Introduction

Hello wonderful people, hope you're doing good? This week brings yet another edition on the steemit crypto academy and I am very delighted to be a part of the various classes. I found that of prof @imagen very interesting and will like to do justice to the tasks at hand. It was on yield farming and one of the interesting topics for the week. Lets go straight into the tasks...…...…..

(1.) Describe the differences between Staking and Yield Farming.

STAKING

With just these few listed above and many other reasons, there Proof Of Stake was developed. In order to validate this consensus mechanism, one needs to stake some amount of money. When this amount is stake the user then earns a certain percentage of the total amount staked within a period of time. In most cases, until you unstake your asserts. Every platform and the amount that comes from what you stake( APY ).

Later on, PoF was expanded by centralized and decentralized exchanges making it easy for users to stake their funds in order to earn rewards through the setting up of nodes and also adding validation of transaction functions to its system.

So in a nut shell, staking simply involves the release of ones funds into a particular platform and get rewarded for doing that within a particular period of time. Meaning their asserts are locked up in a certain platform with the aim of getting back some profits or incentives until it is unlocked by the user or staking period is over.

YIELD FARMING

This is a newly developed ecosystem where users can supply tokens to provide liquidity for them to earn a passive income from the total interest rate that comes with it within a particular period of time. The liquidity pool that is generated by investors makes it possible for the lending of funds, carrying out trading activities etc.. When this economic activates are carried out with the help of the liquidity pool provided, any income that is generated out of it is shared among the liquidity providers proportional to the total amount of funds provided for the liquidity pool.

DeFi platforms have integrated some mechanism known as the Automated Market Maker which helps in the execution of smart contracts of yield farming. Because this mechanism depends on demand and supply, the yields changes with time. For this reason Liquidity Providers have the obligation to check for the highest APY or APR and choose from them.

(2.) Login to Yearn Finance. Explore the platform completely and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options) Show screenshots.

The Yearn Finance platform has various features on their site. I will take you through each one them and explain their functions. These features are;

- Home

- Vaults

- Wallet

- Wallet

- Iron Bank

- Settings

Now let me take you through each one of them starting with the HOME.

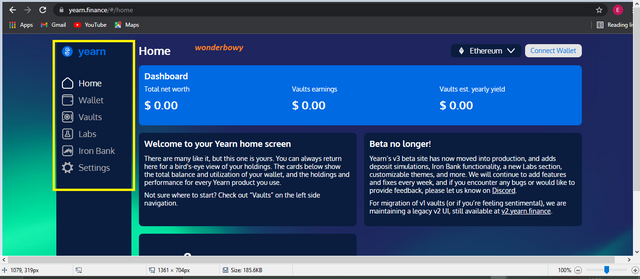

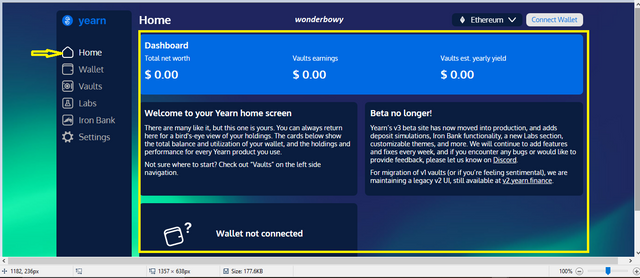

HOME

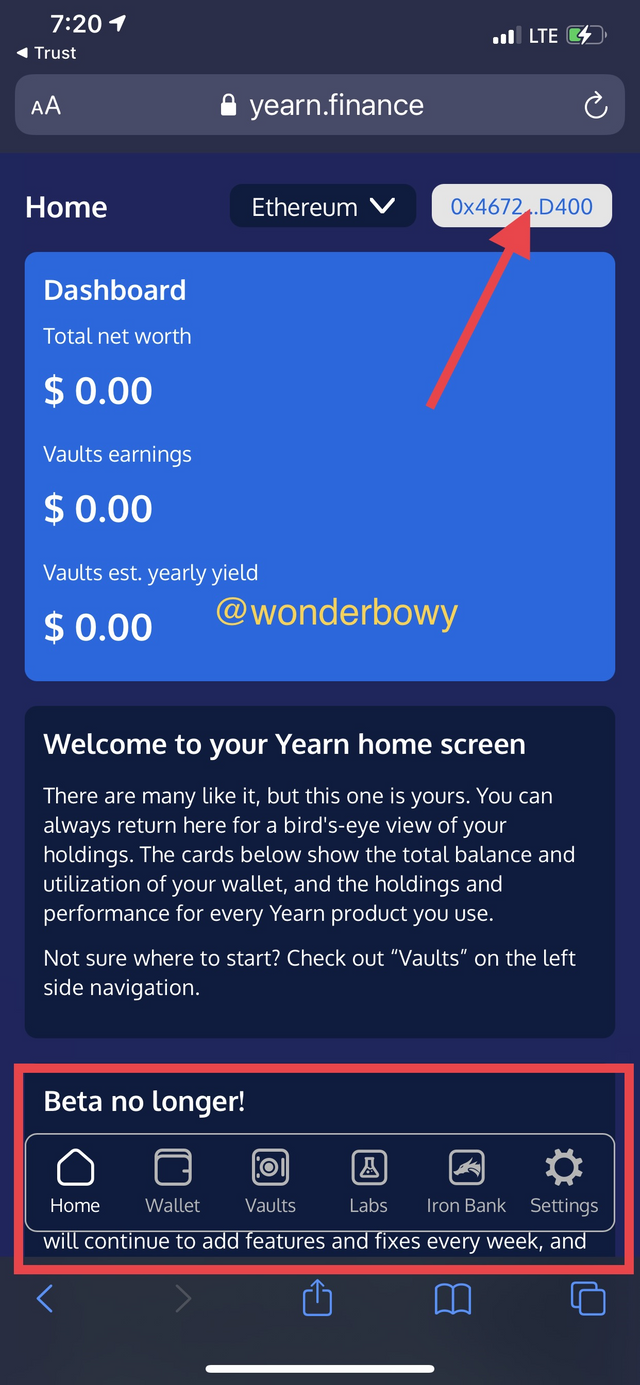

This is the main user interface of the yearn finance platform. It is the first page that pops up when you visit the platform. It contains some sub features such as the total net worth, Vaults earnings and Vaults Estimated Yearly Yield.

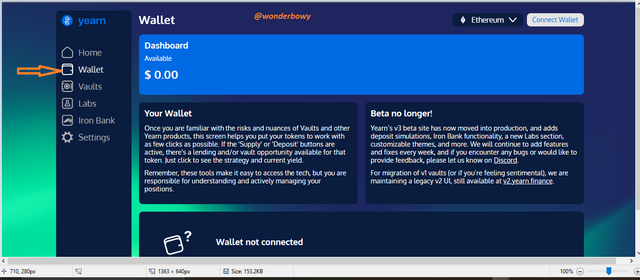

WALLET

This is where a user gets access to deposit funds for caring out some activities such as yield farming itself.

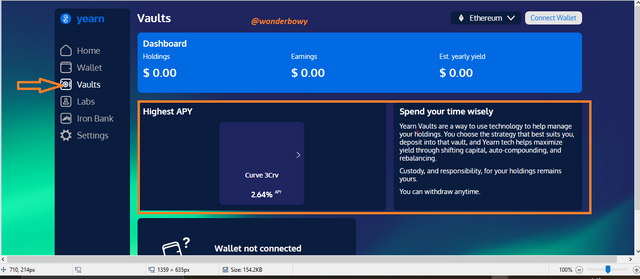

VAULTS

Very essential feature of the Yearn Finance ecosystem comes with the ability to utilize the users funds that are deposited in order to bring forth high profit. This is done automatically by the system through the selection of the highest APY in order to maximize profit. The smart contract triggered ability of the Vault automatically executes the funds during a time of opportunity of possible high profit generations from the yearn finance ecosystem. This gives the user the freedom from frequent checks of available high APY and its corresponding asserts in order to execute the contract. This feature prevents stress that could come with the hunt for maximization of profit.

However, there is a performance fee of 2% as well as a management fee of 2% that is being paid by the user to the platform. This two fee are paid on different terms where the performance fee is being deducted from the total profit generated by the vault whiles the management is being paid on the total deposit within a year.

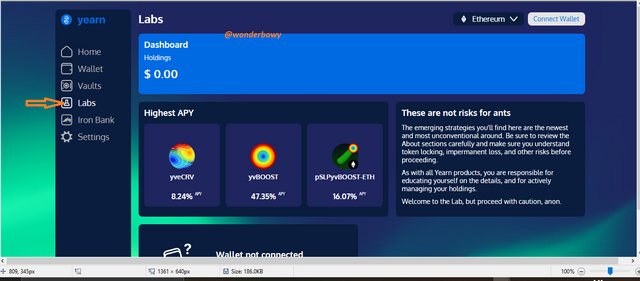

LABS

In this part, new and upcoming developed features are added for experimentation and exploration by users before added to the main existing features such as the vault and iron bank. This are projects that have potential great capability but some could cost you to loss your funds so most at times users are advised to check for any audit before venturing them. That's any losses incurred as a result of using any labs features is the users own fault.

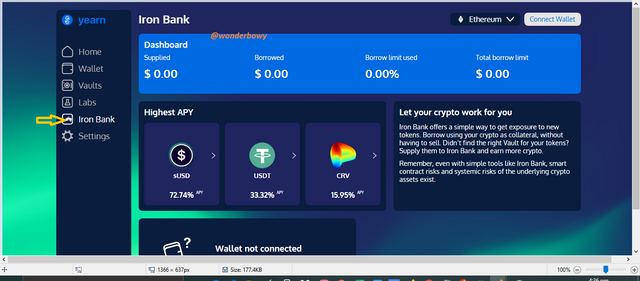

IRON BANK

This feature allows user to lend and borrow money from the platform in various available APPYs. Therefore users with asserts can lend to the ecosystem in which other users can borrow from at the expense of their collaterals. When the borrower pays back the same total borrowed for his or her collateral to be released, then the profit generated is shared among the lenders proportionate to the amount each lender provides.

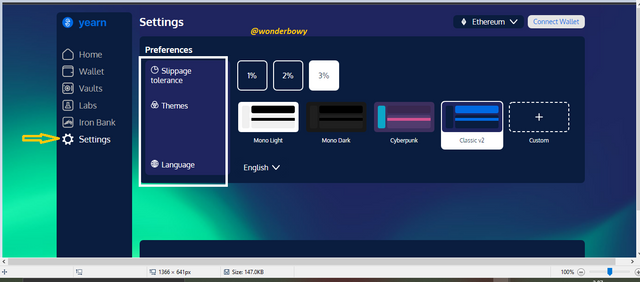

SETTINGS

This feature mainly got do with taste and preference. It gives you the ability to make certain changes to ones own like. These comes in three different forms and they are;

Slippage; which got to do with the percentage rate at which a user will like to tolerate before transacting. The tolerance potentials are 1%, 2% and 3%. User have the chance to choose between any of these three tolerance level.

Theme; its got to do with the physical appearance of the platform in terms of colour, probably looks and design. These also includes some options like mono light, mono dark, cyberpunk, classicv2 and custom.

Language; here we have just two languages to choose from and they are English and Espanol.

Connecting Wallet To Yearn Finance...….

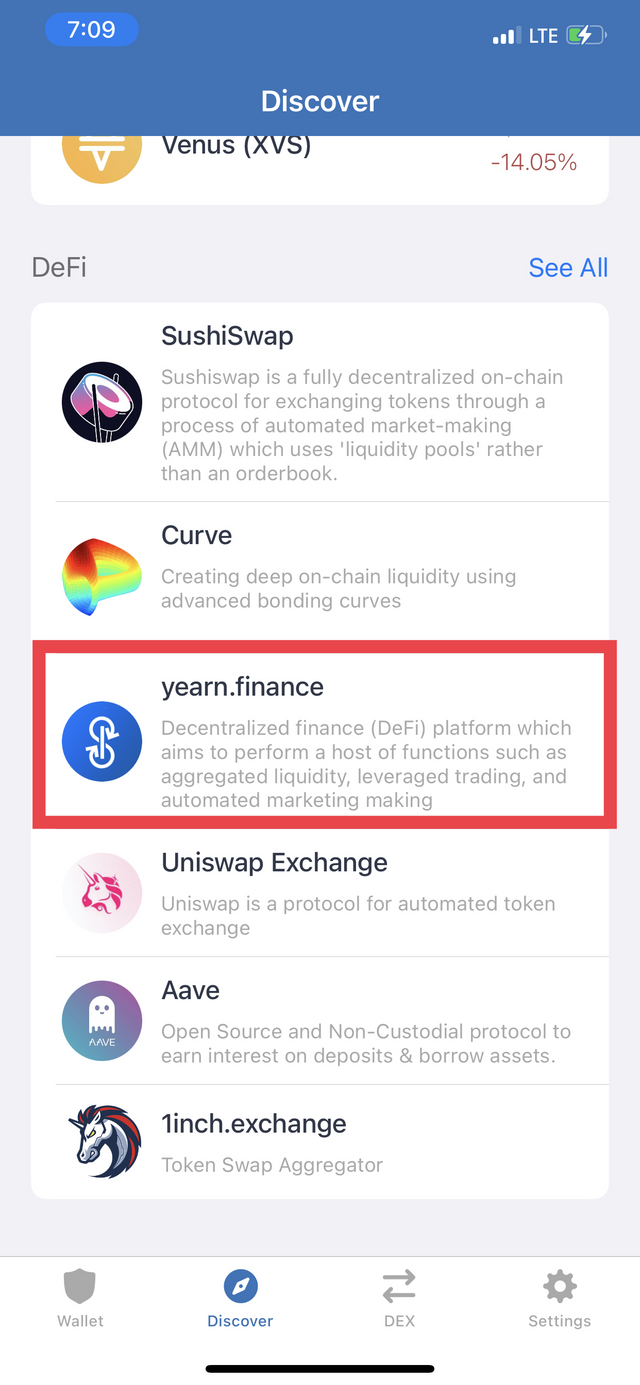

The Yearn Finance platform supports many crypto wallets but I will be using only trust wallet. Lets go through the process.

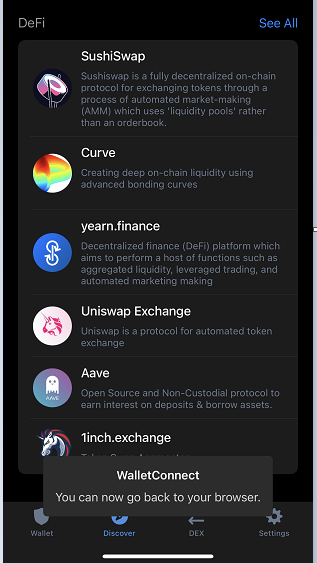

Lauch the trust wallet app and Click on Browser option from the bottom

Click on yearn.finance

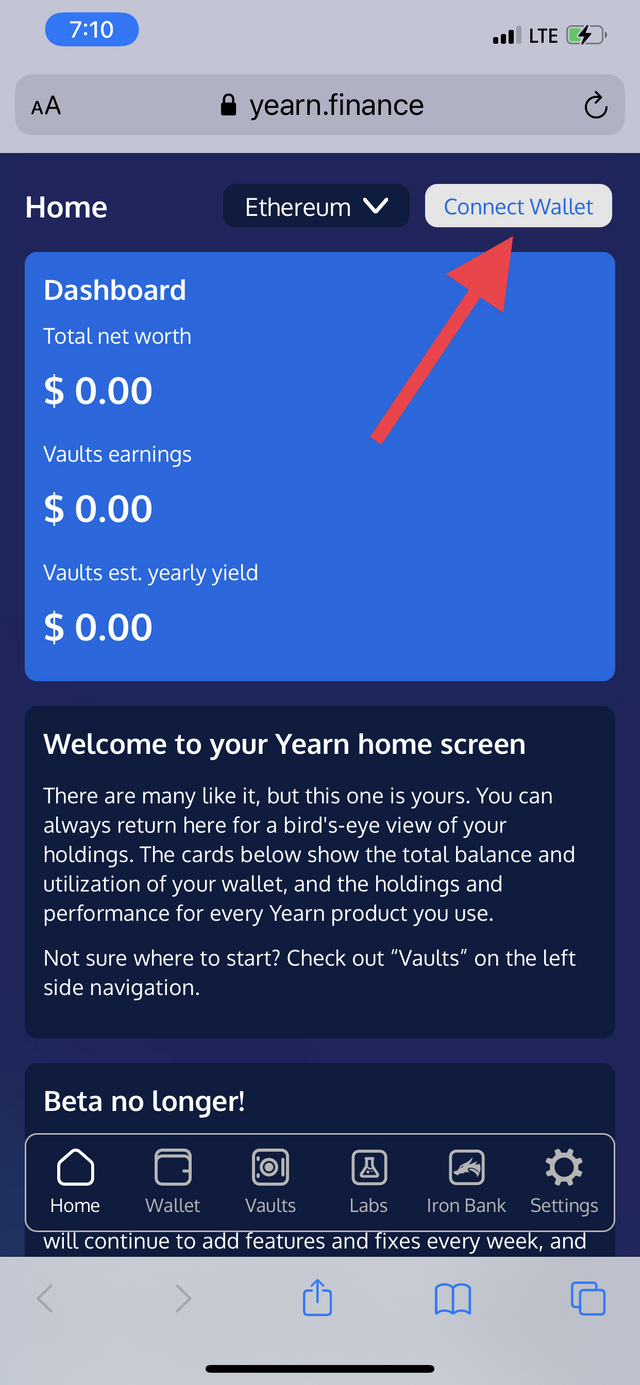

Click on connect wallet

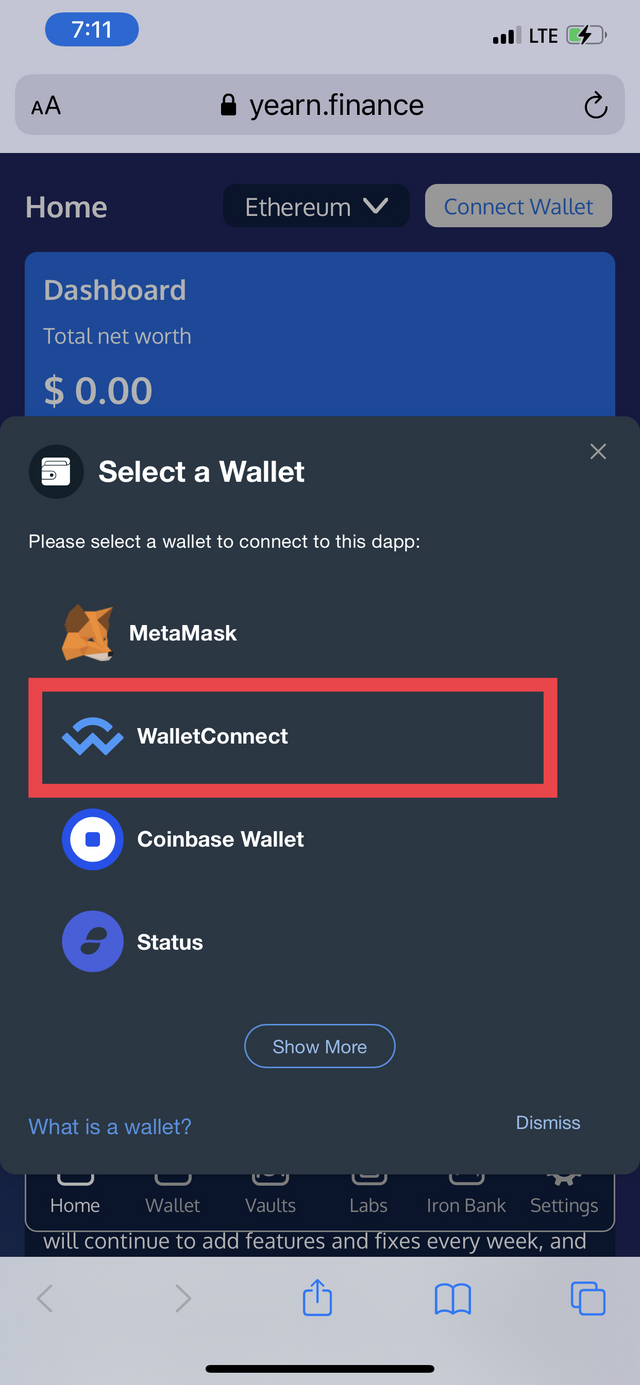

Sellect WalletConnect

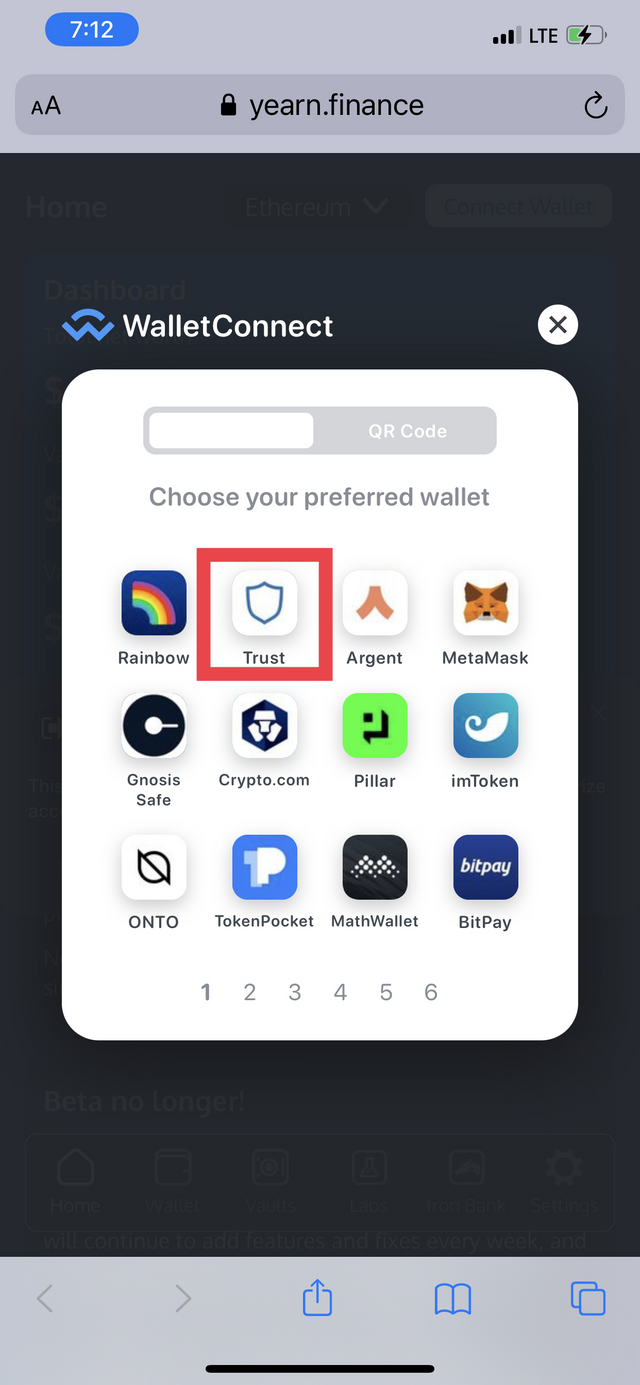

Then click on trust

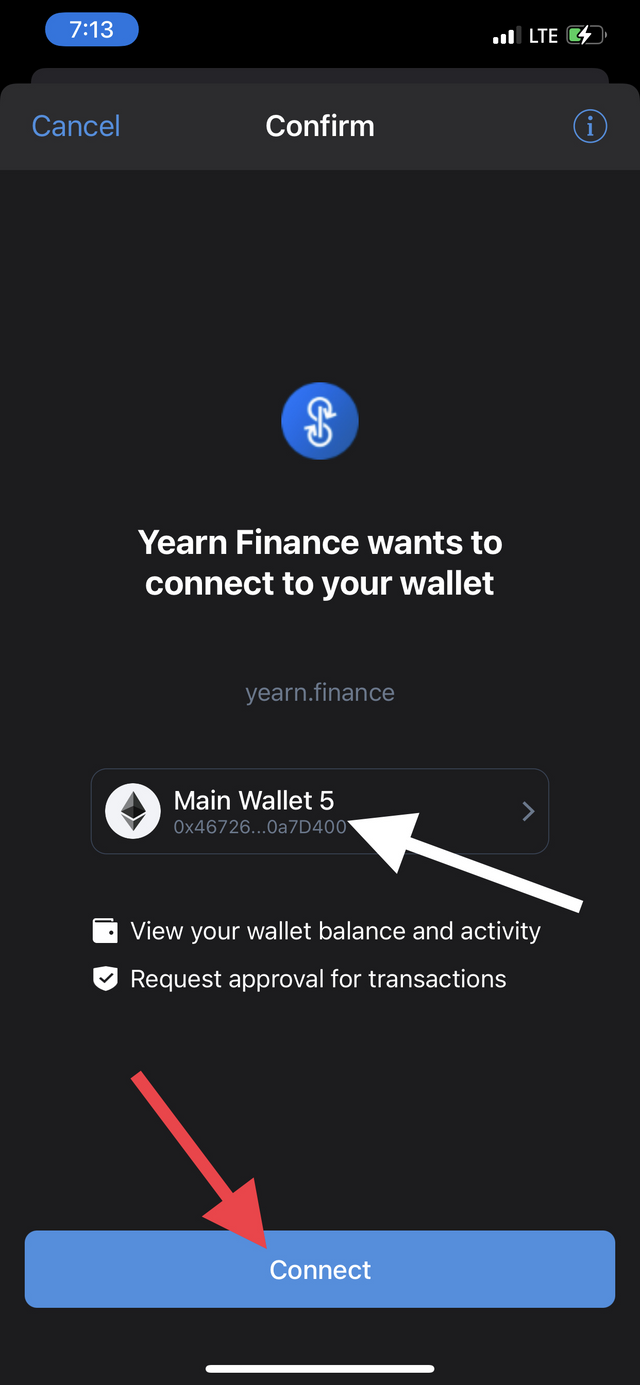

Choose the wallet you wish to connect and then click on Connect.

A pop up indicating that wallet has been connected successfully that we can go back to out browser

- Going to the browser, we can see clearly that the smart chain address of my trust wallet is displaced at the right hand corner indicating that the connection was a success.

(3.) What is collateralization in Yield Farming? What is function?

Lets take this scenario for am example. When a borrower goes to the bank to take a loan, what the bank does is to take some important assert to indemnify the loan. This asserts includes Lands, houses, cars etc. So we can say this asserts are used as an assurance of the loan completely being paid on time. Failure to do so in due time will cost you the lost of your assert. The assert used for the exchange of the loan is mostly greater or equal to the loan being given. From this brief explanation lets take a look at what Collateralisation is in yield farming.

It is a system where a borrower deposits a sum amount of funds as a means of security against the loan borrowed. The yield farming sets the ratio at which the total amount should be deposited to the total amount being loaned to the borrower. They can set this ratio at 100:50, 200:100, 100:80. Remember I said earlier on that the assert or funds deposited for the loan is always equal or greater than the loan given out. Therefore the collateralization ratio always favor the lender.

The main function of the collateralization process is to acts as a security measure against borrowers running off with borrowed funds as well as checking and compensating for any decreased value of borrowed funds over a period of time. This way the exchange platform can prevent liquidation of assert due to volatility in some asserts.

(4.) At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

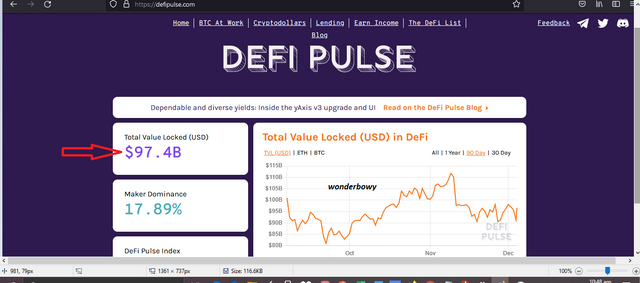

To be able to access this we first visit https://defipulse.com/ where an interface like what is shown below in the screenshot.

Total Value Locked of the DeFi ecosystem as seen in the screenshot above which is 97.04 Billion

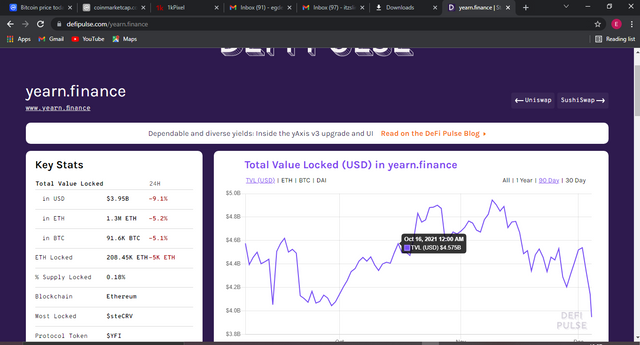

Total Value Locked of the Yearn Finance is $4.51 billion as seen from the screenshot above.

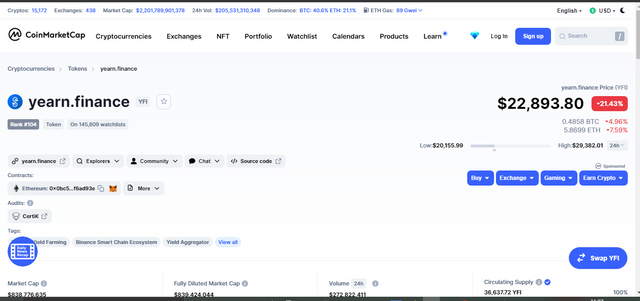

Yearn Finance Protocol Seen In A Screen Shot Above From Coinmaftcap. The Ratio of Marketcap/TVL is 0.18%. Its native tokens price from coinmarketcap is 22,893.80 which has really decreased in value. Today is such a bad day for us crypto investors all the coins are dipping heavy..

(4.1.) The YFI token, is it overvalued or undervalued? State the reasons.

To be able to determine whether YFI is overvalued or undervalued, we need to check the ratio of Marketcap against TVL. In the case where the MarketCap is greater than the TVL we say the assert is overvalued and when its less than one we say its undervalued. Looking at this, I can boldly say it is undervalued since the MarketCap is less than one(1).

(5.) If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

Lets go into the calculations...…

First lets take a look at BTC Price on 21st of August, 2021 and then we take a look at its price this very day 4th December, 2021.

| DATE | PRICE |

|---|---|

| 21/08/2021 | $41,796.90 |

| 04/12/2021 | $ 47,478.08 |

So from the table above, we can say that buying $500.00 is equal to 0.012 Bitcoin on 21st August 2021.

Hence 0.012 * 47,478 = $569.73

ROI = (569.74 - 500) all divided by 500 multiplied by 100

ROI= (69.74/500)100

ROI= 0.139100

ROI= 13.9

As at August 21, 2021 , the price of YFI was $33,063.06 and as at today the price is $24,541.77

Hence an Investment of $500 is equivalent to 0.015

ROI = 0.015 * $24,541.77 will be equal to 368.115

ROI = (368.115-500) divided by 500 all multiplied by 100

ROI = (-131.885/500)100

ROI= (-0.264)100

ROI = -26.4%

Now for Both currency

BTC ROI + YFI ROI = -26.4% + 13%

= -13%

(6.) In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

To every positive thing there are negative sides as well. Here I will take you through some risks involved in Yield Farming. There are a lot of them but will just high light on some major once. Let go into them;

High volatility of some crypto asserts can result in decrease of value from yield farming. This sudden change in value of asserts can generate less profit from the farm than expected. There is no escape since there will be a collateral to settle the damages experienced by the platform whiles the investor alone makes loses.

Liquidation risks are highly recorded in the yield farming. Unlike banks that accepts physical cash from individuals on regular bases and for that matter can provide liquidity at any time, yield farming only relies on the total number of liquidity provides that is the users and the platform owners. Aping in at a high liquidity does not quarantine availability at all times. Sometimes before you realize there is no liquidity at all in the pool including your own liquidity provided earlier.

The likelihood of Rug pull occurrences in some yield farming ecosystem. We all know that developers are also humans just like us and sometimes not everyone has good intentions for the developments of a certain technology. This same issue implies to the yield farming, in some situations the developers can just abounded the project and run away with the liquidity providers funds.

Conclusion

Yield Farming is a new great way of earning passive income on your investments or funds. This helps in providing liquidity and also earning from the platform. This new innovation is very awesome but investors needs to be very careful because it also comes with some petty risk factors.

Thanks to steemit crypto academy once again for making this weeks lectures another great success. Also, special thanks to our honorable proff @imagin for taking us through weeks lectures.