Hey guys,

I welcome you'll to the 8th week of the SteemitCryptoAcademy course by Professor @fredquantum. In this course, I will run a comprehensive review on Crypto Trading cryptto with Triple Exponential Moving Average (TEMA) Indicator

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

What is your understanding of Triple Exponential Moving Average (TEMA)?

Moving averages indicator is essential as it is part of the important technical tools used for technical analysis that deals with candles, pattern trend, and the price trend in Cryptocurrency analysis, Forex markets, and some other stock markets. There are types of moving averages, of which Tripple exponential moving average is one, but the rest are simple Moving average, and Exponential Moving average.

Tripple exponential Moving average has existed and it was being used in other stock markets before it was introduced into the cryptocurrency technical analysis, it was developed by Patrick Mulloy. Tripple exponential Moving average was developed innovatively to remove and destroy noise related to the remaining kinds of Moving average. It was created to level price variation, so it makes it easy to recognize trends with no lag that is commonly seen when the traditional moving average is used in the market chart and analysis. TEMA is useful for analysts and traders in analyzing the market pattern, trend as it is used in the choppy markets to identify trends and also to indicate trends. The effect of large price variation is reduced, and it can also help to identify the direction or the movement of trend, whether upward, Downward, Ranging, it helps to indicate and show support and resistance level, indicates a potential change in short-term trend or pull back. The triple exponential moving average can be used with a Double exponential moving average to compare, and also to indicate the trend of the market pattern.

It is very important to traders and analysts because it is used to indicate market analysis and chart pattern, as there will not be any effective trading if the market patterns and the trending price is not understood, so for this to be carefully understood and analyzed by traders, the Tripple exponential Moving average is needed, and that is why it is a very important tool in analysis. It is used majorly for technical analysis which deals with the candles, the formation of the candles, chart patterns, and market analysis.

Question 2

How is TEMA calculated? Add TEMA to the crypto chart and explain its settings. (Screenshots required).

3 Exponential Moving averages are considered for the calculation of Tripple Exponential Moving Average, Since, it is seen from the name "Tripple". Which later lands into a trending formation in just a single-trend with all noises destroyed.

Calculation and Formula for TEMA

TEMA = (3.EMA1) - (3.EMA2) + EMA3.

From the above expression and written formula, the coefficient of the EMAs is 3, 1, and 2, which is the product of 3 and Other EMAs.

NOTE:

EMA1 = Exponential Moving Average.

EMA2 = EMA of EMA1.

EMA3 = EMA of EMA2.

The three Exponential Moving Averages used for the calculation of the Triple Exponential Moving Average are at the same periods.

Adding Triple Exponential Moving Average to the Chart.

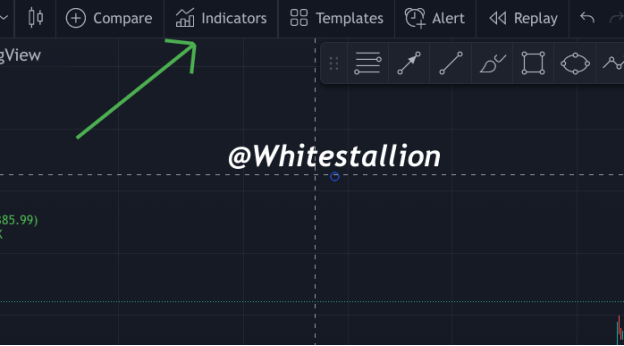

www.tradingview.com would be used as the official website to carry out all of the functionality of the assignment that was given. These are the few steps of Adding TEMA to a chart.

- Visit, www.tradingview.com, and select indicators at the top center of the chart.

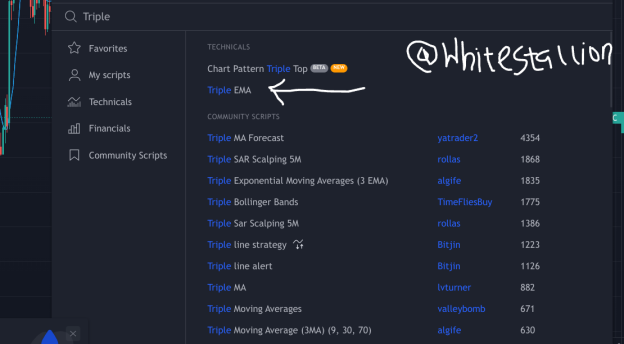

- On the Indicator interface, search for Triple EMA, and select. See the image below.

- TEMA is now added to the chart.

- Double click on the TEMA, select inputs and then change it to the desired period you want.

In the setting and image example shown above, the default of the TEMA is 9 periods, which at the later end, I changed into 25.

