1 - What do you understand about the Concept of Dynamic Support and Resistance? Give Chart Examples from Crypto Assets. (Clear Charts Needed)

Before we talk about Dynamic support and resistance, we must first of all understand that this works with the concept of price action vis-a-vis its reaction on different levels which we may see as price trend lines. These Trend lines are captured in a horizontal view as the case maybe as price continues to react in a given direction but there are unseen effect that this price action respects in some cases, hence the trend line which can be represented with the Exponential Moving Average (EMA). This trend lines maybe captured in either cases to be resistance or support level at different points in the market price.

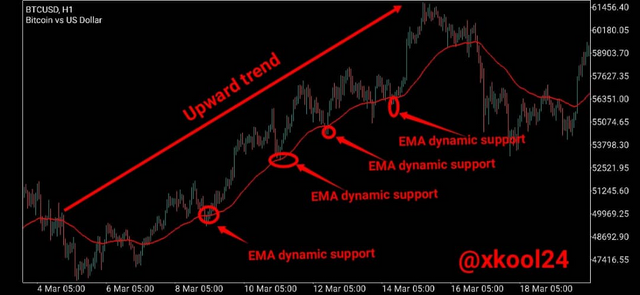

The Concept of Dynamic Support

In this scenario, price action and trend line are seen to be moving in the upward direction. Each time price tend to move downwards and close to the EMA to make a touch, it rebounds and hence forming a support which sees it move upwards. From the screenshot we can see where trend lines were captured and supports levels indicated to show EMA dynamic support level also.

The Concept of Dynamic Resistance

In this scenario, price action is seen to move downwards. The EMA is seen acting as Dynamic resistance each time price tend to move upwards and close to the EMA line. Each time it closes up and touches the EMA line, it is seen to rebound and hence creating a resistance level and continues on its bearish trend.

2 - Make a combination of Two different EMAs other than 50 and 100 and show them on Crypto charts as Support and Resistance. (Clear Charts Needed)

The essence of this double EMAs is to vividly show traders the stronger points and levels where we have the Dynamic supports and resistances. This would invariably guide on the trade entry and exit criteria during trade.

I will be showing using the 30 and 60 EMA periods.

30 and 60 EMA for Dynamic Resistance

In the Downward movement of market price, both periods here has represented different stronger points of price resistance which was respected by the price trends when in touch with the EMAs at those various levels.

30 and 60 EMA for Dynamic Support

In the Upward movement of market price, both periods here has represented different stronger points of price supports which was respected by the price trends when in touch with the EMAs at those various levels.

3 - Explain Trade Entry and Exit Criteria for both Buy and Sell Positions using dynamic support and resistance on any Crypto Asset using any time frame of your choice (Clear Charts Needed)

Trade Entry Criteria:

Entry Criteria for Buy Scenario

- I have to add my 30 and 60 EMA period first.

- Price trend should be seen to be above the added 30 and 60 EMA in order to confirm a valid buy entry.

- Just to verify the valid entry , wait to confirm if price would touch the EMA 30 and 60 periods before rebounding. At this point, do not make buy entry para-venture it pierces through the EMA line. But as soon as it rebounds at this point, that confirms a valid buy entry setup.

- After the rebounds, one can take the trade and make a Buy setup.

Entry Criteria for Sell Scenario

- I have to add the 30 and 60 EMA periods first

- Price should be seen below the added EMA periods in order to counter-plate the sell entry setup.

- At this point when price is below the EMAs, allow price to close up and touch the EMA line or in some cases make a little cross over the 30 EMA line before rebounding. It is wise to allow any sell entry to be sure price rebounds at this point to avoid it pierces down the both EMA and invalidating the setup.

- When it makes a swing down after touching the EMA, a valid sell setup can be initiated.

- When price continues on a lower low , a valid sell setup can be taken.

Trade Exit Criteria

This is a double sword exit positions which sees trade either to our expected direction to take profit or against our expected our anticipated direction and apply the Stop Loss tool. This both exit routes make up the Exit criteria for any given trade.

Exit Criteria for Buy Scenario

- We are to remember to add the 30 and 60 EMA periods

- WE are expecting an uptrend movements in this case given that it is a buy position. So there would support levels seen as trend continue to respect EMA dynamic lines.

- We should be able to place the STOP LOSS below the 60 EMA and if price trend crosses this line, the trade setup is invalidated. Exit trade and set up another buy entry trade.

- But when trade moves to desired position, where your "Take profit" should be placed above the EMAs and Buy entry levels, you can take the trade to your advantage.

Exit Criteria for Sell Scenario

- We are to remember to add the 30 and 60 EMA periods

- WE are expecting a Downtrend movements in this case given that it is a Sell position. So there would be Resistance levels seen as trend continue to respect EMA dynamic lines.

- We should be able to place the STOP LOSS above the 60 EMA and if price trend crosses this line, the trade setup is invalidated. Exit trade and set up another Sell entry trade.

- But when trade moves to desired direction, where your "Take profit" should be placed below the EMAs and Buy entry levels, you can take the trade to your advantage.

4 - Place 2 demo trades on crypto assets using Dynamic Support and Resistance strategy. You can use lower time frame for these demo trades (Clear Charts and Actual Trades Needed)

Trade 1: LTC/USD

From the screenshot and trade we saw at different points where price touched the EMA but rebounded. After the last touch on the EMA 30 with a second bearish trend seen, the Sell order was placed at either 112.046USDT or at 109USDT. My stop loss is at 116.930USDt level.

Trade 2: BTC/USD

From the trade we can also see that there were resistance points captured like in different points.

Stop Loss placed above the EMA 60 at value 29660USDT.

Sell order taken after a valid bullish trend is confirmed after the market price rebound with the EMAs

Thank you

Cc: @cryptokraze

Dear @xkool24

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 7.5/10 Grade Points according to the following Scale;

Key Notes:

*.You have shown good understanding of the strategy by making good charts for different elements of the strategy.

We appreciate your efforts in Crypto academy and look forward for your next homework tasks.

Regards

@cryptokraze

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit