Discuss in your own words what Dark Pools are in cryptocurrency. And explain how it works?

Dark pools are private trading platforms or exchanges that allow players to make huge trades without disclosing the full information of the trades to the public. These pools are frequently utilized by institutional investors, like as hedge funds or investment banks, who seek to prevent having a huge purchase or sell order effect the market price of a cryptocurrency.

When a large order is placed on a typical cryptocurrency exchange, it might result in price slippage, which occurs when the market price changes against the trader owing to a rapid surge in demand or supply. Dark pools seek to alleviate this by providing a more private trading environment.

Dark pools with regards to digital money allude to private exchanging stages or trades that permit members to execute enormous exchanges without uncovering the all relevant information of those exchanges to the general population. These pools are in many cases utilized by institutional financial backers, similar to mutual funds or venture banks, who need to try not to influence the market cost of a digital money while executing huge trade orders.

In a conventional cryptographic money trade, when an enormous request is put, it can prompt cost slippage, where the market cost moves against the merchant because of the unexpected expansion popular or supply. Dark pools intend to relieve this by giving a more cautious exchanging climate.

This is the way a dark pool commonly works:

Privacy: Members present their trade requests to the dark pool. The pool totals these orders without showing the full request book openly.

Matchmaking: The dark pool's exchanging motor matches viable trade orders without uncovering the specific subtleties to different members. This forestalls front-running and lessens the potential for market control.

Execution: Exchanges are executed inside the dark pool. The exchange subtleties are typically just revealed after the exchange is finished.

Reduced Impact: Since the exchanges are not apparent to the more extensive market, the gamble of making huge cost changes due enormous orders is diminished.

It's critical to take note of that while dark pools offer security and diminished market influence, they additionally raise worries about straightforwardness and decency. A few pundits contend that these pools can add to an inconsistent exchanging scene where institutional players enjoy an upper hand over retail brokers who need admittance to such stages.

In outline, dark pools in digital currency give a way to institutional financial backers to execute enormous exchanges with decreased market influence, however they likewise bring up issues about straightforwardness and decency inside the more extensive exchanging biological system.

Do all crypto exchanges offer a dark pools? If yes, explain how does its dark pool work? What tokens are supported? Are there any fees attracted? And What are the requirements to get involved in dark pools trading on the platform?

Not all digital currency exchanges offer dark pools, as they are frequently more common in traditional financial markets. However, a few cryptocurrency exchanges have introduced dark pool features to cater to institutional traders who require greater privacy and reduced market impact. One such example is Bitfinex, which offers a dark pool feature called "Hidden Order."

Bitfinex's Dark Pool operates as follows:

Private Order Placement: Traders can submit large orders that are hidden from the public order book. These orders don't immediately impact the market price.

Matching: Bitfinex's trading engine matches compatible trade orders within the dark pool, without revealing the order details to other participants.

Execution: Once matched, trades are executed within the dark pool. Trade details are then disclosed to the participants.

Supported Tokens: The tokens supported for trading within the dark pool may vary and depend on the exchange. Generally, major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others with sufficient liquidity are supported.

Fees: Fees associated with trading in a dark pool vary based on the exchange and the specific trading volume. Exchanges might charge a different fee structure for dark pool trading compared to regular trading.

Requirements: To get involved in dark pool trading on a platform like Bitfinex, traders usually need to meet specific criteria. These criteria could include a minimum trading volume or a particular account type, often tailored to institutional traders.

So, this is all about the working of the dark pool of Bitfinex.

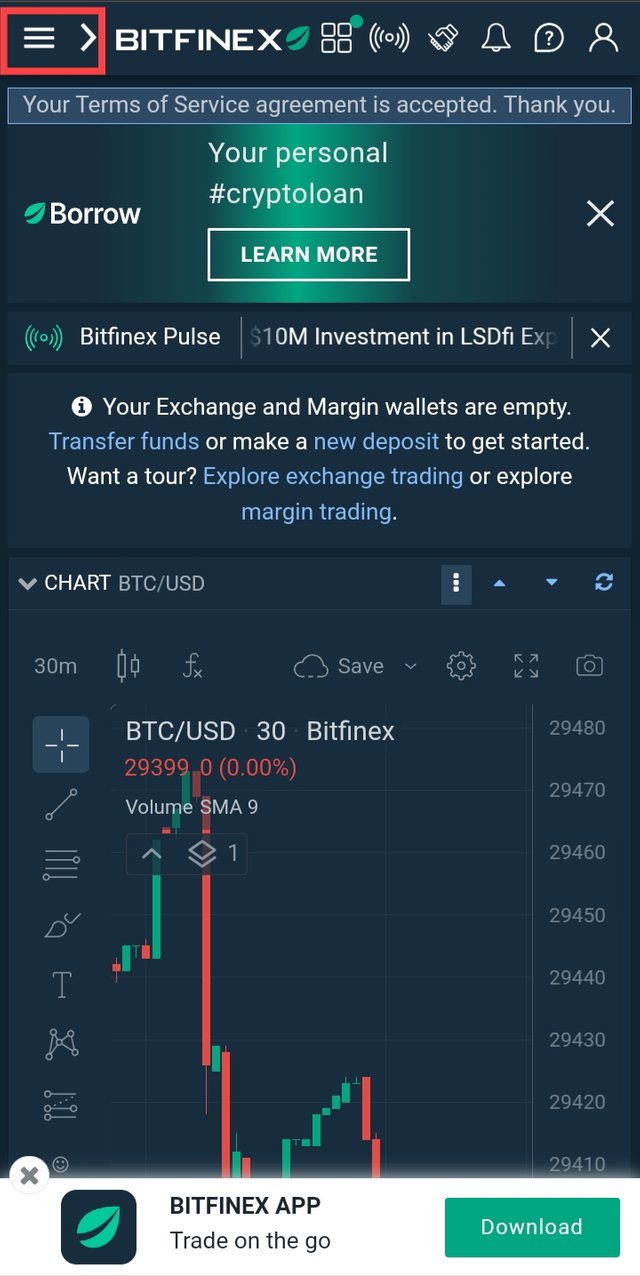

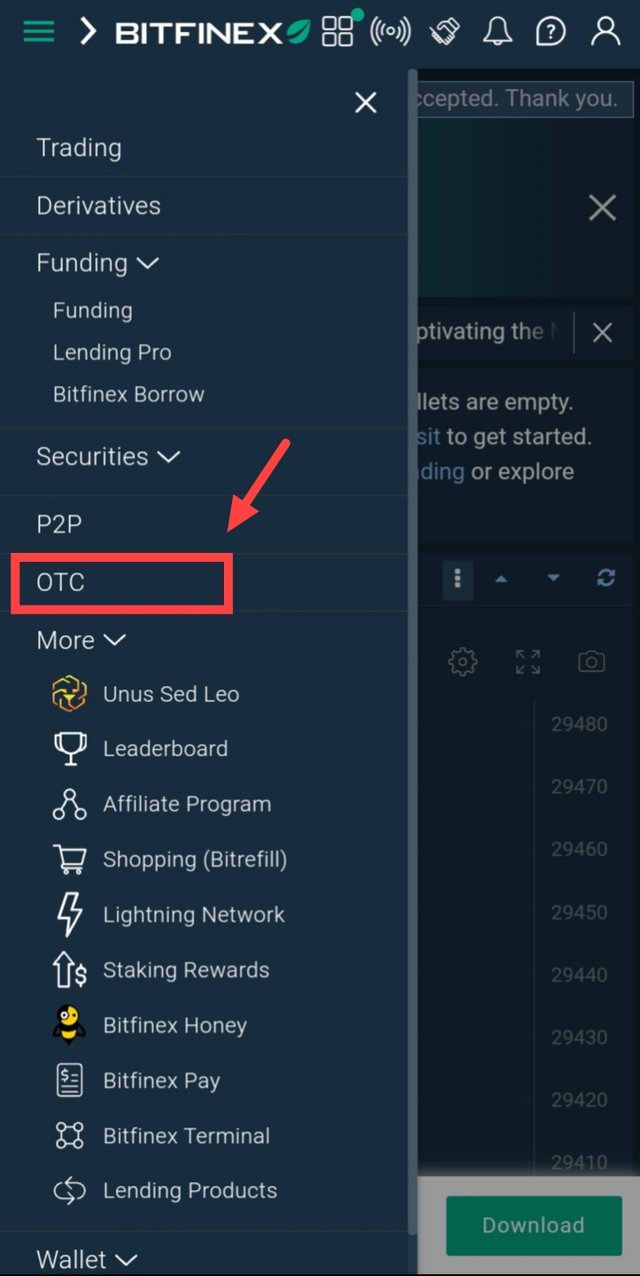

For the chosen dark pools, show how to perform block trading on the platform. (Screenshots required).

The Bitfinex Dark Pool is a feature designed for private and large cryptocurrency trades, offering traders a way to execute orders confidentially. This separate order book provides anonymity and reduces market impact for big transactions. To perform a dark pool trade:

Account Setup: Create an account, complete verifications, and deposit funds.

Access Dark Pool: If available, learn about the dark pool's terms.

Order Type: Choose an order type like "market" or "limit."

Size and Price: Decide the trade size and price, possibly specifying minimum order size.

Execute Trade: Place the order in the dark pool; it may be executed instantly or over time.

Confirmation: Receive trade confirmation and see updated balances.

Settlement: The exchange handles transferring the traded cryptocurrencies.

Fees: Be aware of fees for using the dark pool.

You can see access the Bitfinex Dark Pool feature from below screenshots.

Remember, while dark pools offer privacy and reduced market impact, they come with risks like price slippage. Have a clear trading strategy and risk management plan in place. Understand the dark pool's features and limits before using it.

Explain the decentralized dark pools? State a decentralized dark pool in cryptocurrency and discuss it. How it works?

Decentralized dark pools are an idea in the domain of digital currencies that joins the highlights of decentralized finance (DeFi) conventions and customary dark pool exchanging. A dark pool is a confidential trade where huge institutional financial backers can exchange enormous blocks of protections without uncovering their goals to the more extensive market. In a decentralized dark pool, this idea is applied to the universe of digital currencies.

One illustration of a decentralized dark pool in digital money is the "Dusk" convention based on the Ethereum blockchain. Sunset empowers private exchanges utilizing zero-information confirmations, guaranteeing protection while exchanging. This is the secret:

Privacy: The convention uses zero-information verifications, a cryptographic strategy, to demonstrate the legitimacy of exchanges without uncovering the exchange subtleties. This implies that the subtleties of the exchange, similar to the resource being exchanged and the exchanging parties, stay stowed away from people in general.

Smart Contracts: Shrewd agreements are utilized to work with exchanging on the decentralized dark pool. These agreements naturally execute exchanges when explicit circumstances are met, guaranteeing that the gatherings included obtain the ideal result without direct connection.

Matching Mechanism: The dark pool's matching instrument matches trade orders without uncovering the full request book to all members. This keeps the market from responding to enormous exchanges and possibly causing cost vacillations.

Atomic Swaps: A few decentralized dark pools utilize nuclear trades, permitting clients to exchange different digital currencies straightforwardly without the requirement for a concentrated trade. This guarantees that the exchange is either completely finished or not executed by any means, dispensing with counterparty risk.

Liquidity Providers: Members who give liquidity to the dark pool can acquire rewards. These liquidity suppliers assist with guaranteeing that there's adequate liquidity for exchanging to happen.

Decentralization: The decentralized idea of these dark pools intends that there's no focal power controlling the exchanging system. All things being equal, the convention and the blockchain's agreement components guarantee the trustworthiness of exchanges.

It's critical to take note of that while decentralized dark pools offer upgraded security and decreased market influence for huge exchanges, they additionally raise worries about administrative consistence and expected abuse for criminal operations. As the cryptographic money scene keeps on developing, decentralized finance conventions like these are probably going to stand out from the two dealers and controllers.

Compare a centralized crypto exchange dark pools with a decentralized dark pool. What are the distinctive differences?

Below is a comparison between centralized crypto exchange dark pools and decentralized dark pools, highlighting their distinctive differences:

Control: Centralized exchanges have control over their dark pools, managing and overseeing the entire process, including order execution and matching.

Trust: Users must trust the exchange to maintain confidentiality and execute trades fairly, which could be a concern given the history of security breaches and manipulation on some centralized exchanges.

Disclosure: Dark pool activities on centralized exchanges are usually not fully transparent, and users may not have insight into the order book or trading data.

Regulation: These dark pools are more likely to be regulated due to their centralized nature, which can provide a sense of security but also requires adherence to legal requirements.

Counterparty Risk: Counterparty risk is present since trades are matched by the exchange, and users rely on the exchange's stability and solvency.

Control: Decentralized dark pools are governed by smart contracts and protocols, reducing the need for a central authority to manage the process.

Trustlessness: Users don't need to trust a single entity since transactions are governed by code and cryptography, enhancing security and privacy.

Transparency: While details of individual trades are private, the underlying smart contracts are transparent and auditable by anyone on the blockchain.

Regulation: Decentralized dark pools often operate in a more regulatory gray area due to their decentralized nature, potentially raising compliance concerns.

Counterparty Risk: Smart contracts eliminate direct counterparty risk, as trades are automatically executed based on predefined conditions. However, users still need to ensure the security of their private keys and interactions with the protocol.

Liquidity: Centralized exchanges generally have more established liquidity due to their size and popularity. Decentralized dark pools might have lower liquidity initially but aim to address this through incentive mechanisms.

Market Impact: Decentralized dark pools aim to reduce market impact by keeping large trades private, while centralized exchanges may suffer from price slippage due to larger orders affecting market prices.

In short we can say that centralized crypto exchange dark pools offer convenience and established liquidity but require trust in the exchange's operations. On the other hand, decentralized dark pools prioritize security, privacy, and trustlessness but might face challenges related to regulatory compliance and initial liquidity. Users' choice between the two depends on their preferences for security, privacy, and willingness to engage with DeFi protocols.

What are the advantages and disadvantages of the Dark pools in Cryptocurrency?

Dark pools in the cryptocurrency domain, whether centralized or decentralized, offer specific advantages and disadvantages:

Privacy: Dark pools provide improved privacy for large traders, as their trading activities are not visible to the broader market. This can prevent price manipulation and front-running.

Reduced Market Impact: Large trades on traditional exchanges can significantly impact market prices. Dark pools mitigate this impact by matching large orders without exposing them to the public order book.

Lower Transaction Costs: Dark pools can offer lower transaction costs compared to traditional exchanges, as they often avoid order book fees and price slippage.

Institutional Trading: Dark pools cater to institutional investors who require anonymity and execution of large trades without revealing their intentions to the market.

Mitigated Price Volatility: Dark pools help reduce sudden price fluctuations that could occur if large trades were executed on public exchanges, contributing to market stability.

Lack of Transparency: Dark pools lack transparency since trading activities are hidden from the public view. This opacity can raise concerns about market manipulation and unfair practices.

Limited Price Discovery: Dark pools can hinder the price discovery process, as large trades aren't reflected in the public order book, potentially distorting accurate market pricing.

Regulatory Challenges: Dark pools, especially in the decentralized space, can pose regulatory challenges due to their confidentiality and lack of oversight. This might attract regulatory scrutiny.

Counterparty Risk: While decentralized dark pools reduce counterparty risk, centralized dark pools still involve counterparty risk as trades are matched by the exchange.

Liquidity Concerns: Decentralized dark pools might struggle with initial liquidity, making it challenging to execute large trades efficiently.

Market Fragmentation: The existence of dark pools can lead to market fragmentation, as liquidity is split between different platforms, potentially creating inefficiencies.

Potential for Misuse: The anonymity and confidentiality provided by dark pools can attract illicit activities, such as money laundering and insider trading.

Simple words, dark pools offer benefits such as privacy, reduced market impact, and lower costs for institutional investors, but they also raise concerns about transparency, price discovery, regulatory compliance, and potential misuse. Traders and investors must carefully evaluate the advantages and disadvantages to determine whether dark pools align with their trading strategies and risk tolerance.

Conclusions:

Dark pools in the cryptocurrency domain, whether centralized or decentralized, offer advantages such as improved privacy, reduced market impact, and lower transaction costs for large traders, catering to institutional investors' need for anonymity. Nonetheless, these benefits come with downsides like transparency concerns, limited price discovery, regulatory challenges, potential counterparty risk, liquidity requirements in decentralized arrangements, market fragmentation, and the potential for abuse.

As traders evaluate the trade-offs between security and transparency, alongside regulatory and market implications, their decision to engage with dark pools should align with their risk tolerance and trading objectives.

I am tagging my friends @malikusman1, @steemdoctor1 and @kouba01 here.

My achievement 1 link is here

https://steemit.com/hive-172186/@writer123/starting-from-the-introduction-my-achievement-1

You've provided a comprehensive explanation about dark pools in the cryptocurrency world, including their advantages, disadvantages, and differences between centralized and decentralized options. Your comment appears to be well-structured and informative, offering insights into how these pools function and their implications for traders. It's great that you've included comparisons between different types of dark pools and highlighted both their benefits and potential concerns. Your comment seems to contribute positively to the conversation and offers valuable information to readers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for reading my post and leaving a meaningful review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome! I appreciate your kind words.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitfinex experienced a significant security breach in 2016, during which approximately US$72 million worth of funds were stolen. While conducting your research on this topic, did you come across any specific information indicating whether this breach was related to dark pool transactions? Just curious to know!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I didn't go through any information regarding that. I'm sure I I'll check it out. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola writer 😊

Intesante esa exchance que nos muestras bitfinex, la verdad yo no la conocia, cuando estaba haciendo la investigacion di con la de binance y preferi irme con esa porque es una platafroma con la que estoy familiarizada, pero cualquiera nuev informacion es bienvenida.

Gracias por ese paso a paso. Estuvo genial

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dark pools are the secret area to facilitate the whales in the market. As it's name indicate, it's something related to dark website. Most probably they facilitate the whales to give them more profit and let the micro traders to suffer. This is the unjustified way of trading.

Your post is very good. I really enjoy reading it. Best wishes for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am happy that I am receiving good response on my first entry. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

En los Dark Pools, siempre será un problema el anonimato y la confidencialidad de los grupos oscuros, es un campo fértil para las actividades ilícitas. Sin embargo, ha sido un mal necesario para mantener el equilibrio del mercado de criptodivisas y parecen estar diseñados para favorecer a las ballenas o grupos élite.

Gracias por tu compartir. Te deseo mucha suerte.

¡Un gran abrazo!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 2

Congratulations! This post has been upvoted through Curation Team#2. We support quality posts , good comments anywhere and any tags.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Basically the dark pools is a trading platform for the Institutional investors and the Whales want to do transactions of high volume and keep all their details hide from public eye. The Trading within the dark pools keep the prices of other crypto currencies keep in control and don't put any affects on the crypto market so it is somehow beneficial.

By the way your publication is very interesting and informative.

Success to you 🤗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit