INTRODUCTION

Hello fellow steemians, todays class was on exchange order book, its use and how to place different orders. It was thought by prof @yousafharoonkhan which was well explained. I really liked the teachings and will like to say a very big thanks to you professor for the good work done. Lets good straight into this week’s tasks.

Q1.What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

ORDER BOOK is simply a recorded transactions between two parties either organizations or individuals. It can be written or printed depending on the medium used. When a buyer and seller agrees to make a transaction, they will have to do the exchange, when the exchange is done the transactions details are recorded. Every pair the is recorded is kept as a reference to the transaction. the compilation of this recorded transactions in a written or printed form can be termed as an order book.

ORDER BOOK in crypto trading differs in many ways as compared to the traditional or local market. Below are some of the differences.;

• In crypto trading pairs are seen whiles In the local market there are no trading pairs but rather a single currency acts as a medium of exchange.

• Filling of orders are automated/automatic on predefined prices but local markets order book does not support that.

• when it comes to local market order books it is only accessible to a certain group of individuals buyer/seller but when it comes to crypto trading, every one can have access.

• There is no much price negotiation in the local markets book order due too no availability of significant price volatility

• There are features like stop lost, OCO, stop limit in the crypto market order whiles it does not exit in the local market.

• Technical analysis can be done to predict prices changes in the crypto market order whiles there is no such thing in the local market order book but the only price prediction in the local market is the law of demand and supply.

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

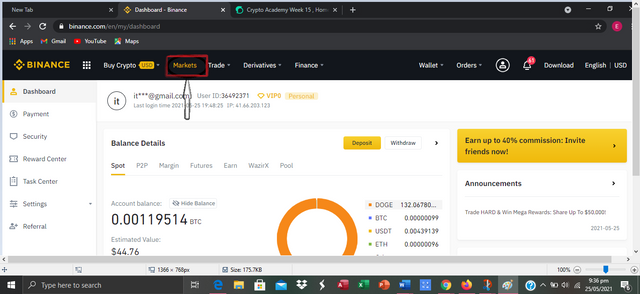

Over the years I have been using binance due to its popularity and trust worthiness when it comes to crypto exchange. I will be very happy to use it for my explanations in this task. I am a verified member and have done some transactions on the exchange platform making me familiar with the system.

Now lets take a look at how to find order book on the binance exchange platform.

As we all know you first have to log into your account before you can do anything so that's step one.

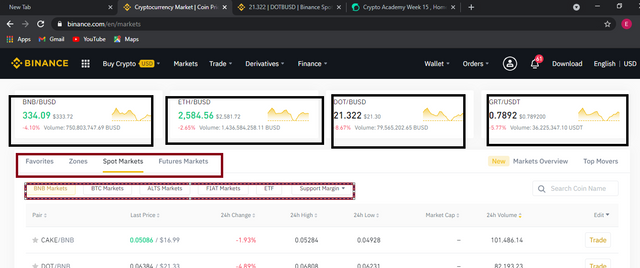

STEP 2 CLOICK ON MARKETS

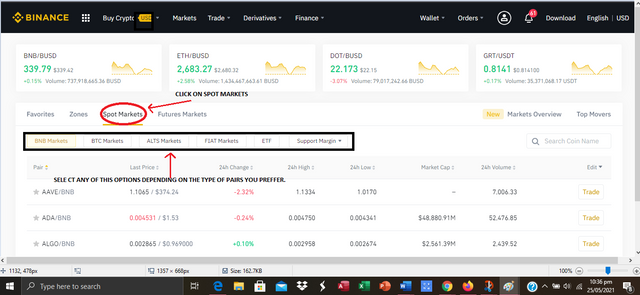

STEP 3 THIS IS WHAT POPS UP, WITH DIFFERENT TRADING PAIRS IN THE LIKES OF DOT/BUSD, GRT/BUSD, BNB/BUSD, ETH/BUSD , SPOT.

STEP 4 CHOOSE ANY OF THE TRADING PIARS, FOR INSTANCE I WILL GO IN FOR TRX/XRP FOR MY EXPLANATIONS.

