Hey guys,

I welcome you'll to the 8th week of the SteemitCryptoAcademy course by Professor @abdu.navi03. In this course, I will run a comprehensive review on TRADING STRATEGY WITH RSI + ICHIMOKU.

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, and meta5trader for the purpose of this assignment.

Question 1

Put your understanding into words about the RSI+ichimoku strategy

Created by a journalist originating from Japan in the latter part of the 1960s, Goichi Hosoda, the Ichimoku Kinko Hyo, otherwise known as the Ichimoku Cloud is a rather popular and powerful technical indicator. It discerns trades with higher chances of success in the market. The Ichimoku depicts a price action that is more dependable by highlighting multiple data points. As a result of these data points, the Ichimoku chart increases the precision of forecast price action. By combining three indicators as well as providing multiple tests, the trader making use of the chart is able to make enlightened choices. The Ichimoku chart reveals important information such as support and resistance levels, the direction of the trend as well as momentum. Although it may be complicated at first because of its many lines and data, traders can benefit a lot from its understanding.

The Ichimoku Kinko Hyo is made up of four components namely; tenkan-sen, kijun-sen, senkou span (which is further divided into senkou span A and senkou span B) and chikou span.

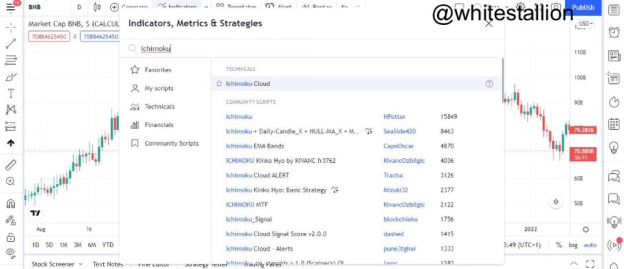

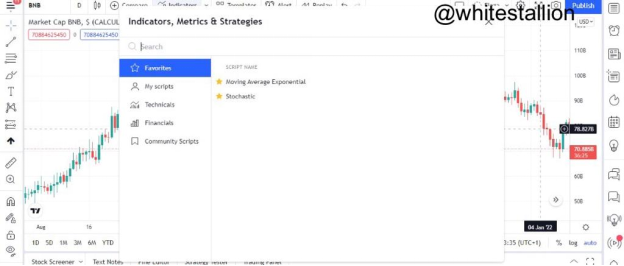

To access the Ichimoku, select “Indicator” on the taskbar at the top of the screen.

- Type “Ichimoku”, the indicator would be displayed

- Then select “Ichimoku Cloud”

The other indicator, Relative strength index (RSI), is one that is used to carry out technical analysis. It is used in the measurement of momentum (momentum oscillator) of price movement to identify either overbought or oversold conditions. When talking about overbought conditions, this simply is a situation when an asset is traded above its inherent value. On the other hand, oversold is a situation when an asset is traded below its inherent value. The RSI comes in the form of a line graph and reads between 0 to 100.

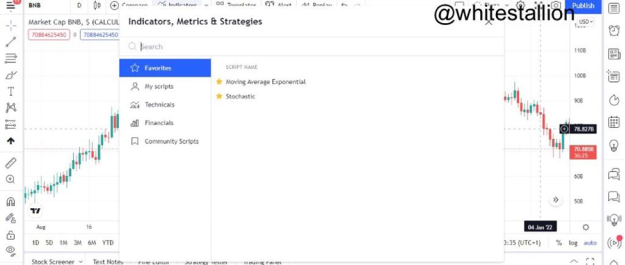

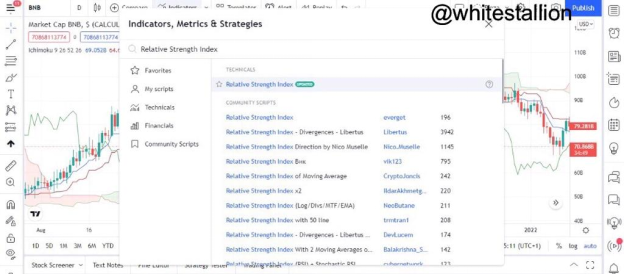

To add the RSI indicator to the chart, select “Indicator” at the top of the screen

- Type in “Relative Strength Index”, the indicator would be displayed

- Then select “Relative Strength Index”

The Ichimoku + RSI strategy involves the use of the powerful Ichimoku indicator coupled with the RSI to serve as confluence. While the Ichimoku cloud is proficient in trend identification, the RSI indicator can be used to craft an entry or exit strategy, depending on overbought or oversold conditions. Traders can use this strategy to pinpoint profitable trends and choose effective entry and exit points. Where one indicator is lacking, the other makes up for it which makes the two a near-perfect match.

Question 2

Explain the flaws of RSI and Ichimoku cloud when worked individually?

RSI

RSI is not a reliable tool when it comes to confirming or executing trades. Although lots of forex traders find the RSI useful as a precursory indicator, its findings still need to be researched and evaluated properly. The RSI performs well when it comes to the identification of overbought and oversold conditions but it lacks the context required to know the reasons for these conditions or whether or not such conditions are favorable for traders.

Another flaw of the RSI is the event of an abrupt spike in price movement, this indicator has the tendency to spike repeatedly in both directions which give false signals. However, it could also signal either an entry point or exit point when those repeated spikes or falls or are used in confluence with other signals.

Also, the RSI indicator proves to be not so reliable in situations where overbought or oversold conditions last for a while before the retraction of price begins. Because of this, traders are more likely to use it with other indicators such as EMA (Exponential Moving Average), MACD (Moving Average Convergence/Divergence). When combined with the MACD, for instance, the RSI would show what it usually does (overbought or oversold conditions) while the MACD signals the buying or selling of an asset by identifying divergence from the asset’s current price.

In the event, the RSI accurately foretells the reversal of price, the state of the market could remain either overbought or oversold for hours or even days. This is maybe more than what traders seek. What this implies is the unpredictable timeline of the reversal of price.

Ichimoku Cloud

The fact that the Ichimoku Cloud is based on historical data serves as a drawback. Although traders may expect history to repeat itself, it may not happen as they predict because nothing is a hundred percent certain so it could give false signals.

Its complexity creates a difficult situation for beginners. This is because of the multiple components of the chart. The amount of information given by the Ichimoku Cloud at the same time might be overwhelming for those who are new to it. It would take quite some time to understand and process these important components, to know what they do, and to use them effectively.

When conducting analysis, traders who would rather have clear charts in order to pay attention to price action encounter difficulties while trying to understand this indicator.

Question 3

Explain trend identification by using this strategy (screenshots are required)?

For this trend identification strategy, the Ichimoku cloud, that is, just the cloud component of the indicator, would be used with the RSI. It is common knowledge that the RSI indicator is not so efficient when it comes to trend identification as its method may lead to missing voluminous candles in a trend. The cloud makes up for this flaw. Its components are two lines that are dynamic in nature, that is, they are used for various functions. However, its major function is trend identification and it has proven to be useful in this area. They help identification of trends of current price which is based on historical price action -the Ichimoku indicator uses historical data in general. In addition, it also helps you identify bullish or bearish trading opportunities. So, if the price is below the Ichimoku cloud, then it is downtrend.

- Similarly, if price is price is above the cloud, then it is an uptrend.

With the size of the cloud, it is possible to tell how strong the trend is (volume in the market), which the RSI cannot.

When these two are used together, they complement each other. While the Ichimoku serves as trend indicator, something the RSI lacks, the RSI indicator can also serve as an exit strategy for traders. The Ichimoku cloud also provides confirmation for strong short-term trends in the direction of the long-term trends.

Question 4

Explain the usage of MA with this strategy and what lengths can be good regarding this strategy (screenshots required)

A moving average is a simple technical analysis tool that is used to identify the trend of assets by smoothening out price data. This is done by producing a consistently updated average price.

While Ichimoku indicator comes with lines that greatly resemble moving averages, Tenkan Sen (Conversion Line) and Kijun Sen (Base Line), moving averages are a suggestion for traders who are not able to grasp the Ichimoku indicator. Although this indicator is a powerful one, its many components may make it strenuous to use for one who doesn’t fully understand it. Moving averages can make the process easier because it is also a trend indications signal that the trader is familiar with.

An important factor to consider when using moving averages is its length. Seeing as the indicator already has lines that are not long, it is best to opt for longer MAs such as 50MA. This indicator (MA) complements the strategy by showing the differences between short/medium/long term trends.

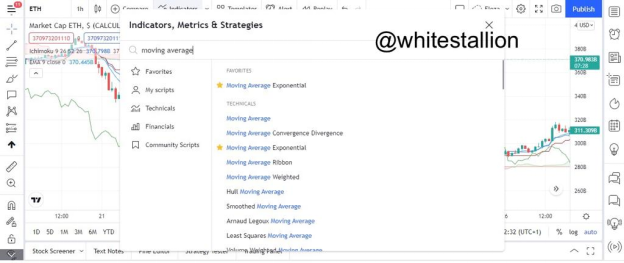

To use the 50MA, select “Indicator” at the top of the screen

- Type “Moving Average” and the indicator would pop up

- Select the indicator

The 50EMA stays above the trend during an uptrend, stays below the trend in a downtrend, and passes through price in a choppy market.

Question 5

Explain support and resistance with this strategy (screenshots required)?

Support and resistance levels are very popular trading concepts usually paired together seeing as they are key levels during analysis. A large number of trading strategies and setups adopt these concepts into the overall layout.

A support level is a level or a zone on a chart where price has dropped to but is not able to break, that is, there is price rejection in this area at least twice. This signifies where there is a surplus of buyers. As for the resistance level, it is a level or zone that price has gotten up to but could not break, that is, price rejects the area at least twice. It shows a surplus of sellers.

The Conversion and Baselines, otherwise known as the Tenkan Sen (the middle of the 9-period high and low) and Kijun Sen (middle of the 26-period high and low) respectively, are similar to moving average and serve as support and resistance while giving information on momentum.

- Concerning the Ichimoku Cloud itself, once it turns green, it is viewed as support but it is considered resistance when it turns red.

- A noteworthy fact is that the distance between the price and the cloud depicts the strength of the trend. The closer the price and the cloud, the weaker the trend and vice versa

- Below is an instance of the Ichimoku + RSI strategy.

The above is for a trending market.

However, in a range-bound market, the efficiency of the Ichimoku is severely depleted. This is where the RSI supports it by providing information. This indicator gives information about support and resistance and tells us about the people's current interest in the market and the positions they could take.

Question 6

In your opinion, can this strategy be a good strategy for intraday traders?

Intraday traders are simply day traders who plot intraday setups and carry out strategies with the aim of making profit from the change in price of an asset. Intraday trading simply entails taking small amounts of profit over a range of multiple trades made, which leads to daily profit generation and reduction in losses or chances of loss.

When it comes to the application of the Ichimoku and RSI strategy, intraday traders are not left out of its utilization. Intraday traders can make use of this strategy because the strong points of both indicators (trend identification and signaling overbought or oversold conditions) can be applied to the hourly timeframe as well. Day traders can use this strategy for such functions mentioned above.

Question 7

Open two demo trades, one of buying and another one of selling, by using this strategy.

Buying trade

The above is an instance of the Ichimoku + RSI strategy used to target bullish positions in a trending market. Price eventually reached the target profit. The Ichimoku Cloud and its other indicators were used gauge the strength of the trend while the RSI was used to craft an existing strategy.

Selling trade

The above is an instance of the Ichimoku + RSI strategy used to identify bearish trading opportunities in a trending market. The target profit was eventually reached. The Ichimoku Cloud and its other indicators were used to gauge the strength of the trend while the RSI was used to craft an exit strategy.

Conclusion

This technical indicator is a beautiful tool that is important in trading the financial market. As you can see in the question above, I was able to make a proper trading decisions using the strategy. Even though this indicator shouldn’t be used alone but with other indicators, it can help all levels of traders to trade successfully.

Special thanks to Professor @abdu.navi03