Short-term traders are traders who don't trade for a long period because they close their trade within a short period, period 9 for the TEMA shows the trend and market pattern within the short time frame that the trader would use to make an order in the market, thereby ensuring they make their decision in very fast order, so that there won't be any loses. The default setting was set to 9, while I customized my setting to 25, which would make me follow the market pattern more undoubtedly and understand the market analysis than when it is in the default state of 9.

Question 3

3.Compare TEMA with other Moving Averages. You can use one or two Moving Averages for in-depth comparison with TEMA.

The TEMA (Tripple exponential moving average) compared with the DEMA (Double exponential moving average).

The TEMA (Tripple exponential moving average) compared with the DEMA (Double exponential moving average), these indicators are created in such a way that they would cause reduction to the inheritance of lag in indicators that are just averagely based. The double exponential moving average, DEMA does not have the reduction capacity of lag like the Tripple exponential moving average.

The processor formula of calculating the DEMA is very different, which supposes that it will give small different information to the traders to trade and operate the market. The DEMA is calculated by the EMA of price-trend multiplied by 2 and then Subtracting an EMA of the original EMA.

Question 4

4.Explain the Trend Identification/Confirmation in both bearish and bullish trends with TEMA (Use separate charts). Explain Support & Resistance with TEMA (On separate charts). (Screenshots required).

Triple Exponential Moving Average (TEMA) is a technical tool, used by the analyst. It follows the trend movement in the market, to determine the market pattern, and also know the state of the market and the price trend. This indicator helps to identify trends more clearly.

To Identify Trends the price trend and TEMA moves in the same way or direction. In an upward trend or a bullish trend, the price trend and the TEMA moves upward, while in a downward trend or a bullish trend, the price trend and the TEMA moves downward. To understand better, there are some factors written below to consider to truly recognize and confirm with TEMA.

- In a bullish trend, the price trend and the TEMA moves upward, so also for a bearish trend, the price trend and the TEMA move downward.

- To fully confirm and be sure about a bullish or bearish trend, the price-trend would be trading over TEMA and the price-trend would be trading under TEMA.

The GALA/BTC chart shown above in the 1-hour timeframe, after a bearish run, the price-trend was reversed which takes the market into an uptrend. The price trend was trading above TEMA, and the price-trend/market trend moves upward. Also, in a bullish trend the price trend was reversed which brings the market into a downtrend. The price trend was below TEMA, and the price trend moves downward.

Support and Resistance'

The Tripple Exponential Moving Average also provides support and resistance for price-trend, which means or implies that when the price is moving in the upward direction, on withdraw i.e pullbacks, the price-trend may move back in the direction or drop to TEMA, and it may showcase itself as if it was just bounced back and the price begins to trend in the upward direction.

This directional movement of the pattern already caused is relying on the accuracy or a better shift back time range for the price-trend and market pattern. Since the TEMA has been used for something like this in the past, it would have given providence to something of such in the future.

The TEMA has a lot of unique characteristics and things that could be achieved when using this indicator for a proper analysis in the market pattern or price-trend, it can be used as a unique or different resistance in the uptrend, or in the bullish market when the price-trend is resisted on the TEMA line and just that action or movement could just begin to fall back into a bearish market or downtrend. TEMA as it serves as resistance also serves as a support in a bearish or downtrend the price-trend is subjected to move off the TEMA line so that the bullish market can now begin.

Uses of TEMA as support and Resistance

The support/resistance level indicator could be a show that a pullback has begun in the market.

The opportunity of the TEMA can be used to get buy/sell openings as the price-trend may move in the new pattern of the market. In this case, effective trading management must be used and adopted.

It can also be used because of the chances and opportunity opening up because of this trade for a pull-back market strategy which later allows traders to make an entrance into the market from the former trend.

The ETH/USD chart above in the 1-hour time frame shows that when the price-trend touched the TEMA, then a unique resistance showed up, which moves the market upwards, and also unique support was seen at the point where the Price-trend moves off to the TEMA and the market pattern moved downwards.

Question 5

Explain the combination of two TEMAs at different periods and several signals that can be extracted from it. Note: Use another period combination other than the one used in the lecture, explain your choice of the period. (Screenshots required).

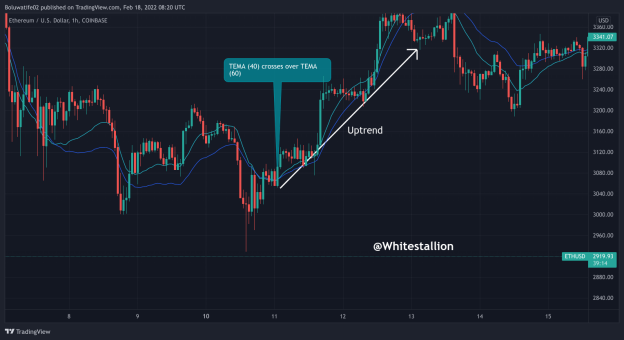

The combination of 2 of the TEMA at a different period would suggest the fact that the value of the period would be higher than the other. This means that there would be a cross-over that would exist between both of the TEMA which can be effectively used to make a buy/sell opening in the trade market but in the same vein that there is also a confirmation that the price trend under would also move far.

The TEMA with a lower period would cross over the one with a higher period, si when it happens, it indicates a correct bullish run and it exposes and shows the trader into a buy entry in the market. On the other hand, if the higher period TEMA crosses that of the lower period, the market brings an indication that the would be a correct downtrend, which means that the trader has been shown the way to make a sell trade.

This particular market trading strategy should be noted with proper market management. The images below clearly show what was explained.

In the ETH/USD chart above, I have added two TEMA with the period 40 (green) and 60 (blue) respectfully. In a bearish run i.e. downtrend, TEMA of the lower period 40, crosses over the TEMA with a higher period 60. This shows the change in trend and the market moves in an upward trend, and this opened the buy entry for the traders who trade in line with the trend.

Also, in the ETH/USD chart above, I have added two TEMA with the period 40 (green) and 60 (blue) respectfully. In a bullish run i.e. uptrend, TEMA of the higher period 60, crosses over the TEMA with a lower period 40. This shows the change in trend and the market moves in a downward trend, and this opened the sell entry for the traders who trade in line with the trend.

Question 6

What are the Trade Entry and Exit criteria using TEMA? Explain with Charts. (Screenshots required).

The Market analysis trading strategy with TEMA for correct entry/exit in a cryptocurrency market would need some special standard or yardstick to be contented when using this indicator in trading time. So, the strategy that would be implored is to use 2 TEMA with different periods and to be sure and give confirmation of how this indicator confirms valid trend movement to place by/sell entries in the market and also to effectively use the proper trade management.

The Standard below should be considered.

Trade entry/Exist for a buy position using 2 TEMAs

1.From the indicator button on the toolbar, add 2 TEMA at a different period, for this case, I would be using 40 and 60.

2.When a bearish run happens or a range market, be patient until the lower period TEMA crosses the higher one.

3.Enter a buy entry after the cross-over had happened.

To exit the trade, the preferred take profit should be set, the stop loss should be under the crossover, i.e. where the TEMA of a lower period has crossed that of a higher period.

Question 7

Use an indicator of choice in addition with crossovers between two TEMAs to place at least one demo trade and a real margin trade on an exchange (as little as $1 would do). Ideally, buy and sell positions (Apply proper trade management). Use only 5 - 15 mins time frame. (Screenshots required).

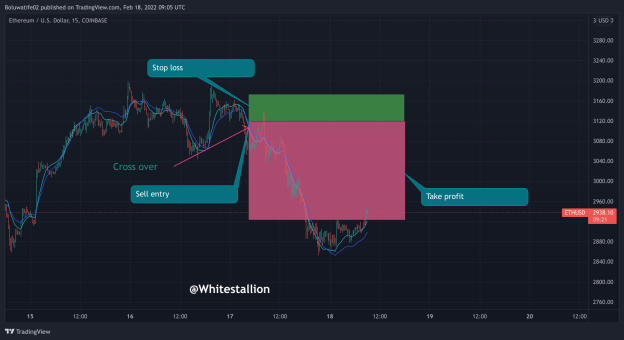

Demo or real trading TEMA should be used on a lower time frame. According to the question, trade would be placed using the 15 minutes time frame, and the trade of ETHUSD would be placed, a sell position was opened as TEMA 60 crosses TEMA 40.

Sell Entry: 3,119.33

Stop loss: 3,174.32

Take profit: 2,923.47

Demo or real trading TEMA should be used on a lower time frame. According to the question, trade would be placed using the 15 minutes time frame, and the trade of ETHUSD would be placed, a buy position was opened as TEMA 60 crosses TEMA 40.'

Buy Entry: 2,609.05

Take profit: 2,811.27

Stop loss: 2,546.20

Question 8

What are the advantages and disadvantages of TEMA?

Advantages of TEMA

1.It is an important tool used for analysis.

2.It helps to indicate trends.

3.It helps to take out noise and volatility from the market.

4.It helps to minimize the cost of price-trend that are large.

Disadvantages of TEMA

1.As TEMA helps to filter and reduces the lag in the market, there is still an inheritance of some problems associated with the Moving average.

2.It generates false signals at times.

Conclusion

In summary, the TEMA is a milestone reached on the moving averages because it settles the problem of lag in the market and it helps analysts to analyze the market better. If there's no good way to make an analysis, there will be a problem as a lot of uncertainties will arise in the market.

Special thanks to Professor @fredquantum