Hello friends and welcome to my assignment task by professor @fredquantum, In this assignment, I will provide a detailed review of Trading Crypto using Aroon Indicator. I hope you enjoy the class.

All images used in this post unless otherwise stated are not mine and were extracted from Tradingview for the purpose of this assignment.

Question One

What is Aroon indicator in your own words? What are Aroon-up and Aroon-down?

This is an indicator that is used in technical analysis; it helps traders identify the changes in trend of an asset’s price. Usually when there is an uptrend that is significantly strong or when there is a downtrend that is significantly strong, the job of this indicator is to highlight these actions to the trader.

- Aroon-Up can be described from a fraction of the name UP. This helps the trader ascertain the occurrence and strength of an uptrend.

It is worth mentioning that the indicator was created by a man called Tushar Chande in the year 1995.

source

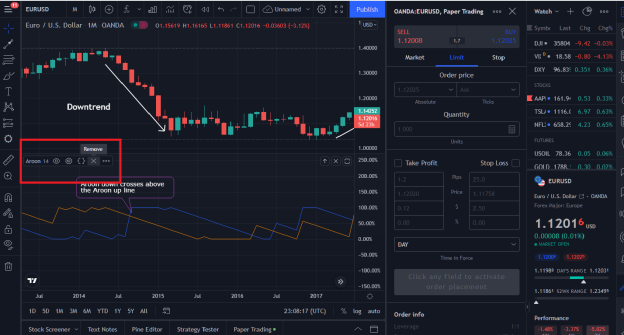

The screenshot below shows how the Aroon indicator looks like in trading view

There are some things we need to understand about this indicator; this indicator has two lines. Each of these lines represents different things i.e the up-line gives the trader a measurement of the number of periods since the last high was observed and the down-line gives the trader an understanding of the number of periods since the last low was observed.

This indicator is by default set or applied to the 25 periods of available data in a chart. So it gives traders information about how many periods have been observed since the last 25 periods. So, as I mentioned earlier, we have Aroon down and Aroon up lines, whenever there is a bullish trend which means there is an uptrend, the Aroon up line goes up above the down line similarly, whenever there is a downtrend also known as bearish trends, the down-line goes up above the up-line. Furthermore, the intersection of these lines means that there is a high probability of trend change. Another significant feature of this indicator is that it operates a 0-100 system such that when there is a reading that is above the 50 mark, whether it was the up or down line, it connotes that the movement was observed in the last 12 periods. Notwithstanding, when a trader observes that the reading is not up to 50 (it is below 50) it connotes that the movement was observed in the past 13 periods. When you set the indicator in a way that you have longer periods you will get smoother pictures of the high and lows however when you set it to fewer periods you will get pictures of more waves and movements in the indicator. Thus, when it goes high it means you should anticipate an uptrend, when it goes low you should anticipate a downtrend.

Question 2

How is Aroon-up/Aroon-down calculated?

There is a straightforward method to calculate this indicator that is, for both the up and down Aroon indicator

To calculate the Aroon-up Indicator do the following

100 x (N minus the number of periods since the last highest high / N OR

100 X (25 MINUS THE PERIODS SINCE THE LAST OBSERVED 25 HIGH) / 25

100 X (25 – 5) 25

= 100 X 0.8 = 80

To calculate for Aroon down

100 x (25 minus the period since the last observed 25 low)

100 x (25 – 2) 25

100 x 0.08 = 8

In other ways, you can use another strategy of the same formula to calculate the Aroon-up and down

For Aroon-Up calculation

nPeriod – The periods since the last high was observed within the specified nPeriod) /nPeriod x100

The default period when you add the indicator is 14, you could set it at 25 as well. So let us assume that we use 25 periods and the highest that we observed during the nPeriod was 6; it becomes

{(25-6)/25} x 100

19/25 x100

= 76

For Aroon down calculation, we are to use the same principle. So the period is set at 25 and the low observed during the period is 4

{(25-4)/25)} x 100

0.84 x 100

= 84

As we can deduce from our calculation, the Aroon-down value is quite higher than the Aroon-up value thus, we can say the market is in a downtrend.

Question 3

Show the steps involved in setting up Aroon indicator on the chart and show different settings?

I will be explaining how to add this indicator to a trading chart on trading view

- The foundation of this process is to visit the trading view site which is www.tradingview.com

- After loading and selecting on charts, you will be presented with a live trading chart of an asset either stocks, cryptocurrency or stocks

As shown above, the charts will be shown plainly without any indicator.

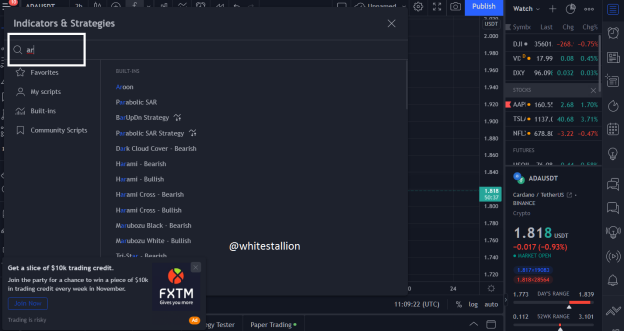

The next step in adding the indicator is to locate the INDICATOR icon on the top of the screen to enable you add the indicator to the chart as shown in the image below

- The next process would be to search and add the indicator. Proceed by clicking on the search bar and type Aroon, you will be shown the indicator and by clicking on it, it will automatically be added to the chart.

- It will be added to the chart as shown in the screenshot below

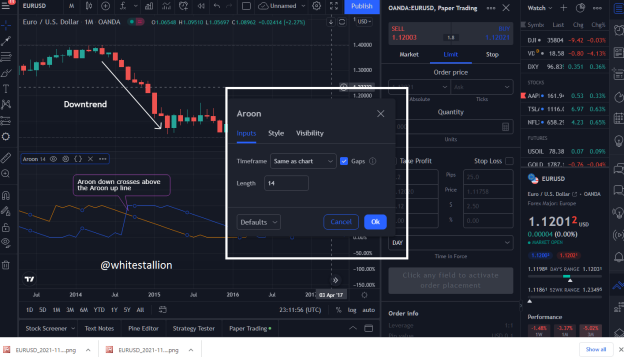

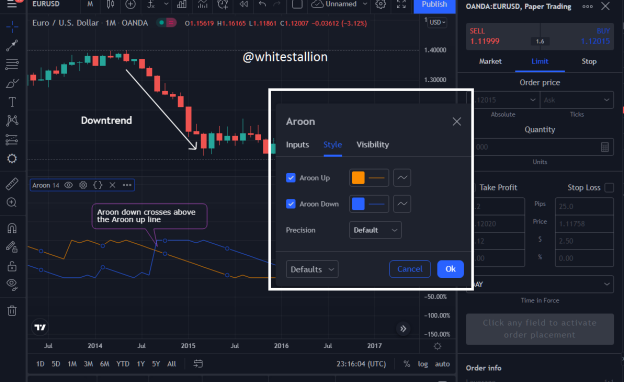

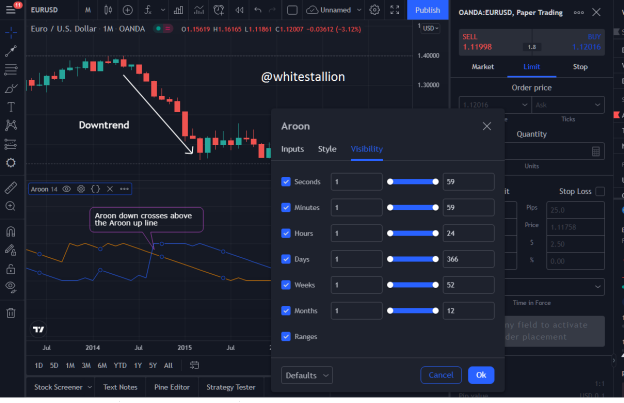

- Furthermore, if you desire to make some adjustments to the properties of the indicator you can do that by navigating your mouse to the left side of the screenshot and a horizontal list of icons will appear, click on the gearings icon

- To proceed, you will see a pop-up menu that will allow you to make changes to the properties of the indicator such as

Inputs

Here you will be able to adjust the timeframe of the chart, which could I set as monthly from my parent chart. You could also set the period although the default is 14, you could change it to 25.

