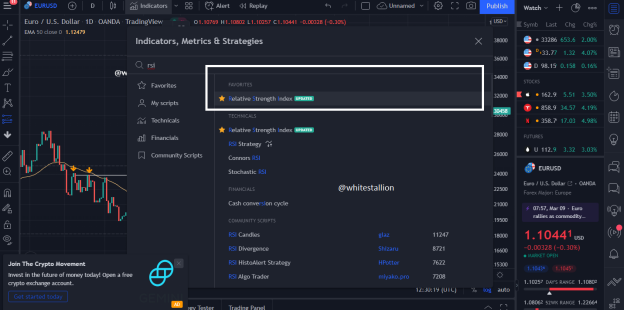

- You can add the indicator to your price chart by clicking on the indicator icon on top of the screen and then typing the name in the search bar.

- The name will automatically appear on the screen, then proceed to click on it and it will be added to the charts.

- The image above shows the RSI indicator on our Euro / U.S Dollar chart. The question demanded that I use the volume and the RSI indicator. I proceeded to add my volume indicator using the same principle.

When the RSI indicator is above 70 it is termed overbought.

**Entry Level **

The Euro / U.S Dollar asset at daily timeframe had resistance levels that were tested a couple of times before the successful breakout. The perfect entry marked by the RSI indicator was at level 56 and the breakout continued until it hit level 80. I t was overbought. A trader could have opened a buy order when the price was about 1.22000 and TAKE PROFIT at 1.25000.

Question Five

Take a real trade (crypto pair) on your account after a successful breakout. (Transaction screenshot required)?

Question Six

Explain the limitation of support and resistance (false breakout)?

False breaks are actually what they sound like. These are motions in the price of an asset that fails to continue beyond a prior level. This results into false breakouts.

Before I explain the limitations of support and resistance levels (false breakouts), there needs to be a foundation of what false breakouts are. These are levels that attempt to pull under or above support or resistance level but retract almost immediately. The image above is an example of what false breakouts are. At daily timeframe, the price of the Euro / U.S Dollar was tested at several levels but what stood out was the fake breakout. The major limitation of support and resistance levels is the presence of false breakouts. As you can see, when the image broke out, the first thing traders were likely to do was to jump into the market to catch the entry early. This is a major limitation because many amateur traders get deceived by these breakouts and thus, lose money. False breakouts are an indication of lack of enough orders to keep the price above resistance level or below supports zone. During post false breakouts, traders may choose to leave their positions if they were in hope of a good breakout.

Summarily, the major limitation of resistance and support levels are the multiplicity of false breakouts. As you can see, these false breakouts are always present in charts and in the market thus, you must be on the watch out.

Conclusion

Primarily, using technical tools like the support and resistance levels can help traders under where the market is coming from, where it is and where it is going. I have explained how the resistance and support line could be maximized during trades and their limitations. I feel if traders have a better grasp of these tools, understanding the market would be easier.

Special thanks to Professor @shemul21