Hello comrades,

WHAT ARE THE DIFFERENT dApps IN THE TRON ECOSYSTEM ARE YOU FAMILIAR WITH?WHAT ARE THE USES OF DeFi APPLICATIONS LIKE Justswap,JustLend,and Sun.io?HOW CAN YOU OPTIMIZE MINING REWARDS BY STAKING TRX AND OTHER TRC20 tokens in Sun.io?EXAMPLES?

I will like to talk a little about tron blockchain and explain what it is before I start. Now, Tron Blockchain is a platform founded in 2017 which is aimed at offering room for decentralized applications but with low transaction cost and high transaction output. This platform was founded by Justin Sun.

WHAT ARE THE DIFFERENT dApps IN THE TRON ECOSYSTEM ARE YOU FAMILIAR WITH?

Let’s first take a look at what DApps are..

dApps are decentralized applications that allows developers to create new online tools whereby some amount of them have reached global business markets. They have no third party regulations and no intermediaries for operations to be able to take place. DApps have greatly changed the financial system by providing services to individuals across the globe without any third party interventions. They are very fast in executing operations and less expensive to use in terms of transaction fees.

The different dApps in the Tron ecosystem are JustLend, JustSwap, JUST, Poloni DEX just to mention a few.

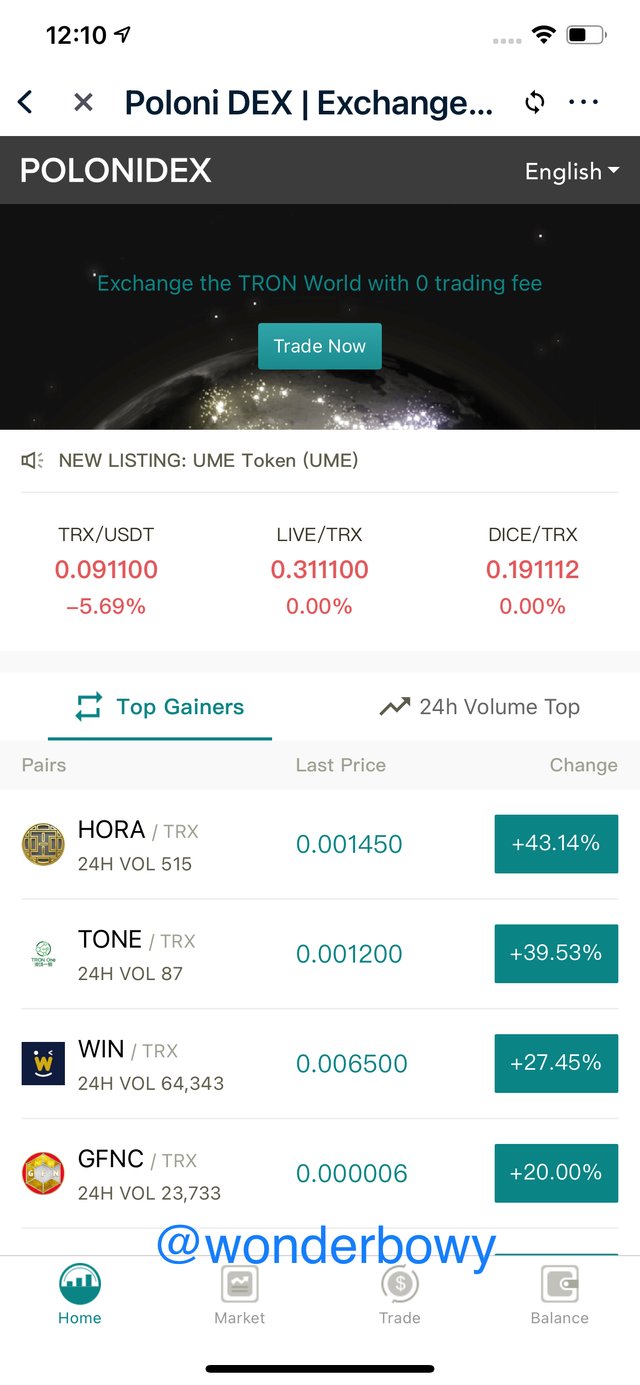

- Poloni DEX

This is a decentralized application under Poloniex which has great liquidity. Every token is eligible for trading on the Poloni DEX platform because transaction fee is not charged making it free to use.

- zkWrapper

This decentralized application has been improved from JustWrapper to zkWrapper.It is a product of JUST foundation and also an anonymous dApp which is mainly used for trading on Tron Blockvhain.

WHAT ARE THE USES OF DeFi APPLICATIONS LIKE Justswap,JustLend AND Sun.io?

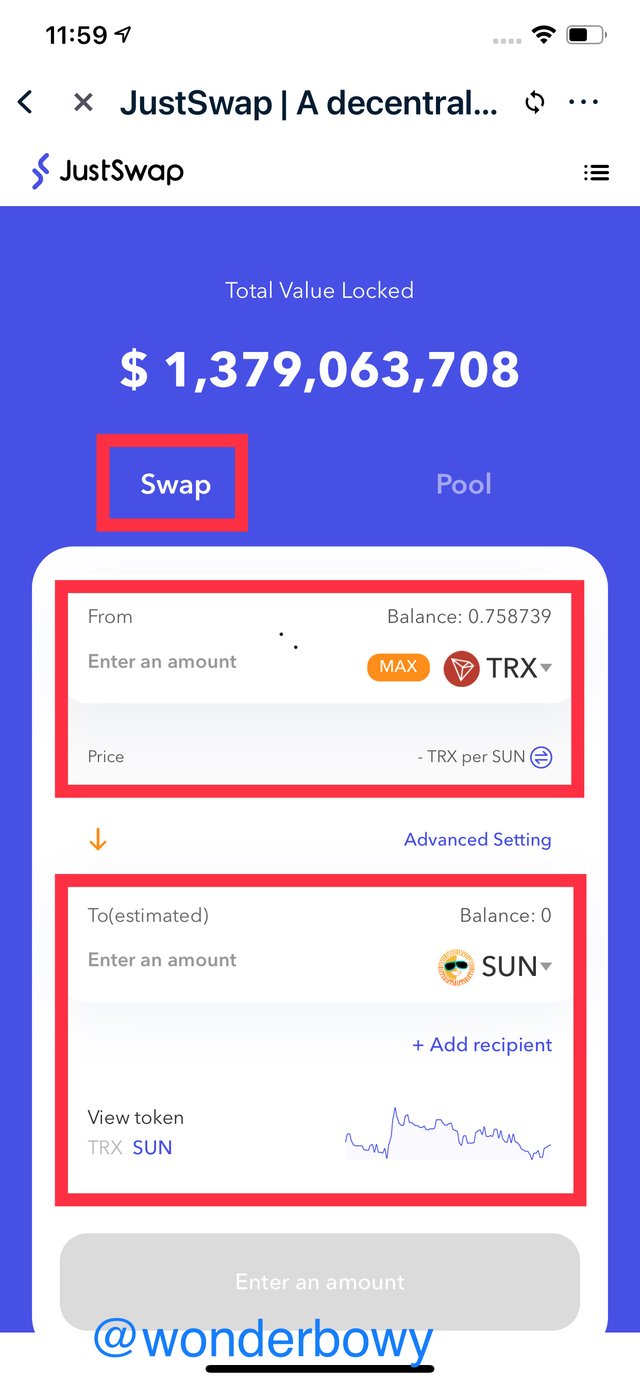

- Justswap

This is the first decentralized exchange(DEX) of Tron Blockchain that grants users the chance to swap a token be it TRX OR TRC20 for the other belonging to the same family without depending on the ease by which the token can be converted to ready cash to perform a swap. Based on a order book model such as CEX, there is a list of bid and ask values and the difference between them is known as spread. Also, in a highly liquid market, the spread is thin and small whilst in an illiquid market the spread goes higher making exchange value worst for a trader.

Basically, DEX suffers more from liquidity issues as compared to CEXs.

In contrast, The major problem with DEX is the liquidity, this is because it is fragmented due to the absence of a centralized pool. The liquidity remains in the decentralized wallets of the individual traders.

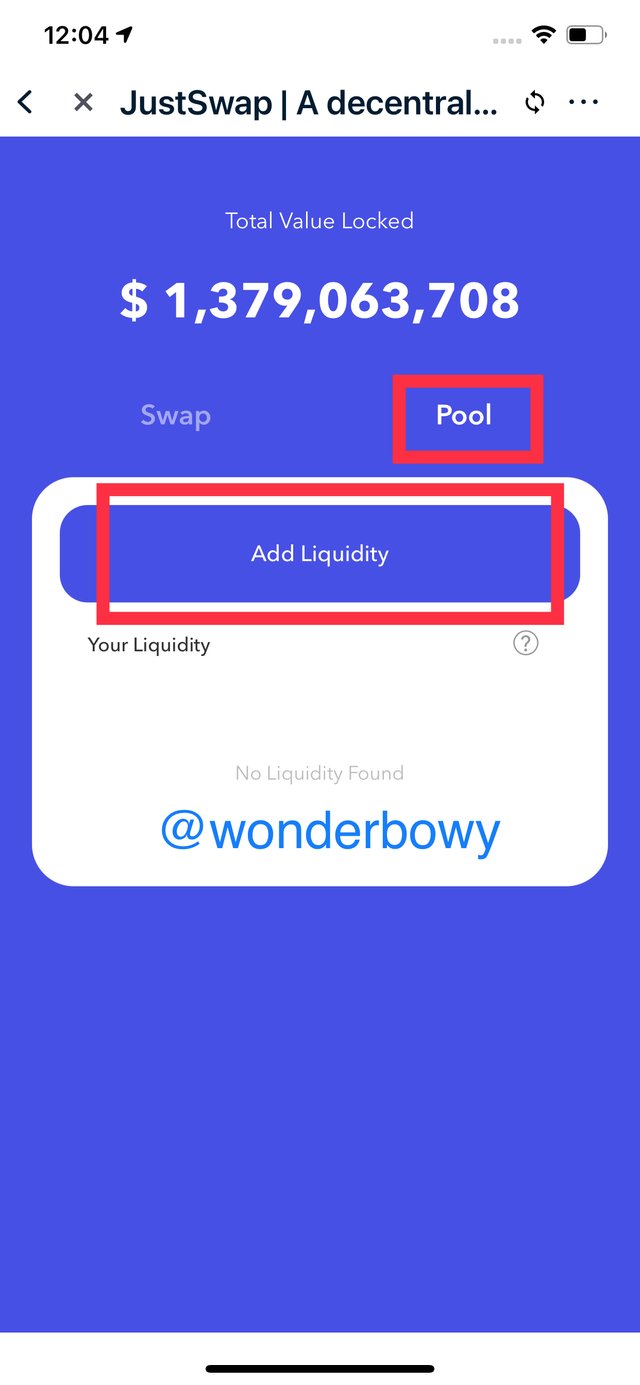

- Justwap Investor Pool

In Justswap, anytime the investor or trader pays 0.3% fee, an exchange happens whereby the fee is distributed proportionally among the( LPs) Liquidity Providers.

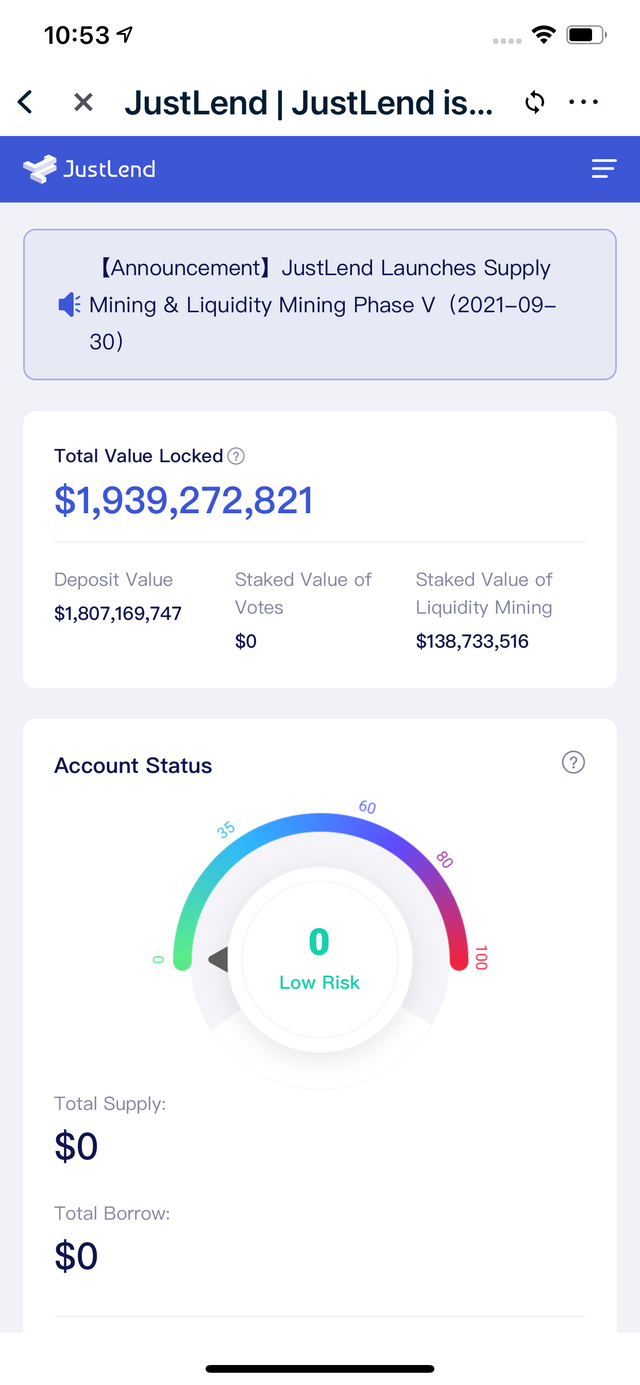

- JustLend

JustLend is a type of DeFi Application at the top of Tron Blockchain, a Money Market advantage with transparent and effective pricing. It follows all the framework of a DeFi which are Low Network Fees and micro-lending.

JustLend establishes Supply Pool and Borrow Pool based on the demand and supply a dynamic interest rate is defined. To explain further, a supplier gains a floating interest rate whilst a borrower pays a floating interest rate.

Also, in the supply pool if the liquidity is higher and the demand is lower, the interest rate decreases and in the supply pool if the liquidity is lower and the demand is higher the interest rate increases. There is a factor that varies from 0 to 1,where a lower value indicates low liquidity and a high value indicates better liquidity which is called the collateral factor. The loan amount for the borrower is the collateral factor multiplied by the collateral value. Higher collateral factor close to 1 stands for higher liquidity whilst lower collateral factor close to 0 stands for lower liquidity.

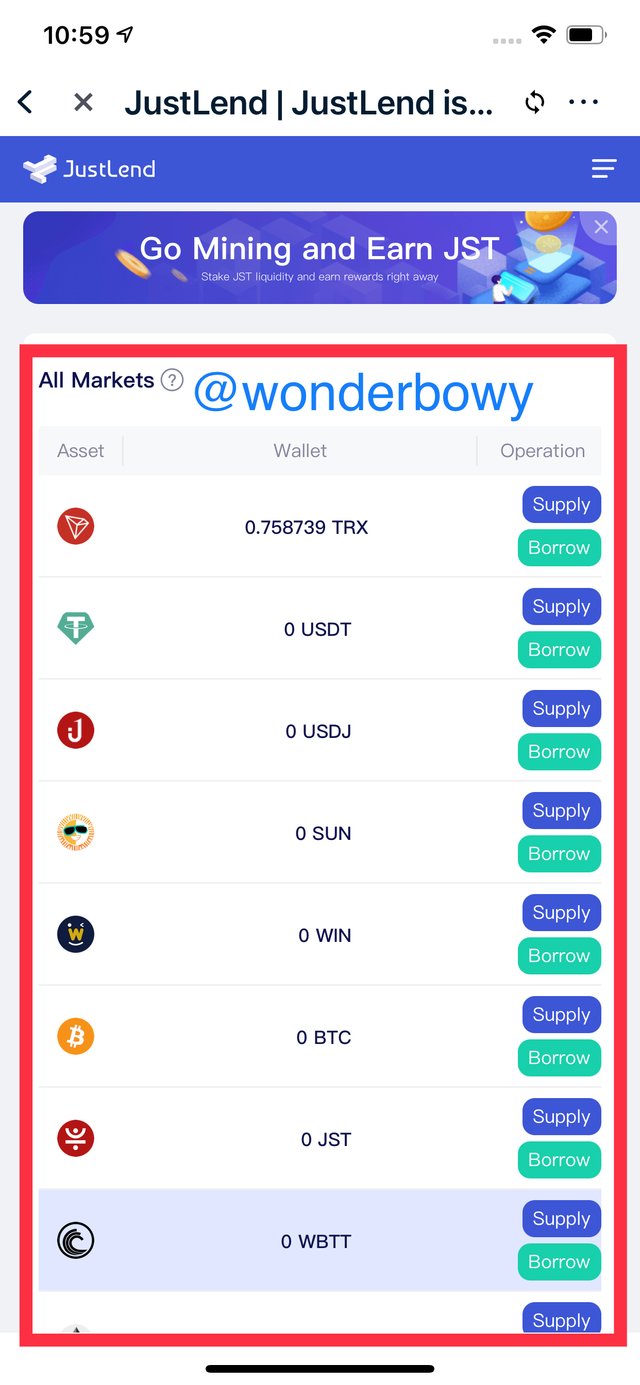

Screenshot of Some of the Tokens you can Supply And Borrow on the Justlend Defi Platform.

There consists of 13 markets in JustLend which are TRX, ETH, SUN, USDT, USDJ, JST, WIN, WBTT, BTC, TUSD, USDC, SUNOLD, NFT.

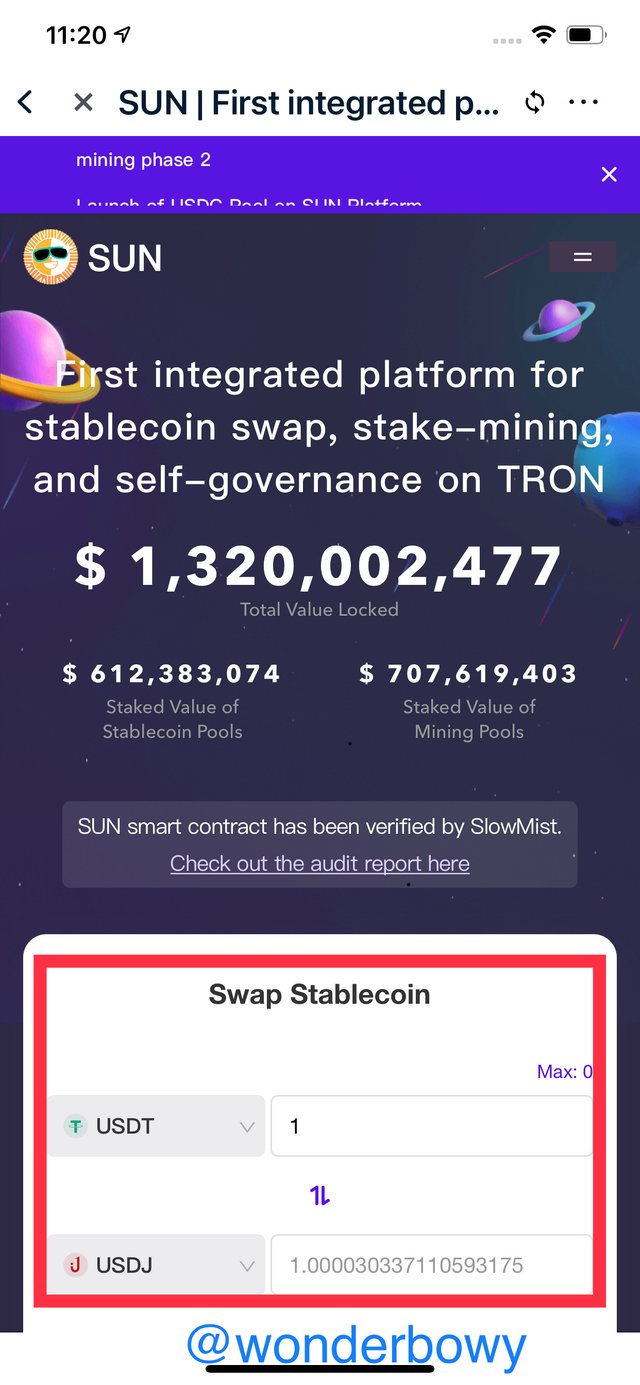

- Sun.io

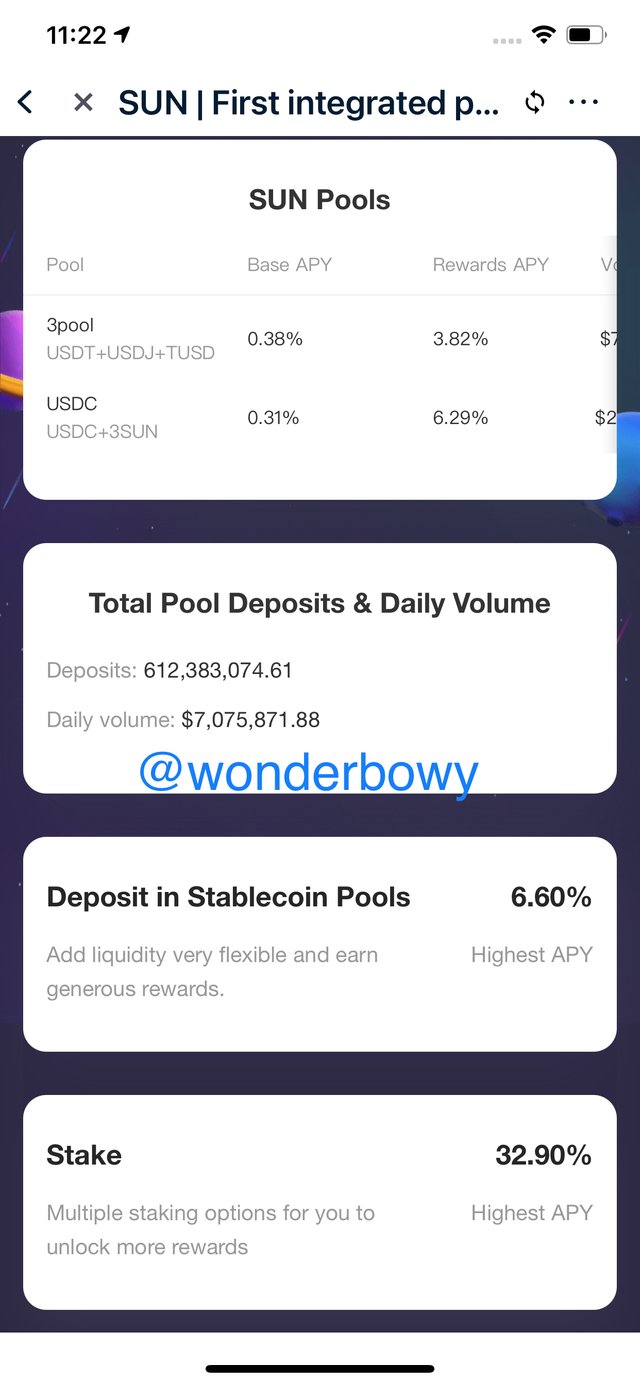

Sun.io is a segment in Tron that harbors different DeFi projects of Tron and stake mining. One can earn a premium in the Sun network. With this type of Sun staking pool, we have the Stake SUN pool where you can stake and withdraw any time you wish without any restriction and also the Stake and Lock SUN pool where you need to stake and lock the token for a duration of time.

Sun.io has concluded century mining to the satisfaction of traders in DeFi successfully.

HOW CAN YOU OPTIMIZE MINING REWARDS BY STAKING TRX AND OTHER TRC20 TOKEN IN Sun.io?EXAMPLES?

The various ways by which you can optimize mining rewards by staking TRX and other TRC20 include;

- Mining Methods:

In here we have the Genesis Mining where you stake TRX into SUN’s smart contact. After completing Genesis mining, the smart contract rewards Sun and take back all assets and tokens back to the user’s accounts taking no handling fees.

We also have the Regular Mining, in this type of mining SUN, USDJ, WIN and liquidity mining pools will be set up and users can participate in mining by staking different tokens.

Also, in order to optimize your rewards, you need to stake and lock your rewards on the Stake and Lock SUN

Lets say for example; Liquidity Pool Provider has earned some Liquidity Pool Token from what he or she has staked, the LP can decide to further stake their earned tokens to in order to earn mining rewards out of it.

The Tron Ecosystem is a decentralized platform with numerous DApps that can help yield much profit through many ways, staking, Mining, Lending, Borrowing etc. Thanks to Prof. @sapwood for such an insightful call on the benefits and uses of the Tron Ecosystem. This class was very interesting and happy to have taken part in your introductory task.

Thank You.