Style

Here, you will be able to make adjustments to the color of the Aroon-up and down indicator for your easy understanding.

Visibility

The last one is visibility; it allows you to make adjustments to the visible parameters on the trading screen. By reducing the values, the visibility of certain features will likewise diminish thus, reducing the noise on the live chart.

Question 4

What is your understanding of the Aroon Oscillator? How does it work?

The Aroon oscillator is also a good tool that can help traders make maximal profits. It can help you grasp an understanding of how the market is going, either in an up or down direction. It can assist you to enter a trade early as the intersection of the indicator line signifies an uptrend or downtrend. Furthermore, every indicator works more or less with numbers thus, this indicator is not an exception. It works using a -100 to 100 mark. The 0 mark is the centerline of the indicator. The extremes are +100 and -100 so, the closer the mark of the indicator to these values, the stronger the trend wither as an uptrend or downtrend.

So the difference between these up and down patterns created by this indicator is known as the Aroon Oscillator. Furthermore, the way the Aroon up-trend oscillator is calculated is such that, it is done by determining the amount of time-based on the percentage that might have elapsed from the start of the period and the period at which the close of the highest price happened. For instance, if the highest closing price for an asset was $50 yesterday and the new high today is $55, the oscillator setting becomes 100, and if the last closing low price was $20 and the new closing low price is $15, the Aroon figure will be zero.

The Consolidation

Whenever the up and down Aroon lines are in close proximity, it means that no strong up trend is anticipated.

Upward and Downward Momentum

Whenever a dip happens and the indicator (Aroon up) line hits below 50, it means that the current uptrend has lost its momentum or strength and it would be a good time to close the trade if it is not going in your favor. Similarly, when the Aroon down indicator line goes below the 50 mark, you should know that the prevailing downtrend has lost its strength.

Trends

The indicator is quite easy to read as it shows as trend direction as well its strength. When the value goes above zero and above 70, it means a strong uptrend is underway. When the value gets to around 30 or so, there is a probability of a trend going in the opposite direction.

Question 5

Consider an Aroon indicator with a single oscillating line, what does the measurement of the trend +50 and -50 signify?

The question demands that we use an Aroon indicator with a single line and we can add this to our chart by clicking on add indicators and selecting single line Aroon.

The second thing I did after adding this indicator is mark the +50 and -50 on my indicator line. As shown in the chart above, there is a point 0.00 which is the midpoint and a trend in either direction can either be bullish or bearish. Thus, the movement of the price at -50 indicates a downtrend and the movement of the price at +50 is an uptrend. Summarily, when the indicator line is around +70 it connotes that the uptrend is very strong which logically means an uptrend of +50 means the uptrend is just strong but not extremely strong. The same applies to a downtrend of -50.

Question 6

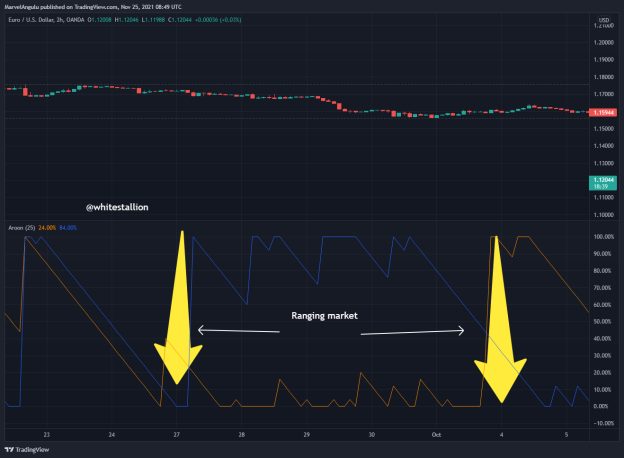

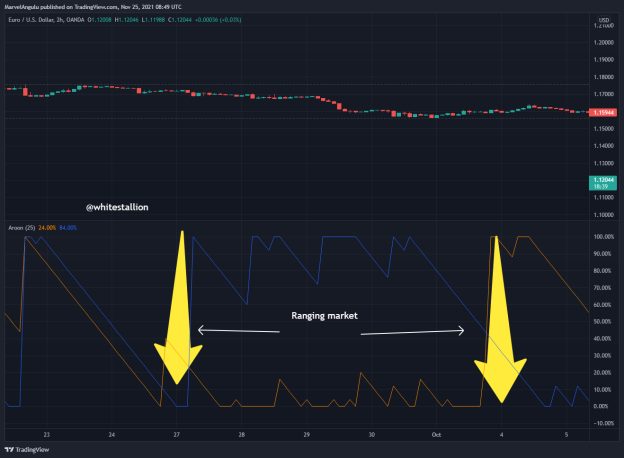

Explain Aroon indicator movement in Range markets?

We should understand that a ranging market is one that the uptrend and downtrend are not extreme but are just dangling in the middle, in other words, no trend is categorically observed from a ranging market.

So during a ranging market, there is a period of accumulation where there is neither an uptrend nor downtrend. The mark of the indicator moves around the 0 mark. Because the characteristic of a ranging market is such that the price of an asset moves back and forth without a tangible hit of an uptrend or downtrend. You can use other technical indicators such as Bollinger band to understand the price action notwithstanding, the Aroon indicator can help you understand the action of a ranging market. As shown in the indicator below; the movements of the indicator do not hit the maximum trending market so the marks will range from +50 and -50 or depending on the price actions at that time.

Question 7

Does Aroon indicator give False and Late signals? Explain. Show false and late signals of the Aroon indicator on the chart. Combine an indicator (other than RSI) with the Aroon indicator to filter late and false signals?

The straight answer to this question is yes. We for once, understand that no indicator is 100% accurate thus, the need to incorporate an indicator with another. So the Aroon indicator is not an exception, it produces false signals. As shown in the screenshot above, we see that there is a delay in response of the Aroon indicator. The continuation of the Aroon-down line makes it look as though the downtrend is still in motion however, with the Heikin-Ashi candlestick noise in the financial market can be filtered and traders can make sound financial decisions on time while trading. The Heikin-Ashi candlestick responded very quickly when the market trend reversed. It is worse when using the traditional candlesticks, the false signals become more pronounced.

Using the MACD indicator alongside the Aroon indicator helps you filter false and delayed signals such that you can enter trades early and exit trades that the Aroon signals are false.

Quickly, I tried using the Bollinger bands which can help a trader identify uptrends and downtrends easily. Note that the Bollinger indicator is more of a futuristic indicator than the Aroon indicator which is characterized by lagging.

From my screenshot above you can see that the Bollinger band was able to register a quick signal of an uptrend while the Aroon-up indicator delayed in response to this latest change in trend. The Bollinger band was able to make a quick call.

Question 8

Place at least one buy or sell trade using the Aroon indicator with the help of the indicator combined above. Use a demo account with proper trade management?

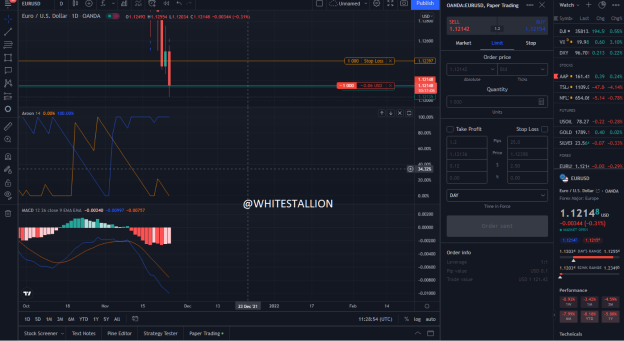

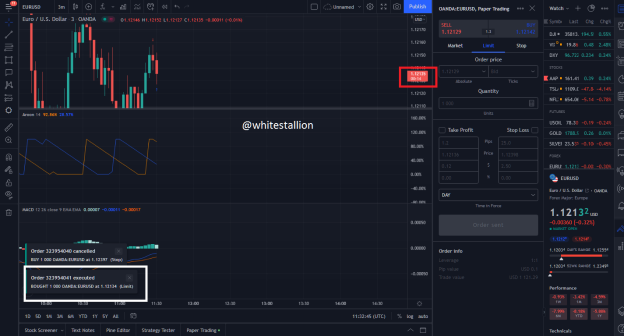

The question demanded that I place a sell order and I did this using the Aroon indicator and the MACD indicator.

With currency pair Euro/USD, at minutes timeframe, I placed a sell order at 1.12142 and I set my take profit level at 1.12135 using the indicators mentioned above.

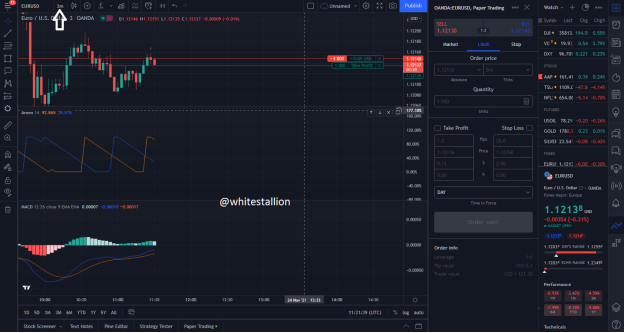

I set my timeframe at 3 minutes and I kept watching the price because the Aroon-down line had taken a curve indicating a point of trend reversal.

Before the elapse of the trade period, I was able to hit my take profit level at 1.12135 using the Aroon indicator and the MACD indicator.

But, I also decided to trade using the Bollinger indicator as explained in the prior question

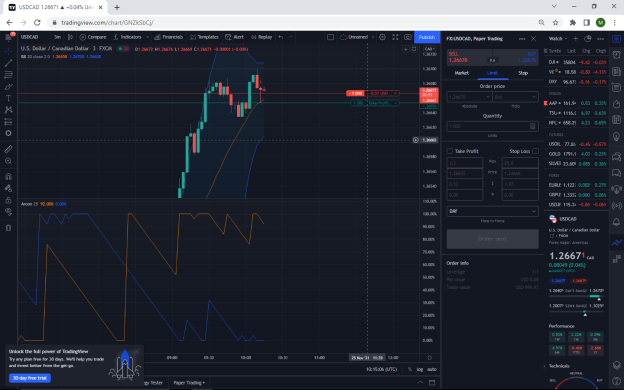

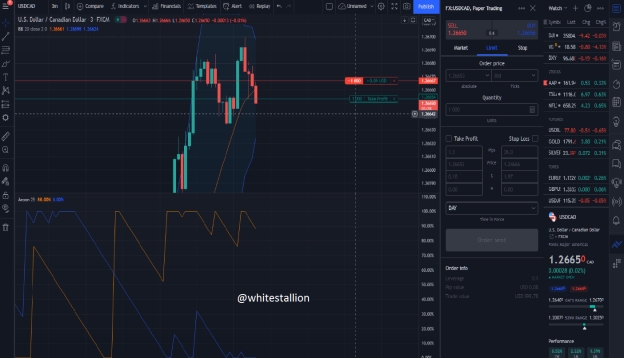

Sell Order

After placing the order, I set my risk level at 1:1 to minimize loss

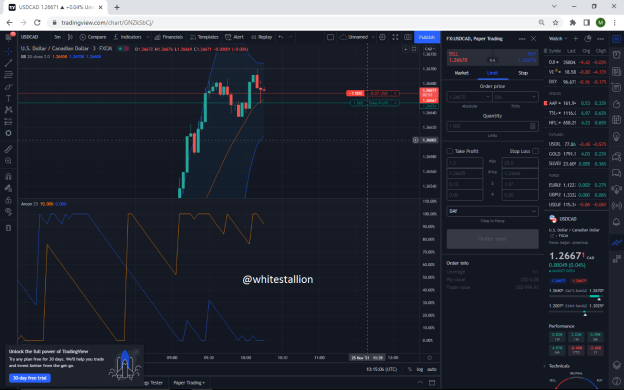

In the screenshot above, I placed a sell order using the Bollinger bands and Aroon indicator. The currency pair was U.S Dollars/Canadian Dollar at 3 minutes interval. The Aroon-up indicator crossed over the Aroon-down indicator as such, indicating an uptrend. After the price crossed the mid-line and was about to hit the resistance level, a layer of red candles emerged alongside the response of the Aroon indicator indicating a reversal in trend.

As shown above, I was able to hit my take profit level.

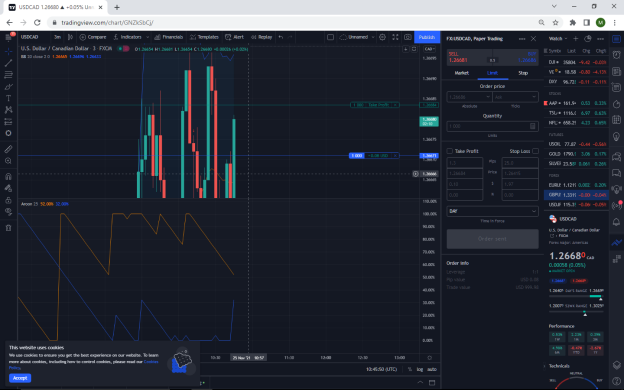

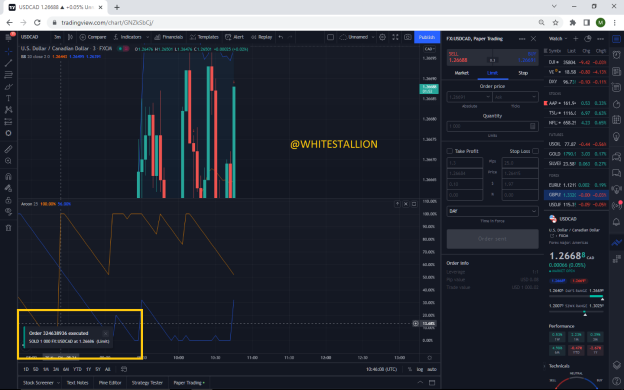

Buy Order

Furthermore, I was able to place a buy order using a combination of the Bollinger band and the Aroon indicator at 3 minutes timeframe with U.S Dollar/ Canadian Dollar

As the Aroon-down moved in an attempt to cross the Aroon-up indicator in response to the rise in the price of the asset, as the market was just exiting a ranging trend, the uptrend meant the consolidation had ended and the new trend was Bullish. Thus at 1:1 profit management, I was able to place a buy order and hit my take profit point at 3 minutes timeframe.

Question Nine

State the merits and Demerits of the Aroon indicator?

Merits of Aroon Indicator

This indicator is one that shows you when the trend of an asset is weak or strong.

Another advantage of this indicator is that it has the ability to deliver great entry and exit signals.

Another advantage of this indicator is that it can depict a change in the direction of a trend early.

Because of the line structural operation of the indicator, it is easy to read.

Delimits of the Aroon Indicator

After mentioning some advantages of this indicator, let us also mention some delimits of the indicator thus, the indicator may sometimes provide false signals.

As I mentioned above, the indicator may depict a crossover however, such might not necessarily happen. In a ranging market, for instance, the indicator is likely to give you a false signal.

The indicator is more concerned about the days since the last high or low was observed not necessarily the price.

As you would other indicators, you will require the need of other technical indicators to optimize the use of the Aroon indicator.

Conclusion

The Aroon-up indicator and oscillator is easy to understand as all you have to do is observe the movement of the lines across and below the 0 centerline marker. Just as no technical indicator is 100% accurate, the Aroon-indicator has its limitations which can be doused by combining it with other indicators. This indicator is definitely a potential tool that can assist traders once they grasp its technical know-how.

Special thanks to Professor @fredquantum