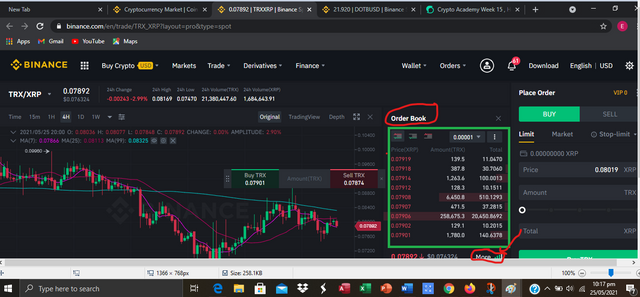

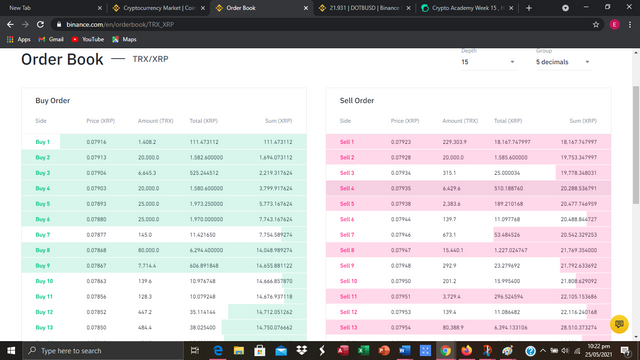

FINALLY THERE YOU HAVE THE ORDER BOOK FOR TRX/XRP

• Pairs

Trading pairs simply means two crypto currencies or assets which is papered together and can exchanged for on any exchange platform. So we could have a trading pair of XRP/TRX, ETH/BUSD, BNB/BTC etc. This means incase you have one of the paired currencies it can be traded for the other on an exchange platform. Example with ETH/BUSD; this means when you have ETH on your wallet, you can use it to buy BUSD on an that exchange platform .

• Support and Resistance

When we talk of support and resistance its simply a point at which a continues movement of a chart hits its maximum or trend and a change in movement is expected.

When the assets prices increases in value for a while and gets to a point when it does not increase any longer and then starts to fall, we call the final point the resistance.

on the other hand a continuous decrease in price of an asset which get to a point and starts to increase again in known as the support level. The two work hand in hand meaning there is no support without resistance and vice versa.

• Limit Order

Its all about how you feel about an assets value on the market. So lets say I'm not happy with the current price of an asset and wish to buy/sell it at a different price you set a LIMIT ORDER. for example I want buy SELL SBD at 15.00 USDT but on the market at the current moment is 5.00 USDT, so not pleased with this price I can set a limit buy. I can set a limit buy that incase the price should hit 15.00 usdt the coins should not be sold. So until the price is attained my SBD will not be sold out for the USDT but as soon as it hits that price then the order will be placed.

• market order

This is placing an order at the current market value. Meaning you don't have to wait for days, weeks or months for your order to be confirmed purchased. So lets say I have SBD and I want to exchange it for STEEM and the price of SBD is 7 dollars on the market at the moment, I wont have to wait. I sell the SBD at 7 dollars for the equivalent steem amount.

QUESTON NO 3

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

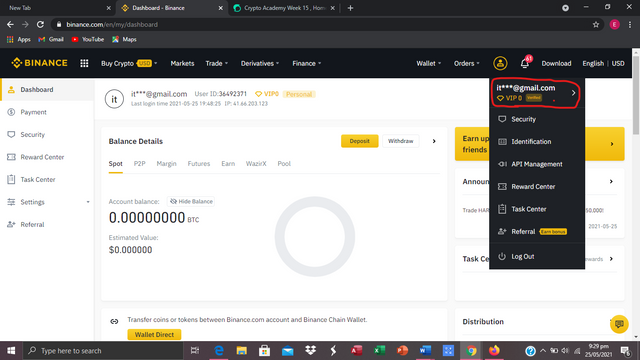

So this is screenshot of my verified binance account...

Now lets take a look at the important features of an order book. You can see there is two options namely the buy and sell order book. The sell in red colours whiles the buy in green colours.

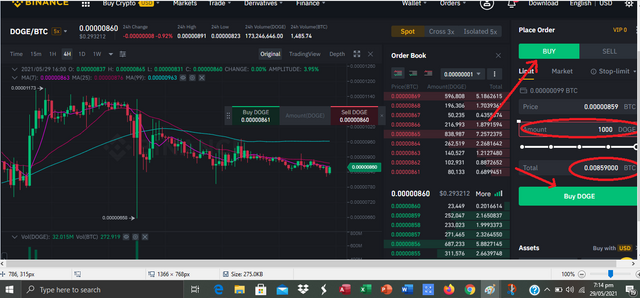

BUY ORDER

This is the total obtained assets from trading or exchange for another asset. So meaning you will give out what you have in order to gain another. So definitely you need to have an asset for exchange of another. When it comes to buy order, you enter the amount you want to buy which will convert into the total you will get after buying the asset and how much it will cost you displaced as well. So I enter amount of 1000 DOGE and that will cost me a total of 0.0089000 BTC. after I am done with it, I then click on buy DOGE TO buy.

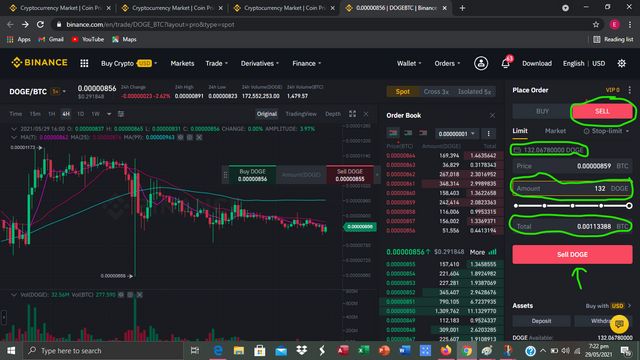

SELL ORDER

Click on sell this time round, and fill out the necessary details. Enter the total amount of doge you wish to sell, im selling at a 100% looking at the chart. hit the sell doge button to sell.

**Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

STOP LIMIT ORDER is simply an intended way of minizine loses in a trade. This is based on how you understand this two technical terms which are support and resistance. Meaning a trader needs to understand both the resistance and support limit in order to set a stop limit order. As a trader you need to analysis this two in order to set a stop limit.

Setting a STOP LIMIT ORDER comes with setting A STOP PRICE and A LIMIT PRICE ..

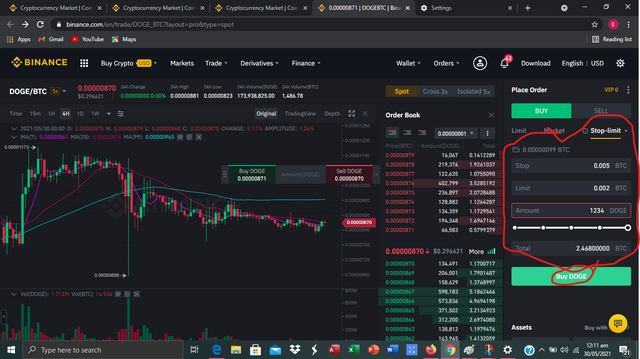

Now lets take a look at how this two can be used in placing A STOP LIMIT ORDER. I will be using binance account for this process. As we all know you first have to log into your account in order to perfume any task.

From the diagram above, I set a stop limit should be below 0.002 to buy whiles to minimize losses a stop loss set at 0.005. Meaning it would be triggered to buy at a price below 0.002. Vice versa for the sell order too.

Question no 5 :

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

The usefulness of order book depends on how you understand it as a trader. And to get maximum satisfaction from the order book you need to understand how the stop limit order, market order, and limit order works. Through the limit order we can do trade like selling Doge at a higher price of 0.60 usd instead of 0.40 usd by setting a limit spot. We can also intend to buy usd a lower rate and sell at a higher rate by setting the stop lost at a lower price rate.

Also getting all the complete details of all online transactions through the order book market where a buyer can just decide that I am comfortable with the current price and for that matter willing to do a trade. this can help the trader by doing quick transaction and profit gained in a very short period.

Also, placing of different orders with the help of the OCO trade with the use of different technical indicators is very useful. In using varieties of different indicators, selling at a higher profit margin is assured. With the OCO you can weigh from two different angles.

Conclusion

Will explained lectures for this week on ORDER BOOK and some benefits that comes with it. I want to say the ORDER BOOK can help in maximizing profit as trader depending on the understanding you are able to get from it. Make use of some components of the ORDER BOOK like the market price, stop loss and the limit stop[p loss.

THANK YOU.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

How an order book can help a trader make a profit , your answer was very much short , need more detail to explore this question۔

i could not find oco order that was 2nd part of question 4

it is very much important to submit your work in time, so you are also late in submitting [4 hours]

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 6

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit