Hey guys,

I welcome you'll to the 4th week of the SteemitCryptoAcademy course by Professor @fredquantum. In this course, I will run a comprehensive review of Trading Crypto with On-Balance-Volume Indicator.

All images used in this post unless otherwise stated are not mine and were extracted from Tradingview for the purpose of this assignment.

Question One

In your own words, explain your understanding of On-Balance-Volume (OBV) Indicator.

The On-Balance indicator was developed by Joseph Granville, he developed the first OBV in 1963. On- Balance Volume Indicator is a technical analysis indicator that shows the momentum of the market, it is used to ascertain the overall movement of an asset's price using the volume injected in either by the bears or bulls. Principally, the indicator works in such that it operates using buying and selling pressures.

The overall volume up/down of this indicator is used to determine the price of an asset which gives the trader an advantage of where the asset price is headed in the future before making a decision. The volume injected into an asset in any direction (buy/sell) affects the price of an asset, if the volume of buys in the market is high, the price of an asset is most likely to go up/ increase. And if there are massive sells in the market, the asset would most likely drop in price. The indicator helps in ascertaining the volume that is recorded in the up-days and it subtracts the volume on the down days. It is imperative to note that the indicator is basically a momentum indicator just like the RSI indicator.

The On-Balance-Indicator helps to calculate the buy and sell pressures in the market giving the trader an idea of the next possible trend of the asset. The On- Balance- Indicator calculates the volume of buys and sells in the market over some period of time. It helps traders determine the price of an asset by the injected volume either buy or sell. It also helps to spot breakout in the markets and bullish or bearish divergence. Furthermore, It uses swing highs and lows in the market movement to validate the trend of an asset price. Once traders enter the market enthusiastically and begin to open buy orders, the volume will increase and the indicator would respond likewise in volume. Furthermore, whenever there is a swell in either buy or sell orders in the market, there is a response by the on-balance volume indicator such that it begins to tilt towards the direction that has more volume. After prices hit the resistance level, a lot of traders begin to open sell orders which in turn makes the price of the asset begin to go down. Basically, the indicator does the following:

8 Indicate the condition of the market at any given time period. It does this by putting together the volumes of the day with ups and subtracting them from the day’s lows.

*The indicator can also help confirm trends and identify breakouts and divergences

Furthermore, when a currency pair, cryptocurrency, or any asset generally closes higher than it did in its previous close, throughout the day, all the volume is considered to be up contrarily, when an asset closes at a lower level than it did in its previous close, the volume of the day is termed down-volume.

For instance, 200,000 are not quite as significant if the following day has about 600,000 in its volume. Actually, let us say the OBV is heading in an upward direction, it doesn’t necessarily mean that the value is valid but it means that there is a great possibility that big moves are liable to come from that direction.

Question Two

Using a charting platform of choice, add On-Balance volume on the crypto chart?

I will answer this question by explaining how to add the indicator to the trading view platform.

- The first step would visit the trading view platform www.tradingview.com and after accessing the site, a page containing a lot of info would be displayed. Click on charts located at the top of the screen

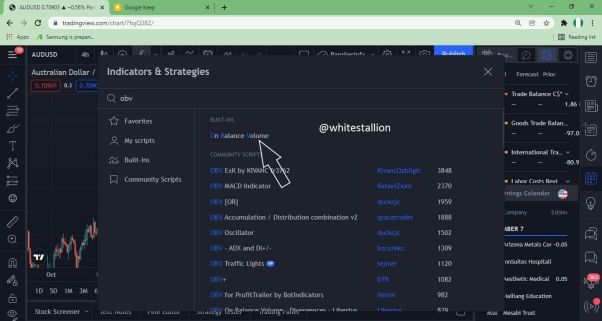

- After that, a page containing a chart of a crypto asset or currency pair will be displayed. Furthermore, locate and click on the "fx" icon and you will see a drop-down menu as shown in the screenshot below-

- The next step is to click on the search bar and type for OBV in the search bar. Click on the result and the indicator will be added to the chart

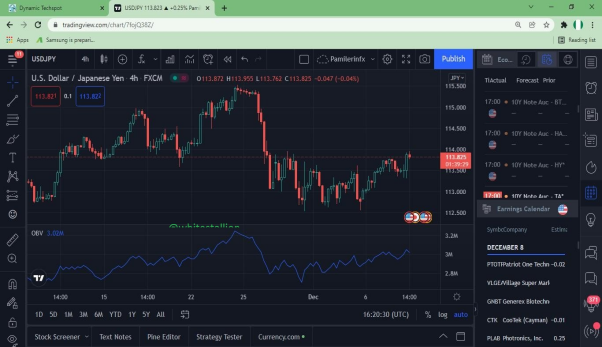

- The screenshot below shows the indicator, added to the chart

Question Three

What are the formulas and rules for calculating OBV indicators?

Calculating the OBV

In order not to make the formulas and calculations complicated, some keywords would be put in place.

OBV= means the current On-Balance Level

OBV previous = means the previous ON-Balance Volume Level.

If the current price close of an asset is higher than the previous day's close

Then OBV = means the OBV previous + Current Volume.

If the current price close of an asset equals the previous day's close, then, OBV = OBV previous + 0.

If the current price of an asset is lower than the previous day's close

Then OBV = OBV previous - Current Volume.

For example.

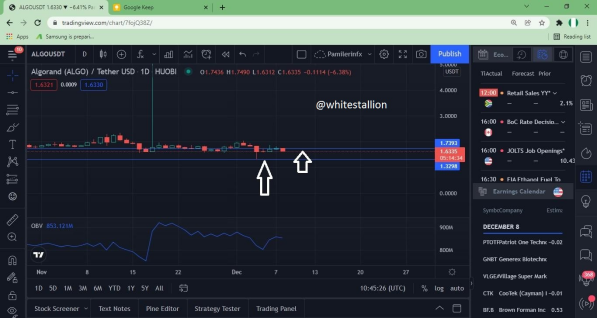

We are going to be looking at the ALGO/USDT market and here the main asset is ALGO.

We are going to be using a daily time frame for this illustration as the daily candle shows the overall direction of an asset per 24 hours.

As you can see in the image above, the candle closed above the former candle which means the overall trend direction in the last few days is bullish, hence the OBV will be calculated by using the formula given above

OBV = OBV previous + Current Volume 1.3298+1.7393= 3.0691

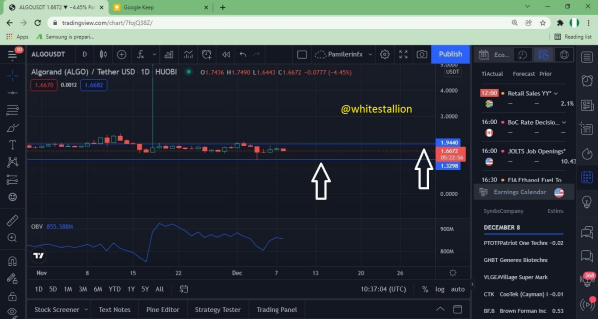

The candle shown above in this condition closed below the previous candle which shows a general downward trend for that day, so the OBV will be calculated using the above formula-

If OBV = OBV previous – Current Volume

1.9440-1.3298= 0.6142

For elaboration sake, if the current’s day closing price is much higher than the close of the previous day then our

OBV = OBVprevious day + CV (Current volume)

And,

If the current day’s close price is at equilibrium to that of the previous day our formula becomes

OBV=OBVprevious + 0

Question Four

What is trend confirmation using on-balance volume indicator? Show it on the crypto charts in both bullish and bearish directions

Trend confirmation using OBV is a very good strategy, it entails using the OBV to confirm existing trends, and the OBV works based on the amount of volume injected to the market, using the OBV allows you know that you’re not opposing the market direction. This gives extra confidence to the trader knowing the fact that the market is on his side, and most times the market chart and OBV charts show the same directions and similar points for highs and lows, enabling the trader to find good entries and ride the trend. So if the pressure is pumped in the bearish direction, it connotes that the price is going down or falling and if the pressure is pumped in the bullish direction, it means that the price is rising.

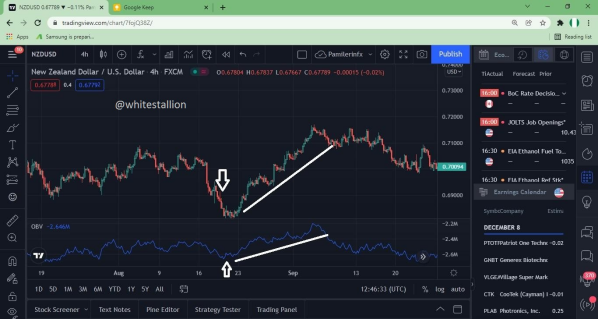

Bullish Direction

From the example illustrated above, we can see that the OBV and market direction are in alliance with each other, the higher highs and higher lows formed by the OBV here shows that the market is in an uptrend and the buyers are in control of most of the market, using the highs and lows above makes a trader find an entry for buys. As shown in the image above, we can see, as I mentioned earlier that the actions were characterized by higher highs and higher lows meaning that the trend is bullish.

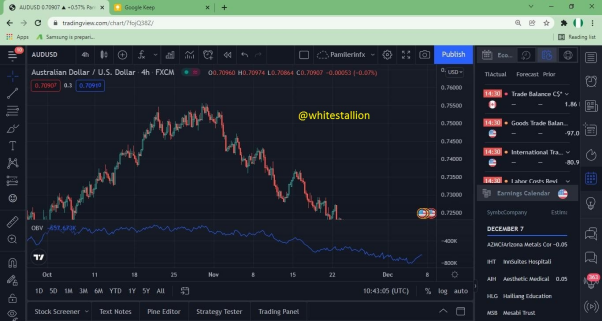

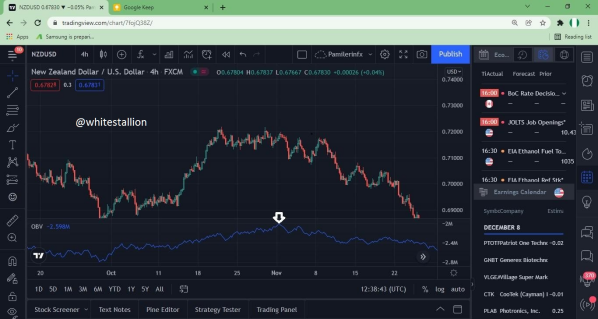

Bearish Trend

As shown below we can see both lower highs and lower lows made by both the OBV and the market chart, this shows the sellers are mostly in control, there is an overall downward trend, the OBV can be used to find more accurate entries for sell This means that the pressure mounted by traders was channeled towards the sell direction Once there are actions of lower lows and lower highs, it is a confirmation that the trend is bearish. Prices move from higher concentration to lower concentration areas.

Question Five

What's your understanding of Breakout Confirmation with On-Balance-Volume Indicator? Show it on crypto charts, both bullish and bearish breakouts

We can also use the OBV indicator to ascertain breakouts in either upsides or downsides. Breakouts can be discovered by the OBV, when the market/price of an asset has been ranging for a period of time, it would have been changing market directions at different and multiple supports and resistance, this would have made the OBV to be stuck in a price range as there is no clear direction of the volume added. Breakouts happen after a period of strong uptrends or downtrends then a consolidation happens which leads to breakouts after periods of wallowing around the support and resistance levels.

After the market is done with the range, the OBV helps to identify the true direction of the true breakout preventing the trader from being trapped in false breakouts, and allowing the trader to know the amount of volume that brought the breakout. It helps to confirm and authenticate breakouts

.

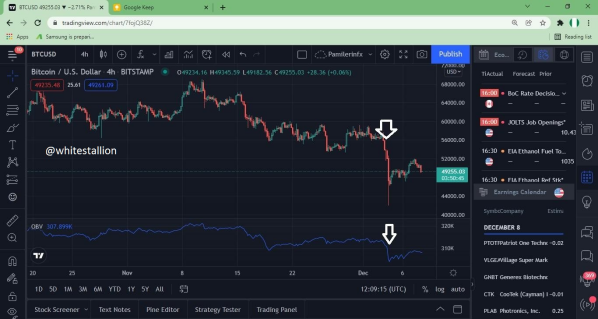

Bearish Breakouts

We can confirm bearish breakouts using the OBV indicator. After a period of a sustained bearish trend, the market moves into a consolidating stage and after the rally, there was a breakout of the Bitcoin/U.S Dollar pair at 4-hour duration in a bearish direction.

The market has been stuck in arranging before the breakout occurred and just immediately the breakout occurred we can see that the OBV confirmed the breakout and, sell orders would have been placed here. If you look at the price movement and the indicator, you will observe a period of consolidation on the OBV indicator then it fell in the bearish direction.

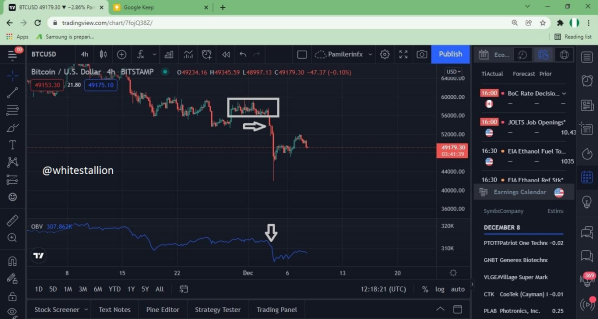

Bullish Breakouts

The market range has been going on for some time, before the bulls gained control of the market and caused an uptrend from the point of breakout it can be seen that the OBV gave off a bullish confirmation for the buy orders to be opened. As highlighted in the screenshot below, there was a period of sustained uptrend then there was a wallowing around the resistance and support level which resulted in the ranging market then a breakout in the bullish direction.

Question Six

Explain Advanced Breakout with On-Balance-Volume Indicator. Show it on crypto charts for both bullish and bearish?

Advanced breakouts are a special type of breakouts that occurs when price fails to break a previous swing high or low. During breakouts when the market fails to break a previous swing high or low but contrarily the price is broken on the OBV, it shows the direction in which the market is headed and price is going to eventually break the high/ low which it previously failed to break. It shows that the volume injected into the market is going to make the asset break the swing low or high which it had previously failed to break. In order words, it occurs before the breakout on the price chart happens. It connotes that even before the breakout happens on the price chart, the OBV indicator records it.

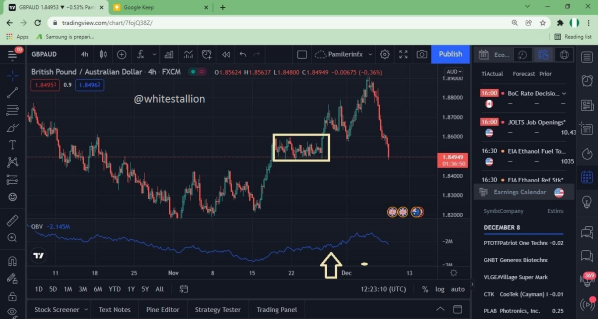

Bullish Breakout

Here it can be shown on the OBV that the high is broken even though the market was still struggling to break the previous high here, But the OBV had already confirmed the presence of buy volumes in the market and confirmed the uptrend. In explaining what the advance bullish break out is, it is important to note a major feature which is; the price of the asset rises even far above its previous high in the case of a bullish trend breakout. So, new highs break previous highs. The screenshot above shows the OBV indicator breaking the previous high even before it happened on the price chart.

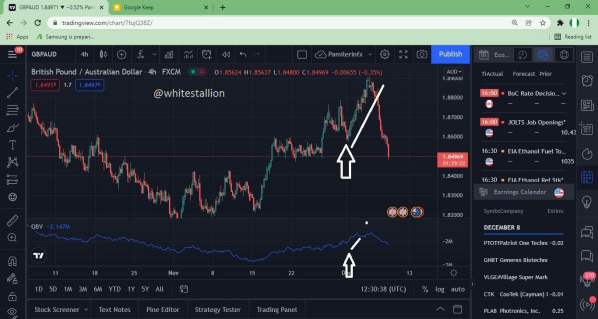

Bearish Breakouts

Here it can be shown on the OBV that the low is broken even though the market was still struggling to break the previous low here. But, the OBV had already confirmed the presence of sell volumes in the market and confirmed the uptrend. The OBV can be used to counter-detect market breakouts. The prices of assets retrace in an attempt to correct the bearish leg in a quick pattern even before another bearish leg is formed. So if the retracement ends and the new legs don’t break the old bearish trend, meanwhile if you observe the OBV line, and it had already broken the prior low, what is formed is known as advanced bearish breakout.

In the screenshot above we can see that the OBV had broken the prior low before the price did. This is an indication that you need to get ready to ride the trend.

Question Seven

Explain Bullish Divergence and Bearish Divergence with On-Balance-Volume Indicator?

What is divergence?

Divergence to simply describe it happens whenever the price of an asset and the indicator go in opposite directions. I.e. if the price of an asset is going down and the indicator goes in up (in the opposite direction) it means a divergence has occurred

Bearish Divergence'

During a bull run, higher highs and higher lows are being formed by the market but if the OBV shows lower volumes by making lower highs this is a Bearish divergence.

It indicates that the buy volume in the market is losing momentum and there would be a change of trend which provides the trader a safe escape before the market changes direction fully. As shown above, the market was still making higher highs and lows meanwhile the OBV is already indicating a possible change in momentum. Basically, this occurs after a period of prices riding the uptrend then traders enter multiple sell trades such that they pull trends from up to down. In the price chart, the market is characterized by higher highs but in the OBV indicator, the movement of the line is lower highs.

Bullish Divergence

Bear markets are characterized by lower highs and lower lows, the OBV showing a higher low indicates trend weakness and a possible change in trend ahead. When a market starts showing weakness on the OBV by showing higher highs it’s safer for the trader to exit bearish trades at this moment as the OBV divergence is a tool used to indicate possible trend reversals. Basically, the price makes lower lows, and the OBV indicator in turn make higher lows. As the momentum of traders who opened buy positions reduces, the OBV responds. In the screenshot below, we observe that after the bearish trend, the OBV responded by depicting higher lows while the price showed periods of lower low.

- Another image showing the same divergence

Question Eight

Confirm a clear trend using the OBV indicator and combine another indicator of choice with it. Use the market structure to place at least two trades (one buy and one sell) through a demo account with proper trade management.

To answer this question, I chose to open a sell order using the British Pound / Swiss Franc currency pair and I will be combining the OBV indicator with the Alligator indicator. The alligator indicator was fashioned by one of the market psychology experts known as Bill Williams. This indicator is one of the tools used by traders globally on the foreign exchange market and financial market. The indicator consists of 3 moving averages that when used simultaneously gives you an overall direction of the market which are the green, red and blue line.

Sell Order

The OBV is currently in a downtrend as it makes lower highs and lower lows, using an extra confirmation from the alligator indicator, the trend is being confirmed by the awakening phase of the alligator after the little market consolidation. By combining all these together I was to place a sell order. Furthermore, whenever the green indicator line of the alligator crosses the other line and goes beneath, it depicts the beginning of a downtrend as shown in the screenshot below. I used the British Pound/Swiss Franc currency pair at 4-hour intervals.

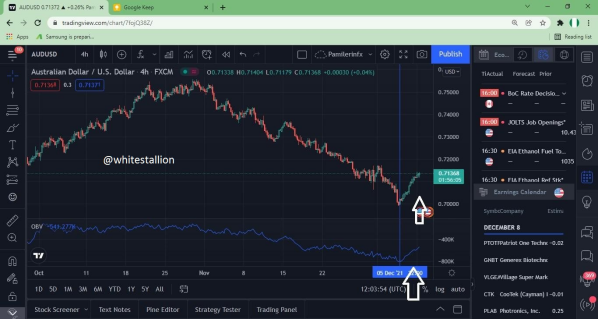

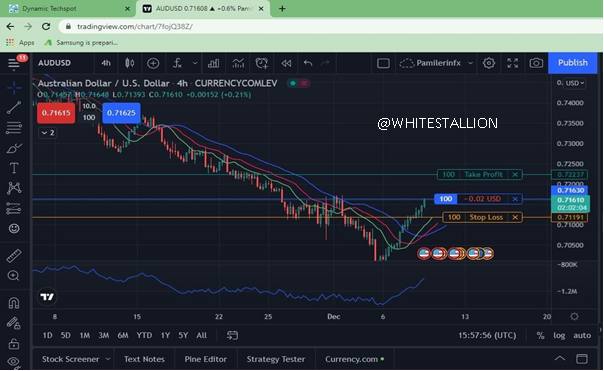

Buy Order

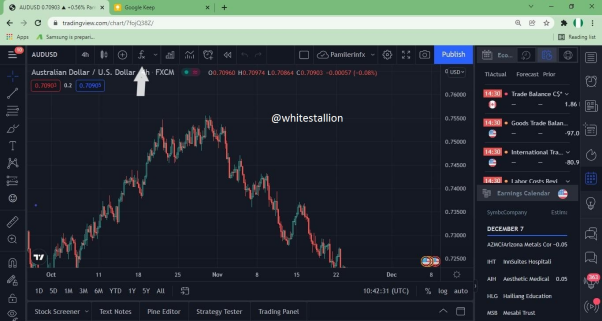

As shown below, the OBV is in an uptrend as it's making higher lows and higher highs, the alligator indicator is also indicating an uptrend as its meal phase has already started in the bullish direction. Thus combining these indicators make it easy for me to take the buy order. The alligator indicator’s green line went across all the other indicator lines indicating the beginning of the uptrend also; it also depicts the strength of the uptrend. I used the Australian Dollar/U.S Dollar currency pair at 4 hours duration.

Question Nine

The advantages and disadvantages of the On-Balance-Volume Indicator?

Advantages

When used in the right way it is one of the most efficient trading tools especially while trading breakouts as it already indicates the direction in the breakout is most likely to occur.

It helps to confirm existing trends.

It also serves as an exit indicator during trend changes.

Disadvantages

It is vulnerable to market manipulation by big institutions as they tend to provide volume in one direction and later provide volume in another direction so as to take out small and retail traders. It is safer to use this indicator as a confirmation indicator and not a reason for entries.

Conclusion

The OBV indicator is a vital trading tool that can be used in technical analysis to assist traders make proper trading decisions. It works in such a way that although it is not 100% accurate, no indicator is, it has the potential of helping traders maximize the financial market. Basically, as a result of its response to volume activity in the market, its signal can be trusted.

Special thanks to Professor @fredquantum